Closing Bell: ASX swings wildly, Scentre drags and these assets could Trump bump

The ASX was up and down on Thursday, with Quickstep and Sigma Healthcare in the spotlight. All after Wall Street hit record highs following Trump’s win.

ASX slipped after early gains, then finished strongly

Energy sector helped offset losses; Quickstep, Sigma Healthcare turned heads

Wall Street rallied to record highs after Trump's win

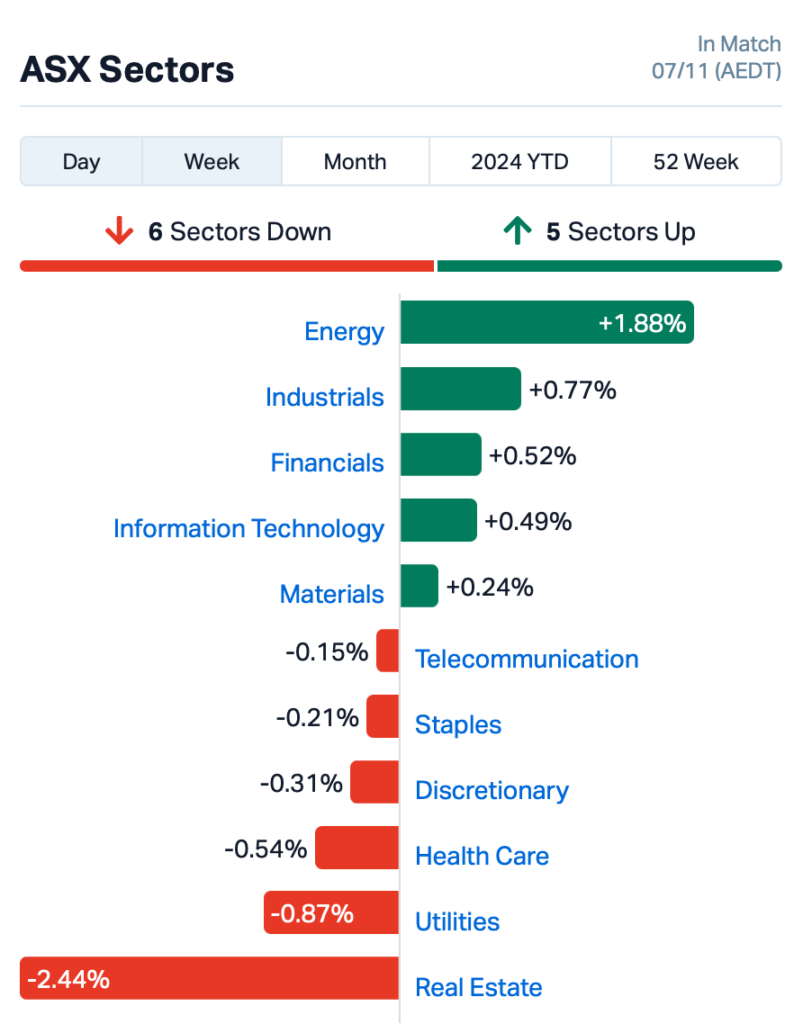

The ASX swung from gains, to losses at lunchtime, to gains again before the final bell sounded. At the close of Thursday, the S&P/ASX 200 was up 0.33 per cent.

The Energy sector led, helping to offset losses in property stocks, following Donald Trump’s decisive US election victory, which pushed Wall Street indices and Bitcoin to record highs.

Of the 11 sectors on the ASX, five were in the green.

The biggest laggard, Real Estate, was dragged down by sector heavyweight Scentre Group (ASX:SCG), which dropped 2 per cent after the company provided its operating update.

The stock fell due to concerns over its ongoing capital management initiatives, including a $900 million issuance of subordinated notes and the completion of a cash tender offer for its outstanding debt.

Also, the market has been wary of the potential risks and costs associated with the group's large-scale retail developments, such as the $4 billion pipeline and the repurposing of department store spaces across multiple Westfield locations.

National Australia Bank (ASX:NAB) held steady despite reporting an 8 per cent decline in cash profit for FY24, although it slightly increased its annual dividend.

