Closing Bell: ASX has worst drop since Covid; gold, iron ore, Bitcoin also hammered

The ASX plummeted 4pc, while gold, copper and Bitcoin were smashed. Abacus Storage King jumped, however, after a buyout offer.

ASX tanks 4pc, worst drop since may 2020

Gold, copper, Bitcoin hammered in global rout

Abacus Storage King bursts up after receiving buyout proposalÂ

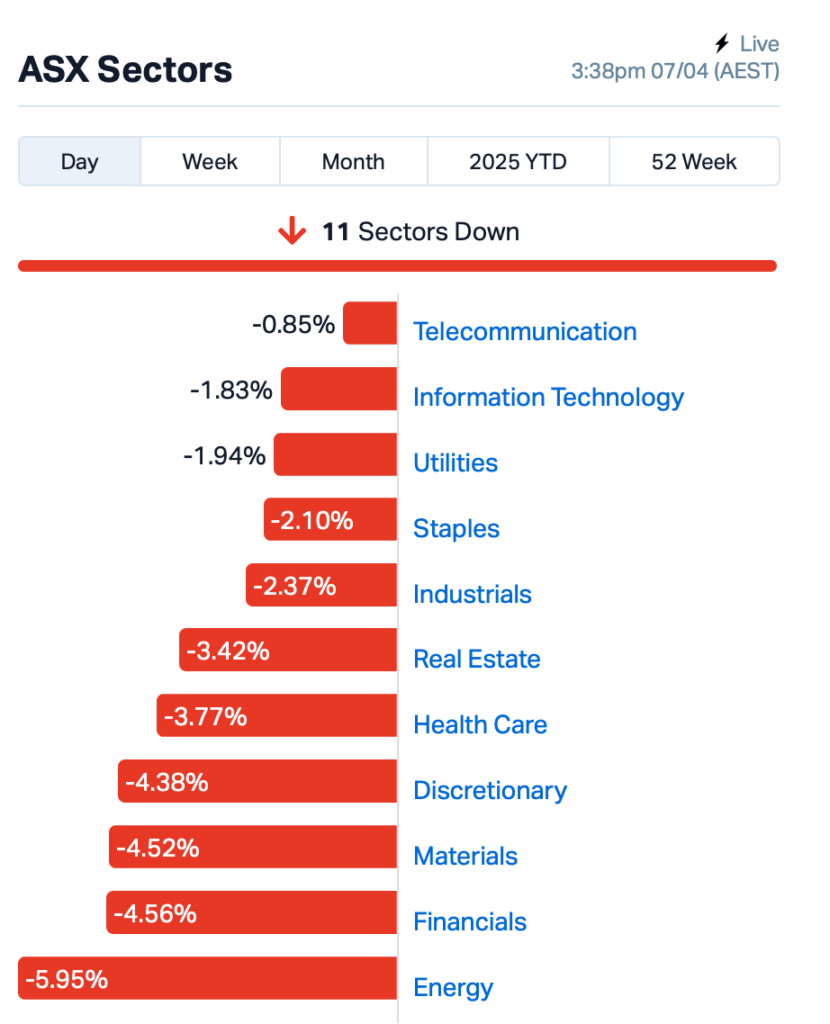

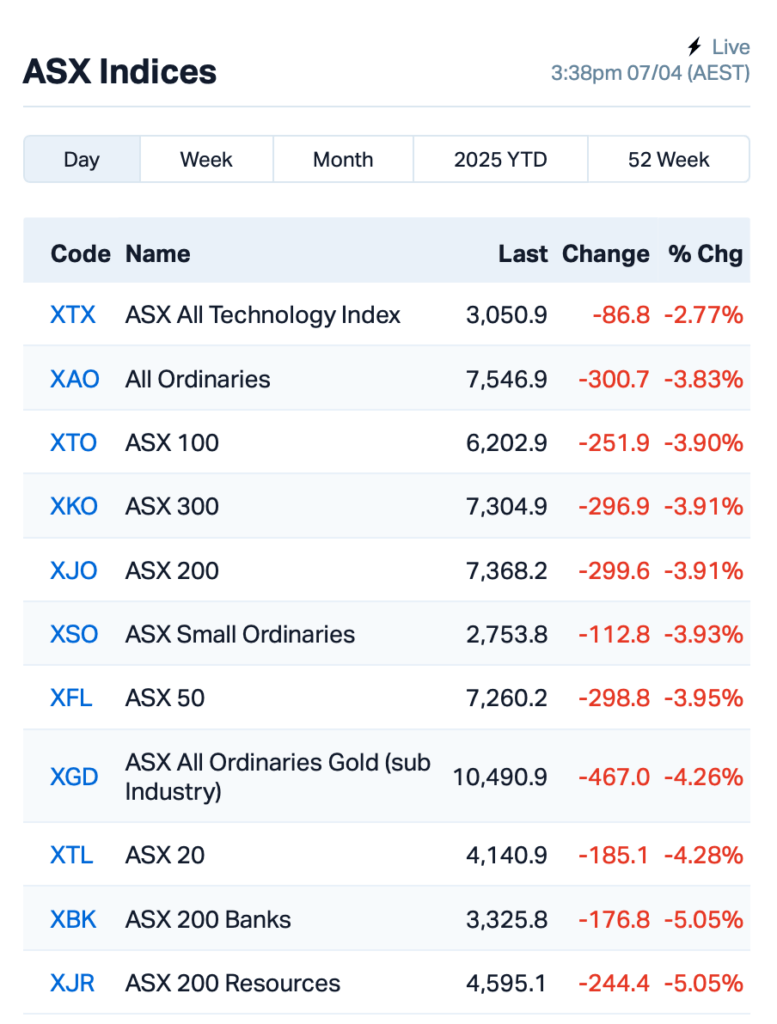

The ASX has taken a big hit on Monday, dropping by 4% as it marked the worst one-day loss since May 2020 amid fears over a growing global trade war.

The Aussie bourse lost over $100 billion even after bouncing back from a 6% drop earlier in the day.

The meltdown follows a major sell-off on Wall Street on Friday, where the S&P 500 closed down by 6%, wrapping up its worst week since the Covid chaos of March 2020.

The Nasdaq also crashed by 6%, which pushed the tech-heavy index officially into bear market territory.

Even gold, the ultimate safe haven, couldn’t escape the bloodbath. Gold tumbled from all-time highs and dropped by as much as 2.5%, falling below US$3,000 an ounce today.

Copper plunged 8%, marking its sharpest fall in five years. Bitcoin certainly couldn’t escape either, dipping below US$78,000 as the turmoil escalated.

Across Asia, things were looking fairly grim this afternoon.

Hong Kong's Hang Seng Index took a nosedive, losing over 11.5% after China responded to the US’s aggressive moves by slapping a 34% levy on American goods – matching the US’s tariff rates.

Nikkei 225 was also down 7%.

“But as always with Trump, hopefully there is room for negotiation,” said John Birkhold at TWC Invest.

“He is transactional by nature, and wants to put perceived wins up on his scoreboard as he plays to the history books.”

Over on the ASX, all sectors were in the red today, and big players like BHP (ASX:BHP) and Commonwealth Bank (ASX:CBA) plunged by 6%.

