Lunch Wrap: ASX swings sideways as gold bounces back; Fed call in focus

Markets have wobbled on Tuesday as Wall Street paused gains. ASX stocks are split between bright spots such as Vicinity and caution from WiseTech.

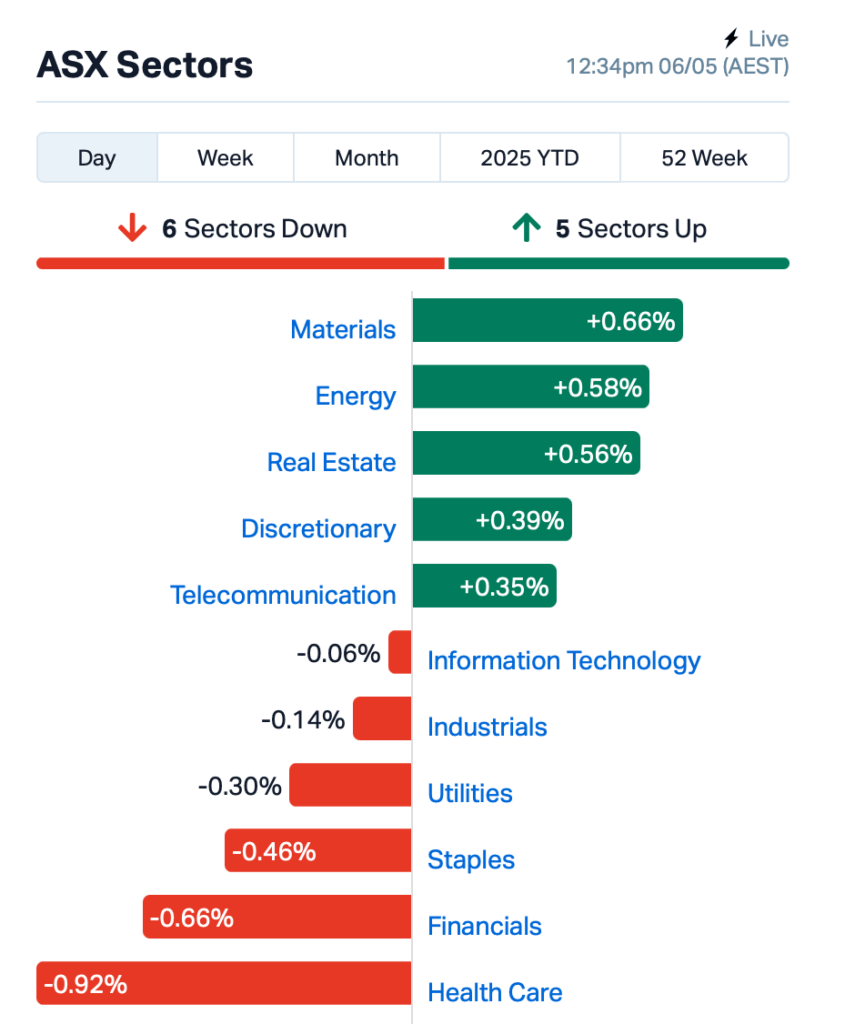

ASX wobbles as financial and staple stocks slip

Overnight, Wall Street stumbled with the Fed back in the hot seat

Meanwhile SiteMinder shines but Sigma sinks and WiseTech warns

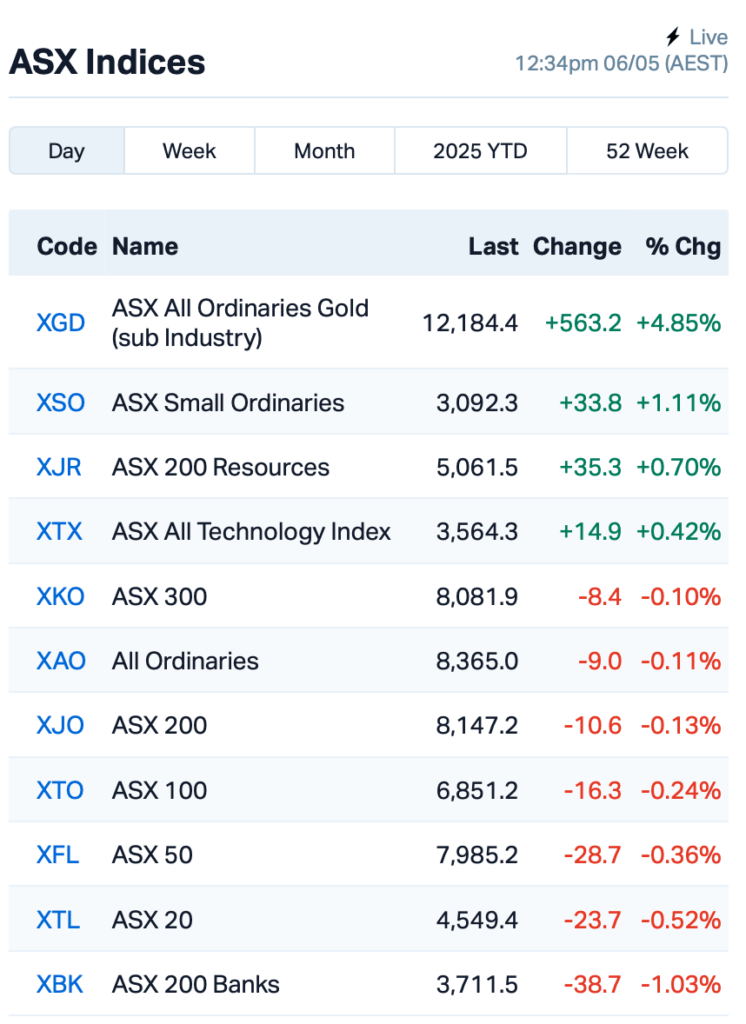

It's been a wobbly old day on the ASX so far, with the benchmark ASX 200 index swinging between gains and losses before flattening out by around lunchtime in the east.

Overnight, the US S&P 500 finally hit the brakes after a record nine-day run, dropping by 0.64%. The tech-heavy Nasdaq also fell by 0.74%.

Wall Street traders had mixed signals. On one hand, Trump reckons a few trade deals might land this week, but he’s not picking up the phone to Xi.

Some reckon Trump’s got a limited window to ink trade deals before the damage becomes harder to reverse.

On the other hand, stronger-than-expected US services data cooled recession fears, but it also reignited talk of rising prices.

That puts the Federal Reserve front and centre again, with traders now betting the Fed will leave rates unchanged in its upcoming decision.

That announcement’s due first thing Thursday morning our time, but short-term yields have risen three days straight.

On the stock front, the news wasn’t fantastic, either.

Ford Motors has yanked its guidance, tech giant Palantir missed expectations, and the overall mood on Wall Street was just more twitchy than bullish.

Back home, investors tuned into updates flowing from the Macquarie conference.

