Closing Bell: Iron ore slump drags down ASX; goldies under pressure on Fedspeak

The ASX ended Monday flattish, while uranium miners rose after Cameco halted production. Also… news just in – Trudeau looks set to quit.

ASX flat despite tech rally

Uranium miners gain further after Cameco suspends production

Canada's PM Justin Trudeau set to resign amid mounting pressure

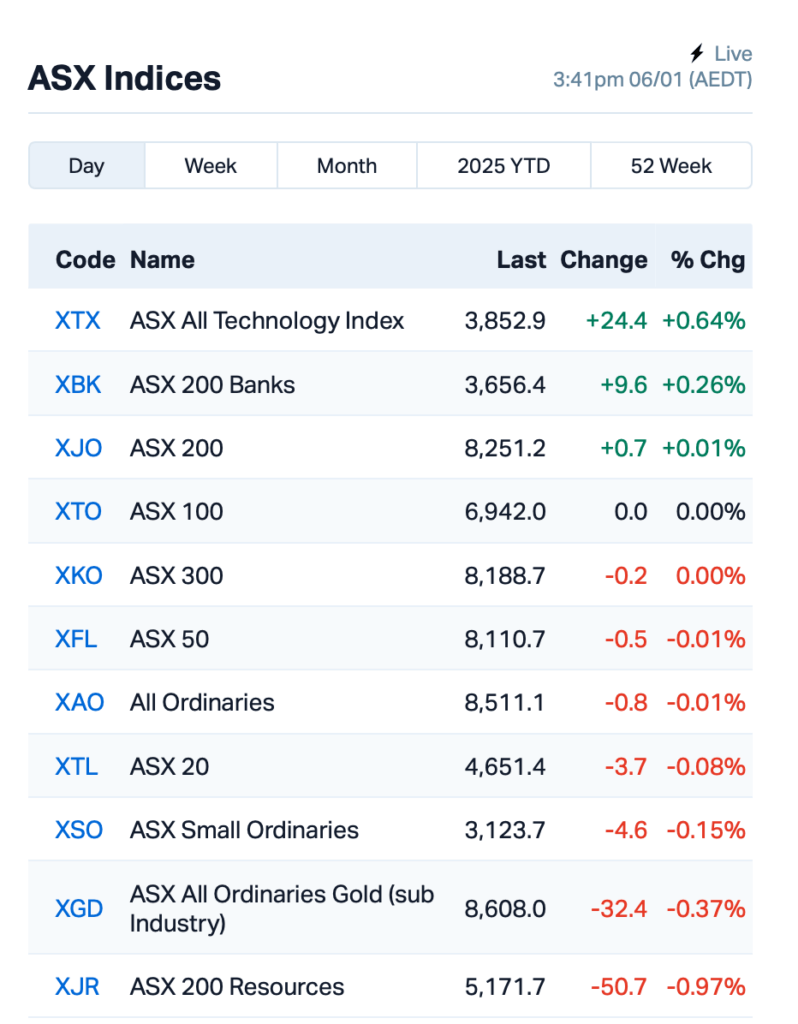

The ASX closed flattish on Monday despite a tech rally.

The tech sector rose following a bounce back on Wall Street after five days of losses, with Bitcoin also making a comeback, trading above $99,200 at the time of writing.

US investors were a little more buoyant after Mike Johnson, an ally of Donald Trump, held onto his role as Speaker of the House.

Johnson, who was elected Speaker of the House on Friday, managed to avoid the drawn-out, chaotic battle that his predecessor Kevin McCarthy faced to secure the role.

