Closing Bell: ASX surges after inflation shock; banks and goldies lead the charge

The ASX popped on Wednesday as inflation rose, miners ripped, and Energy Transition Minerals rocketed on Trump’s Greenland talk.

ASX up again after surprise inflation spike

Miners led gains as financials rode rate bet

Energy Transition Minerals soared on Trump talk

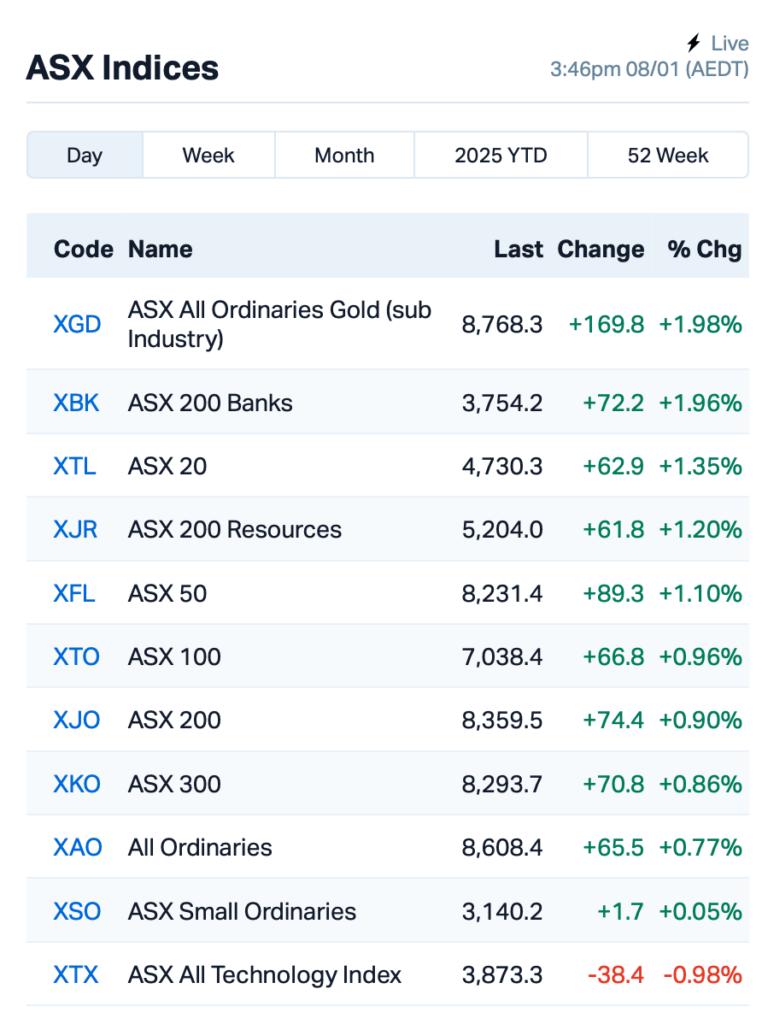

The ASX kept its momentum rolling, up 0.77% on Wednesday as an inflation report surprise gave the RBA more room to cut rates.

According to the ABS, November CPI jumped to 2.3%, up from 2.1% in October, making the decision easier for the RBA and sending stocks higher.

“On a more encouraging side, inflation in the new dwellings category was the weakest since mid-2021,” said State Street Global’s Krishna Bhimavarapu.

“Yes, we can now confidently say that disinflation is running apace in Australia.”

Meanwhile, Wall Street was going in the reverse direction last night – the S&P 500 dropped 1% and Nasdaq fell almost 2% after strong US job and business data.

Strong data is good for the economy, but bad for stocks as higher growth means inflation could linger, keeping the Fed’s rate cuts on hold.

