Resources Top 5: Scandium pop, bonanza gold and Greenland Trump Bump

Scandium resource upgrade sends Australian Mines flying, Meeka Metals up on gold hit, Trump’s Greenland obsession puts explorer in focus.

Australian Mines nearly doubles NSW scandium resource

Golden days for Meeka Metals

Energy Transition Metals gets the Trump Bump

Your standout small cap resources stocks for Wednesday, January 8, 2025.

AUSTRALIAN MINES (ASX:AUZ)

Used in solid oxide fuel cells, alloys for aerospace, ceramics, lasers, electronics and more, scandium is not a metal that pops up on the radar of too many general investors.

But in the current geopolitical context it's worth keeping a watch on the market.

Like specialty metals such as gallium, germanium and last year's superstar commodity antimony, scandium production is largely sourced from China (over 80%) and mostly as a by-product or from reprocessed tailings streams.

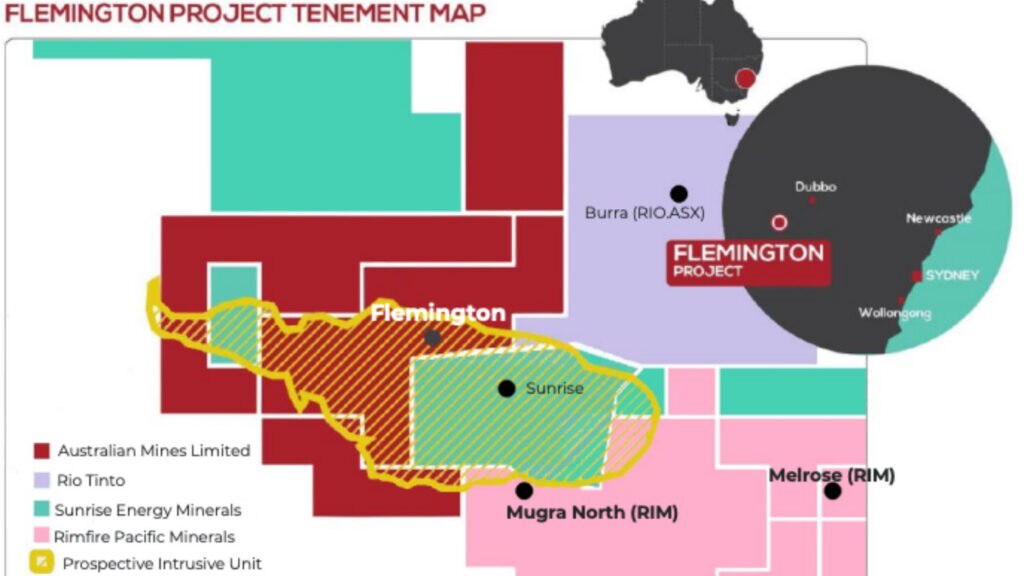

It came onto the radar of many in the west after a couple of big investments (though a rounding error by its standards) from Rio Tinto (ASX:RIO), which followed a decision to process scandium from titanium dioxide slag in Canada with the purchase of a project called Burra in New South Wales.

That asset contains 33.7Mt at 395ppm, but nearby Australian Mines has Rio trumped for grade.

It's building a little bit of scale as well, close to doubling the resource at its Flemington project in NSW on Wednesday from 3.7Mt at 458ppm to 6.3Mt at 446ppm.

That's at a 300ppm cutoff. At a lower 100ppm cutoff, the project contains some 28Mt at 217ppm Sc. Of the 300ppm cutoff resource, 98% is in the measured and indicated category, meaning it's been drilled to a density needed for mine planning.

Rio is not the junior's only neighbour. Flemington is abutted by Sunrise Energy Metals (ASX:SRL) and Rimfire Pacific Mining (ASX:RIM), the latter having seen a 95% rise in its share price over the past year. While RIM has a $91m market cap, AUZ is worth under $17m – at 21Mt at 125ppm Sc, its Murga resource is larger though considerably lower in grade with a broader exploration target of 100 to 200Mt at 100 to 200ppm Sc.

AUZ's advantage, it thinks, is the shallow lateritic nature of the resource, with 90% of it just 50m from surface and below, and boasting nickel and cobalt credits.