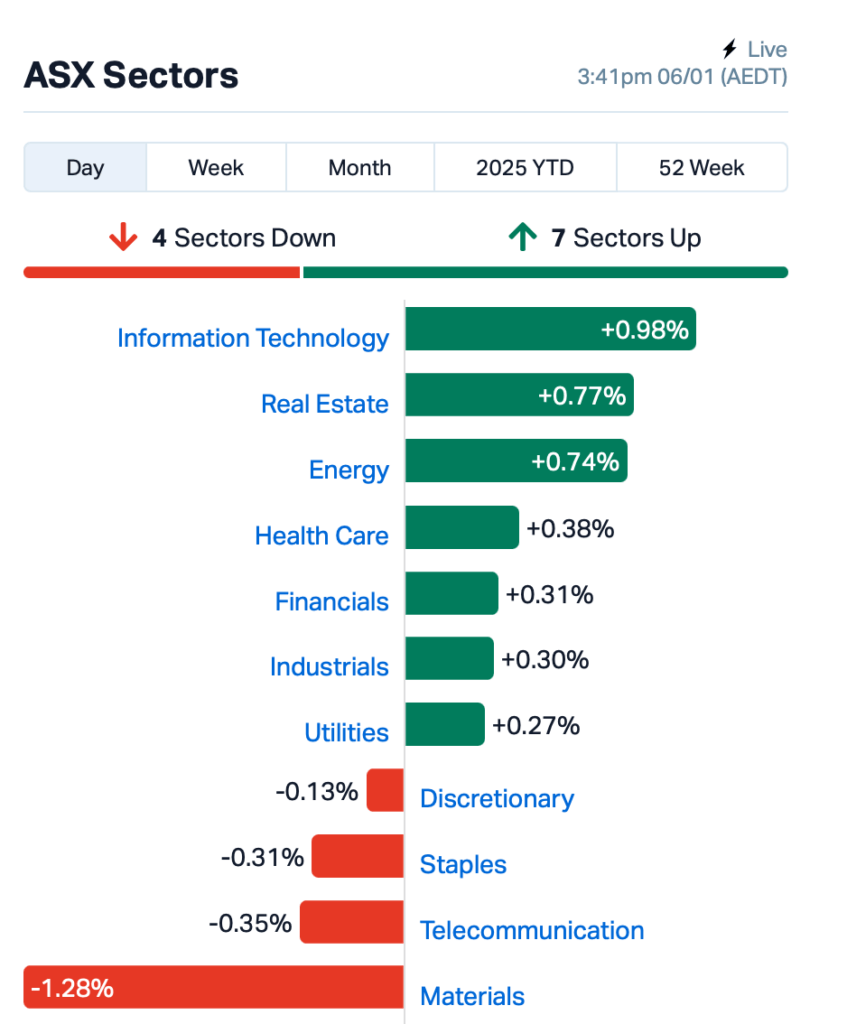

Back on the ASX, seven out of the 11 ASX sectors finished in the green.

Losses in the mining sector offset tech gains after iron ore futures slid by almost 3%, dragging down heavyweights like BHP (ASX:BHP) and Rio Tinto (ASX:RIO).

Making headlines today was superannuation giant, Insignia Financial (ASX:IFL), which surged 13% after announcing it had received a takeover bid of $4.30 per share from private equity firm CC Capital Partners.

Uranium miners had another good day, too. Boss Energy (ASX:BOE)and Paladin Energy (ASX:PDN) both continued their Friday’s rally and enjoyed a further 5% hike each today.

This came after Canadian uranium giant Cameco suspended operations at its Inkai plant in Kazakhstan. The move sent shockwaves through the sector as the suspension could affect global uranium supply.

Over at Bellevue Gold (ASX:BGL), however, things weren’t looking too rosy. The miner’s shares tumbled over 13% after it announced production had fallen short of expectations for the December quarter.

The broader gold sector faced pressure today as Federal Reserve officials signalled a more cautious stance on rate cuts this year.

And news just in, it looks like Canada's PM, Justin Trudeau, is on his way out.

Word is, he’s planning to announce his resignation this week. Trudeau's been under fire from within his own party, especially after a public fallout with his finance minister, Chrystia Freeland.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Security Description Last % Volume MktCap PKO Peako Limited 0.003 50% 166,667 $2,190,283 SIS Simble Solutions 0.006 50% 3,005,879 $3,345,321 GES Genesis Resources 0.007 40% 360,000 $3,914,206 AAU Antilles Gold Ltd 0.004 33% 4,547,481 $5,573,628 GMN Gold Mountain Ltd 0.004 33% 109,815,880 $11,902,420 SUM Summitminerals 0.200 33% 5,570,222 $12,949,198 CYC Cyclopharm Limited 2.000 25% 311,578 $177,818,960 NTM Nt Minerals Limited 0.005 25% 2,500,008 $4,843,612 TMK TMK Energy Limited 0.003 25% 1,569,047 $18,651,130 FDR Finder 0.039 22% 200,402 $9,097,226 MAG Magmatic Resrce Ltd 0.040 21% 119,367 $13,762,674 1CG One Click Group Ltd 0.012 20% 1,763,798 $11,778,799 ALR Altairminerals 0.003 20% 184,356 $10,741,444 ICG Inca Minerals Ltd 0.006 20% 555,583 $5,133,613 RMI Resource Mining Corp 0.006 20% 177,521 $3,261,739 RNX Renegade Exploration 0.006 20% 1,713,341 $6,420,017 TAS Tasman Resources Ltd 0.006 20% 66,667 $4,026,248 VEN Vintage Energy 0.006 20% 1,315,837 $8,347,656 GAL Galileo Mining Ltd 0.160 19% 551,429 $26,679,365 MHC Manhattan Corp Ltd 0.026 18% 301,731 $5,167,776 WC1 Westcobarmetals 0.020 18% 1,670,966 $2,990,511

Summit Minerals (ASX:SUM) is set to acquire the Mundo Novo Niobium-REE-Phosphate Carbonatite project in Brazil. SUM said the site is rich in niobium, rare earth elements (REE), and phosphate, with promising mineralisation confirmed, though it remains underexplored. The project lies near Highway 156 – some 6km east of Mundo Novo, in Goiás State. The acquisition depends on Summit completing a satisfactory due diligence.

