Lunch Wrap: ASX does a U-turn, ticking back up as goldies gain

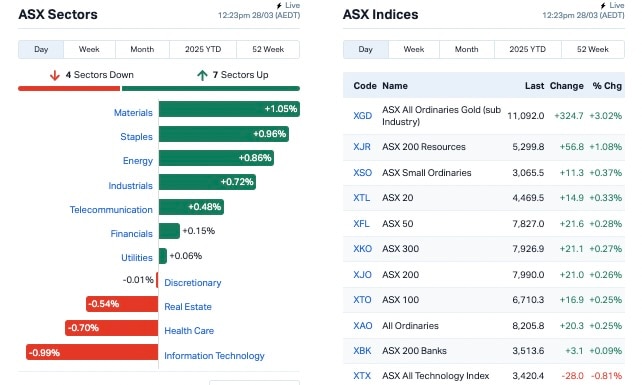

The ASX 200 has bounced back so far on Friday despite Wall Street ticking lower. Ressie and energy stocks are showing the way.

The ASX 200 has bounced back so far on Friday after a saggy Thursday

This comes despite another bleed in US markets, albeit stemmed compared with the prior session

Resources and energy stocks are leading the way, while tech is still lagging

It's always nice to see a day on the local stock exchange when it's not taking all its cues from a bruised Wall Street.

And that seems to be the case so far today for the ASX 200, which has recovered nicely so far from yesterday's dip with a 0.38% intraday gain at the time of writing.

As for our usually highly influential American mates, the S&P and Dow Jones indexes closed 0.3 per cent lower, while the tech-heavy Nasdaq index shed 0.5 per cent.

That said, let's not get ahead of ourselves here – the next pile of US inflation data (this time, PCE – Personal Consumption Expenditure), plus further tariff announcements are a weekend hurdle to negotiate, which could well end up having a large say on Wall Street's mood on Friday night, not to mention the ASX's direction come Monday.

How's crypto faring, you probably didn't ask? I'm telling you anyway. The OG and dominant crypto asset, Bitcoin, may be outshone by gold at present (which just hit another record high today – see further below), but it's still holding up very well indeed, hanging in there around US$87,400 for the moment.

Despite a stagnant, and nervy crypto market of late, big BTC claims are never going to be too far away while we have a pro-crypto US administration. Here's one from Republican US senator Cynthia Lummis, who believes Bitcoin has the potential to cut the US national debt (a staggering +US$36 TRILLION) in half over the next 20 years.

“I’ve kind of been looking for the Bitcoin strategic reserve my whole life,” Lummis added, referring to the US government's plan to stockpile the asset as best it can, also noting that she believes Bitcoin will shape the country’s economic future.

But we digress. Back to the ASX, and here's what the sectorial performance looks like as we approach 12.30pm…

ASX MARKET NEWS

Amid nervy times for the US of A's economy and therefore globally, it's yet another good day to be a goldie, with the commodity's prices continuing to hit record highs.

The yellow metal, at time of writing, has risen to US$3077, while in Aussie dollars it's cruising at a $4,891 altitude.

And Aussie gold miners and explorers are helping the local bourse rise today.

Ramelius Resources (ASX:RMS), is surging today,with a 6.5% rise to $2.46.

Northern Star Resources (ASX:NST), meanwhile – a $21.34bn beast – has jumped 3.96% to $18.65, while another big gun, Evolution Mining (ASX:EVN) has jumped 3.23% to $7.19.

As mentioned yesterday, Goldman Sachs has released a new prediction that the record-breaking run in the yellow metal isn’t about to slow down any time soon. In fact, the US investment bank reckons it’s set to turn on the gas even more, noting the medium-term price risks for gold “remain skewed to the upside” and “in tail-risk scenarios, gold can exceed US$4,200 by end-2025”.

What else? The ASX might be performing even better today if it wasn't for a drag from the tech sector – a knock-on effect from the hit to Nvidia the other day, perhaps.

The embattled, management-drama-enveloped WiseTech Global (ASX:WTC) continues its slide, down another 1,89% at time of writing, while another big one, Xero (ASX:XRO), has shed 0.84%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for March 28 :

| Code | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| EDE | Eden Innovations | 0.0015 | 50% | 500,498 | $4,109,881 |

