Closing Bell: Goldies sprint ahead with Yandal doubling; but MinRes and WiseTech scandals sink stocks

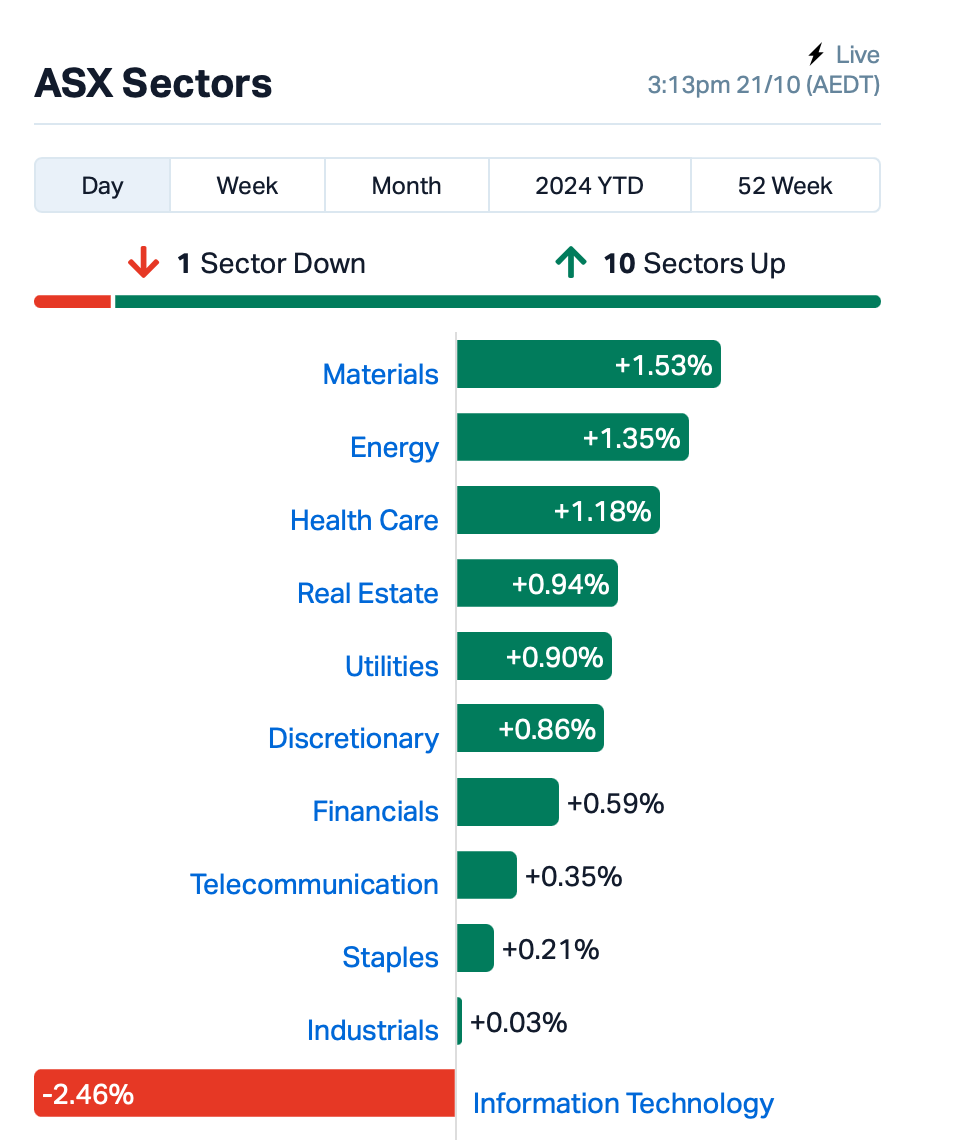

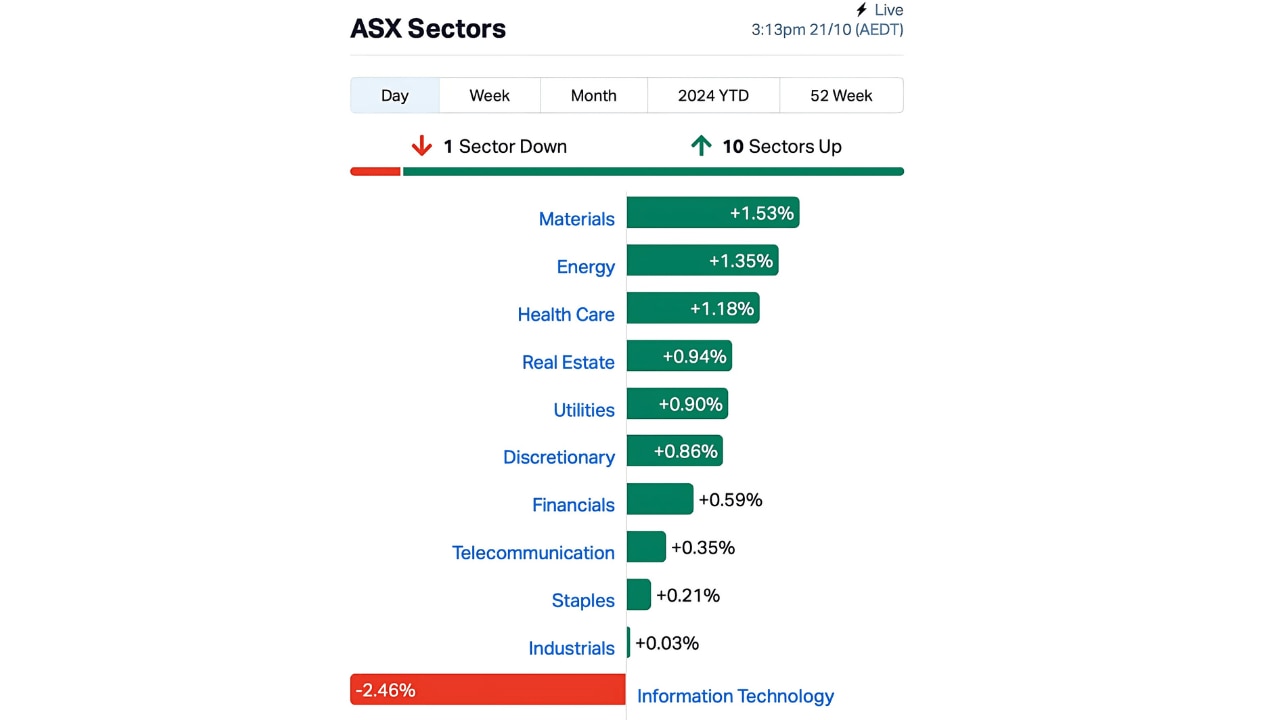

The ASX enjoyed a solid day on Monday, buoyed by a strong performance in the mining sector and a record-setting run on Wall Street.

ASX closes higher led by strong mining sector

Wisetech and Mineral Resources suffer heavy losses amid scandals

Gold prices soar past $US$2,700 on geopolitical tensions

The ASX rose on Monday after a solid run on Wall Street and some strong action from the mining sector. At the close, the ASX 200 Index nudged higher by 0.74 per cent.

On Friday, the S&P 500 scored its 47th record in 2024, riding high on strong earnings, particularly from Netflix.

But ASX miners stole the show on Monday, bouncing back with iron ore prices on the rise and gold hitting over $US2700 an ounce.

Big names like BHP (ASX:BHP) and Rio Tinto (ASX:RIO) were up close to 2 per cent. West African Resources (ASX:WAF) also jumped 6 per cent.

Giant tech stocks WiseTech Global (ASX:WTC) however dragged the Tech sector lower, crashing by 11 per cent after its board announced that it was looking into allegations against founder Richard White.

White had allegedly paid millions to settle a dispute with a former partner secretly.

“The board is currently reviewing the full range of matters raised in today’s media reports and is actively seeking further information and taking external advice,” said Wisetech’s statement.

