Resources Top 5: Geez, people may be getting excited again about lithium explorers

Drill results have Tony Leibowitz and John Young’s lithium play Astute Metals on the up; White House cash lifts Ioneer and Element 25.

Tony Leibowitz and John Young's Astute Metals shoots up on lithium drill hit in Nevada

Ioneer and Element 25 nab Washington critical minerals cash as Biden exits the White House

Nimy and Agrimin also rise in big day for speccy buying

Your standout small cap resources stocks, Monday, January 20, 2025.

ASTUTE METALS (ASX:ASE)

It's been a while since lithium explorers were able to move the needle, with prices and investment tailing off at the small end of the market.

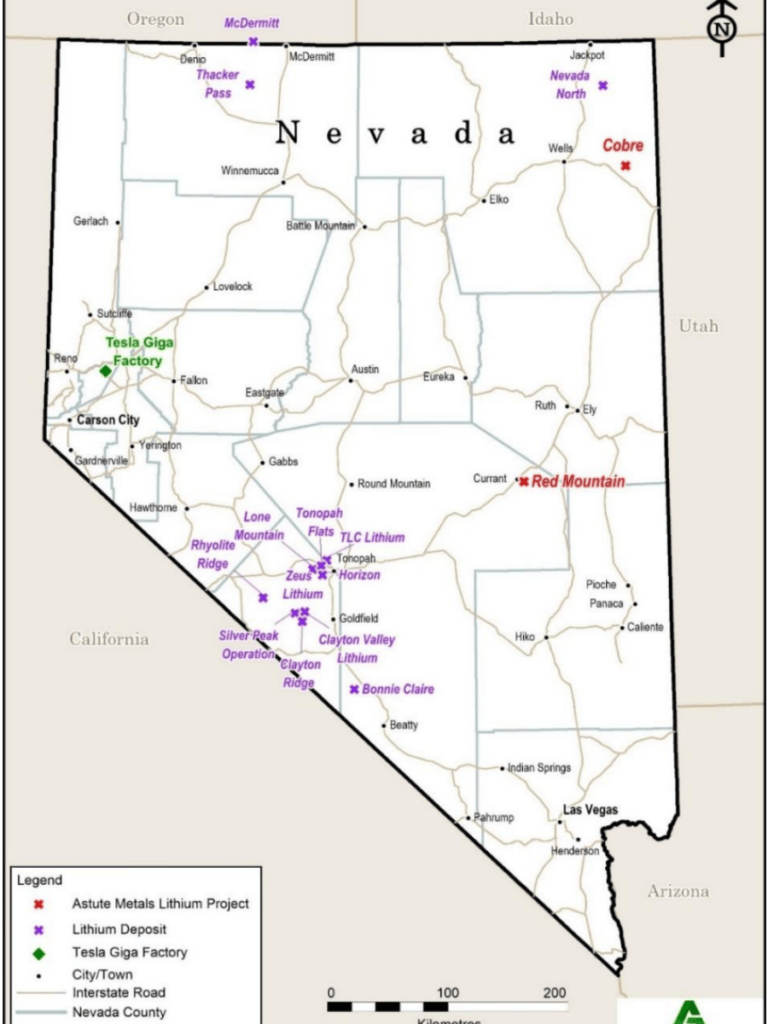

But Tony Leibowitz and his fellow director John Young have been through the wars before, and the former Pilbara Minerals (ASX:PLS) chairman's Nevada lithium play Astute has pulled some eyeballs back to the scene with a monster drill hit at the Red Mountain project in the well-endowed US state.

Home to some of America's largest potential lithium developments – more on that in a moment – results from the second diamond hole in the maiden drill campaign at the site have pulled up big numbers ahead of a mineral resource estimate due this year.

That includes a hit of 86.9m at 1470ppm (parts per million) or 0.78% lithium carbonate equivalent from 18.3m, including 32.1m at 2050ppm (1.09% LCE) from 46.2m.

The project is located in similar rocks to those that hold Lithium Americas' 62.1Mt LCE Thacker Pass – now the largest undeveloped lithium reserve in the world – ABML's 15.8Mt Tonopah Flats and American Lithium's 9.8Mt TLC project.

The diamond holes come off the back of 11 RC drill holes, which drew up 1518m of core over a 4.6km strike length of the outcropping claystone project.

"Like all great discoveries, Red Mountain continues to grow and improve the more we drill," Leibowitz said ahead of a ~60% lift in Astute's share price on Monday.

"The manifest scale and high tenor of mineralisation are testament to Red Mountain being one of the most important recent US lithium discoveries.

"This drill hole is the latest in a succession of 13, all of which intersected strong lithium mineralisation, establishing a solid foundation for a maiden mineral resource estimate to be advanced rapidly in 2025."

IONEER (ASX:INR) and ELEMENT 25 (ASX:E25)

Tomorrow morning's inauguration of US President Donald Trump (in Australian time) comes at a precarious time for America's hopeful battery metals producers.

Many of those in the queue are Australian listed companies who have benefitted from the largesse of the Biden administration, which has rolled out a host of loan and subsidy programs for future electric vehicle suppliers alongside its signature US$369 billion Inflation Reduction Act, a manifesto of sorts for the onshoring of mining and refining previously outsourced to an increasingly unfriendly China.

Two Aussie companies have emerged as winners of a last-minute acceleration from the Biden administration to get grants and loan agreements signed off ahead of the changeover.

