Lunch Wrap: ASX rebounds; DigiCo REIT and Capstone Copper earn spots in ASX 200

ASX rises with energy stocks in the lead, while Trump rattles nerves. Meanwhile, DigiCo REIT and Capstone Copper make their way into the ASX 200.

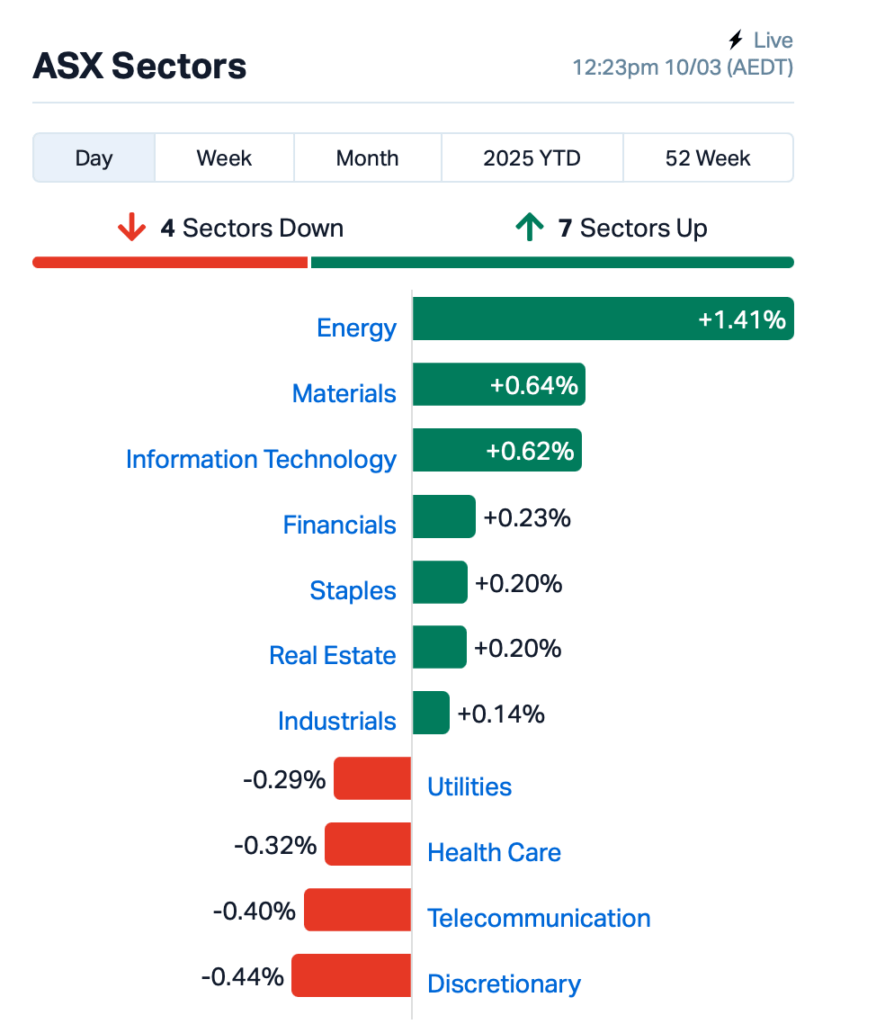

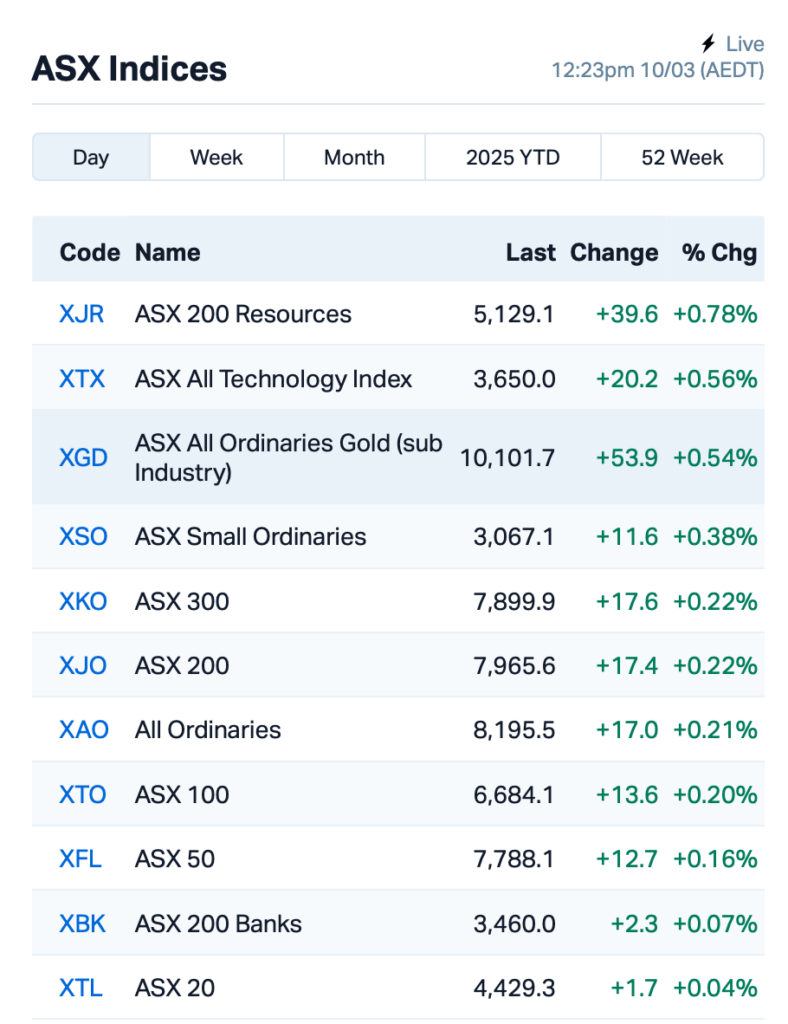

ASX edges up with energy stocks leading the way

Trump stirs nerves, Bitcoin drops

DigiCo REIT joins ASX 200 as part of March index shake-up

The ASX lifted modestly by 0.2% on Monday morning, with bargain hunters jumping in after last week’s chaos.

While the energy sector led the charge, early trade was still pretty cautious.

Investors are bracing for another week of volatility, with the looming 25% tariffs on steel and aluminium (including those from Australia) set to hit the US from Wednesday, although the Albanese government is still pushing for an exemption.

On Friday, Wall Street bounced back as the tech-heavy Nasdaq managed to claw back some losses after hitting correction territory, lifting by 0.7%.

But President Trump’s comments over the weekend about the economy and urging everyone to look the other way as the US stock market rapidly tanked haven’t exactly calmed nerves.

“Look, what I have to do is build a strong country. You can’t really watch the stock market,” Trump told Fox News.

“If you look at China, they have a 100-year perspective. We have a quarter. We go by quarters. And you can’t go by that.”

Crypto traders were spooked, with Bitcoin falling fast toward the US$80k mark, trading now at US$81,200.

The drop also followed Trump’s new Bitcoin Reserve order, which tells the Treasury and Commerce departments to come up with plans to get more Bitcoin, but without using taxpayer money. Although that, in principle, sounds long-term bullish for Bitcoiners, it didn’t actually go down too well with investors.

“The knee-jerk reaction lower likely stems from the realisation that no actual budget has been allocated for Bitcoin purchases in the near term,” said QCP Capital in a note.

Back home, energy stocks led the morning's ASX session, with heavyweight Woodside Energy Group (ASX:WDS) gaining 2.3%.

In the large caps space, Star Entertainment Group (ASX:SGR) is in the hot seat once again as it mulls over a rescue offer from US casino giant Bally’s. Shares in Star remain suspended for now.

Bally's proposal suggests it could raise at least $250 million for The Star. This would involve The Star issuing special notes, which could later be converted into shares. If this happens, Bally’s would end up owning more than 50% of The Star’s shares.