Mineral Resources (ASX:MIN) ) also dropped heavily today, down 13% after backing its managing director, Chris Ellison, amid claims he dodged tax for years.

Media reports have earlier raised concerns about payments made to offshore entities linked to Ellison, which date back to before the company's IPO in 2006. These payments were recorded as liabilities in the company's financial statements.

Ellison has since reportedly self-reported to the Australian Taxation Office, repaid what he owed, and informed the board about these issues. The company said it has brought in some legal help to sort things out.

Still in large caps, furniture retailer Nick Scali (ASX:NCK) dropped 7% today after warning that rising freight costs could hurt its profits. The company said it was expecting a net profit between $30 million and $33 million for the first half in Australia and New Zealand.

Elsewhere, gold stocks rallied after the price of bullion skyrocketed on rising tensions in the Middle East and a close US election.

Gold surged past $US2,700 an ounce for the first time on Friday, which marked a 30% increase this year. Silver is also up by 30% in 2024, and has hit its highest price since 2012.

Across the region todat, Asia’s main stock index made small gains. China’s CSI 300 Index fluctuated after Chinese banks officially lowered their benchmark lending rates today.

ASX SMALL CAP LEADERS

Monday’s best performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| PUA | Peak Minerals Ltd | 0.005 | 150% | 124,483,121 | $4,994,221 |

| YRL | Yandal Resources | 0.200 | 100% | 5,368,984 | $26,780,761 |

| DOU | Douugh Limited | 0.013 | 44% | 39,440,249 | $9,738,620 |

| TZN | Terramin Australia | 0.077 | 40% | 2,107,883 | $116,410,950 |

| CAV | Carnavale Resources | 0.004 | 33% | 33,508,449 | $12,270,655 |

| EXL | Elixinol Wellness | 0.004 | 33% | 3,074,199 | $4,680,214 |

| GCR | Golden Cross | 0.004 | 33% | 1,450,332 | $3,291,768 |

| ODE | Odessa Minerals Ltd | 0.006 | 33% | 12,030,707 | $5,707,271 |

| TZL | TZ Limited | 0.065 | 33% | 1,686,170 | $12,572,573 |

| BML | Boab Metals Ltd | 0.170 | 31% | 5,289,318 | $30,341,364 |

| VR1 | Vection Technologies | 0.013 | 30% | 68,609,049 | $13,265,890 |

| POD | Podium Minerals | 0.049 | 26% | 2,882,841 | $17,735,124 |

| LRV | Larvottoresources | 0.525 | 25% | 8,320,185 | $133,454,923 |

| 88E | 88 Energy Ltd | 0.003 | 25% | 3,727,876 | $57,867,624 |

| EVR | Ev Resources Ltd | 0.005 | 25% | 20,400 | $5,585,086 |

| RIL | Redivium Limited | 0.005 | 25% | 28,008 | $10,987,419 |

| SS1 | Sun Silver Limited | 1.100 | 21% | 2,485,509 | $77,281,978 |

| RXL | Rox Resources | 0.180 | 20% | 3,673,148 | $61,589,293 |

| ERL | Empire Resources | 0.003 | 20% | 805,599 | $3,709,783 |

| ARD | Argent Minerals | 0.022 | 19% | 32,589,598 | $25,990,662 |

| USL | Unico Silver Limited | 0.340 | 19% | 2,910,119 | $100,636,470 |

| IVR | Investigator Res Ltd | 0.051 | 19% | 13,611,481 | $68,321,822 |

| AYA | Artryalimited | 0.450 | 18% | 321,557 | $29,926,517 |

Yandal Resources (ASX:YRL) surged on news of an emerging discovery at the New England granite prospect, part of the wider Ironstone Well-Barwidgee gold project near Wiluna, WA.

The first assay results from the 12-hole, 2400m RC program completed across the New England prospect have been received, returning a standout 78m intersection averaging 1.2g/t gold from 96m in hole 24IWBRC0039.