Sigma Healthcare (ASX:SIG) surged 24 per cent after the ACCC approved its merger with Chemist Warehouse, while Zip Co (ASX:ZIP) suffered a 1.5 per cent fall despite a 234 per cent increase in Q1 FY25 cash earnings.

Neuren Pharmaceuticals (ASX:NEU) posted strong gains, up 8 per cent, after forecasting solid income growth for FY24.

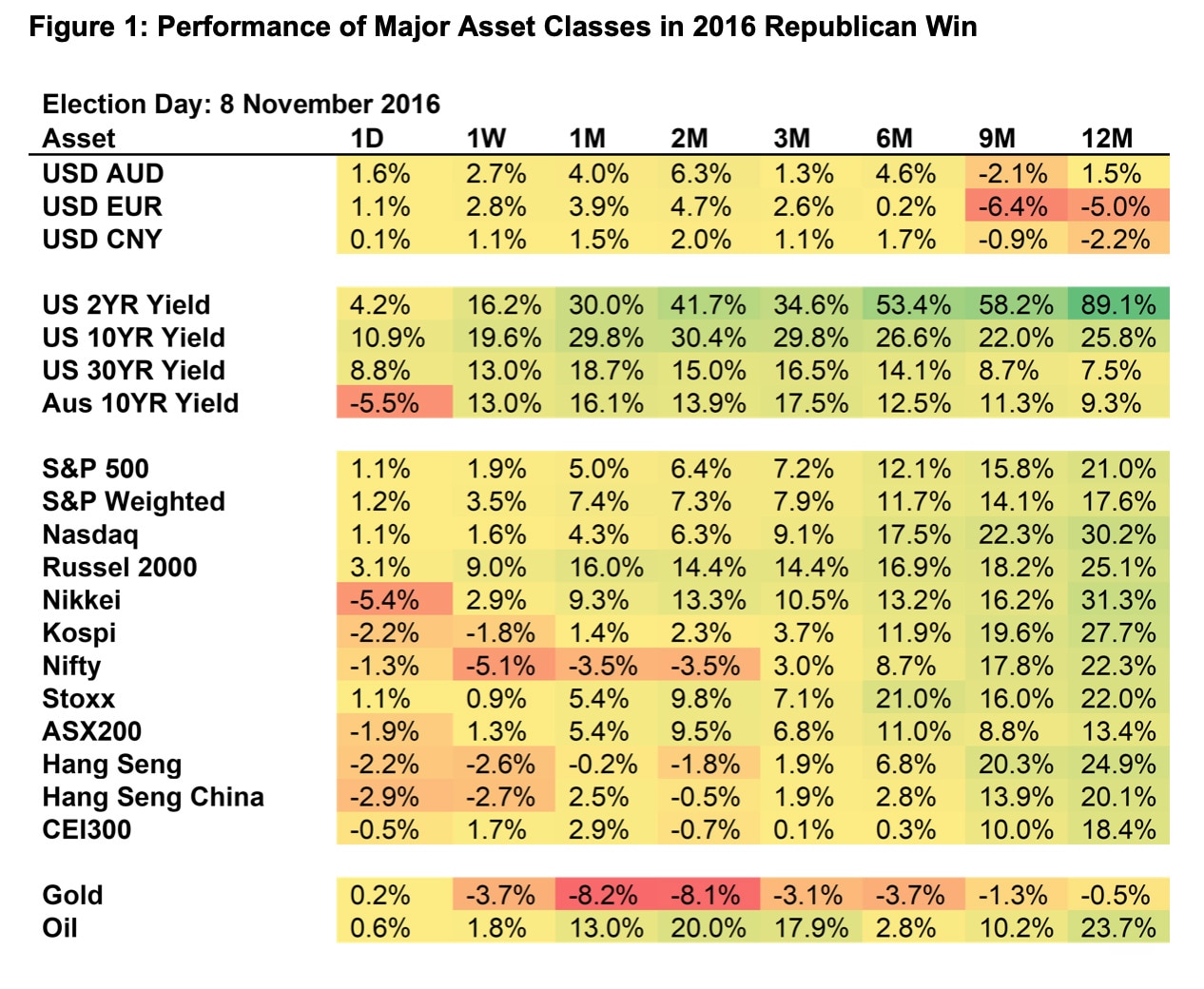

Which assets could win under Trump?

