Rise and Shine: Everything you need to know before the ASX opens

All the market, commodity and stock news you need to know before the ASX opens to trade on Thursday, October 10 2024.

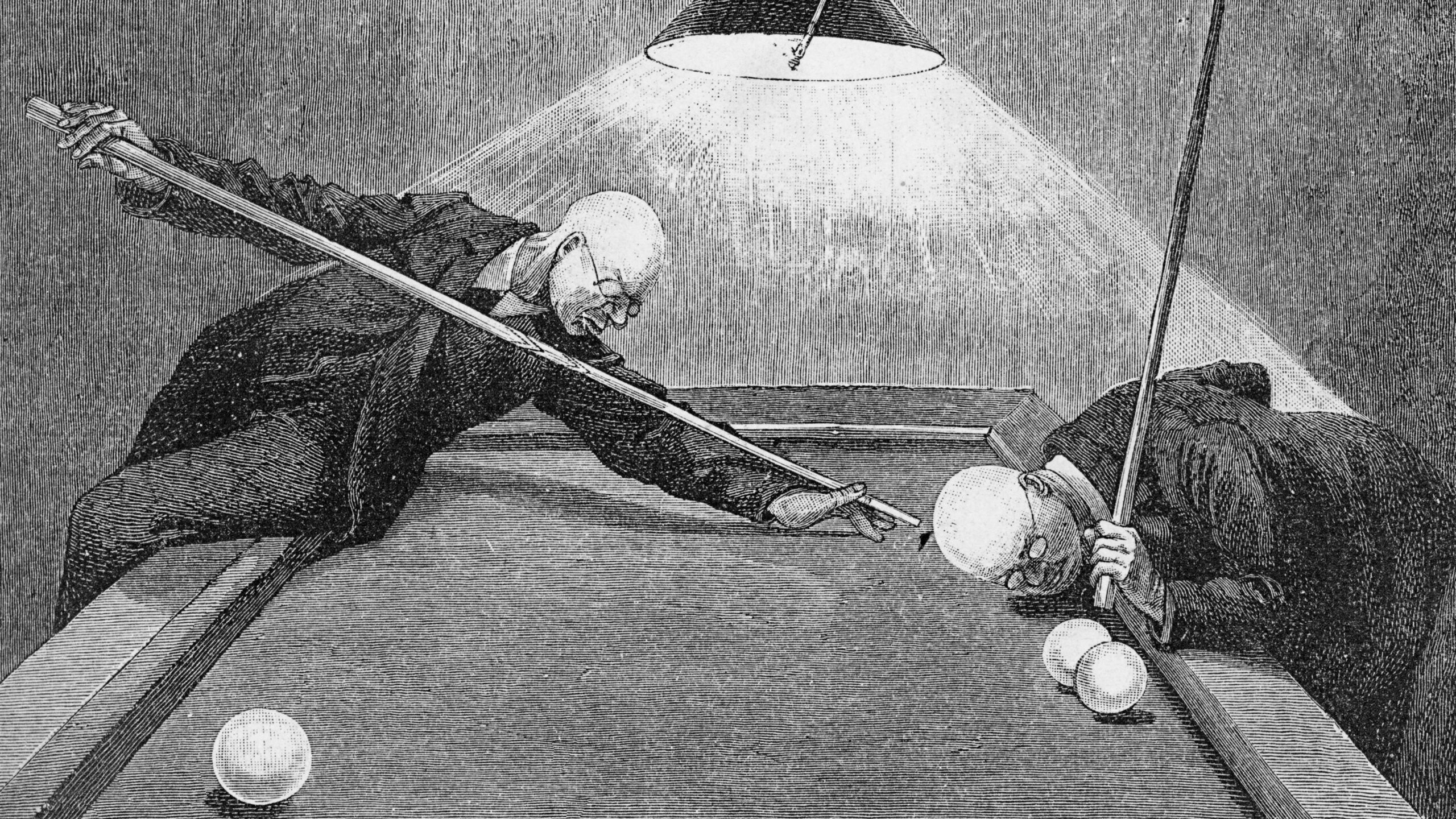

Good morning everyone, and welcome to Thursday, October 10, 2024 – an important date in the history of sports enjoyed by portly individuals.

That’s because it was on this day in 1865 that John Wesley Hyatt patented the billiard ball made from cellulose nitrate (celluloid) in Albany, New York.

Rumours that Hyatt modelled the ball on his own, rather bald, head are apocryphal at best, however his invention forever changed the sport into what we know today, as prior to his invention billiards was played using balls made entirely of wood, with all of the predictability and durability that entails.

For a short time, the balls were fashioned from ivory – but with ivory coming at the cost of many, many lives as the creatures in possession of said ivory were usually loathe to part with it, and were large enough to put up one hell of a fight.

Luckily for you, you won’t need to completely reinvent a sport in order to get your hands on good pre-market info today.

That’s because – as always – we’ve worked super-hard to gather together lots of fiddly little things below, so you don’t need to go ferreting all over the internet for your ASX info this morning.