The other hole, 24IWBRC0044, was completed 170m to the north-west, intersecting 14m at 1.8g/t gold from 63m including 3m at 4.9g/t gold from 64m. Gold mineralisation within the emerging discovery, now called Siona, remains open at depth and along strike.

YRL managing director Chris Oorschot described the results as “exceptional”, suggesting they may point to a “significant emerging gold discovery” within the Ironstone Well-Barwidgee project area. The timing of this discovery is even more compelling given the current gold price setting.

YRL plans on completing follow up drilling at Siona as soon as possible to determine the geometry of the mineralisation so that the exploration team can begin to assess the scale of the mineralised system.

Vection Technologies (ASX:VR1) was rising on news that it has partnered with IT giant Dell to launch its AI-based ‘Algho’ platform, securing its first sale of $500,000. The company says the launch is “testament to the value and potential of Vection’s acquisition of TDB” – the acquisition TDB, which supplied the generative AI layer which powers Vection’s ‘Algho’ platform, goes before shareholders for approval on Monday, October 28.

Drilling at Unico Silver (ASX:USL)’s Cerro Leon silver project in Argentina has kicked off with an initial 5000m reverse circulation campaign aiming to expand the project’s current 91Moz silver equivalent resource for 16.5Mt at 172g/t silver equivalent.

Six prospects where silver mineralisation is open at depth or along strike have been prioritised for drilling, including several new areas that fall outside of the current MRE.

The first assays are expected by mid-December. Cerro Leon is strategically located within the same structural corridor that is host to AngloGold Ashanti’s world-class Cerro Vanguardia mine.

It is host to the second largest vein field in Argentina’s Santa Cruz province, second only to AngloGold Ashant

Carnavale Resources (ASX:CAV) was up on news that it has commenced an extensional drilling program at the high-grade Swiftsure deposit within the Kookynie Gold Project is under way, testing extensions to the Swiftsure bonanza gold grade shoots that contain zones of +30g/t within the resource.

The company says it will monitor the drilling carefully and modify the program to chase the best mineralisation as it is encountered.

Elixinol Wellness (ASX:EXL) was up on news that it will be consolidating its securities, from 1.56 billion to a somewhat more manageable 195 million, with the process to be voted on as part of the company’s AGM later this month.

TZ (ASX:TZL) was up on news that it’s entered into a heads of agreement to acquire Proptech company, Keyvision Holdings – a “high margin, recurring revenue proptech company that provides Tenant Experience Apps for the property sector: Residential; Commercial; Retail; Aged Care and Community Groups”, according to the announcement.

Quickfee (ASX:QFE) was up after releasing a quarterly business update this morning, revealing quarterly revenue of $5.6 million, up 33 [er c emt on pcp. The increase was driven by “strong growth in the core Finance product in both Australia and the US”, and has the company set for an expected FY25 EBTDA in the range of $1.5 -$2.5 million, with a stronger second half-year.

Kaiser Reef (ASX:KAU) climbed on news that it has received firm commitments for a placement of Kaiser shares at $0.15 per share to raise $8 million (before costs) to complete the last stage of the A1 Mine production plan. The funds have been earmarked for completion of the A1 Mine ramp up and expansion for high-grade gold production, and the resumption of drilling at the A1 Mine.

Earlier, Environmental Clean Technologies (ASX:ECT) rose on news of the signing of a joint venture Aagreement with ESG Agriculture, advancing from the heads of agreement signed in July 2024. The company says it marks a significant milestone in the progression of the COLDry Lignite-Nitrogen Fertiliser Project.

TMK Energy (ASX:TMK) was up on news that the first of the three additional pilot production wells at the Gurvantes XXXV Coal Seam Gas (CSG) Project, being drilled as part of the 2024 drilling program, has been successfully drilled to a total depth of 480m and has intersected approximately 60m of net coal, which is “as per prognosis and consistent with the existing three surrounding pilot production wells”.