The slightly bearish sentiment on the ASX today was in sharp contrast to Wall Street, which had its biggest post-election rally ever following Trump’s decisive win.

The Dow, S&P 500, and Nasdaq all hit record highs last night as investors anticipated that Trump’s return to the White House could trigger pro-business policies and tax cuts.

The 10-year Treasury yield rose 13 basis points, Bitcoin surged to a new all-time high and the US dollar strengthened.

The Russell 2000 small-cap index soared by more than 5per cent, while the VIX, or "fear gauge" dropped sharply, posting its second-largest one-day decline since 2021.

Financial stocks, led by JPMorgan and Goldman Sachs, reached new records, and Tesla’s stock jumped 15 per cent, bolstered by expectations that the EV giant would benefit from Trump’s administration.

Stephen Dover of Franklin Templeton noted that the positive growth outlook could continue in the coming months, but urged investors to be cautious in their investment decisions.

Here’s a table showing which major asset classes performed well when Trump took office in 2016.

What’s happening elsewhere?

Meanwhile, across the region on Thurssday, Asian stock markets were mixed as investors continued to react to Donald Trump's win.

Stocks in Hong Kong and China had gains, while those in Australia (for a while) and South Korea fell.

There are concerns about higher inflation due to Trump's proposed tariffs, which have been driving US bond yields higher in recent days.

The US Federal Reserve, however, is expected to cut interest rates by 25 basis points later Thursday night (Australian time), with more cuts likely in December and 2025.

Globally, central banks are keeping an eye on how Trump's policies might impact the economy.

ASX SMALL CAP LEADERS

Thursday’s best-performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| QHL | Quickstep Holdings | 0.375 | 92% | 3,462,481 | $13,986,612 |

| PHL | Propell Holdings Ltd | 0.032 | 78% | 1,651,187 | $5,010,086 |

| GTI | Gratifii | 0.006 | 57% | 147,757,494 | $15,769,584 |

| OAR | OAR Resources Ltd | 0.002 | 50% | 476,944 | $3,300,835 |

| RNE | Renu Energy Ltd | 0.002 | 50% | 318,937 | $1,727,328 |

| AOK | Australian Oil. | 0.004 | 33% | 175,000 | $3,005,349 |

| HPC | Hydration Pharmaceuticals Co | 0.017 | 31% | 762,262 | $3,963,870 |

| AIV | Activex Ltd | 0.018 | 29% | 614,415 | $3,017,036 |

| TRI | Trivarx Ltd | 0.019 | 27% | 19,546,129 | $6,855,580 |

| ENT | Enterprise Metals | 0.005 | 25% | 2,106,423 | $4,713,269 |

| TMK | TMK Energy Ltd | 0.003 | 25% | 949,466 | $16,784,811 |

| VML | Vital Metals Ltd | 0.003 | 25% | 151,585 | $11,790,134 |

| SIG | Sigma Health Ltd | 2.415 | 24% | 45,508,028 | $3,173,979,633 |

| CAN | Cann Group Ltd | 0.058 | 23% | 1,438,930 | $22,027,325 |

| SES | Secos Group Ltd | 0.039 | 22% | 534,173 | $19,091,521 |

| HIQ | Hitiq Ltd | 0.030 | 20% | 420,323 | $8,796,124 |

| LVH | Livehire Ltd | 0.030 | 20% | 649,483 | $9,540,364 |

| AKN | Auking Mining Ltd | 0.006 | 20% | 19,737,977 | $1,956,751 |

| BLZ | Blaze Minerals Ltd | 0.006 | 20% | 4,067 | $3,142,791 |

| CUL | Cullen Resources | 0.006 | 20% | 250,000 | $3,467,009 |

| FFF | Forbidden Foods | 0.012 | 20% | 3,692,858 | $5,722,235 |

| M2R | Miramar | 0.006 | 20% | 6,122,132 | $1,984,116 |

| SBW | Shekel Brainweigh | 0.041 | 17% | 62,300 | $7,982,143 |

Quickstep Holdings (ASX:QHL), an aerospace manufacturer, saw its shares soar 95 per cent after receiving a takeover bid from one of its biggest customers, Asdam Operations, at 40 cents a share. The bid is a significant premium to Quickstep’s current share price of 20 cents, and is conditional on 90 per cent shareholder approval.

