Silver is poised for its breakout, and these explorers are spinning the drills

Silver could be getting setup as the next commodity to boom as industrial demand, safe haven interest and supply deficits converge.

Silver spot price sitting around US$32/oz with experts tipping a leg higher

Demand soaring off the back of global trade tensions and supply deficits

Silver hunters like Coolabah Metals are reporting high-grade hits

Gold's run to ~US$3300/oz may be on every investor's lips, but cast your eyes down a little further and silver is also ready to grab a share of the spotlight.

Strong industrial demand, persistent supply deficits and increased investment interest amongst economic uncertainty (thanks to Prez Trump’s terrible tariff saga) have all provided steam for the precious metal.

This past month, silver prices even rose above US$34 per ounce, hitting their highest level in 13 years as escalating global trade tensions fuelled demand for safe-haven assets.

It’s currently sitting at US$32.61/oz (at the time of writing) and there could be even more eye-watering gains on the horizon.

Investment firm Triple Eight Capital reckons the silver price is strengthening towards US$50 per ounceover the next couple of years – mainly because supply isn’t keeping up with demand.

Lowell Resources Fund (ASX:LRT) chief investment officer John Forwood agrees it is possible we could see US$50/oz silver.

"The gold-silver ratio is currently at historic highs of over 100:1,” he said.

“Should it revert to the long term mean of say 60:1, and the gold price maintain current levels, then silver would move to a new high level.

“Alternatively, if it maintains this ratio and gold continues to climb, then silver would also rise.

”Silver does seem to be lagging gold on the upside, whereas historically it is more volatile (silver has outperformed gold in six of the last seven bull markets).

“One reason for this may be that central bank gold buying for “de-dollarisation”, which has been a major driver of the gold price, has not applied to silver.”

While Forwood notes the silver supply-demand deficit is driven by its use in photovoltaic solar panels, he cautions that the effect of the trade war on the Chinese PV industry is yet to be seen.

“New silver mines, particularly silver dominant mines, are very limited, so the supply-demand deficit is being met from stockpiles,” he said.

“Also limited are the number of listed companies which offer good silver exposure, particularly on the ASX.

“So, if silver starts to outperform gold, investor interest may cause equities to have outsized leverage to the metal price.”

A good time to be a silver hunter

And elevated commodity prices can only mean good things for ASX silver hunters like Coolabah Metals (ASX:CBH) (soon to be renamed Broken Hill Mines) who, fresh off signing off on a joint venture that gives a 70% interest in the Pinnacles mine in NSW, unveiled exceptional silver-lead-zinc results from previously unassayed historical drill holes at Broken Hill last month.

And we do mean exceptional, with results including:

- 8.9m grading 920g/t silver, 12.2% lead and 1.3% zinc (36.3% zinc equivalent) from 11m

- 8.2m at 763g/t silver, 13.4% lead and 1.7% zinc (33.1% ZnEq) from 18m and;

- 5.2m at 278g/t silver, 5.4% lead and 1.6% zinc (13.4% ZnEq) from 200m.

Not to mention, many of the drill holes are outside the existing resource of 6Mt at 10.9% ZnEq (133g/t silver, 3.3% lead, 4.7% zinc and 0.5g/t gold).

“To have metal grades of this calibre near surface, on granted mining leases adjacent to an historic open pit, highlights the near-term potential for open pit operations that we are investigating, alongside the significant underground resource,” chairman Stephen Woodham said at the time.

“These exceptional initial results also demonstrate the magnitude of the untapped potential of the Pinnacles mine to provide long term ore feed to Broken Hill Mines’ operating Rasp mine processing plant just ~15km away.”

Logging of historical drillcore as well as infill drilling is planned. CBH’s reverse takeover and joint venture will consolidate two of the three companies with operating mines at Broken Hill and is expected to bring a wealth of development opportunities.