Peak Minerals (ASX:PUA) surged 150 per cent before receiving a speeding ticket from the ASX. In response, Peak said that on October 15, the company announced it completed the acquisition of an 80 per cent stake in the Kitongo and Lolo uranium projects and the Minta Rutile Project in Cameroon. The acquisition followed thorough due diligence, including recent field visits by director Phillip Gallagher.

ASX SMALL CAP LAGGARDS

Monday’s worst-performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| SI6 | SI6 Metals Limited | 0.00 | -50% | 2,416,374 | $4,737,719 |

| VPR | Voltgroupltd | 0.00 | -50% | 2,038,273 | $21,432,416 |

| KLI | Killiresources | 0.09 | -39% | 12,692,995 | $20,332,443 |

| NSM | Northstaw | 0.02 | -37% | 2,929,485 | $5,627,152 |

| PRX | Prodigy Gold NL | 0.00 | -33% | 55,800 | $6,997,367 |

| IBG | Ironbark Zinc Ltd | 0.00 | -25% | 1,054,353 | $7,334,591 |

| JAV | Javelin Minerals Ltd | 0.00 | -25% | 1,021,834 | $17,107,385 |

| SFG | Seafarms Group Ltd | 0.00 | -25% | 64,214 | $19,346,397 |

| CC9 | Chariot Corporation | 0.22 | -21% | 402,980 | $25,095,801 |

| PXX | Polarx Limited | 0.01 | -20% | 1,874,265 | $23,755,010 |

| PRS | Prospech Limited | 0.03 | -19% | 871,266 | $9,381,460 |

| PPG | Pro-Pac Packaging | 0.03 | -18% | 1,004,583 | $6,904,133 |

| NME | Nex Metals Explorat | 0.03 | -18% | 122,891 | $10,891,118 |

| KCC | Kincora Copper | 0.04 | -17% | 366,663 | $9,475,223 |

| VTI | Vision Tech Inc | 0.10 | -17% | 10,865 | $6,604,376 |

| BPP | Babylon Pump | 0.01 | -17% | 75,000 | $14,997,294 |

| BUY | Bounty Oil & Gas NL | 0.01 | -17% | 5,351,166 | $8,991,006 |

| H2G | Greenhy2 Limited | 0.01 | -17% | 300,000 | $3,589,105 |

| LPD | Lepidico Ltd | 0.00 | -17% | 1,905,339 | $25,767,375 |

| POS | Poseidon Nick Ltd | 0.01 | -17% | 870,138 | $25,223,253 |

| PRM | Prominence Energy | 0.01 | -17% | 820 | $2,335,058 |

IN CASE YOU MISSED IT

Bailador Technology Investments (ASX:BTI) will invest a further $10m in DASH Technology Group to fund the acquisition of investment management platform IPS, which combines technology and service to streamline portfolio administration and reporting through its non-custodial, ‘whole-of-wealth’ platform.

Greenvale Energy (ASX:GRV) has acquired the highly prospective calcrete-hosted Henbury uranium project in the Amadeus Basin region of the NT, the third such move it has made in recent weeks. The company is planning shallow, cost-effective drilling.

Mt Malcolm Mines (ASX:M2M) has produced gold doré from bull sampling at Golden Crown, increasing its confidence in the economic potential of the prospect. The collected material was processing at a nearby gravity facility.

Red Metal (ASX:RDM) has defined a giant maiden resource of 4.8Bt at 302ppm NdPr and 28ppm DyTb for its Sybella rare earths project. The resource starts from surface and remains open below 100m depth, meaning there’s potential to grow.

Chariot Corporation (ASX:CC9) has raised $1.61m following a placement of 8.09m shares at an issue price of 20c per share, which was strongly supported by a group of institutional, sophisticated and professional investors.

The existing cash reserves combined with the proceeds of the placement will fund phase 2 drilling at the Black Mountain lithium project, the fourth purchase price payment to Black Mountain Lithium Corp, execution of the pilot mine strategy and metallurgical test work in Perth.

“With this funding, we are now well positioned to pursue our medium-term plans,” CC9 managing director Shanthar Pathmanathan said.

