Resources Top 5: Arcadium goes to Rio, Burley kicks iron ore goals

Arcadium shareholders approve $10 billion takeover by Rio Tinto, with the mining giant hoping to secure its lithium prize by mid-2025.

Arcadium Lithium gets shareholder approval for $10bn Rio takeover

Christmas Eve trade brings speculative small caps to the fore

Burley Minerals, Green Critical Minerals, Resolution Minerals and Black Dragon Gold (again) all up on nada

Your standout small cap (and other) resources stocks for Tuesday, December 24, 2024.

ARCADIUM LITHIUM (ASX:LTM)

Despite a suit filed in four US states by three as of now undisclosed investors and a battle from a small number of fundies to up the value of the deal, shareholders in the ASX and New York listed lithium stock have voted to support Rio Tinto's (ASX:RIO) US$6.7bn ($10bn) takeover of the major lithium producer.

It's one tranche of a massive investment BHP's sparring partner as the world's second biggest miner is making in the unloved battery metal, predicting the bottom of the market by also announcing a US$2.5bn investment in the 60,000tpa Rincon brine project in Argentina.

In Arcadium Rio gets two producing brine projects with 75,000tpa lithium carbonate equivalent production, a major growth arm in Canada's hard rock lithium scene and expansion prospects in the South American country.

Rio expects the deal to clear next year, with work now afoot to sew up a funding package for the deal, which Rio CEO Jakob Stausholm told investors earlier in December could include a new share placement.

The deal is expected to close by mid-2025, with Rio's 14.99% ownership by China's Chinalco reported as a potential discussion point.

But LTM said merger control clearance has already been satisfied or waived in Australia, Canada, China, the UK and USA, with investment screening approval satisfied in the UK.

"Today's vote of support by our shareholders confirms our shared belief that with Rio Tinto, we will be a stronger global leader in lithium chemicals production," LTM boss Paul Graves said.

"Together, we enhance our capabilities to successfully develop and operate our assets while supporting the clean energy transition. We are confident that this transaction will provide future benefit to our customers, employees and the communities in which we operate, and I am excited by the path ahead."

LTM is the combination of a string of small lithium businesses that grew into major market players during the last boom. It emerged last year after the merger of US-based Livent and Australia's Allkem, the latter a partnership between Galaxy Resources and Orocobre.

According to a corporate filing, 176 company shareholders representing 708,235,861 votes cast their decision in favour of the merger, with 17 or 14,308,618 against. That comfortably cleared the 75% yes hurdle required to support the US$5.85 per share scheme.

The deal clocked in at a 90% premium to LTM's trading price before Rio's approach was revealed publicly in October, and 39% over its VWAP since the Livent-Allkem merger consummated in January (as of October 9).

Rio shares fell 0.91% on the news.

BURLEY MINERALS (ASX:BUR)

(Up on no news)

'Twas the night before Christmas, when all through the ASX not a small cap was stirring.

Well not quite, but it is a little light on news as the market rolls into an early finish on Xmas Eve, the sort of thing they generally refer to as an anti-climax.

Yet the Burley is still bouncing (one for our WA cohort there) with the iron ore and lithium explorer on the move as the new season approaches.

There is some added potential liquidity coming in this stock, with 1.2 million shares tied to the purchase of exploration ground in Manitoba, Canada, where the small cap was chasing white gold (more like white silver after the past year's price action), due to come out of escrow on Jan 1.