Broken Hill has already signed a $40m offtake funding deal linked to lead concentrate offtake from the Pinnacles mine with Hartree Metals as part of a re-listing that will consolidate the key silver and lead deposits around the historic mining town, the birthplace of the world's biggest miner BHP (ASX:BHP) in 1883.

Which other explorers have hit some high-grade silver?

Errawarra Resources (ASX:ERW)

The company recently acquired silver-rich tenements in WA’s Pilbara, a top tier mining jurisdiction often ranked among the most attractive globally for mining investment.

The company signed binding agreements for a 70% stake in the historical Elizabeth Hill silver project, 70% of the silver rights to the Pinderi Hills project tenement package and 70% ownership of three tenement applications surrounding Elizabeth Hill.

The project, which was shut down in 2000 when silver prices were ~US$5 an ounce, previously produced 1.2Moz of silver from 16,000t of ore at a head grade of 2,194g/t silver in only one year of production.

ERW, which will be renamed West Coast Silver (ASX:WCE) subject to shareholder approval, is the first explorer to consolidate the additional highly prospective underexplored areas for silver mineralisation.

“We’re positive on the silver price, we believe it will go higher and the demand exceeds the supply so there’s no reason why the silver price shouldn’t be going higher in our view. And hopefully we can help plug the deficit,” ERW executive director Bruce Garlick told Barry FitzGerald on the recent Explorers Podcast.

The company’s inaugural drill campaign is set to commence in 6-8 weeks with an extensive soil sampling program already underway and a resource estimate expected in the near-term.

