Closing Bell: Iron ore miners hammered, but Trump’s Canada tariffs boost uranium stocks

The ASX pushed higher on Wednesday. Tech stocks soared on Trump’s $500b AI plan, while Canada tariffs sent uranium stocks up.

ASX climbs as tech stocks lead the charge

Trump’s $500b AI plan boosts tech stocks

Tariff talk sparks gains for uranium stocks, losses for iron ore miners

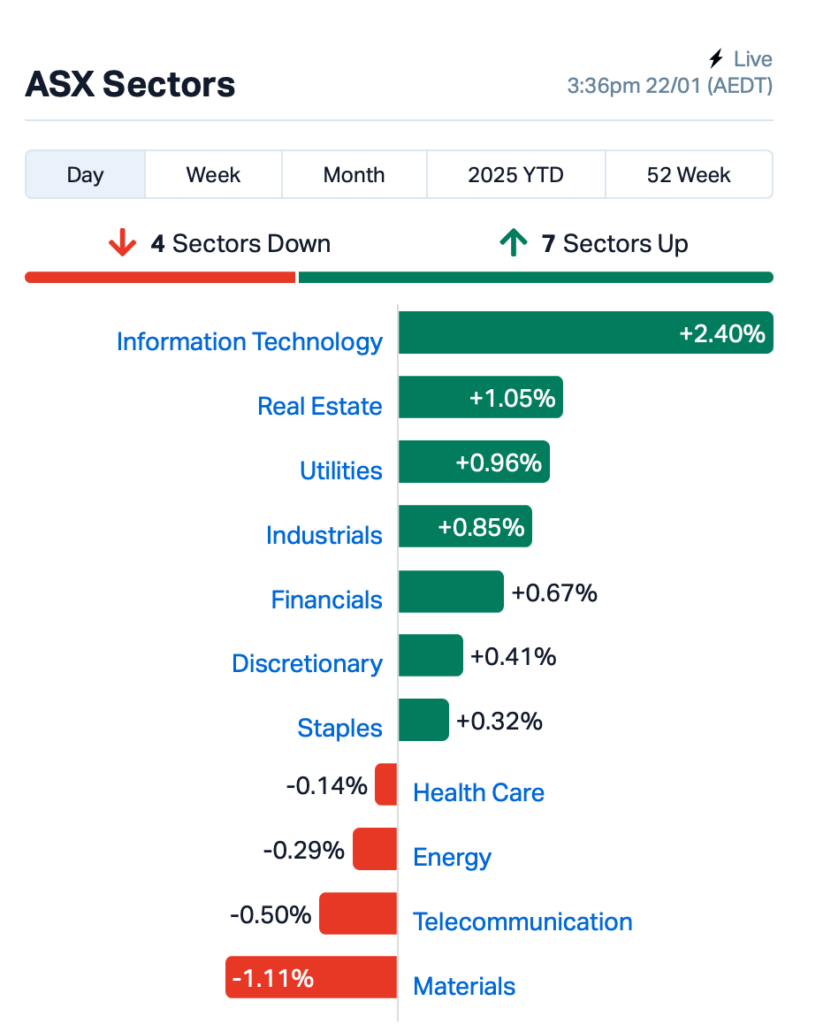

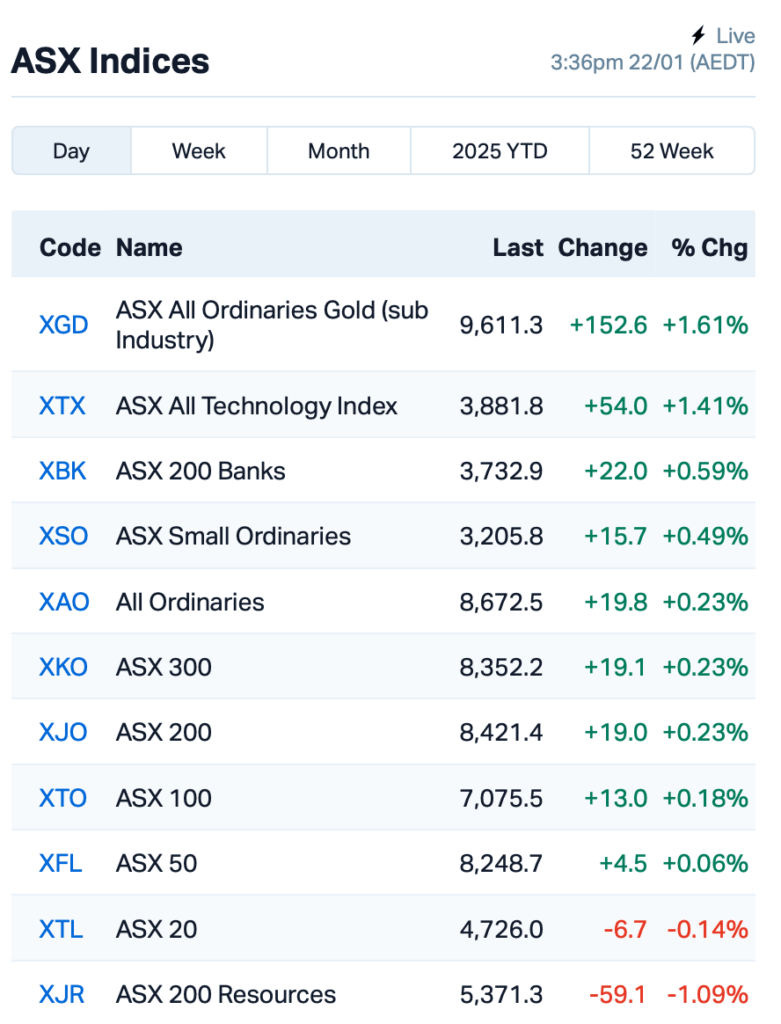

Wednesday saw another climb for the Aussie stock market as the S&P/ASX 200 index closed 0.33% higher.

But the real action was in the tech sector, which surged after Trump unveiled an eye-watering US$500 billion AI investment as part of his ambitious “Stargate” initiative.

Trump has apparently pulled in some of the biggest names in tech, including OpenAI’s Sam Altman and Oracle’s Larry Ellison, to channel this massive funding into artificial intelligence, data centres, and a whole range of next-gen infrastructure.

Tech stocks BrainChip Holdings (ASX:BRN), WiseTech Global (ASX:WTC) and NextDC (ASX:NXT) were among the day’s best performers.

While tech was cruising, Trump’s 10% tariff proposal on China, which he said could be triggered as early as next month, sent shockwaves through Australia’s iron ore exporters.

BHP (ASX:BHP) and Fortescue Metals Group (ASX:FMG) fell about 2% each as markets reacted to the possibility of fresh trade tensions.

In China, shares also fell across the board.

But interestingly, Trump’s tariff threat also had a positive knock-on effect for uranium stocks.