COMMODITY/FOREX/CRYPTO MARKET PRICES

Gold: US$2,615.62/oz (-0.23%)

Silver: US$30.50/oz (-0.35%)

Nickel (3mth): US$17,530/t (-1.38%)

Copper (3mth): US$9,657.50/t (-0.88%)

Zinc: US$3,021.50/t (-1.95%)

Oil (WTI): US$73.40/bbl (-0.20%)

Oil (Brent): US$76.94/bbl (-0.34%)

AUD/USD: 0.6725 (-0.32%)

Bitcoin: US$61,744 (-1.2%)

WHAT GOT YOU TALKING

Orthocell has been turning many a 'Biocurious' head this week. Read Tim Boreham's excellent breakdown on the Aussie regenerative medtech's latest happenings, here…

Why Singapore approval is so critical for an Aussie company taking medical miracles out of the realm of science fiction. Read Tim Boreham's latest Biocurious column here $ASX $OCC https://t.co/d1LOb6Hwzk

— Stockhead (@StockheadAU) October 9, 2024

WEDNESDAY'S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AUH | Austchina Holdings | 0.002 | 100% | 3,834,534 | $2,100,384 |

| IBG | Ironbark Zinc Ltd | 0.003 | 50% | 346,989 | $3,667,296 |

| NES | Nelson Resources. | 0.003 | 50% | 100,000 | $1,277,189 |

| SMM | Somerset Minerals | 0.004 | 33% | 658,672 | $3,092,996 |

| SHP | South Harz Potash | 0.012 | 33% | 3,858,853 | $8,497,601 |

| GRX | Greenx Metals Ltd | 0.86 | 26% | 542,819 | $190,060,702 |

| AVE | Avecho Biotech Ltd | 0.0025 | 25% | 419,936 | $6,338,594 |

| NAE | New Age Exploration | 0.005 | 25% | 11,360,790 | $7,175,596 |

| TMK | TMK Energy Limited | 0.0025 | 25% | 40,274 | $13,843,224 |

| EIQ | Echoiq Ltd | 0.29 | 21% | 36,949,438 | $141,245,050 |

| AZ9 | Asianbatterymet PLC | 0.036 | 20% | 720,398 | $9,066,449 |

| BP8 | Bph Global Ltd | 0.003 | 20% | 271,340 | $991,604 |

| CYQ | Cycliq Group Ltd | 0.006 | 20% | 1,847,121 | $2,227,583 |

| H2G | Greenhy2 Limited | 0.006 | 20% | 4,821,846 | $2,990,921 |

| IPB | IPB Petroleum Ltd | 0.006 | 20% | 751,039 | $3,532,015 |

| IXR | Ionic Rare Earths | 0.012 | 20% | 7,190,631 | $48,697,626 |

| LML | Lincoln Minerals | 0.006 | 20% | 606,725 | $10,281,298 |

| PUR | Pursuit Minerals | 0.003 | 20% | 205,000 | $9,088,500 |

| WML | Woomera Mining Ltd | 0.003 | 20% | 166,666 | $5,137,686 |

| 1AI | Algorae Pharma | 0.007 | 17% | 1,618,707 | $10,124,368 |

| AL8 | Alderan Resource Ltd | 0.0035 | 17% | 3,870,234 | $4,713,747 |

| ATH | Alterity Therap Ltd | 0.0035 | 17% | 8,100 | $15,961,008 |

| G88 | Golden Mile Res Ltd | 0.014 | 17% | 293,859 | $4,934,674 |

Polymetals Resources (ASX:POL) is growing increasingly confident in its decision to restart the prolific Endeavor mine near Cobar in NSW after it cropped up some exceptional results from geotechnical drilling at the Upper North Lode area of the project.

The junior believes the intercepts of up to 13.5g/t gold, 1410g/t silver, 12.5% zinc & 34.0% lead are evidence that a significant portion of Upper North Lode can support accelerated mining rates, especially after hitting into a nice thick 67m at 517g/t silver and 2.01g/t gold mineralised zone.

The Endeavor mine is on track for an imminent restart with first cashflows in H1 2025 after an optimised mine plan demonstrated the mine could produce 260,000t zinc, 90,000t lead and 10.6Moz silver to generate a whopping $1.85 billion in revenue over an initial 10-year Stage 1 mine life.

Junior explorer Patagonia Lithium (ASX:PL3) has announced it’s been granted exploration rights for three years on 830154/2024, which is one claim in a group of seven covering 12,032 hectares.

Exec chairman Phillip Thomas noted: “We now have a major component of our exploration concessions granted and are actively assessing the potential for other minerals in addition to lithium, such as antimony, niobium and gold where the granites and ultramafic rocks are present.”

Medicinal cannabis company Cann Group (ASX:CAN) is trading up on capital raising news. The company is seeking to raise, through a non-renounceable rights issue, approximately $6.25 million (before associated costs) in order to fund increased production at its Mildura facility.

Dreadnought Resources (ASX:DRE) is lighting the candle for carbonatite-hosted niobium (Nb) finds in WA’s Gascoyne. After a nine-hole drill program testing its Stinger discovery at Mangaroon, it’s popped up with what it says are exceptional hits into the Gifford Creek REE-Nb complex.