TrivarX (ASX:TRI) has announced a significant breakthrough in its research and development program with the advancement of its MEB-001 algorithm, designed to screen for current major depressive episodes (cMDE) using a single-lead ECG. This new algorithm, which uses heart rate and heart rate variability as biomarkers, can accurately perform sleep staging and screen for cMDE, achieving 87 per cent sensitivity and 67 per cent specificity in initial testing.

This development opens up new market opportunities beyond sleep centres, including cardiology, sports and performance monitoring, military applications, and consumer wearables. The technology could also be licensed for remote patient monitoring. A provisional patent application has been filed to protect the innovation, and further clinical trials and testing are under way to explore additional potential applications.

Archer Materials (ASX:AXE) has successfully miniaturised its Biochip graphene field effect transistor (gFET) design, reducing the size of the chip by 97 per cent. This advancement, fabricated by Archer’s foundry partner Applied Nanolayers in the Netherlands, makes the gFET more cost-effective to produce while improving its foundry readiness. The miniaturised chips have already undergone wafer dicing and assembly at AOI Electronics in Japan and are now being tested by Archer.

This new design is a key step towards Archer’s goal of using the Biochip for at-home testing of chronic kidney disease, with the miniaturised gFET sensors playing a crucial role in the functionality. The company aims to reduce fabrication costs and increase the production scale, with over a thousand chips expected to be produced in future wafer runs. This progress also strengthens Archer’s partnerships with semiconductor supply-chain partners and moves the Biochip closer to commercialisation

Strickland Metals (ASX:STK) presented a webinar held by its senior leadership team – perhaps the reason the global gold hunter was one of the few ressies doing well on the bourse on Thursday.

The junior laid down an update on recent exploration progress at both its Rogozna gold and base metals project in Serbia and at the 100 per cent-owned Yandal gold project in WA.

STK MD Paul L’Herpiniere and non-exec director and geoscientist Dr Jon Hronsky OAM provided a comprehensive overview of the company’s exploration and growth strategy across both assets.

The company has been busy with exploration this past year after selling its Millrose gold project to Northern Star Resources (ASX:NST) last year for $61m – cash it’s using to put straight back into the ground at Yandal and now Rogozna.

King River Resources (ASX:KRR) was up on Wednesday’s news.

KRR’s 2024 drilling campaign has discovered a new 250m-long gold zone at Kurundi, south of the central main workings with grades of up to 12.75g/t gold. Exploration was focused on extending previously discovered high-grade gold mineralisation it sussed out from drone magnetic surveyance last year.

Other results showed: 3m at 8.3g/t gold from 35m, including 1m at 16.25/t gold from 36m at the central main zone and 2m at 5.11g/t from 44m, including 1m at 6.33g/t from 45m at the northern workings.

Forbidden Foods (ASX:FFF) gave a trading update on Thursday. The company saw strong growth in October, with group sales reaching $360,000, a 44 per cent increase from September and 70 per cent higher than the same period last year.

This was driven by the strategic acquisition of Oat Milk Goodness (OMG), which led to cost savings, improved sales, and stronger momentum. Online sales for Blue Dinosaur, a key brand in the group, grew 93 per cent year-on-year, and the integration of OMG products is expected to boost ecommerce sales further.

FFF has also launched a partnership with the McGrath Foundation, linking sales of Blue Dinosaur bars to breast cancer fundraising. Operational efficiencies are being realised through streamlined processes, improving profit margins.

Management remains optimistic about continued growth, especially with key marketing campaigns planned for the Australian summer.