Paladin Energy (ASX:PDN) and Boss Energy (ASX:BOE) surged today after he indicated that he could move quickly to impose tariffs on Canada, the US’s largest supplier of uranium.

A sharp reminder that in the globalised world, for every loser in the tariff game there’s also a winner.

This is where things stood on the ASX leading up to today's close:

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Security Description Last % Volume MktCap EDE Eden Inv Ltd 0.002 100% 1,500,000 $4,109,876 5GG Pentanet 0.053 77% 33,667,203 $12,995,150 AUH Austchina Holdings 0.002 33% 2,500,000 $3,600,575 CRB Carbine Resources 0.004 33% 212,500 $1,655,213 GTR Gti Energy Ltd 0.004 33% 419,228 $8,888,849 HLX Helix Resources 0.004 33% 3,454,519 $10,092,581 EPM Eclipse Metals 0.009 29% 11,097,212 $16,014,989 CMD Cassius Mining Ltd 0.019 27% 482,445 $9,630,667 1TT Thrive Tribe Tech 0.003 25% 14,613,978 $4,063,446 ADD Adavale Resource Ltd 0.003 25% 5,675,599 $3,081,664 BNL Blue Star Helium Ltd 0.005 25% 631,550 $10,779,541 EVR Ev Resources Ltd 0.003 25% 301,963 $3,625,007 MOM Moab Minerals Ltd 0.003 25% 193,800 $3,133,999 TMK TMK Energy Limited 0.003 25% 429,653 $18,651,130 VML Vital Metals Limited 0.003 25% 1,383,304 $11,790,134 BUB Bubs Aust Ltd 0.120 22% 26,757,037 $87,526,744 EFE Eastern Resources 0.033 22% 290,285 $3,404,429 EE1 Earths Energy Ltd 0.012 20% 3,504,792 $5,299,642 PKO Peako Limited 0.003 20% 1,672,271 $2,737,854 TEG Triangle Energy Ltd 0.006 20% 550,000 $10,446,170