Ioneer told investors on Monday it had closed a US$996 million ($1.6bn) loan, including US$968m in principal and US$28m of capitalised interest, a US$268m mark up from a conditional loan announced for its Rhyolite Ridge project in Nevada's Esmeralda County.

Earmarked as America's first new lithium mine in six decades and first new boron operation in almost a century, the project received its federal permit in October 2024.

First product is targeted for 2028, with a final investment decision and conclusion of the conditional agreement that would give PGE producer Sibanye-Stillwater a 50% share of the project for US$490m in project funding still to come. The latter is a condition precedent to receiving the first funding from the loan.

Ioneer intends to finalise a new update to its resource and reserve at Rhyolite Ridge, as well as financial estimates for the project.

“The need for domestically sourced and processed lithium and boron has never been greater. The United States requires Rhyolite Ridge and more projects like it if we want secure domestic critical mineral production. It’s as simple as that,” INR exec chair James Calaway said.

“We’re thrilled to provide these critical battery components to the American manufacturing supply chain."

MD Bernard Rowe said the project is fully permitted and construction ready.

Element 25, meanwhile, has been formally awarded a US$166m ($268m) grant to support the construction of a high purity manganese sulphate monohydrate plant in Louisiana.

Backed also by US$115m ($185m) in funding from carmakers General Motors and Stellantis, it sets up the project to begin by the start of April.

It means the company will be able to ship ore from the Butcherbird mine in WA, where it recently secured approval from the State's mines department to triple capacity, to the US to be used in the battery industry.

Most manganese is currently used to supply steelmakers, and manganese sulphate has struggled in the past couple of years as EV producers making consumer models in China have shifted from nickel-cobalt-manganese cathodes to lithium-iron-phosphate.

According to Fastmarkets, manganese sulphate plants in China were operating at 39% of capacity in November and under 20% as recently as last February.

But E25 says it will use the 135,000tpa plant to supply 'ethically sourced, IRA compliant' HPMSM to US customers.

"This grant from the US Department of Energy represents a major milestone in our development of the Louisiana HPMSM Project and adds to the commitments already received from GM and Stellantis which include both offtake and financing agreements in support of the refinery," E25 MD Justin Brown said.

"The grant will fund up to half of the construction capital costs for the project and when combined with existing commitments, will propel the project towards financial close and commencement of construction, creating long-term jobs for Louisiana and delivering ethically sourced, IRA compliant HPMSM to our customers.”

NIMY RESOURCES (ASX:NIM)

Nimy shares shot through the roof on Monday ahead of responding to an ASX price and volume query (aka a speeding ticket) asking why its shares ran from 8.7c on Thursday to 12.5c on the back of a wing and a prayer.

There's nothing to explain the change, the junior said, though it is continuing to work on a maiden JORC-compliant exploration target for gallium at the Block 3 East prospect at its Mons project in WA.

"The Company expects that an announcement will be made on this matter as soon as practical possible but likely within a fortnight, once the data is interpreted and understood by the Company," NIM said.

"As mentioned in the 27 November 2024 announcement, the Company advised that initial discussions with potential industry partners commenced after approaches from two overseas groups which have expressed strong interest in securing offtake rights to the Block 3 East gallium.

"The Company confirms that discussions remain ongoing with no agreement (either binding or nonbinding) having been reached."

Gallium has attracted attention from investors in recent times thanks to its use in semiconductors and restrictions on its export by major producer China, part of a trade war with the United States over materials used in critical applications like supercomputers, defence and EVs.

AGRIMIN (ASX:AMN)

Much like lithium, and probably even more so, it's been a lonely world for potash stocks in the past couple years after the failure of a host of WA sulphate of potash brine operations torched investor confidence in the industry.

Still, a bit of positive news has sent one of the early proponents of the WA SoP sector, which once promised to disrupt a global market but fell collectively into technical challenges, with Agrimin gaining WA state environmental approval for its Mackay project in the State's north.

“We thank the Kiwirrkurra, Ngururrpa and Tjurabalan peoples for their enduring support and our strong partnership. The world-class Mackay Potash Project has exceptional environmental and social credentials and the potential to support sustainable food security for future generations," MD and CEO Debbie Morrow said.

“Agrimin recognises the extensive accredited assessment completed by the WA EPA through the Department of Water and Environmental Regulation (“DWER”) and other subject matter experts. We thank the Department of Jobs, Tourism, Science and Innovation (“JTSI”) as our designated Lead Agent under the WA government’s Lead Agency Framework for their support, and all involved in the assessment process for their disciplined approach and collaboration.

“We also appreciate the level of involvement that the Department of Climate Change, Energy, the Environment and Water (“DCCEEW”) committed during the state accredited assessment process and Page 2 of 2 we now look forward to concluding the decision stage for the Commonwealth environmental approval."

Located 940km south of Wyndham, the project is slated to produce 450,000tpa of 'organically certified' SoP at the mine gate, leveraging a 20Mt reserve and 123.4Mt resource.

Previously led by Mark Savich, Agrimin also holds 40% of private company Tali Resources, which holds prospective tenements in WA's West Arunta region and a 13% stake in WA1 Resources (ASX:WA1), the boom stock which found the Luni niobium deposit in the same part of the state.

Originally published as Resources Top 5: Geez, people may be getting excited again about lithium explorers