“Additionally, with two series of options set to expire this year and further funds anticipated from the sale of listed shares from past divestments, this capital raise serves as a strong bridge to meet our future liquidity requirements.”

Maiden drilling at Javelin Minerals (ASX:JAV) brownfields Coogee gold-copper asset, 55km southeast of Kalgoorlie, has been increased by 30 per cent to 3000m after priority targets were identified in earlier drilling. The first phase of drilling will begin in mid-late November, testing several strong gold-copper targets close to the mined Coogee Deposit and over the surrounding areas.

Despite hosting a resource 126,685oz of gold and being located next to the world-class St Ives goldfield, Coogee has not had a systematic exploration drilling campaign undertaken around the Coogee pit since Ramelius (ASX:RMS) completed mining operations in 2014. A Program of Work (PoW) has been approved and a drilling-for-equity agreement has been signed with highly regarded contractor Topdrill.

Titanium Sands (ASX:TSL) has completed its presentation to the Central Environment Authority (CEA) and 34 key stakeholders from various governmental departments at a formal meeting held recently at the CEA head office in Colombo, Sri Lanka.

The objectives of this meeting were to hear from all stakeholders and for TSL to have the opportunity to present its scoping plan and next steps for the Mannar heavy mineral sands project. A combined site visit by all the interested stakeholders is set to take place next, followed by the terms of reference (TOR) being issued to the company.

“The key stakeholder presentation was a significant step in the evolving environmental process and as outlined by the Director General himself, now allows for the planning of the next steps leading to the finalisation of the process and then the issue of the IML for Mannar,” TSL managing director Dr James Searle said.

Zeotech (ASX:ZEO) has received a $905,000 R&D tax incentive relating to the Australian Government’s R&D Tax Incentive Program, which provides a cash refund on eligible research and development activities performed by Australian companies.

The refund relates to the company’s expenditure on development of its proprietary mineral processing technology for the sustainable production of manufactured zeolites.

It also reflects its spending on advancing its dual stream agri-soil product development, methane emissions control technology and high reactivity metakaolin research for low-carbon cement and concrete from his high-purity Toondoon kaolin project.

ZEO has used $589,248.19 to repay the secured research & development loan with R&DIUM Capital and has banked the remaining $316,636.28.

TRADING HALTS

Corella Resources (ASX:CR9) – pending the release of announcement in relation to Board and Management changes.

HeraMED (ASX:HMD) – pending an announcement by HeraMED regarding a proposed capital raise.

Patagonia Lithium (ASX:PL3) – for the purpose of considering and executing a proposed capital raising.

Suvo Strategic Minerals (ASX:SUV) – pending an announcement regarding a capital raising.

Great Western Exploration (ASX:GTE) – pending the release of an announcement to the market regarding a fund raising.

Belararox (ASX:BRX) – pending an announcement regarding a proposed capital raise.

Nutritional Growth Solutions (ASX:NGS) – pending the release of an announcement regarding a capital raise by way of a placement to institutional and sophisticated investors.

Dateline Resources (ASX:DTR) – to allow the company the time necessary to finalise a detailed report in regard to the Company’s 100% owned Colosseum Gold-REE Project.

New Age Exploration (ASX:NAE) – pending an announcement in connection with a material capital raising.

PYC Therapeutics (ASX:PYC) – pending an announcement to the market in relation to the ongoing Retinitis Pigmentosa type 11 clinical trials.

True North Copper (ASX:TNC) – pending release of an announcement regarding an update in relation to proposed financing arrangements.

At Stockhead we tell it like it is. While Bailador Technology Investments, Chariot Corporation, Greenvale Energy, Javelin Minerals, Mt Malcolm Mines, Red Metal, Titanium Sands and Zeotech are Stockhead advertisers, they did not sponsor this article.

Today’s Closing Bell is brought to you by Webull Securities. Webull Securities (Australia) Pty. Ltd. is a CHESS-sponsored broker and a registered trading participant on the ASX.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: Goldies sprint ahead with Yandal doubling; but MinRes and WiseTech scandals sink stocks