After observing “outstanding” early sales growth for its Remplir nerve repair product, Orthocell (ASX:OCC) will accelerate a global commercial expansion for Remplir with regulatory submissions for five new countries planned for this year. Orthocell say Remplir – a collagen wrap used in peripheral nerve repair – has sold well in Australia, New Zealand and Singapore to achieve a third consecutive quarter of record revenue.

Top priority for the company is penetrating the US$1.6 billion US market. Orthocell has already submitted its US DFA 510(k) approval for clearance to sell Remplir in the States with a result expected by the end of April this year. Also on the list for expansions is Thailand, the UK, the EU and Brazil.

Eastern Resources (ASX:EFE) just dropped some solid news from its Lepidolite Hill project. Preliminary metallurgical tests showed a healthy 80.5% lithium recovery, producing a concentrate with 3.75% Li2O. Even better, the concentrate’s iron contamination was minimal at just 0.07%.

Pentanet (ASX:5GG), the telco and tech company, flipped from a small loss to a positive EBITDA of $0.6m in Q2. Revenue’s up 7% year-on-year, and gaming’s booming with a 31% rise in revenue. The 5G side’s picking up steam, too, and the cloud gaming service is smashing it, with ARPU (Average Revenue Per User) up 23%.

Bubs Australia (ASX:BUB) has reported a turnaround in Q2 FY25, from a $6.8m loss last year to a $2.9m positive EBITDA. Revenue’s up 42% to $32.9m, and gross margins improved to 48%. Cash is flowing, with $3.9m in inflows and $17.2m in the bank. On the US front, the FDA trial’s progressing well, with approval expected by October. Bubs also said it’s still on track to hit the $102m revenue forecast this year.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Code Name Price % Change Volume Market Cap ERA Energy Resources 0.002 -33% 1,393,763 $1,216,188,722 NTM Nt Minerals Limited 0.003 -25% 192,333 $4,843,612 RGL Riversgold 0.003 -25% 40,000 $6,734,850 GW1 Greenwing Resources 0.035 -20% 5,000 $10,588,665 ECT Env Clean Tech Ltd. 0.002 -20% 4,938,642 $7,929,526 ENV Enova Mining Limited 0.004 -20% 280,000 $4,924,647 AU1 The Agency Group Aus 0.018 -18% 21,849 $9,670,685 M24 Mamba Exploration 0.014 -18% 45,000 $3,994,274 ALM Alma Metals Ltd 0.005 -17% 3,058,300 $9,518,072 CUL Cullen Resources 0.005 -17% 1,265,000 $4,160,411 VEN Vintage Energy 0.005 -17% 3,372,217 $10,017,188 RDG Res Dev Group Ltd 0.016 -16% 542,360 $56,066,304 SLM Solismineralsltd 0.064 -15% 173,921 $5,792,088 T88 Taitonresources 0.120 -14% 60,000 $10,424,033 AVM Advance Metals Ltd 0.038 -14% 3,458,955 $7,413,964 GCM Green Critical Min 0.020 -13% 40,408,678 $43,873,726 DUN Dundasminerals 0.034 -13% 643,397 $4,181,515 AJL AJ Lucas Group 0.007 -13% 326,454 $11,005,837 AQX Alice Queen Ltd 0.007 -13% 4,717 $9,175,121 SER Strategic Energy 0.007 -13% 130,750 $5,368,267 WBE Whitebark Energy 0.007 -13% 107,454 $2,018,668 ZEU Zeus Resources Ltd 0.007 -13% 80,000 $5,125,385

IN CASE YOU MISSED IT

North American white hydrogen explorer HyTerra (ASX:HYT)has advised the market it expects to drill at its Nemaha project following Kansas’ winter period, which typically runs from December to February.

