October Tech Winners: ASX tech sector falls 4.43pc, still top YTD

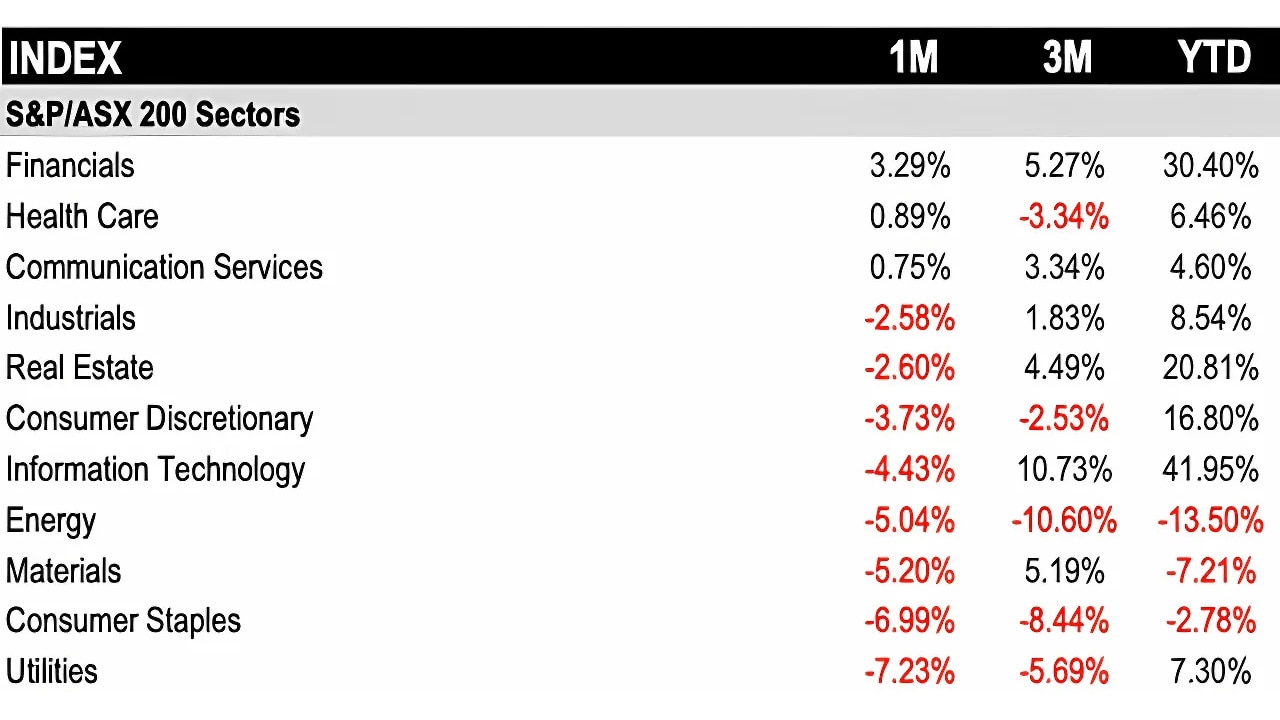

The S&P/ASX 200 Information Technology sector is down ... and up. It fell 4.43 per cent in October but remains the ASX’s top performer, up 41.95 per cent YTD.

The S&P/ASX 200 Information Technology sector fell 4.43 per cent in October in what was a weaker month for global markets but remains the ASX's top-performing sector of 2024, up 41.95 per cent YTD.

The US Nasdaq Composite index – the bellwether for the global tech sector – fell 0.5 per cent in October.

Global X investment strategist Billy Leung told Stockhead that despite the significance of macro factors such as the US elections, geopolitics, and RBA commentary, Australian tech stocks were largely impacted by company-specific events.

"Other ASX sectors, including Energy and Materials, underperformed largely due to external pressures like China’s economic slowdown and the lack of clear policy stimulus, which impacted commodity demand," he said.

"Against this, Australian tech remains a more internally driven sector, with company fundamentals playing a pivotal role."

October's top ASX tech winners

| Code | Name | Price | % Change | Market Cap |

|---|---|---|---|---|

| TZL | TZ Limited | 0.08 | 321% | $20,526,649 |

| NVU | Nanoveu Limited | 0.043 | 115% | $21,711,676 |

| VR1 | Vection Technologies | 0.017 | 113% | $22,552,012 |

| XPN | Xpon Technologies | 0.014 | 100% | $5,074,181 |

| VIG | Victor Group Hldgs | 0.05 | 67% | $28,611,334 |

| LIS | Lisenergy | 0.195 | 66% | $128,040,046 |

| AI1 | Adisyn Ltd | 0.065 | 63% | $15,752,406 |

| FLX | Felix Group | 0.24 | 50% | $49,079,931 |

| XF1 | Xref Limited | 0.21 | 45% | $39,707,486 |

| PPK | PPK Group Limited | 0.505 | 37% | $45,860,311 |

| LNU | Linius Tech Limited | 0.002 | 33% | $11,730,481 |

| 1CG | One Click Group Ltd | 0.012 | 33% | $11,386,411 |

| AVA | AVA Risk Group Ltd | 0.13 | 33% | $37,718,030 |

| FND | Findi Limited | 6.4 | 32% | $313,767,814 |

| SOR | Strategic Elements | 0.05 | 28% | $23,440,422 |

| RWL | Rubicon Water | 0.325 | 27% | $78,225,907 |

| CT1 | Constellation Tech | 0.0025 | 25% | $3,686,834 |

| VNL | Vinyl Group Ltd | 0.13 | 24% | $152,075,596 |

| ZMM | Zimi Ltd | 0.011 | 22% | $1,525,635 |

| SLX | Silex Systems | 5.25 | 22% | $1,245,518,001 |

| AXE | Archer Materials | 0.27 | 20% | $70,082,929 |

| SMN | Structural Monitor | 0.69 | 19% | $94,777,746 |

| SPZ | Smart Parking Ltd | 0.7 | 19% | $244,494,044 |

| KYP | Kinatico Ltd | 0.13 | 18% | $56,366,958 |

| NXL | Nuix Limited | 7.74 | 18% | $2,543,621,982 |

| 360 | Life360 Inc. | 21.97 | 16% | $4,089,133,257 |

TZ Ltd (ASX:TZL) rocketed 321 per cent higher in October with news that it had entered into a Heads of Agreement to acquire Proptech company, Keyvision Holdings, a “high margin, recurring revenue proptech company that provides tenant experience apps for the property sector: residential; commercial; retail; aged care and community groups”, according to the announcement.