EBR Systems’ (ASX:EBR) stock jumped 40% last week and another 2% today, prompting a probe from the ASX. The company denied it knew anything about the big spike.

DroneShield (ASX:DRO), a drone-detection tech company, shot up 4% after it scored a $9.7 million order from a major Latin American military customer.

Metro Mining (ASX:MMI) has announced record shipments of 5.7 million WMT in 2024, a 24% increase on 2023, but the share price was flat today. December shipments hit a record 0.48 million WMT, up 53% on last year, despite challenging weather conditions.

Imugene’s (ASX:IMU) shares keep on surging after Friday’s announcement. The biotech company said it has dosed its first Australian patient in the phase 1b clinical trial of its allogeneic CAR T-cell therapy, azer-cel, at Royal Prince Alfred Hospital in Sydney. The trial targets relapsed or refractory diffuse large B-cell lymphoma (DLBCL), a tough form of non-Hodgkin’s lymphoma

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Code Name Price % Change Volume Market Cap IS3 I Synergy Group Ltd 0.003 -40% 105,000 $1,781,089 EEL Enrg Elements Ltd 0.001 -33% 86,000 $4,880,668 ERA Energy Resources 0.002 -33% 2,563,775 $1,216,188,722 D3E D3 Energy Limited 0.056 -30% 12,007 $6,358,000 88E 88 Energy Ltd 0.002 -25% 3,804,923 $57,867,624 BYH Bryah Resources Ltd 0.003 -25% 128,267 $2,013,147 NRZ Neurizer Ltd 0.002 -25% 32,027,560 $5,929,721 OB1 Orbminco Limited 0.002 -25% 262,892 $4,333,180 RGL Riversgold 0.003 -25% 1,045,911 $6,734,850 LYK Lykosmetalslimited 0.010 -23% 271,199 $2,448,622 FGH Foresta Group 0.007 -22% 3,391,208 $23,662,069 WNR Wingara Ag Ltd 0.007 -22% 3,765 $1,579,883 CHM Chimeric Therapeutic 0.006 -20% 982,806 $11,813,624 CDT Castle Minerals 0.002 -20% 210,000 $4,742,035 CYQ Cycliq Group Ltd 0.004 -20% 302,278 $2,302,583 ROG Red Sky Energy. 0.008 -20% 59,106,653 $54,222,272 BP8 Bph Global Ltd 0.003 -17% 65 $1,419,924 ENV Enova Mining Limited 0.005 -17% 100,000 $5,909,576 EVR Ev Resources Ltd 0.003 -17% 100,558 $5,437,510 LNR Lanthanein Resources 0.003 -17% 236,000 $7,330,908 AON Apollo Minerals Ltd 0.012 -14% 1,036,037 $10,996,196 OSL Oncosil Medical 0.006 -14% 26,922,205 $32,246,061

IN CASE YOU MISSED IT

QEM’s (ASX:QEM)Julia Creek vanadium and energy project in Queensland has been declared a ‘controlled action’ by the Commonwealth government, streamlining its approval pathway. The decision follows the recent designation of Julia Creek by the Queensland government as a coordinated project, designated for projects of strategic significance to the locality, region, or state.

Summit Minerals (ASX:SUM)is set to acquire the advanced Mundo Novo project in central Brazil, with due diligence underway before finalising the acquisition. The project, with proven REE and niobium mineralisation, adds a drill-ready asset to the company’s portfolio.

Anson Resources (ASX:ASN)has secured approval to drill 24 exploration holes for ~1,000 metres at its Yellow Cat uranium and vanadium project in Utah, USA. Drilling will target extensions of mineralisation near the Windy Point and Mineral Treasure mines, where previous sampling returned grades of up to 10.33% U3O8 and 25.6% V2O5.

Firetail Resources (ASX:FTL) has been selected as one of eight early-stage exploration companies to participate in the 2025 BHP Xplor program. BHP will provide US$500,000 in non-dilutive funding to support and drive Firetail’s exploration plans for its Picha copper-silver project in Peru during the six-month program.

At Stockhead, we tell it like it is. While QEM, Summit Minerals, Anson Resources and Firetail Resources are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: Iron ore slump drags down ASX; goldies under pressure on Fedspeak