"The 2025 resource update not only confirms Flemington as a high-quality critical mineral resource but also as one of the best defined and highest-grade scandium resources within the area," AUZ CEO Andrew Nesbitt said.

"This coupled with the near surface lateritic nature of the resource should provide AUZ a competitive advantage."

MEEKA METALS (ASX:MEK)

A second 'bonanza' gold hit in three days has Meeka Metals running to a more than 20% gain over the past week, with over 10% in morning trade on Wednesday.

Now worth over $200 million, Meeka is set to become one of the next junior gold producers on the ASX, with first ore from its restart of the Murchison gold project due in April.

The project, which once made previous owner Doray Minerals the toast of the Australian gold sector, would deliver 65,000ozpa over its first seven years at average all-in sustaining costs of $1982/oz and all-in costs of $2247/oz according to a feasibility study last month.

At $4100/oz, a touch under current spot gold prices, the project will deliver $721 million of free cash flow after tax.

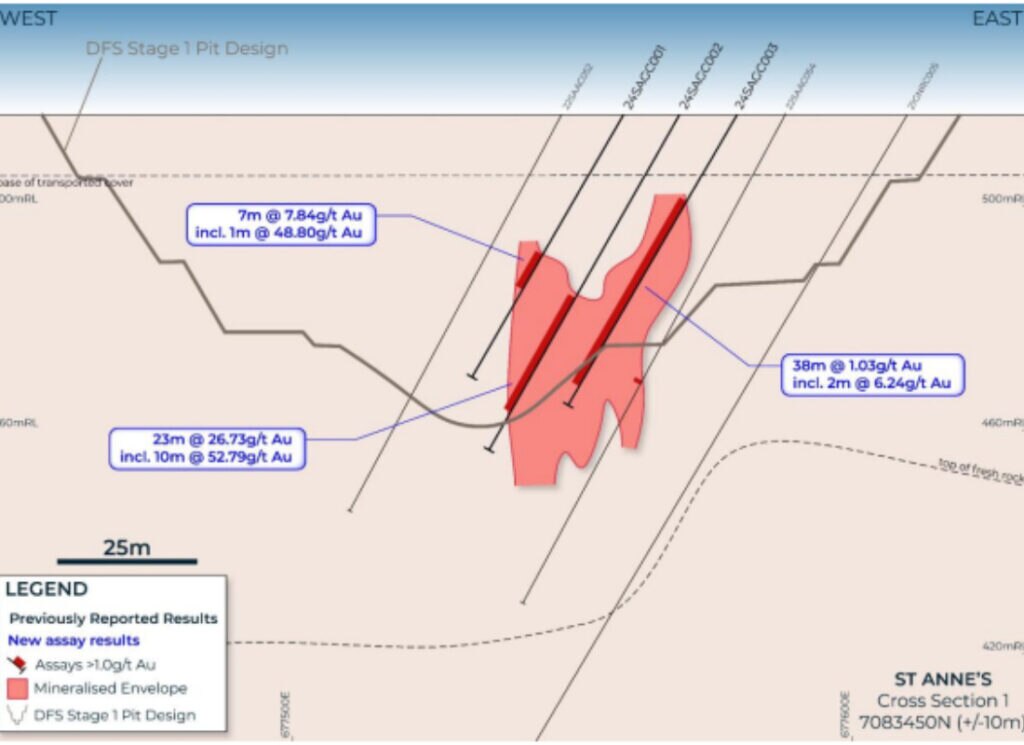

Meeka already says it could expand the shallow open pit being mined in the project's first stage, hitting 23m at 26.73g/t from 38m in RC drilling at the St Anne's deposit.

That includes a narrower section of 10m at 52.79g/t and comes after results of 6m at 26.47g/t Au from 59m and 4m at 30.19g/t Au from 81m at Turnberry caught the attention of the market on Monday.

“This is some of the highest grades we have seen from St Anne’s and will result in the Stage 1 open pit being expanded to the north where hole 24SAGC002 intersected a 10m zone of bonanza gold grading nearly two ounces per tonne," MEK managing director Tim Davidson said.

"Further assays are expected in January 2025 from the remaining 96 holes drilled during the December 2024 quarter. Drilling remains ongoing.”