In the ASX rebalance news, DigiCo Infrastructure REIT (ASX:DGT) will be making its debut in the S&P/ASX 200, just three months after its sharemarket debut. But DGT's shares were down 1.5%.

The data centre stock will join the main index on March 24, alongside other additions like Capstone Copper Corp (ASX:CSC) and Temple & Webster (ASX:TPW).

Capstone Copper, the Canadian copper miner, marks its entry to the ASX 200 just over a year after it began trading here.

As part of the shuffle, other names like Star Entertainment and coal miner Coronado Global Resources (ASX:CRN) will be pushed out.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for March 10 :

| Code | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| RML | Resolution Minerals | 0.016 | 78% | 19,948,113 | $2,684,377 |

| HT8 | Harris Technology Gl | 0.015 | 50% | 2,615,669 | $2,991,355 |

| WOA | Wide Open Agricultur | 0.015 | 36% | 9,051,534 | $5,870,553 |

| 88E | 88 Energy Ltd | 0.002 | 33% | 4,002,309 | $43,400,718 |

| NMG | New Murchison Gold | 0.013 | 32% | 49,506,217 | $77,295,797 |

| AEV | Avenira Limited | 0.009 | 29% | 3,933,838 | $22,243,508 |

| CMG | Criticalmineralgrp | 0.150 | 25% | 6,299 | $8,644,487 |

| BMO | Bastion Minerals | 0.005 | 25% | 2,344,870 | $3,378,899 |

| MTB | Mount Burgess Mining | 0.005 | 25% | 1,200,000 | $1,358,150 |

| PAB | Patrys Limited | 0.003 | 25% | 618,016 | $4,114,895 |

| LMS | Litchfield Minerals | 0.180 | 24% | 685,956 | $4,090,645 |

| AMO | Ambertech Limited | 0.170 | 21% | 100,177 | $13,356,670 |

| EMH | European Metals Hldg | 0.150 | 20% | 286,669 | $25,930,588 |

| EPM | Eclipse Metals | 0.006 | 20% | 4,645,740 | $14,299,095 |

| LCY | Legacy Iron Ore | 0.012 | 20% | 1,496,448 | $97,620,426 |

| SER | Strategic Energy | 0.006 | 20% | 24,470 | $3,355,167 |

| STM | Sunstone Metals Ltd | 0.006 | 20% | 1,126,439 | $25,750,018 |

| VNL | Vinyl Group Ltd | 0.115 | 20% | 4,259,540 | $120,868,218 |

| RFA | Rare Foods Australia | 0.019 | 19% | 20,150 | $4,351,732 |

| ASQ | Australian Silica | 0.026 | 18% | 1,289 | $6,200,928 |

| OMA | Omegaoilgaslimited | 0.450 | 17% | 1,013,892 | $126,772,221 |

| AVE | Avecho Biotech Ltd | 0.007 | 17% | 26,625,597 | $19,015,782 |

| PVT | Pivotal Metals Ltd | 0.007 | 17% | 477,638 | $5,443,355 |

| SPQ | Superior Resources | 0.007 | 17% | 571,428 | $13,019,183 |

| TMK | TMK Energy Limited | 0.004 | 17% | 3,649,343 | $28,090,995 |

Resolution Minerals (ASX:RML) has struck a deal to acquire three projects focused on antimony, gold and copper in New South Wales and Queensland. The projects include Drake East (NSW), Neardie (QLD), and Spur South (NSW), with Drake East showing high-grade antimony, gold, and silver. Neardie hosts past-producing antimony mines, and Spur South is in a highly mineralised area. The move aims to tap into the growing demand for antimony, which saw a 250% price increase in 2024, said the company.

Wide Open Agriculture (ASX:WOA) is making moves with over 5 metric tonnes of lupin protein sales across Europe, Latin America, and Australia. WOA has secured orders from a leading health food company in Europe, a Mexican distributor, Latin American distributors in Argentina and Chile, and an Aussie food manufacturer. These initial sales prove the global potential of WOA’s lupin protein, said the company.

