Bauxite boom brings opportunity

Bauxite prices are on a tear and Lowell Resources Fund CIO John Forwood is looking at ways to play the booming price run.

Bauxite prices are on a tear and Lowell Resources Fund CIO John Forwood is looking at ways to play the booming price run.

Junior companies are capitalising on the high price environment by picking up distressed gold assets to give them a new lease on life.

After posting “oustanding” pivotal trial data, Orthocell will apply for US FDA approval of its Remplir nerve-repair product.

Tit for tat bans on uranium imports and exports by the US and Russia present a tremendous opportunity for ASX companies operating in Africa.

Morningstar recommends using the Rule of 40 to assess SaaS-based companies, and here are their stock tips.

Aura Energy could reach FID in 2025 at its US$230m Tiris uranium mine in Mauritania, which Argonaut calls one of ASX’s best undeveloped projects.

While Bitcoin and crypto have pulled back a tad since the Trump trade sent BTC to fresh highs in November, there are plenty of tailwinds to suggest the moon mission is intact.

Profits from the leading rural stocks have been subdued, but there’s a rich harvest for investors taking the long-term view.

ASX retreats from record highs, but focus is now Black Friday sales which could offer a catalyst for next week.

Worley, with its renewable energy projects, is being recognised by Goldman as an undervalued green stock.

For now, the uncertainty surrounding Trump’s tariff threats is keeping gold elevated with the Aussie gold price up 0.14% to $4063 on Friday.

MTM Critical Metals will turn its flash joule heating technology to processing gallium, germanium and indium from scrap in a US MoU.

Averting the threat of blackouts will require firming sources of power like batteries and natural gas.

Energy expert Roscoe Widdup of Triple Eight Capital says copper bulls would be wise to look at silver for exposure to the electrification thematic.

Its growing use in solar panels, Chinese restrictions on its exports and flagging production, have made antimony a growing market star.

Two new biotech companies – Vitrafy and Renerve – listed today, breaking an eight-month drought of life sciences IPOs on the ASX.

The ASX has dipped from record highs, but the tech sector is travelling okay so far on Friday. Meanwhile, MTM has partnered with Indium for US metal recovery.

Stockhead TV’s Sarah Hughan brings you today’s Break it Down, detailing the initial antimony testwork from Warriedar Resources.

Stockhead TV’s Sarah Hughan brings you today’s Break it Down, detailing a high-value metals recovery partnership from MTM Critical Metals.

WA is pumping $150 million into a lifeline for cash-strapped lithium miners. Will it prevent job losses?

Edith Cowan University is assessing green direct extraction processing to unlock Australian resources of the ultra valuable metal rubidium.

The ASX reached a new record high on Thursday – on banks and healthcare gains, while Pro Medicus secured a $330 million deal with Trinity Health.

Regenerative medicine play Orthocell appears to be breaking out, technically speaking, and its chart run might just be getting started.

Desert Metals rose Thursday on a Cote d-Ivoire gold anomaly, while Hastings was up on Saudi rare earths plant proposal.

Dental supplies chain SDI reports promising initial sales of its “exciting” aesthetic amalgam filling replacement product, Stela.

2D Generation’s groundbreaking graphene technology could revolutionise next-gen chips.

Stockhead TV’s Sarah Hughan brings you today’s Break it Down, detailing a new Saudi MoU from Hastings Technology Metals.

Stockhead TV’s Sarah Hughan brings you today’s Break it Down, detailing the new “Freak” third gold discovery at the Dalgaranga project from Spartan Resources.

ASX nears record high, Bitcoin rebounds above US$96k, AV Jennings runs hot on takeover.

While mineral sands are not seen as exciting, they are nonetheless a solid choice for resource investment.

Euroz keeps speculative buy on Hazer with $0.57 target, citing hydrogen demo plant progress and graphite growth.

Aussie stocks rose on Wednesday after Israel-Hezbollah ceasefire talks turned positive. Meanwhile, City Chic stumbled.

Mount Hope Mining’s managing director and CEO Fergus Kiley joins Barry FitzGerald on the Explorers Podcast to talk about the company’s upcoming ASX listing.

Guy Le Page checks back in on MTM Critical Metals with some advice on how to tap into a smaller-scale, but high-margin business.

Nagambie Resources shares rose strongly off the back of an announcement it would trial the storage of road building waste at its west pit.

Stockhead TV’s Sarah Hughan brings you today’s Break it Down, detailing the new commercial expansion of a nerve repair device from Orthocell.

Local markets have followed Wall Street higher today, with the goldies out in front once more.

Australia faces a looming gas shortage crisis. Here are the projects that could ease concerns on the East Coast.

Good morning, and welcome to Stockhead’s Top 10 at 11, a short, sharp update to help frame the trading day.

WA’s ASX-listed resources stocks are shooting high on demand for the critical minerals antimony and niobium.

The ASX has been struggling for traction today, following a mixed result on Wall Street overnight.

ASX 200 down. BHP’s profit up 2pc, but dividend cut. Lovisa drops 12pc; Zip Co loses over 10pc despite strong revenue

Investors are eyeing mining stocks after China’s news, while Star Casino comes crashing out of a trading halt.

The ASX rises on positive US inflation news, Xero ticks up 5%, Selfwealth attracts another suitor and Bitcoin hits US$93k before cooling off a tad.

The ASX rose, driven by gains in Xero, while gold stocks slid. Meanwhile Variscan surged 50% and Bitcoin briefly hit US$93k before retreating.

The ASX opened higher on Wednesday after ceasefire news in the Middle East, while Bitcoin dipped below $92,000, and Web Travel surged.