ASX SMALL CAP LAGGARDS

Thursday’s worst-performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| MHC | Manhattan Corp Ltd | 0.001 | -50% | 583,083 | $8,995,940 |

| TKL | Traka Resources | 0.001 | -50% | 1,100,000 | $3,891,317 |

| MNC | Merino and Co | 0.750 | -48% | 901,638 | $76,961,027 |

| PRX | Prodigy Gold NL | 0.002 | -33% | 2,198,991 | $9,525,167 |

| VPR | Volt Group Ltd | 0.001 | -33% | 5 | $16,074,312 |

| CMX | Chemx Materials | 0.026 | -28% | 992,918 | $4,644,804 |

| NME | Nex Metals Explorations | 0.026 | -28% | 65,166 | $9,802,006 |

| AL8 | Alderan Resource Ltd | 0.003 | -25% | 10,500 | $7,637,168 |

| EVR | Ev Resources Ltd | 0.003 | -25% | 109,157 | $5,585,086 |

| RIE | Riedel Resources Ltd | 0.002 | -25% | 290,065 | $4,447,671 |

| DTI | DTI Group Ltd | 0.009 | -25% | 19,000 | $5,382,617 |

| CVW | Clearview Wealth Ltd | 0.398 | -24% | 5,967,387 | $342,010,596 |

| HTG | Harvest Tech Grp Ltd | 0.011 | -21% | 2,611,192 | $12,139,450 |

| RFA | Rare Foods Australia | 0.031 | -21% | 20,592 | $10,607,347 |

| WML | Woomera Mining Ltd | 0.002 | -20% | 26,492,739 | $5,416,475 |

| WEC | White Energy | 0.049 | -18% | 31,265 | $11,939,057 |

| GPR | Geopacific Resources | 0.028 | -18% | 2,883,495 | $40,224,462 |

| IBX | Imagion Biosys Ltd | 0.043 | -17% | 706,315 | $2,238,011 |

| CYL | Catalyst Metals | 2.820 | -17% | 6,041,953 | $768,340,650 |

| BUY | Bounty Oil & Gas NL | 0.005 | -17% | 2,114,418 | $8,991,006 |

| MEM | Memphasys Ltd | 0.005 | -17% | 3,811,708 | $10,528,489 |

Regis Resources (ASX:RRL) has started legal proceedings in the Federal Court to challenge federal Environment Minister Tanya Plibersek's decision to protect part of the McPhillamys Gold Project under a Section 10 Declaration. The company is seeking a ruling that the declaration is invalid, that a different minister should reconsider the application, and that Regis be awarded costs for the legal process.

While the timeline is uncertain, Regis hopes the matter will be resolved by mid-2025 and will keep the market updated on any important developments.

IN CASE YOU MISSED IT

Finder Energy (ASX:FDR) is leveraging the enormous amount of work sunk into its Kuda Tasi and Jahal oil fields by previous operators to progress quickly through early project milestones. It is currently evaluating the suitability of available FPSO vessels for developing the fields.

Drilling at Renegade Exploration’s (ASX:RNX) Greater Mongoose zone has intersected significant copper mineralisation in every drill hole, reflecting the best results the company has received to date at the broader Cloncurry project.

Victory Metals (ASX:VTM) has grown its North Stanmore rare earth mineralisation to more than 13.5km of strike after drilling intersected world class ratios of prized heavy rare earth oxides. Heavy rare earths make up 41 per cent of the total rare earth oxide content.

Raiden Resources (ASX:RDN)has carried out maiden drilling on the Andover South project in WA with 3500m completed to date. The company initially focused on targets 1 and 2 but the program has since expanded to include target areas 3, 4 and 7 with the arrival of a second drill rig. Operations are now proceeding on schedule and budget with the first batch of samples dispatched to the laboratory for assay analysis. Based on the anticipated timetable, Raiden expects results to be on track for release within November.

At Stockhead, we tell it like it is. While Finder Energy, Raiden Resources, Renegade Exploration and Victory Metals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: ASX swings wildly, Scentre drags and these assets could Trump bump