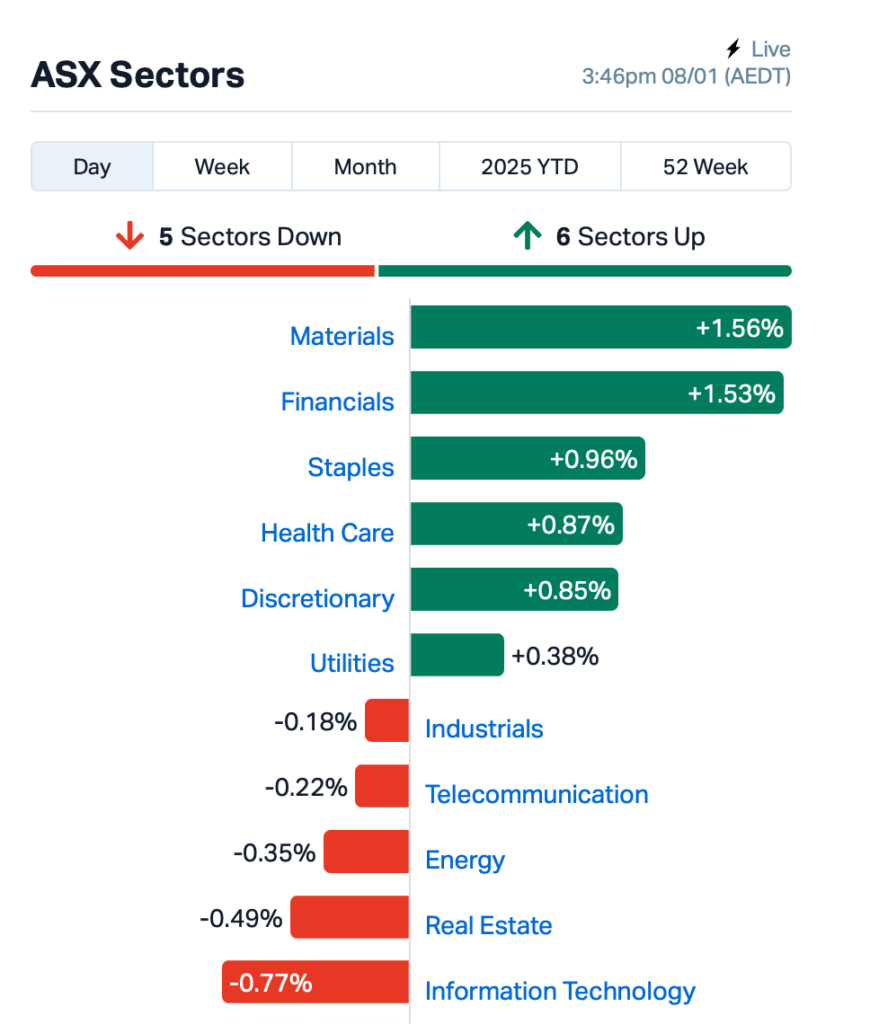

Back to the ASX, six out of 11 sectors were in the green today, with miners and banks leading the charge:

Financial stocks were on fire following the CPI release, suggesting that some traders are backing rates to stay high for a while (banks thrive on higher rates).

Miners also bounced back after days in the red, despite iron ore still stuck at a four-month low.

Uranium miners, however, struggled, with Boss Energy (ASX:BOE) dropping 3% and Paladin Energy (ASX:PDN) slipping 4%.

And just when you thought it couldn’t get weirder, Energy Transition Minerals (ASX:ETM) rocketed 33% on Trump’s Greenland takeover talk. Yup, he said the US should own the island for its rare earths and strategic location. You can read more about that in today's Resources Top 5.

Meanwhile across the region, Asian stocks mostly followed Wall Street's slide today.

Tech stocks tanked, while China’s bond market looked grim, flashing deflation warnings.

Hong Kong and Tokyo fell hard, but Samsung bucked the trend, keeping Korea in the green.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Security Description Last % Volume MktCap AUZ Australian Mines Ltd 0.012 50% 25,319,797 $11,188,097 RDN Raiden Resources Ltd 0.015 43% 26,432,039 $36,234,360 MKL Mighty Kingdom Ltd 0.007 40% 10,164,122 $1,080,317 SPN Sparc Tech Ltd 0.275 34% 817,379 $19,653,954 OB1 Orbminco Limited 0.002 33% 250,000 $3,249,885 ETM Energy Transition 0.066 27% 26,346,909 $73,252,851 SMX Strata Minerals 0.024 26% 2,053,445 $3,625,488 DTM Dart Mining NL 0.010 25% 251,071 $4,784,445 MXO Motio Ltd 0.034 21% 367,135 $7,798,095 CMD Cassius Mining Ltd 0.012 20% 10,291 $5,420,045 CRR Critical Resources 0.006 20% 13,962,684 $12,159,816 NES Nelson Resources. 0.003 20% 269,000 $5,429,819 QEM QEM Limited 0.068 19% 1,125,565 $10,877,520 FBM Future Battery 0.025 19% 1,778,812 $13,972,474 TKM Trek Metals Ltd 0.025 19% 239,925 $10,922,580 NIM Nimyresourceslimited 0.089 19% 508,920 $13,966,407 SIO Simonds Grp Ltd 0.165 18% 57 $50,386,903 IXR Ionic Rare Earths 0.007 17% 1,231,171 $31,370,570 SHE Stonehorse Energy Lt 0.007 17% 170,525 $4,106,610 CDD Cardno Limited 0.180 16% 154,410 $6,054,403

Regenerative medicine company Orthocell (ASX:OCC) has recorded its third consecutive quarter of record revenue, posting $2.21 million in Q2 FY25, up 9% on Q1. The company largely attributed the growth to increase in sale s of its Striate+ and Remplir products. The trend could well continue, with Orthocell anticipating regulatory approval of Remplir in the US in March/April this year.