HyTerra has contracted Murfin Drilling Company – one of the leading drillers in the US Midwest region – for a fully funded exploration phase at Nemaha as part of a multi-well campaign targeting key prospects. Fortescue Future Industries Technologies acquired nearly 40% in HyTerra in December for more than $20m.

VHM (ASX:VHM)has officially received endorsement from the Victorian Minister for Planning Sonya Kilkenny for its Environment Effects Statement at the Goschen rare earths and mineral sands project.

The company is now working on mining licence approval, work plan submissions and engineering plans with the expectation of starting construction late this year. First production would then occur in the second half of next year with plans for an initial 1.5Mtpa output before ramping up to 5Mtpa over a three-year period.

Future Battery Minerals (ASX:FBM) has expanded its footprint in Western Australia’s Eastern Goldfields via new tenement applications near its existing Coolgardie lithium projects as well as other known gold deposits. The explorer is planning to kick off initial ground evaluations at the new prospects late Q1 this year.

European oil and gas explorer ADX Energy (ASX:ADX)is celebrating with a cup of espresso today after it was awarded a channel permit in Sicily for gas exploration offshore of southern Italy. The application was previously delayed in 2018 due to a government moratorium on the awarding of new exploration licences in Italy. ADX say the permit is “highly prospective” for clean, pure gas.

Hydrous kaolin producer Suvo Strategic Minerals (ASX:SUV) is extending its sales relationship with buyer Norske Skog to continue supplying hydrous kaolin from its Pittong operation in Victoria for another three years. Norske says it anticipates purchasing between 21,000-24,000t of hydrous kaolin over the three years. Suvo previously supplied roughly 16,300t of product to Norske over a past three-year period.

Island Pharmaceuticals (ASX:ILA) announced today all 10 subjects have been enrolled in the phase 2b trial of its ISLA-101 clinical trial in dengue fever treatment. The study will explore ISLA-101’s ability to reduce the symptoms of patients already infected with dengue fever. Island expect to receive results from the study around April this year while full unblinded study results from the Phase 2a/b trial are expected in Q4 FY25.

Indiana Resources (ASX:IDA)has identified titanium targets via source rocks at the Carne prospect, part of its Gawler Craton project in South Australia. Past drilling at Carne has previously showcased results such as 8m at 1.3% titanium. Follow-up drilling at Carne is now a high priority for Indiana’s exploration program in South Australia this year.

LTR Pharma (ASX:LTR) – a company developing a nasal spray treatment for erectile dysfunction in men – has signed a national pharmacy distribution agreement with Symbion. Symbion is one of Australia’s largest pharmaceutical wholesalers, serving nearly 4000 customers. Today’s agreement enables a nationwide distribution of LTR’s Spontan product via Symbion’s network in the event of a future commercial launch.

Sovereign Metals (ASX:SVM) released to the market today the results of an optimised pre-feasibility study of its Kasiya rutile-graphite project in central Malawi, southeast Africa. Key metrics from the study include a pre-tax US$2.3bn NPV, US$16.4bn in total revenue, operating costs of US$423/t, 27% pre-tax IRR and a US$665m capex to reach first production.

Critical Metals Corp (CRML) has today become the first Nasdaq-listed company to adopt Bitcoin as a primary treasury reserve asset after it executed a convertible note for up to US$500m in BTC.

CRML chairman Tony Sage said the move was made due to the “enormous growth and interest” in the Bitcoin market. European Lithium (ASX:EUR) holds 74.30% of CRML’s shares – worth close to $900m based on the CRL share price as of January 21, 2025.

At Stockhead, we tell it like it is. While HyTerra, VHM, European Lithium, ADX Energy, Orthocell, Sovereign Metals, LTR Pharma, Indiana Resources, Island Pharmaceuticals, Suvo Strategic Minerals and Future Battery Minerals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: Iron ore miners hammered, but Trump’s Canada tariffs boost uranium stocks