Stockhead TV’s Sarah Hughan brings you today’s Break it Down, detailing ovarian cancer detection testing from Cleo Diagnostics.

The maker of anti-snoring mouthguards, Somnomed has upgraded full-year revenue and profit guidance and investors are awake to the opportunity.

When Renerve makes its IPO on the ASX today, it will join Orthocell (ASX:OCC) as one of only two nerve-repair companies to be listed on the local bourse.

Lion Selection Group’s Hedley Widdup is optimistic a strong gold market could bring cash back into junior resources next year.

The US$3.8bn sale of Anglo American’s Queensland coal operations to Peabody shows the value miners still place on the Asian market.

Cryopreserver Vitrafy Life Sciences face stiff competition, but believes it has the ingredients for success under CEO and former MasterChef winner Brent Owens.

The ASX dropped as Trump’s tariff threat rattled markets, but at least the day saw some gainers, including BlueScope, Reece and EML Payments.

Phosphate hopeful PhosCo ran over 60% higher on Tuesday after Tunisia approved a key permit for development of Northern Phosphate Basin.

The ASX has dropped on Tuesday following Trump’s tariff announcement, but EML Payments surged after reporting strong Q1 results.

Stockhead TV’s Sarah Hughan brings you today’s Break it Down, detailing near-term gold production plans from Native Mineral Resources.

Stockhead TV’s Sarah Hughan brings you today’s Break it Down, detailing the new partnership with a German-based renewable energy company from Altech Batteries.

Newcomer BHM is about to put the outback town of Broken Hill back on the map for investors with its Rasp and Pinnacles mines.

As a company focused on delivering a re-purposed erectile dysfunction drug via a nasal spray, LTR Pharma is a simple story to understand. Tim Boreham evaluates.

The ASX is approaching the 8,500 mark, while Cuscal’s IPO debuted poorly, trading below its listing price.

It’s in a trading halt but a potential lithium find at Raiden Resources seems to have investors piling into neighbour Errawarra.

Stockhead TV’s Sarah Hughan brings you today’s Break it Down, detailing the Lucapa Diamond Company’s Merlin restart in the Northern Territory.

Stockhead TV’s Sarah Hughan brings you today’s Break it Down, detailing the new human pharmacokinetic study from Neurotech.

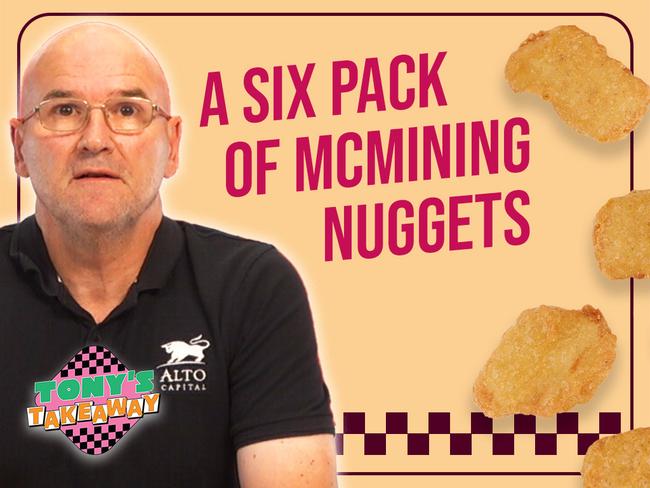

This week on Tony’s Takeaway, Locantro wants to share his sides with you – his six ‘McMining Nuggets’, starting with Far East Gold.

Drumroll… it’s Pilbara Minerals. And that’s despite the lithium prices tracking upwards just lately.

While three of the biggest building material companies have been taken over, there are still opportunities to tap an expected recovery in housing activity.

Following key online promotional events, EZZ Life Sciences reports surging Chinese sales of its health and beauty products.

Australia’s love of betting is as strong as ever, although the wagering market is consolidating. One asset manager is tipping BlueBet and PointsBet to succeed.

Supermajor Shell’s reportedly successful appraisal program at the Taroom Trough could pry the play open to ease east coast gas woes.

Western Australia’s remote Paterson Province is looking interesting once again, particularly for junior explorer Antipa Minerals. Kristie Batten reports.

AusQuest has been riding with South32 for eight years. Is it on the cusp of a major discovery?

RFC Ambrian says gold forecasters tend to underpredict future prices 80% of the time, with bullion regularly making analysts look silly.

One of the world’s top lithium companies has taken a shine to ASX junior iTech Minerals in a frontier exploration JV.

The ASX rose on Friday on energy gains and A2 Milk’s spurt, while WiseTech and Megaport dragged tech down and Bitcoin soared (again).

As Donald Trump’s second term in the Oval Office looms, global markets face a seismic shift with opportunities and risks both firmly in play, writes Nigel Green.

Three companies, including Orica, Sims, and Australian Vintage, were recognised for their strong ESG efforts in 2024.

Morgans analyst Scott Power notes global healthcare markets have fallen after Trump’s appointment of RFK Jr as Secretary of US Department of Health and Human Services.

The ASX has risen on Friday on energy gains, while tech stocks have dropped on the back of WiseTech, Megaport sell-offs.

In this episode, host Fraser Palamara delves into 5E Advanced Materials’ (ASX:5EA) achieving its first full truckload shipment of boric acid super sacks to a US customer.

In this episode, host Fraser Palamara tells all on AML3D (ASX:AL3) more than doubling its US manufacturing capacity on the back of a successful $30 million capital raise.

Original URL: https://www.news.com.au/finance/business/stockhead/news/page/20