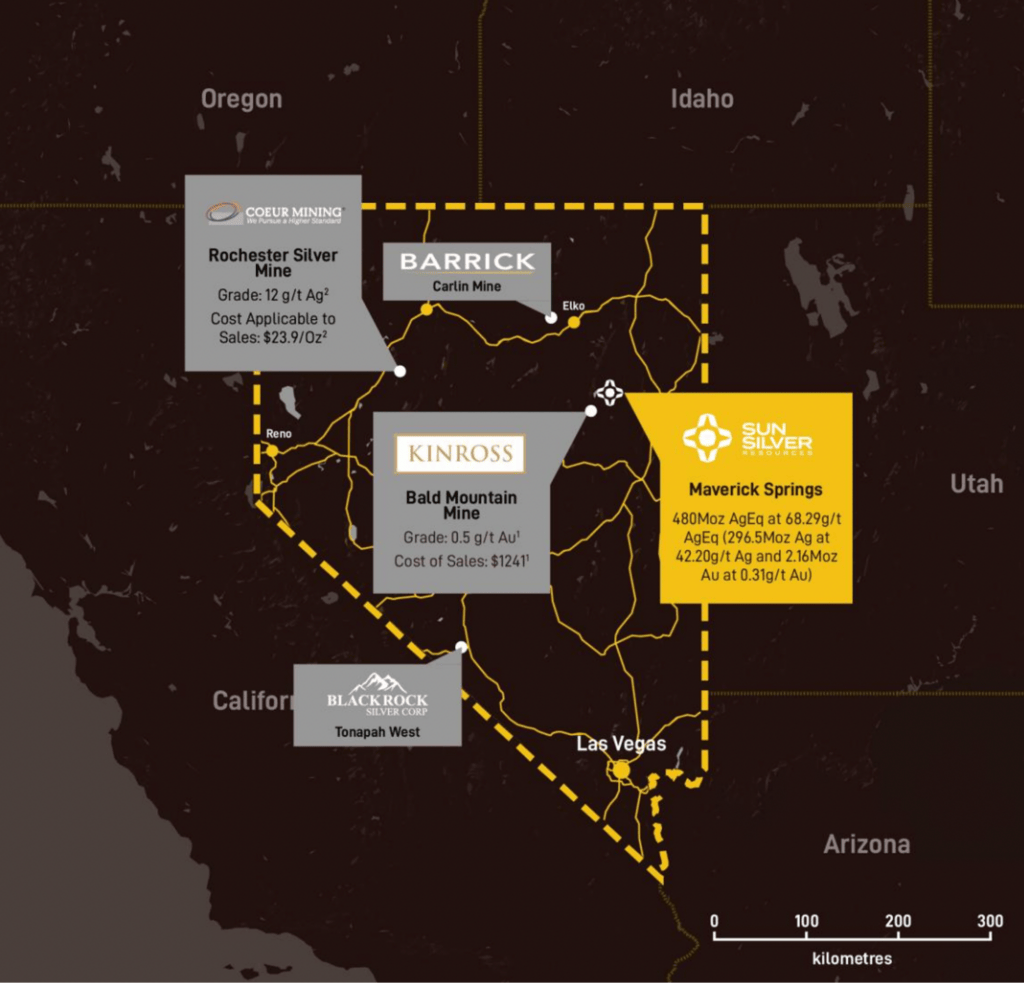

Sun Silver (ASX:SS1)

Owner of the Maverick Springs project in the US mining hotspot of Nevada, Sun Silver shares have lifted over 60% since an IPO in May last year.

A recent resource estimate update to 480 million ounces of silver equivalent at 68.29g/t AgEq (a 57Moz uplift) included an increase in both ounces and grade in silver metal to 296.5Moz at 42.20g/t.

That reinforced Maverick Springs as the largest pre-production primary silver deposit on the ASX.

With the resource open in all directions and at-surface and near-surface mineralisation shown by historic drilling to lie above the southern portion of its zone, the company sees plenty of room to keep building future production potential.

Sun Silver is set to begin infill drilling next month with the objective of systematically upgrading its resource to the higher confidence indicated category.

The company also expects to get some extensional work done on high-priority step-out targets, which could further expand its resource base.

Sierra Nevada Gold (ASX:SNX)

North American explorer Sierra Nevada Gold brought impressive rock chip results to the market last month, which reached in excess of 3400g/t silver at its Blackhawk Epithermal Project in Nevada.

Standout results included 3460g/t silver, 1.47% copper and 0.38% antimony, 256g/t silver, 4.52% copper and 0.83g/t gold, and 10g/t silver and 0.33% copper.

“Blackhawk has vast potential for high-grade precious and base metals mineralisation,” SNX executive chairman Peter Moore said.

“We continue to work to better understand the geology of this historic mining precinct with low-cost activities aimed to firm up targets for future drilling.”

Continued field exploration programs are planned throughout this year, with a focus on geological mapping, and geochemical and spectral sampling.

Argent Minerals (ASX:ARD)

Argent’s flagship Kempfield polymetallic project in NSW hosts a resource of 63.7Mt at 69.75g/t silver equivalent for 142.8m silver equivalent ounces.

Drilling results announced last month including 5m at 40.5 g/t silver – including 1m at 146g/t - from the Kempfield NW Zone.

Results like that reinforce the upside at the project, as the company continues expanding the mineralised footprint well beyond the current Kempfield deposit.

Maronan Metals (ASX:MMA)

In Feb, flotation testwork from the company’s namesake project in QLD produced concentrates grading above 74% lead and 2900g/t silver with respective recoveries of 95% and 91%.

“This result is a further confidence builder in our program to better define the mine production parameters and de-risk the project,” managing director Richard Carlton said at the time.

With large scale, rich silver grades exceeding 100g/t in a favourable location, GBA Capital expects Maronan to deliver positive studies across the next year or so and reach production in 2030. Maronan is now collecting more metallurgical samples and updating the resource before releasing its scoping study for the project.

At Stockhead, we tell it like it is. While Broken Hill Mines, Errawarra Resources, Sun Silver, Sierra Nevada Gold, Argent Minerals and Maronan Metals are Stockhead advertisers, they did not sponsor this article.

Originally published as Silver is poised for its breakout, and these explorers are spinning the drills