Australian Mines (ASX:AUZ) just announced a major upgrade to its Flemington resource, with the 2025 scandium mineral resource jumping from 3.7 million tonnes to 6.3 million tonnes, maintaining strong grades of 446-458 ppm. The total mineralised inventory now stands at 28 million tonnes at 217 ppm scandium, a huge leap from 4.5 million tonnes in 2017. AUZ said most of the resource is near surface and classified as Measured and Indicated.

Reach Resources (ASX:RR1) has kicked off a drilling program at its 100%-owned Murchison South gold project (formerly Primrose), targeting high-grade areas from previous drilling. The RC drill campaign will include around 12 holes, mostly between 60-80m deep. Updates are expected soon.

MTM Critical Metals (ASX:MTM) has made a further breakthrough in its Flash Joule Heating (FJH) technology, achieving 93% conversion of REEs into chlorides and removing 95% of key impurities. The technology allows for the production of >90% purity products in a single step, reducing both complexity and reagent costs. MTM is engaging with industry stakeholders to explore FJH’s integration into the REE supply chain.

And, Julian Hanna has been appointed managing director at Artemis Resources (ASX:ARV) to lead a big drilling push at the Karratha gold project in 2025. Hanna brings loads of experience from his time with Western Areas and MOD Resources. Meanwhile, executive director George Ventouras has stepped down to chase new opportunities.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Code Name Price % Change Volume Market Cap FRX Flexiroam Limited 0.007 -30% 6,733,818 $7,856,438 AYM Australia United Min 0.003 -25% 213,636 $7,370,310 FHS Freehill Mining Ltd. 0.003 -25% 704,267 $12,314,111 LNU Linius Tech Limited 0.002 -25% 220,588 $12,302,431 QXR Qx Resources Limited 0.003 -25% 1,539,973 $5,120,311 VPR Voltgroupltd 0.002 -25% 342,072 $21,432,416 AHN Athena Resources 0.004 -20% 1,203,737 $7,971,402 CUL Cullen Resources 0.004 -20% 1,000,000 $3,467,009 MEL Metgasco Ltd 0.004 -20% 31,937 $7,287,934 AHF Aust Dairy Limited 0.065 -20% 4,572,514 $60,209,067 AVH Avita Medical 3.550 -18% 1,993,756 $302,362,845 LMS Litchfield Minerals 0.100 -17% 60,100 $3,385,362 ERA Energy Resources 0.003 -17% 124,686 $1,216,188,722 LNR Lanthanein Resources 0.003 -17% 55,710 $7,330,908 MGU Magnum Mining & Exp 0.010 -17% 321,896 $9,712,337 XGL Xamble Group Limited 0.022 -15% 13,675 $8,814,370 TZL TZ Limited 0.050 -15% 174,891 $15,651,565 GR8 Great Dirt Resources 0.140 -15% 37,418 $4,842,958 ADN Andromeda Metals Ltd 0.006 -14% 686,416 $24,001,094 AJL AJ Lucas Group 0.006 -14% 300,517 $9,630,107 GES Genesis Resources 0.006 -14% 200,000 $5,479,889 JAV Javelin Minerals Ltd 0.003 -14% 102,630 $21,076,853

IN CASE YOU MISSED IT

Arika Resources (ASX:ARI)has resumed phase 2 drilling at the Pennyweight Point prospect within its Yundamindra gold project in WA, focusing on testing extensions to the known mineralisation at depth and along strike.The program began before Christmas, with 11 holes already completed for ~1,350 metres and assays expected in the coming weeks.

Nova Minerals (ASX:NVA)has strengthened its balance sheet to capitalise on surging antimony and gold prices, reaching an agreement with Nebari to eliminate its existing convertible debt by converting it into ordinary shares. The move is a vote of confidence in Nova’s vision, leaving the company with ~$16 million in cash to accelerate development at its Estelle gold and critical minerals project in Alaska.

iCandy Interactive (ASX:ICI)joint venture, ZKCandy, has raised US$4 million in a round of seed funding, with funds being used to strengthen its technology, develop new features and prepare for mainnet launch in the first half of this year. The raise was led by well-known Web3 institutional investors including Wemix, Animoca Ventures, Spartan Group, Perlone Capital, Presto Labs, Flowdesk, Prometheuz, Lecca Ventures, and Efficient Frontier.

Live Verdure (ASX: LV1)has acquired an additional 6% equity stake in Decidr.ai for $13.2 million, increasing its holding to a controlling 51%. The move strengthens its ability to influence and drive Decidr's strategic direction, “a pivotal moment for the company” according to LV1 executive chairman David Brudenell.

At Stockhead, we tell it like it is. While Arika Resources, Nova Minerals, iCandy Interactive, Live Verdure, MTM Critical Metals and Orthocell are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: ASX surges after inflation shock; banks and goldies lead the charge