New Murchison Gold (ASX:NMG) has hit visible gold in a diamond drill core at its Crown Prince gold project. Drilling targeted extensions of gold mineralisation, and at 252m down hole, a quartz-carbonate vein with native gold was found. This is the deepest gold find in the south-eastern zone and suggests the mineralisation might continue deeper. The drilling is ongoing, with assay results expected in a couple of weeks.

Cobre (ASX:CBE) has teamed up with BHP (ASX:BHP) to explore copper-silver deposits in Botswana, with BHP ready to fork out up to $40 million for exploration over the next few years. BHP can earn a 75% stake in Cobre’s Kitlanya East and West projects by funding the exploration. Cobre will keep operating and managing the projects during the earn-in phase, and if BHP helps find a JORC-compliant mineral resource, Cobre could get an extra US$10 million.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for March 10 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ANR | Anatara Ls Ltd | 0.011 | -72% | 19,010,042 | $8,321,965 |

| GGE | Grand Gulf Energy | 0.001 | -50% | 9,197 | $4,900,774 |

| AYT | Austin Metals Ltd | 0.003 | -33% | 80,000 | $5,958,861 |

| CR9 | Corellares | 0.002 | -33% | 97,865 | $1,403,230 |

| JAY | Jayride Group | 0.002 | -33% | 200,000 | $715,737 |

| BIT | Biotron Limited | 0.003 | -25% | 1,091,609 | $3,609,531 |

| CYQ | Cycliq Group Ltd | 0.003 | -25% | 4,305,421 | $1,842,067 |

| MEL | Metgasco Ltd | 0.003 | -25% | 20,000 | $5,830,347 |

| NRZ | Neurizer Ltd | 0.002 | -25% | 37,825,706 | $6,716,008 |

| TFL | Tasfoods Ltd | 0.007 | -22% | 3,187,034 | $3,933,860 |

| HCT | Holista CollTech Ltd | 0.024 | -20% | 295,834 | $8,573,001 |

| ASR | Asra Minerals Ltd | 0.002 | -20% | 22,000 | $5,932,817 |

| AUK | Aumake Limited | 0.004 | -20% | 86,461 | $15,053,461 |

| CAV | Carnavale Resources | 0.004 | -20% | 160,001 | $20,451,092 |

| QXR | Qx Resources Limited | 0.004 | -20% | 124,000 | $6,550,389 |

| CLA | Celsius Resource Ltd | 0.009 | -18% | 3,216,829 | $29,361,623 |

| ALM | Alma Metals Ltd | 0.005 | -17% | 156,121 | $9,518,072 |

| BCB | Bowen Coal Limited | 0.005 | -17% | 275,849 | $64,653,841 |

| GES | Genesis Resources | 0.010 | -17% | 326,706 | $9,394,096 |

| PKO | Peako Limited | 0.003 | -17% | 145,581 | $4,463,226 |

| WBE | Whitebark Energy | 0.005 | -17% | 6,001 | $1,849,255 |

| AVW | Avira Resources Ltd | 0.006 | -14% | 120,874 | $1,028,578 |

| TON | Triton Min Ltd | 0.006 | -14% | 418,841 | $10,978,721 |

| TRU | Truscreen | 0.025 | -14% | 80,000 | $16,025,142 |

| KPO | Kalina Power Limited | 0.007 | -13% | 102,559 | $21,919,950 |

Anatara Lifesciences (ASX:ANR)' stock price plunged after disappointing news about its GaRP-IBS trial. The trial's Stage 2 results are in, and it looks like the primary goal – reducing IBS symptoms significantly compared to a placebo – won’t be met, even though secondary goals might still show improvement. As a result, the company has paused recruitment and is waiting for the final results, expected soon.

Boss Energy's (ASX:BOE) shares dropped despite securing a deal with Eclipse Metals for the Liverpool Uranium Project in the Northern Territory. Boss has an option to earn up to 80% of the project by spending $250,000 on exploration in the next 12 months, with a total commitment of $8 million over the next seven years.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Lunch Wrap: ASX rebounds; DigiCo REIT and Capstone Copper earn spots in ASX 200