TZL also reported its latest quarterly reports, including revenue of $2.8m, short of the targeted $3.7m plan, with the company impacted by delays to projects in the US that would have delivered an additional $750K in top line revenue.

While the US operating subsidiary fell short of their quarterly revenue target, TZL said the Australia New Zealand region, ASIA and EMEA, all exceeded revenue expectations for the quarter.

Nanoveu (ASX:NVU) rose 115 per cent higher during October with news it planned to acquire EMASS, a company which has advanced chip technology that allows devices to perform complex tasks quickly without relying on the internet.

By purchasing EMASS for $5 million in shares, NVU gains access to unique technology and patents. This innovation can create glasses-free 3D experiences, making products more engaging across various devices. Investors are excited as NVU plans to integrate this technology into its own offerings, potentially opening up new opportunities in the AI market.

Vection Technologies (ASX:VR1) rose 113 per cent in October. During the month VR1 announced that it had partnered with IT giant Dell to launch its AI-based ‘Algho’ platform, securing its first sale of $500k.

Algho is powered by the core AI technology of TDB, a generative AI company Vection is acquiring, and will now be available to Dell’s salesforce and channel partners.

VR1 said the collaboration positionsed Vection at the forefront of AI and spatial computing, providing advanced enterprise-ready AI solutions to Dell’s global customer base.

Li-S Energy (ASX:LIS) rose 66 per cent in October, announcing during the month a globally significant breakthrough for its unique lithium sulfur cell chemistry.

The latest substantial improvement in the performance of its battery technology brings the company even closer to commercialising its tech as it targets the rapidly growing drones, defence and electric aviation markets where weight is critical.

Life360 (ASX:360)rose around 16 per cent in October as Leung said investors positioned ahead of the company’s Q3 results.

"Life360, known for its family safety and location-sharing app, has seen strong traction by monetising a high-margin subscription model," he said.

"The business is expected to maintain this growth while driving towards profitability in FY24, setting it as a promising tech player in Aussie market."

October's worst ASX tech losers

| Code | Name | Price | % Change | Market Cap |

|---|---|---|---|---|

| NOV | Novatti Group Ltd | 0.034 | -56% | $13,816,342 |

| ATV | Active Port Group | 0.02 | -51% | $7,068,831 |

| CML | Connected Minerals | 0.2 | -44% | $8,271,642 |

| LVH | Livehire Limited | 0.028 | -38% | $10,685,208 |

| BCC | Beam Communications | 0.09 | -36% | $8,123,661 |

| ADA | Adacel Technologies | 0.32 | -35% | $24,423,996 |

| SMP | Smartpay Holdings | 0.615 | -34% | $148,795,230 |

| DRO | Droneshield Limited | 0.945 | -31% | $832,869,977 |

| ICE | Icetana Limited | 0.017 | -29% | $4,498,683 |

| CAG | Caperange | 0.145 | -28% | $13,761,704 |

| HTG | Harvest Tech Group | 0.013 | -28% | $11,272,346 |

| IXU | Ixup Limited | 0.011 | -27% | $18,380,845 |

| 8CO | 8Common Limited | 0.03 | -27% | $6,722,847 |

| DUG | DUG Tech | 1.835 | -27% | $249,077,920 |

| SIS | Simble Solutions | 0.003 | -25% | $2,260,352 |

| DUB | Dubber Corp Ltd | 0.017 | -25% | $23,581,498 |

| ERD | Eroad Limited | 0.83 | -22% | $155,341,925 |

| ODA | Orcoda Limited | 0.155 | -21% | $26,219,346 |

| FCT | Firstwave Cloud Tech | 0.022 | -21% | $37,620,426 |

| W2V | Way2Vatltd | 0.008 | -20% | $7,256,400 |

| TYR | Tyro Payments | 0.775 | -18% | $408,415,236 |

| KNO | Knosys Limited | 0.04 | -18% | $8,645,548 |

| WHK | Whitehawk Limited | 0.01 | -17% | $5,033,126 |

| CF1 | Complii Fintech Ltd | 0.022 | -15% | $12,581,437 |

| WTC | Wisetech Global Ltd | 118.28 | -14% | $39,560,138,629 |

WiseTech Global (ASX:WTC) suffered a 14 per cent decline in October after allegations of misconduct by founder, executive director and CEO Richard White. It was announced on October 24 that White would transition to a strategic advisory role.

"The company’s CargoWise platform, widely used by large freight forwarders, continues to support its growth," Leung said.

"WiseTech also has expansion opportunities through new offerings, including Container Transport Optimisation and ComplianceWise, which are expected to support its long-term strategy.

"Investors are looking to the upcoming Investor Day in December for reassurance on management stability and the company’s growth roadmap."

At Stockhead, we tell it like it is. While Li-S Energy is a Stockhead advertiser, it did not sponsor this article.

Originally published as October Tech Winners: ASX tech sector falls 4.43pc, still top YTD