Mining as well as property players were in form this morning.

Vicinity Centres (ASX:VCX) jumped 3% after saying it's tracking toward the top end of full-year guidance.

But there were losses in consumer staples. Endeavour Group (ASX:EDV) gave up 4% after flagging flat-to-modest retail sales ahead.

Energy stocks also eased back a bit, as Brent crude sank to as low as $US57 a barrel before bouncing back to US$60.

Meanwhile, gold bounced back more than 2% overnight, snapping its losing streak as jittery markets piled back into the shiny stuff ahead of the Fed’s big call this week.

In other large caps news, data centre stock NextDC (ASX:NXT) said its forward order book has more than doubled, its strongest result yet. Shares rallied 8%.

Pharma distributor Sigma Healthcare (ASX:SIG)dropped nearly 4%, dragging down the health sector, despite lifting earnings 36% in the first half, thanks mainly to its merger with Chemist Warehouse.

Hotel booking tech platform SiteMinder (ASX:SDR) said it’s expecting revenue to grow faster in the second half. That gave investors something to cheer about in the tech space. Shares rose 1%.

WiseTech Global (ASX:WTC), however, struck a more cautious tone.

Presenting at the Macquarie conference, WTC warned that geopolitical tension and fresh trade tariffs could bite in FY25.

The logistics software giant didn’t change its full-year guidance, but noted that global container volumes are tipped to fall by 1% this year. WTC shares slipped 2.5%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for May 6 :

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| DTR | Dateline Resources | 0.034 | 55% | 165,867,081 | $60,842,510 |