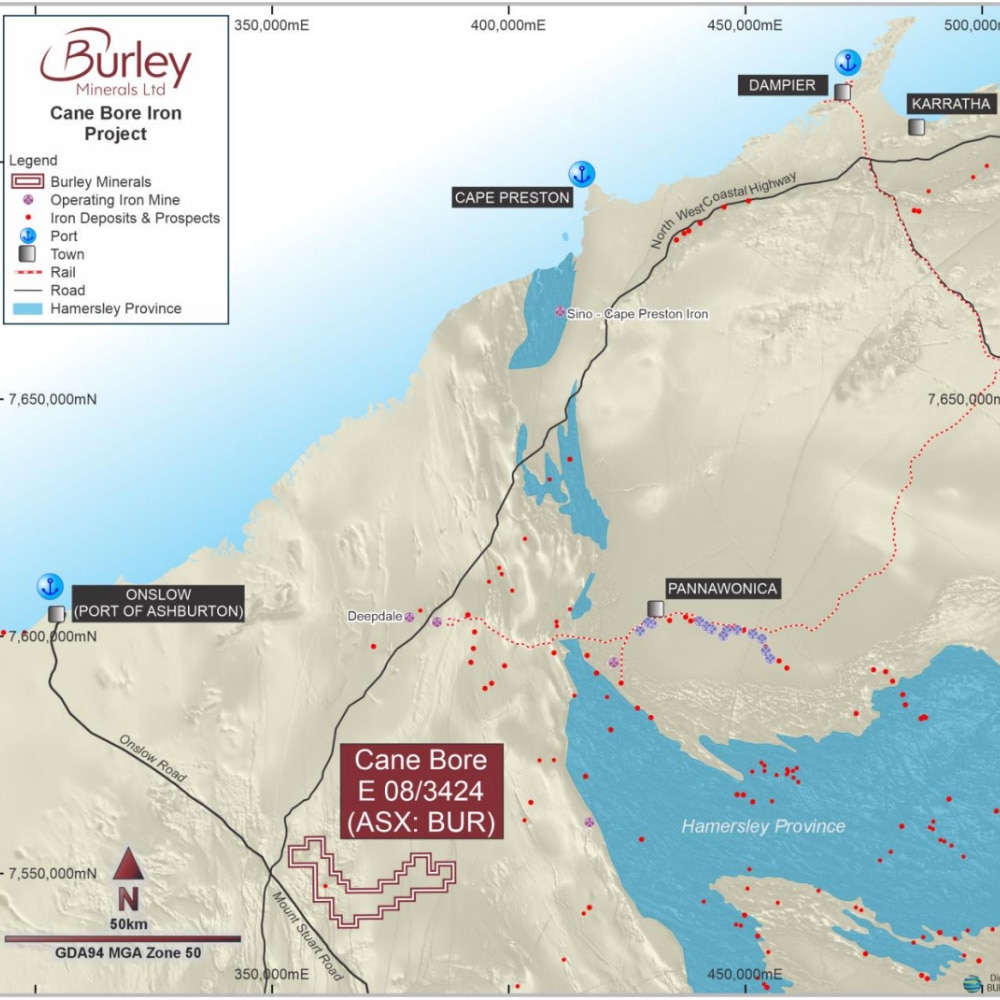

But on the ground its focus has shifted to the Pilbara, where BUR has been undertaking mapping and rock chip sampling over channel iron deposit areas at its Cane Bore licence.

The most recent samples averaged 52.6% Fe in the lab or 58.8% Fe when calcined, with a high of 56.9% Fe (63.6% Fe calcined).

What is interesting about Cane Bore is the location. It sits less than 100km by sealed road from Onslow and the Port of Ashburton.

That district has been opened up over the past year with the development of Mineral Resources' (ASX:MIN) $3bn, 35Mtpa Onslow Iron project.

Another company, Miracle Iron, which is linked to Chinese interests, has purchased the Paulsens East project from Strike Resources but is still awaiting foreign investment review board approval for the purchase of CZR Resources' (ASX:CZR) Robe Mesa project.

Combined they could become a 5Mtpa iron ore hub in the West Pilbara region. Channel iron deposits are typically gravelly and can be mined without drilling and blasting, making them economic at far low ore grades than banded iron formation deposits.

A program of works for maiden drilling at Cane Bore is sitting with WA's mines department, with Burley MD and CEO Stewart McCallion telling investors last month he had also met with two traditional owner groups ahead of heritage surveys.

Green Critical Minerals (ASX:GCM)

(Up on no news)

Green Critical Minerals has captured the eye since its shift to focus on a new graphite block technology.

Invested by scientist Professor Charles Sorrell and a team working at the University of New South Wales, the very high density – or VHD – graphite blocks can be used in materials for the defence and nuclear industries, electrical discharge machining, thermal energy storage, electronics, aerospace, semiconductors and heat sink appliances.

That takes GCM beyond the currently faltering battery metals supply chain, where prices of a host of commodities have come off the boil due to faltering economic growth in China and oversupply.

The promise of the VHD block technology, which could become a host to tail operation if GCM develops the McIntosh deposit in which it is earning an 80% stake, is that it could disrupt high-end graphite products with a process time cut from 12 weeks for synthetic alternatives to 24-36 hours at lower temperatures.

Similar products currently made today via nuclear and pyrolitic processes can sell for over US$1000/kg in premium markets, GCM says.

Production could start late next year, with commissioning of a pilot plant, already under construction, due in Q3 2025.

"The progress at our NSW pilot plant is truly exciting and demonstrates the great momentum we are building at GCM," GCM MD Clinton Booth said this month.

"The speed and quality of the work being undertaken reflects our team's commitment to excellence. This pilot plant is a pivotal milestone in proving the commercial viability of our VHD Technology."

GCM is looking to make two products initially, smaller VHD blocks for heat sinks in high performance computers and larger VHD blocks for solar-thermal energy storage systems.

RESOLUTION MINERALS (ASX:RML)

(Up on no news)

This penny dreadful raised $300,000 on December 10, the sort of cash that could be referred to as keeping the lights on, having ended the September quarter with just $80,000 in the bank.

It's got a handful of early stage projects including Allegra and 64North in Alaska, George in South Australia and Carrara Range in the NT.

But its flagship is the Benmara project in the Northern Territory, a collection of nine licences, one under application, where its hoping to find a tier-1 deposit of some kind.

The brief is broad. A presentation in September called Benmara highly prospective for IOCG, sedex copper, Mt Isa-style copper cobalt and unconformity related uranium mineralisation.

With analogues like Ernest Henry, Century Zinc, McArthur River and more this is a blue-sky, world-is-your-oyster kind of thing.

There are large players nearby. South32 and Encounter Resources are exploring nearby at the Jessica-Carrara JV.

Now to actually get the dollars into the ground.

BLACK DRAGON GOLD (ASX:BDG)

(Up on no news)

It wouldn't be Christmas without one more unexplained gain for the summer's most mystifying ASX stock.

BDG received some disheartening news earlier this month that its rezoning application, part of the permitting process for the development of the 1.5Moz Salave gold project in Spain, was knocked back by the Tapia de Casariego Council.

Last we were told BDG was assessing the 'highly frustrating decision' while it awaits the formal minutes of the meeting, saying there were no environmental grounds to reject the application to rezone its land from agriculture to industrial production.

Located in the wider province of Asturias, BDG has, perhaps counter-intuitively, been rising like a Mitch Starc bouncer for the past week, somehow clearing a 100% YTD gain.

The company issued a bland no response to a speeding ticket from the ASX on Monday, only to climb higher on Tuesday as punters filed in before the early close.

Is it all hope? We'll see what specifics around the Salave development and regulatory environment emerge after the break.

At Stockhead, we tell it like it is. While Green Critical Minerals is a Stockhead advertiser, it did not sponsor this article.

Originally published as Resources Top 5: Arcadium goes to Rio, Burley kicks iron ore goals