| HLX | Helix Resources | 0.003 | 50% | 70,000 | $6,728,387 |

| VML | Vital Metals Limited | 0.003 | 50% | 2,530,000 | $11,790,134 |

| RNV | Renerve Limited | 0.15 | 36% | 3,713,796 | $12,039,250 |

| BUY | Bounty Oil & Gas NL | 0.0025 | 25% | 328 | $3,122,944 |

| MMR | Mec Resources | 0.005 | 25% | 10,196,267 | $7,399,063 |

| AVE | Avecho Biotech Ltd | 0.006 | 20% | 32,903,205 | $15,846,485 |

| ARD | Argent Minerals | 0.028 | 17% | 19,344,142 | $34,695,372 |

| IXR | Ionic Rare Earths | 0.007 | 17% | 1,789,116 | $31,430,570 |

| REC | Rechargemetals | 0.014 | 17% | 1,046,656 | $3,077,880 |

| BC8 | Black Cat Syndicate | 0.915 | 17% | 6,506,788 | $525,629,474 |

| ELT | Elementos Limited | 0.079 | 16% | 348,181 | $16,056,966 |

| SPX | Spenda Limited | 0.008 | 14% | 135,734 | $32,306,508 |

| NUZ | Neurizon Therapeutic | 0.12 | 14% | 192,490 | $51,692,105 |

| AD1 | Adneo Limited | 0.049 | 14% | 90,739 | $6,295,499 |

| BCB | Bowen Coal Limited | 0.0045 | 13% | 4,269,946 | $43,102,561 |

| BDM | Burgundy D Mines Ltd | 0.055 | 12% | 280,836 | $69,645,281 |

| AYA | Artryalimited | 0.89 | 11% | 1,816,334 | $79,124,849 |

| EMS | Eastern Metals | 0.01 | 11% | 746,257 | $1,023,086 |

| NHE | Noble Helium | 0.02 | 11% | 2,330,941 | $10,465,908 |

| VRC | Volt Resources Ltd | 0.005 | 11% | 277,777 | $21,081,501 |

| FDR | Finder | 0.06 | 11% | 100,000 | $15,351,569 |

| OMX | Orange Minerals | 0.03 | 11% | 181,084 | $2,999,761 |

| VN8 | Vonex Limited | 0.03 | 11% | 7,900 | $20,320,295 |

| KAI | Kairos Minerals Ltd | 0.021 | 11% | 1,334,722 | $49,987,332 |

Helix Resources (ASX:HLX) is up 50% in morning trade after entering conditional binding agreements to acquire the White Hills copper-gold project in Arizona, comprising a total of seven tenements over 23km2.

White Hills is in the Arizona Arc, a belt prospective for copper-gold porphyry and IOCG deposits, which also lies within the southern part of the Nevada Walker Lane gold trend, host to several multi-million-ounce gold deposits in Arizona.

Avecho Biotechnology (ASX:AVE) has risen 20% after receiving the initial US$3 million licensing fee from Sandoz AG as part of a recent licensing deal for the commercial rights to its proprietary cannabidiol (CBD) product in Australia.

Under the deal Sandoz has exclusive commercial rights for Avecho’s phase III CBD capsule for insomnia in Australia for 10 years.

Avecho retains rights to commercialise the product in all other territories, with Sandoz holding a first right of refusal. Avecho is eligible for subsequent milestone and royalty payments under the deal.

Elementos Limited (ASX:ELT) is up 16% in morning trade after its Spanish subsidiary, Minas de Estaño de España S.L.U. (MESPA), secured an extension to its investigation permit for the Oropesa tin project tenement.

ELT said the extension followed close collaboration with the Andalucía Mining Department to ensure continuity of rights over the permit, which is equivalent to an Australian exploration licence.

The company is now finalising submission of documentation for a new mining concession and a Unified Environmental Authorisation (AAU) for the future mining operation. Once submitted, the company’s rights over the investigation permit will remain in place until a decision is made on the mining licence application.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for March 28 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| 88E | 88 Energy Ltd | 0.001 | -33% | 200,000 | $43,400,718 |

| CYQ | Cycliq Group Ltd | 0.003 | -25% | 2,010,604 | $1,842,067 |

| FAU | First Au Ltd | 0.002 | -20% | 936 | $5,179,983 |

| AUR | Auris Minerals Ltd | 0.005 | -17% | 699,616 | $2,859,756 |

| AYT | Austin Metals Ltd | 0.005 | -17% | 1,788 | $7,945,148 |

| JAV | Javelin Minerals Ltd | 0.0025 | -17% | 94,522 | $18,138,447 |

| TON | Triton Min Ltd | 0.005 | -17% | 3,250 | $9,410,332 |

| EGR | Ecograf Limited | 0.315 | -16% | 954,036 | $170,299,432 |

| ASR | Asra Minerals Ltd | 0.003 | -14% | 411,070 | $8,305,944 |

| AZL | Arizona Lithium Ltd | 0.006 | -14% | 222,739 | $31,932,702 |

| KPO | Kalina Power Limited | 0.006 | -14% | 100 | $20,221,206 |

| OLI | Oliver'S Real Food | 0.006 | -14% | 42,500 | $3,785,123 |

| SPQ | Superior Resources | 0.006 | -14% | 186,388 | $15,189,047 |

| TYX | Tyranna Res Ltd | 0.006 | -14% | 1,150,000 | $23,015,477 |

| WWG | Wiseway Group | 0.155 | -14% | 22,900 | $30,123,575 |

| BMG | BMG Resources Ltd | 0.013 | -13% | 8,215,305 | $12,575,957 |

| BNL | Blue Star Helium Ltd | 0.007 | -13% | 720,333 | $21,559,082 |

| PIL | Peppermint Innovations | 0.0035 | -13% | 2,600,177 | $8,845,917 |

| RFA | Rare Foods Australia | 0.008 | -11% | 100,000 | $2,447,849 |

| BUR | Burley Minerals | 0.05 | -11% | 72,575 | $8,420,773 |

| ATH | Alterity Therap Ltd | 0.009 | -10% | 600,144 | $66,568,489 |

| EVR | Ev Resources Ltd | 0.0045 | -10% | 700,000 | $9,929,183 |

| MPR | Mpower Group Limited | 0.009 | -10% | 156,000 | $3,437,033 |

| TEG | Triangle Energy Ltd | 0.0045 | -10% | 1,487,695 | $10,446,170 |

| HIO | Hawsons Iron Ltd | 0.0135 | -10% | 386,086 | $15,247,521 |

IN CASE YOU MISSED IT

Impact Minerals (ASX:IPT) has completed a renounceable rights issue, raising over $3.5 million. The funds will be used to finalise the pre-feasibility study for its Lake Hope high-purity alumina project and support an upcoming drilling program at the Caligula copper-nickel-platinum-gold target to begin in the coming weeks.

At Stockhead, we tell it like it is. While Impact Minerals is a Stockhead advertiser, it did not sponsor this article.

Originally published as Lunch Wrap: ASX does a U-turn, ticking back up as goldies gain