| BP8 | Bph Global Ltd | 0.003 | 50% | 190,000 | $2,101,969 |

| WCN | White Cliff Min Ltd | 0.033 | 43% | 150,113,733 | $43,595,827 |

| AN1 | Anagenics Limited | 0.008 | 33% | 325,000 | $2,977,922 |

| OVT | Ovanti Limited | 0.004 | 33% | 200,592 | $8,104,644 |

| VEN | Vintage Energy | 0.004 | 33% | 746,250 | $5,697,666 |

| AZL | Arizona Lithium Ltd | 0.009 | 29% | 37,093,560 | $31,932,702 |

| BGE | Bridgesaaslimited | 0.019 | 27% | 32,000 | $2,997,888 |

| IPB | IPB Petroleum Ltd | 0.005 | 25% | 1,042,715 | $2,825,612 |

| KRR | King River Resources | 0.010 | 25% | 2,302,601 | $12,225,766 |

| WTM | Waratah Minerals Ltd | 0.290 | 23% | 4,473,099 | $47,717,729 |

| PRS | Prospech Limited | 0.027 | 23% | 8,588 | $7,234,170 |

| OD6 | Od6Metalsltd | 0.038 | 23% | 316,311 | $4,936,618 |

| S66 | Star Combo | 0.140 | 22% | 1,500 | $15,534,543 |

| SMM | Somerset Minerals | 0.017 | 21% | 19,919,156 | $5,918,271 |

| EVR | Ev Resources Ltd | 0.006 | 20% | 2,190,333 | $9,929,183 |

| WBE | Whitebark Energy | 0.006 | 20% | 407,246 | $1,999,534 |

| LKY | Locksleyresources | 0.027 | 17% | 3,063,052 | $3,373,333 |

| GCM | Green Critical Min | 0.014 | 17% | 12,879,491 | $23,540,140 |

| IPT | Impact Minerals | 0.007 | 17% | 5,387,410 | $22,215,980 |

| OSL | Oncosil Medical | 0.004 | 17% | 1,652,672 | $13,819,740 |

| TEG | Triangle Energy Ltd | 0.004 | 17% | 600,133 | $6,267,702 |

| C1X | Cosmosexploration | 0.078 | 16% | 12,820 | $6,932,262 |

| HAW | Hawthorn Resources | 0.051 | 16% | 405,694 | $14,740,687 |

White Cliff Minerals (ASX:WCN) has hit a very promising copper intercept at its Danvers project in Canada, drilling 175m at 2.5% copper from just 7.6m down. The hole ended in even higher grades, still open at depth. The company says it's one of the best copper hits globally in decades, and is planning more drilling to chase it further. More assays are on the way, with a maiden JORC resource in the works.

Waratah Minerals (ASX:WTM) fronted the RIU Resources Conference with a cracking pitch on its gold-copper hunt in NSW’s Lachlan Fold Belt, one of Australia’s hottest mineral districts. It’s sitting on a big district-scale land position at its Spur project, 100% owned, right near majors like Newmont and Gold Fields, with solid hits already in the bag including 11m at 10.8g/t gold and nearly 200m at 0.54% copper equivalent. Waratah reckons it’s only just getting started in what’s shaping up to be a prime gold-copper postcode.

Somerset Minerals (ASX:SMM) has just wrapped up the acquisition of the high-grade Coppermine Project in Nunavut, right next door to White Cliff’s monster copper hit at Danvers. It now controls a massive 1,200km² landholding packed with historical copper finds, including grades up to 45.4% copper, and is gearing up to launch its maiden drill campaign in just a couple of weeks. Early targets at Coronation are looking juicy, the company said, with reprocessed geophysics lighting up multiple anomalies, and old drill holes that ended in mineralisation.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for May 6 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| HCF | HGH High Conviction | 0.024 | -33% | 86,865 | $698,633 |

| AXP | AXP Energy Ltd | 0.001 | -33% | 165,000 | $9,862,021 |

| BIT | Biotron Limited | 0.002 | -33% | 70,000 | $3,981,738 |

| PAB | Patrys Limited | 0.002 | -33% | 370,000 | $6,172,342 |

| RLL | Rapid Lithium Ltd | 0.002 | -33% | 310,371 | $3,734,834 |

| VFX | Visionflex Group Ltd | 0.002 | -33% | 15,181 | $10,103,581 |

| VML | Vital Metals Limited | 0.002 | -33% | 833,333 | $17,685,201 |

| IMI | Infinitymining | 0.006 | -25% | 1,109,674 | $3,384,126 |

| SRJ | SRJ Technologies | 0.013 | -24% | 500,000 | $10,294,827 |

| DYM | Dynamicmetalslimited | 0.255 | -23% | 346,933 | $16,197,832 |

| KPO | Kalina Power Limited | 0.006 | -21% | 530,244 | $20,259,538 |

| AVE | Avecho Biotech Ltd | 0.004 | -20% | 862,287 | $15,867,318 |

| DGR | DGR Global Ltd | 0.004 | -20% | 256,000 | $5,218,480 |

| DTM | Dart Mining NL | 0.004 | -20% | 30,915 | $3,438,820 |

| HLX | Helix Resources | 0.002 | -20% | 300,000 | $8,410,484 |

| LNR | Lanthanein Resources | 0.002 | -20% | 103,299 | $6,109,090 |

| OLI | Oliver'S Real Food | 0.004 | -20% | 372,250 | $2,703,660 |

| VRC | Volt Resources Ltd | 0.004 | -20% | 1,257,263 | $23,423,890 |

| C29 | C29Metalslimited | 0.038 | -17% | 301,626 | $8,012,659 |

| SER | Strategic Energy | 0.005 | -17% | 7 | $4,026,200 |

| SHP | South Harz Potash | 0.005 | -17% | 318,260 | $6,495,472 |

| SKK | Stakk Limited | 0.005 | -17% | 200,000 | $12,450,478 |

| 8CO | 8Common Limited | 0.016 | -16% | 75,001 | $4,257,803 |

| MXO | Motio Ltd | 0.032 | -16% | 253,082 | $10,583,130 |

Originally published as Lunch Wrap: ASX swings sideways as gold bounces back; Fed call in focus