Closing Bell: ASX trims losses as RBA softens rate-hike language

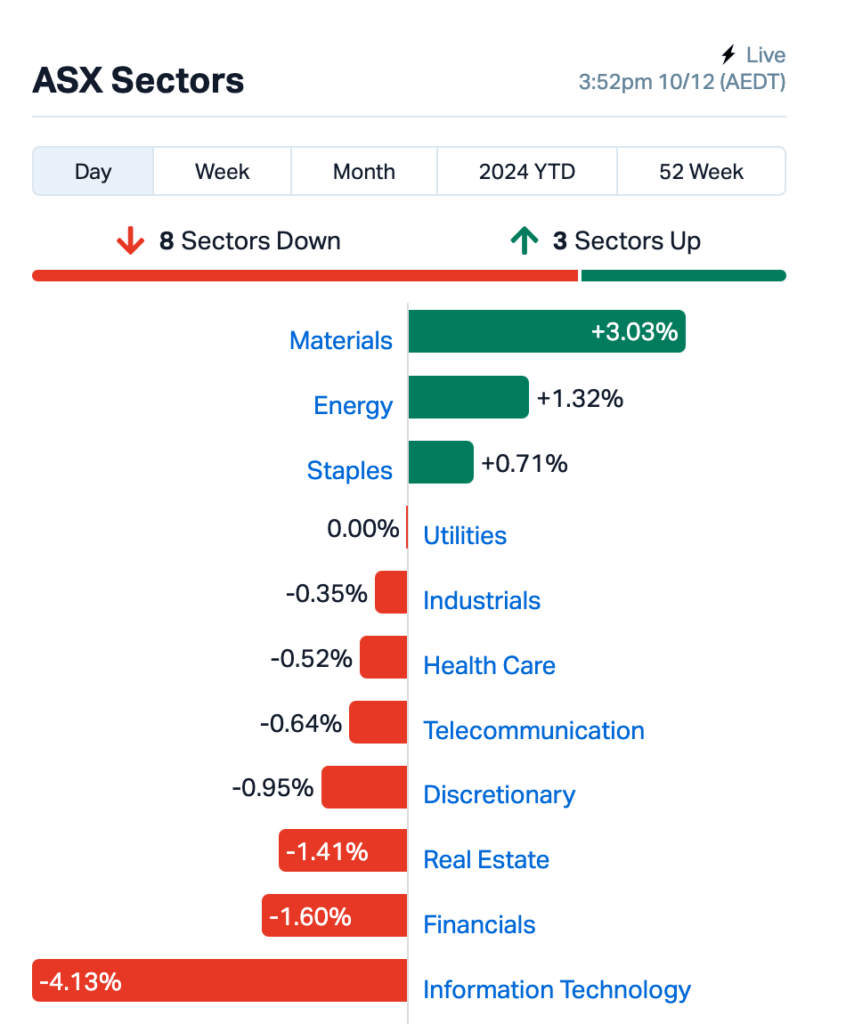

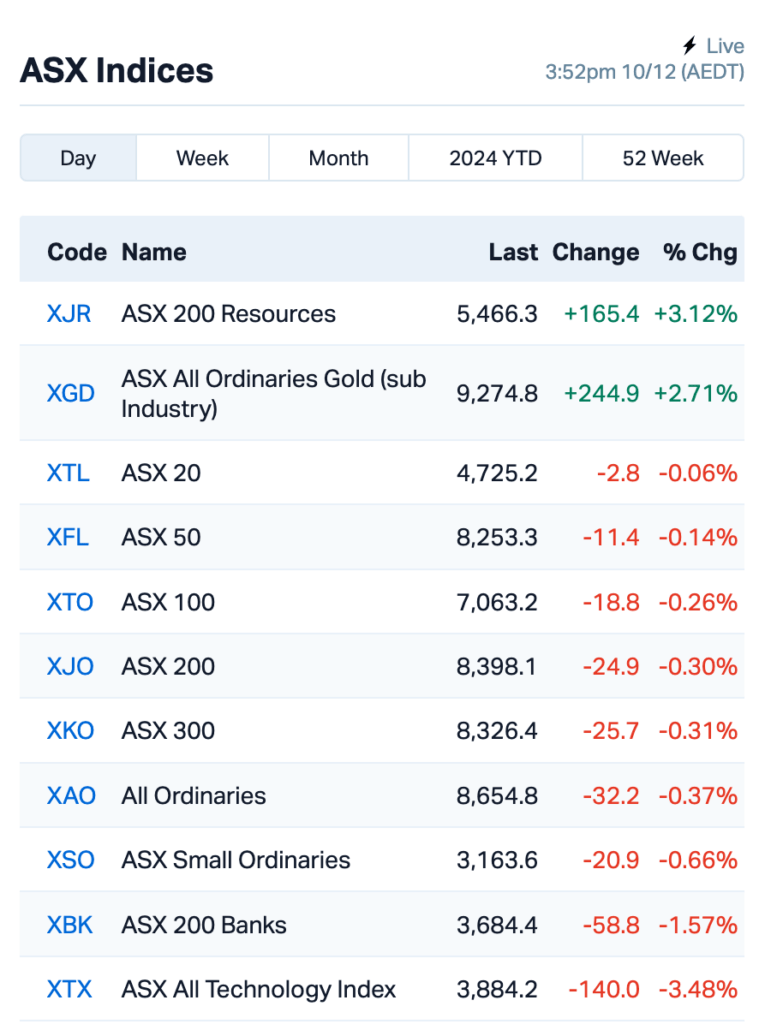

The RBA held rates at 4.35pc, with the ASX paring losses as mining stocks rose and tech shares fell after China’s policy shift.