Reason? Because niobium’s properties are used to create high-strength, low-alloy steel that’s perfect for renewables, infrastructure and automobiles, reducing weight by up to 30%. The explorer has held the tenure since September 2022 and spent much of last year fingerprinting high-grade zones of Nb and rare earths carbonatites across the 17km-long Gifford Creek carbonatite zone.

In DRE’s latest round of digging it’s cropped up three zones of thick oxide Nb mineralisation with up to 1.3% NbO5 discovered at Stinger. The holes paint a picture of a 1.2km-long strike that’s open in all directions which DRE says has significant upside potential for Nb and other critical minerals such as rare earths (REE), scandium (Sc), titanium (Ti) and phosphorous (P).

Nova Minerals (ASX:NVA) has been digging into resource expansion of the RPM North pit area within its 500km2 Estelle gold project in Alaska’s prolific Tintina gold belt and the first eight holes of a 21-hole RC program have delivered multiple >5g/t gold from surface intersections.

Interval grades showed up to 39g/t in sections and a thick 43m at 4.4g/t gold mineralisation was discovered from the ground down. The drilling is targeting the near-surface mineralisation above the current high-grade core of RPM North and things are looking upbeat to add results of the program to an upcoming resource update that will incorporate two years’ worth of exploration and resource drilling.

It’ll all be jigsawed in to an upcoming pre-feasibility study of the RPM starter mine with an aim to commence a smaller-scale, low-capex, high-margin operation as soon as possible, which will provide cashflow to fund the expansion of the larger Estelle project organically.

And, Echo IQ (ASX:EIQ) has received FDA marketing approval for its aortic stenosis diagnostic, causing its shares to jump over 20% after emerging from a trading halt. The company is now preparing to seek approval for a heart failure indication and is confident about the process, having worked closely with the FDA for 18 months.

EchoSolv AS aims to enhance standard echocardiograms by automatically identifying patients at significant risk, addressing the underdiagnosis of aortic stenosis, which affects about 1.5 million people in the US. The company estimates a potential US revenue of $6.5 million annually with a 10% market penetration. Echo IQ is also gearing up for FDA submission for heart failure and has appointed a new US CEO to lead its commercial efforts.

WEDNESDAY'S ASX SMALL CAP LAGGARDS

Here are the worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| LPD | Lepidico Ltd | 0.002 | -33% | 1,000,000 | $25,767,375 |

| CCZ | Castillo Copper Ltd | 0.006 | -25% | 1,136,216 | $10,396,043 |

| CRB | Carbine Resources | 0.003 | -25% | 722,000 | $2,206,951 |

| SCN | Scorpion Minerals | 0.013 | -24% | 1,520,545 | $6,960,755 |

| GTR | Gti Energy Ltd | 0.004 | -20% | 300,000 | $13,358,133 |

| NTM | Nt Minerals Limited | 0.004 | -20% | 1,300,668 | $5,087,015 |

| TYX | Tyranna Res Ltd | 0.004 | -20% | 12,078,700 | $16,439,627 |

| VML | Vital Metals Limited | 0.002 | -20% | 1,032,540 | $14,737,667 |

| FFG | Fatfish Group | 0.009 | -18% | 840,009 | $15,472,303 |

| 88E | 88 Energy Ltd | 0.003 | -17% | 40,926,032 | $86,801,436 |

| SFG | Seafarms Group Ltd | 0.003 | -17% | 200,000 | $14,509,798 |

| ATC | Altech Batt Ltd | 0.044 | -15% | 8,059,578 | $97,962,311 |

| ANR | Anatara Ls Ltd | 0.046 | -15% | 271,926 | $10,416,261 |

| ROG | Red Sky Energy. | 0.006 | -14% | 499,121 | $37,955,590 |

| GLN | Galan Lithium Ltd | 0.125 | -14% | 4,664,633 | $86,429,333 |

| RR1 | Reach Resources Ltd | 0.013 | -13% | 52,000 | $13,116,470 |

| HPC | Thehydration | 0.020 | -13% | 676,058 | $7,013,001 |

| ADY | Admiralty Resources. | 0.007 | -13% | 40,000 | $13,035,792 |

| SPQ | Superior Resources | 0.007 | -13% | 6,206,225 | $17,358,910 |

| CAG | Caperangeltd | 0.175 | -13% | 90,799 | $18,981,660 |

| KAL | Kalgoorliegoldmining | 0.022 | -12% | 3,840,953 | $6,757,710 |

TRADING HALTS

DRA Global (ASX:DRA) – Application to be removed from ASX

Novatti (ASX:NOV) – Cap raise

Neometals (ASX:NMT) – Cap raise

Excite Technology (ASX: EXT) – Cap raise

Anax Metals (ASX:ANX) – Cap raise

Metals Acquisition (ASX:MAC) – Cap raise

Antilles Gold (ASX:AAU) – An update to an announcement released on October 8

Originally published as Rise and Shine: Everything you need to know before the ASX opens