Times are getting tougher for junior miners but M&A could save the day

Most funding for ASX explorers is going to a dwindling pool of companies, as falling cash balances put lithium M&A on the agenda.

The fortunes of small explorers and large ones are diverging as capital flows to the big end of town

93% of the exploration stocks on the ASX enjoyed just 22% of the fresh capital in the June quarter, says BDO's Sherif Andrawes

Lithium ripe for M&A as explorers' kitties are drained of cash

Just 7% of the largest exploration companies on the ASX are collecting 78% of the capital available to the industry, according to financial services firm BDO, showing a growing chasm across the ASX's junior mining sector.

While funds raised lifted 82% to $2.95 billion in the June quarter compared to March, BDO's latest explorers quarterly cash update shows the top 47 ASX raisers reporting Appendix 5B reports in the June quarter pulled in 78% of the take.

That means the other 93% of the pre-production stocks in the mining, oil and gas industries raised just 22% of the total, with the big winners largely those who made their discoveries or acquisitions in the cash happy days of the post-pandemic boom.

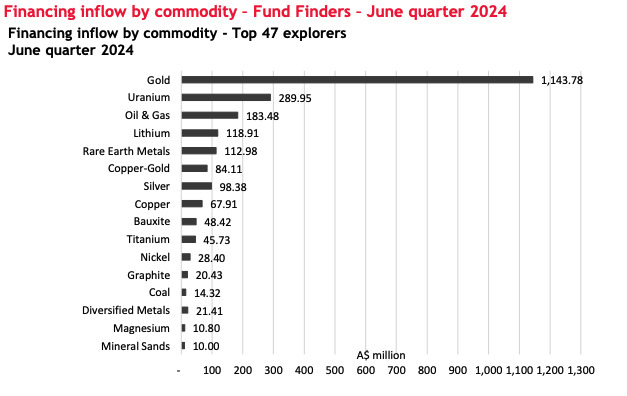

Gold stocks raised a massive $1.14bn of the total in the three months to June 30, led by the $599m in equity pulled in by Hemi gold project operator De Grey Mining (ASX:DEG).

Uranium came in second at $289.95m, with near-term producers Paladin Energy (ASX:PDN) and Peninsula Energy (ASX:PEN) both hitting the market for more than $100 million.

Oil and gas stocks, dominated by NT driller Tamboran Resources (ASX:TBN), pulled in $183.5m, with lithium and rare earths drawing $118.9m and $113m respectively, mild by their recent standards.

Reflecting extraordinary record gold prices, the commodity pulled in the highest amount of capital raised of a single commodity since BDO began collected its fund finder data in 2015.

"If you look at it, you can see that the total amount raised is up quite a bit, which is good, exploration spend's up a little bit, which is good too," BDO Head of Global Natural Resources Sherif Andrawes told Stockhead.

"But ... Fund Finders are only like 6-7% (of the market). There's like 93% that have raised 22% of the money. A lot are struggling.

"There's a few that are doing really well, but they're more the advanced exploration companies."

Ripe for M&A

Greenfields explorers are among those feeling the pinch, while cash reserves are beginning to diverge by commodity.

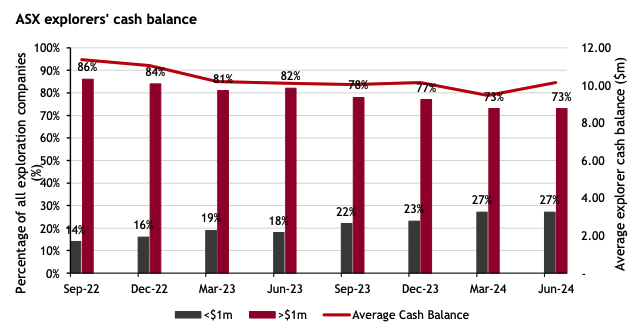

Still a healthy 73% of reporting companies have bank balances upwards of $1 million, albeit down from the 86% seen in September 2022.

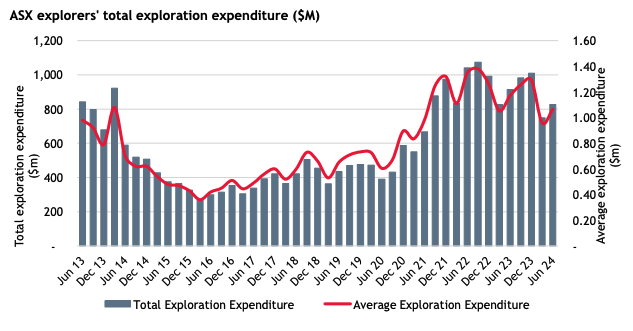

Exploration spending also lifted 10% to $826m, with the average spend per company up from $960,000 in the March quarter to $1.07m in the June quarter of 2024.

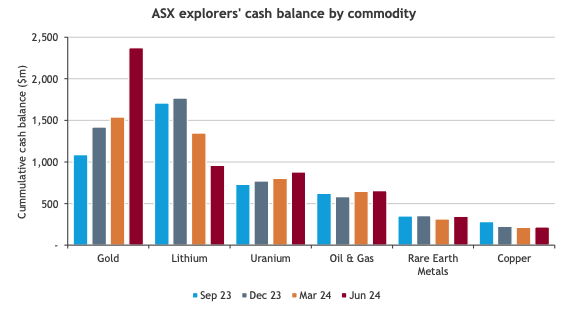

But a slight uptick in average cash balances from a three year low of $9.5m in March to $10.2m in June belies a growing disconnect between thriving gold and uranium, and dwindling lithium.

Collectively gold explorers' cash balances have lifted from a touch over $1bn in September 2023 to around $2.4bn in the space of nine months.

In lithium, which peaked at ~$1.75bn in December 2023, the combined cash of hand of ASX explorers has dropped to under $1bn in the space of just six months.

It's an environment Andrawes believes is ripe for scrip-based M&A, something already seen in Pilbara Minerals' (ASX:PLS) $560 million takeover of Brazil's Latin Resources (ASX:LRS) and Core Lithium's (ASX:CXO) rejected bid for Charger Metals (ASX:CHR).

"You've already got Latin and Pilbara and I'm sure we might see some more in the lithium space too," Andrawes said.

"We see M&A when things are really going strong or weak. We've seen and we are continuing to see gold M&A happening.

"I think we'll see some more lithium M&A happening as well while the prices are down, and those that are the haves will be taking over the have nots and making the most of it right now."

Meanwhile, Andrawes thinks explorers are unlikely to see the full benefit of interest rate cuts until the Reserve Bank of Australia follows suit next year, with their capital largely sourced from local super funds and retail investors.

Most IPOs in BDO's pipeline are seeking dual listings from other markets, mainly Canada, with local explorers largely preparing to enter the pipeline in 2025.

"We are talking to a few that are planning on IPOs for next year," Andrawes said. "There's always people planning for it, but in the event things do turn around."

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Times are getting tougher for junior miners but M&A could save the day