RBA holds rates at 4.35pc and removes hike warning

ASX pares losses after RBA statement

Mining stocks rise, tech shares fall after China news

The RBA has left interest rates on hold at 4.35% today, but removed its previous warning about raising rates further.

The shift in tone suggested that inflationary pressures may be easing, although the RBA still sees risks.

“With underlying or trimmed mean inflation at 3.5 per cent year on year, the RBA is in no hurry to cut rates so we pushed out our expected first rate cut to May,” said AMP’s Shane Oliver.

The ASX pared its losses following the RBA's statement, closing the day 0.36% lower, while the Aussie dollar tumbled below US63.9c.

The mining sector led today after China said it will adopt a "moderately loose" monetary policy to support its recovery, a shift from its previous "prudent" stance.

Mineral Resources (ASX:MIN) rose 8%, while Pilbara Minerals (ASX:PLS) was up 5%.

Tech stocks were the biggest losers following a sell-off on Wall Street after news that China had launched a probe into Nvidia, causing tech stocks to drop globally.

In the large caps space, Perpetual (ASX:PPT)faces a potential tax bill of $493-529 million after the ATO raised concerns over its asset sale to KKR, up from an initial estimate of $106-227 million. Shares dropped 6%.

Dual-listed Life360 (ASX:360) fell by 5% after the company revealed that a miscalculation of its stock’s weighting in the US Russell indexes had led to passive funds needing to adjust down their positions. This followed an 8% drop yesterday.

And, Insurance Australia (ASX:IAG) said it plans to fight a class action filed in the Supreme Court of Victoria, which claims that its subsidiary IAL and its related entity, IMA, misled customers about the discounts they would receive. Shares were down 2%.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| 88E | 88 Energy Ltd | 0.002 | 50% | 5,931,042 | $28,933,812 |

| ERL | Empire Resources | 0.003 | 50% | 1,212,074 | $2,967,826 |

| MOM | Moab Minerals Ltd | 0.003 | 50% | 1,694,660 | $3,133,999 |

| TAS | Tasman Resources Ltd | 0.006 | 50% | 14,244,546 | $3,220,998 |

| TKL | Traka Resources | 0.002 | 50% | 200,000 | $1,945,659 |

| EDE | Eden Inv Ltd | 0.002 | 33% | 2,106,584 | $6,162,314 |

| SFG | Seafarms Group Ltd | 0.002 | 33% | 357,733 | $7,254,899 |

| APC | Aust Potash Ltd | 0.020 | 25% | 156,437 | $1,628,090 |

| CZN | Corazon Ltd | 0.003 | 25% | 2,499 | $1,535,811 |

| ERA | Energy Resources | 0.003 | 25% | 1,034,475 | $810,792,482 |

| NRZ | Neurizer Ltd | 0.003 | 25% | 974,512 | $5,635,721 |

| SI6 | SI6 Metals Limited | 0.022 | 22% | 565,938 | $2,636,380 |

| AKA | Aureka Limited | 0.140 | 22% | 908,088 | $11,780,013 |

| MQR | Marquee Resource Ltd | 0.017 | 21% | 2,233,832 | $5,829,381 |

| NFM | New Frontier | 0.018 | 20% | 7,341,304 | $21,806,030 |

| MTC | Metalstech Ltd | 0.130 | 18% | 685,256 | $21,729,343 |

| SMX | Strata Minerals | 0.021 | 17% | 209,123 | $3,434,673 |

| BRN | Brainchip Ltd | 0.255 | 16% | 22,157,251 | $433,942,955 |

| VHM | Vhmlimited | 0.445 | 16% | 295,147 | $63,489,447 |

| SMM | Somerset Minerals | 0.015 | 15% | 2,988,449 | $2,680,602 |

| CND | Condor Energy Ltd | 0.023 | 15% | 1,818,470 | $11,726,674 |

Corazon Mining (ASX:CZN) has expanded its MacBride Base and Precious Metals Project in Canada, more than doubling its landholding. The project now covers a 14-kilometre strike, with significant potential for copper, zinc, gold and silver deposits. Historical exploration has already identified high-grade gold samples, and an aerial VTEM survey is underway to help target drilling for early 2025.

New Frontier Minerals (ASX:NFM) has contracted New Resolution Geophysics (NRG) to conduct a high-resolution airborne magnetic and radiometric survey at its Harts Range project in the Northern Territory. The survey, covering 2,253 line kilometres, will help identify potential extensions to known uranium, niobium, and rare earth mineralisation. Results from the survey are due to be completed in January 2025.