Meeka is planning to transport ore from the Turnberry and St Anne's open pits to the refurbished Andy Well plant, acquired from Silver Lakes Resources (now Vault Minerals) after its takeover of Doray.

Just 49 of the 145 holes drilled to December 2024 have had their assays returned, with drilling expected to continue at Turnberry and St Anne's through this quarter.

ENERGY TRANSITION MINERALS (ASX:ETM)

(Up on no news)

Greenland has become the centre of the political world in the past couple days with Donald Trump escalating calls to acquire the island territory from Denmark and his son flying in on a press opportunity aboard the Trump-branded Boeing disguised as a personal trip.

The president-elect has called ownership of the arctic island a matter of national security, with some commentary tying his desire to pick up the piece of Inuit real estate to presentations made by Aussie geologist Greg Barnes in Washington back in 2019.

Barnes is the owner of the Tanbreez project, a large rare earths deposit now being farmed into by European Lithium (ASX:EUR) backed Critical Metals Corp.

Better known is the Kvanefjeld rare earth project held by Energy Transition Minerals, previously Greenland Minerals, located near Narsaq and 35km from Narsarsuaq international airport on Greenland's southern tip.

A feasibility study was released in 2015 and updated twice in 2016 and 2019, with an environmental assessment approved for public consultation in 2020.

But ETM's subsidiary GMAS has since applied for arbitration to have its existence and scope for an exploitation licence at Kvanefjeld confirmed following decisions by the Greenland government to reject exploitation licence applications in 2023.

With Trump's claims to Greenland there are hopes from investors that a US takeover could bring development of the project back to the fore.

ETM acknowledged as much in a recent response to a price and volume query from the ASX on January 3.

"The Company notes that there has been significant global media coverage this week stemming from recent statements by incoming US President Donald Trump that owning and controlling Greenland is an 'absolute necessity' for the United States," it said in response to the ASX's letter.

"Mr Trump made the comments in a social media post announcing the appointment of PayPal cofounder Ken Howery as his choice for US ambassador to Denmark. Greenland is an autonomous territory of Denmark.

"The Company notes that Mr Trump’s comments (which have since been repeated) and the associated media coverage, have been reported in online stock market forums and commentary on ETM during the week.

"This together with other factors including the upcoming elections in Greenland, scheduled for no later than 6 April this year, indicate more positive investor sentiment about the prospects for the Company’s flagship Kvanefjeld Rare Earths Project in Greenland, one of the largest and most strategic undeveloped rare earths deposits globally."

ETM said at the time that discussions on potential acquisitions and strategic partnerships related to other projects had either ceased or were at a "very preliminary stage".

STRATA MINERALS (ASX:SMX) and RAIDEN RESOURCES (ASX:RDN)

(Up on no news)

Small cap Strata is in an advantageous location if you're a believer in the laws of nearology, boasting the Penny South gold project that captures a 2.5km extension of the Penny West Shear.

That's the host of Ramelius Resources' Penny gold deposits, which host 440,000t of ore at a fairly ridiculous 22g/t for 320,000oz of gold.

It's not hard to work out the potential value proposition if (that's the qualifying term) something of a similar nature can be teased out by drilling.

The average depth of drill holes at Penny South historically is around 42m, with just 18 holes deeper than 100m and no diamond drilling conducted before SMX moved in. RMS trucks ore from Penny to Mt Magnet but the sugar hit from the orebody will only be around for a short time, putting a premium on any nearby discoveries that can extend its life.

READ: Broadening the Spectrum: Strata Minerals eyes untapped riches at Penny South

Also exploring near a major mineral discovery, Raiden Resources has been drilling into pegmatite at the Andover South lithium project, adjacent to the Andover deposit which turned Azure Minerals into a $1.7bn takeover target of Hancock Prospecting and SQM.

Drilling at the Target Area 7 prospect was ongoing until mid-December, and is expected to restart this month.

At Stockhead, we tell it like it is. While Australian Mines, Strata Minerals and Raiden Resources are Stockhead advertisers, they did not sponsor this article.

Originally published as Resources Top 5: Scandium pop, bonanza gold and Greenland Trump Bump