88 Energy (ASX:88E) has received initial 2D seismic data from Monitor Exploration, confirming 10 significant structural leads in its PEL 93 licence area in Namibia’s Owambo Basin. The seismic data reveals large closures, some up to 100 km², with hydrocarbon charge potential. 88 Energy said it plans to independently validate these findings.

Boab Metals (ASX:BML) has secured a US$30 million prepayment and an offtake agreement with Trafigura for lead-silver concentrate from its Sorby Hills project. Repayments start after 18 months, and Trafigura will purchase 75% of the concentrate if conditions are met, dropping to 25% otherwise.

Somerset Minerals (ASX:SMM) has agreed to acquire the high-grade Coppermine project in Nunavut, Canada, adjacent to White Cliff Minerals’ (ASX:WCN) Rae project. The acquisition will give Somerset control of a 1,208 km² land package, hosting multiple high-grade copper lodes, including rock chip results of up to 45.4% copper.

BrainChip Holdings (ASX:BRN) has secured a US$1.8 million contract with the Air Force Research Laboratory (AFRL) to develop radar signalling algorithms for neuromorphic hardware. The project will focus on micro-Doppler signature analysis, using BrainChip’s proprietary TENNs algorithm optimised for its Akida 2.0 hardware.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| VTI | Vision Tech Inc | 0.057 | -58% | 733,530 | $7,429,923 |

| 1TT | Thrive Tribe Tech | 0.001 | -50% | 456,113 | $1,406,723 |

| MTL | Mantle Minerals Ltd | 0.001 | -50% | 177,452 | $12,394,892 |

| SIT | Site Group Int Ltd | 0.001 | -50% | 3,812,824 | $6,514,980 |

| LYN | Lycaonresources | 0.105 | -45% | 8,029,314 | $10,067,116 |

| IBG | Ironbark Zinc Ltd | 0.003 | -38% | 5,175 | $7,334,591 |

| GGE | Grand Gulf Energy | 0.002 | -33% | 21,877 | $7,351,161 |

| LNU | Linius Tech Limited | 0.001 | -33% | 34,500 | $9,226,824 |

| NES | Nelson Resources. | 0.002 | -33% | 400,704 | $6,515,783 |

| RLL | Rapid Lithium Ltd | 0.005 | -29% | 907,400 | $5,124,776 |

| WC1 | Westcobarmetals | 0.013 | -28% | 920,801 | $2,866,798 |

| GMN | Gold Mountain Ltd | 0.003 | -25% | 702,194 | $15,629,893 |

| VRX | VRX Silica Ltd | 0.045 | -21% | 1,660,995 | $35,810,573 |

| VMC | Venus Metals Cor Ltd | 0.056 | -20% | 13,860 | $13,729,008 |

| AAU | Antilles Gold Ltd | 0.004 | -20% | 1,503,272 | $9,289,380 |

| ADD | Adavale Resource Ltd | 0.002 | -20% | 282 | $3,087,330 |

| ARV | Artemis Resources | 0.008 | -20% | 4,823,373 | $19,168,824 |

| CDT | Castle Minerals | 0.002 | -20% | 10,017,866 | $4,182,035 |

| CAG | Caperangeltd | 0.105 | -19% | 3,750 | $12,338,079 |

| SVL | Silver Mines Limited | 0.093 | -19% | 29,002,298 | $173,424,170 |

| EMH | European Metals Hldg | 0.130 | -19% | 1,000 | $33,191,153 |

| BUS | Bubalusresources | 0.115 | -18% | 156,275 | $5,090,995 |

| AUG | Augustus Minerals | 0.033 | -18% | 301,465 | $4,767,657 |

IN CASE YOU MISSED IT

Asra Minerals (ASX:ASR) has appointed the experienced Paul Stephen as its new CEO to lead its Leonora gold exploration drive. With a track record of discovering and delineating 2.8Moz, Stephen is set to leverage his expertise in the high-performing gold market.

James Bay Minerals (ASX:JBY) has unveiled historical data revealing up to 4% copper and 6,874 g/t silver from its Independence gold project in Nevada. The company is investigating the potential for multi-commodity mineralisation of the newly acquired project.

Summit Minerals (ASX:SUM)has kicked off maiden drilling at its Barra lithium project in Brazil. The 3000m RC program is targeting quartz outcrops believed to be extensions of previously unmapped pegmatite quartz cores, and is supported by recent magnetic surveys.

FintechOvanti (ASX:OVT) is raising $6 million to expand its US team. The company aims to launch a BNPL offering and is eyeing a listing on a US exchange, following the path of peers like Sezzle and Afterpay.

Lanthanein Resources (ASX:LNR) has extended its farm-in agreement with Gondwana Resources by six months to earn a 50% interest in tenement E77/2143, agreeing to pay $200,000 in cash. The extension accommodates delays in regulatory approvals and allows time to complete drilling, receive assay results and evaluate the project’s potential for the next farm-in stage.

At Stockhead, we tell it like it is. While Asra Minerals, James Bay Minerals, Summit Minerals, Ovanti and Lanthanein Resources are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: ASX trims losses as RBA softens rate-hike language