Oil stocks took a massive hit after Saudi Arabia slashed crude prices, with Santos (ASX:STO) and Woodside Energy Group (ASX:WDS) sinking by 9% and 5%, respectively.

The mining sector wasn’t spared with iron ore prices dropping, and Fortescue Metals Group (ASX:FMG) seeing a 4% fall. Even gold miners like Evolution Energy Minerals (ASX:EV1) couldn’t dodge the sell-off, dropping over 7%.

In large caps news, Abacus Storage King (ASX:ASK)shot up 19% after receiving a buyout proposal from its major investor Ki Corporation and Public Storage.

Telix Pharmaceuticals (ASX:TLX) tried to ease concerns, assuring investors that the tariffs wouldn’t significantly impact its operations, thanks to a strong US-based manufacturing setup. Telix’s stock still dropped by 3%.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Security Description Last % Volume MktCap BDT Birddog 0.047 52% 2,472,693 $5,006,067 1TT Thrive Tribe Tech 0.002 50% 175,000 $2,031,723 88E 88 Energy Ltd 0.002 50% 3,925,421 $28,933,812 OB1 Orbminco Limited 0.002 50% 147,500 $2,166,590 CVR Cavalierresources 0.295 34% 347,781 $12,725,288 PRX Prodigy Gold NL 0.002 33% 3,322,665 $4,762,583 VEN Vintage Energy 0.004 33% 1,405,699 $5,366,766 ECT Env Clean Tech Ltd. 0.003 25% 23,951,282 $7,293,621 ERA Energy Resources 0.003 25% 1,005,527 $810,792,482 ABE Ausbondexchange 0.040 21% 328,782 $3,718,048 ROG Red Sky Energy. 0.006 20% 1,590,410 $27,111,136 SER Strategic Energy 0.006 20% 3,766,466 $3,355,167 ASK Abacus Storage King 1.383 19% 13,399,403 $1,524,359,436 MKL Mighty Kingdom Ltd 0.007 17% 711,999 $1,296,380 PRM Prominence Energy 0.004 17% 2,251,427 $1,167,529 QML Qmines Limited 0.047 16% 1,641,291 $17,370,567 1CG One Click Group Ltd 0.008 14% 830,000 $8,245,159 BIT Biotron Limited 0.004 14% 2,216,738 $3,158,340 LCL LCL Resources Ltd 0.008 14% 552,406 $8,363,689 ACR Acrux Limited 0.025 14% 273,620 $8,960,934 AT1 Atomo Diagnostics 0.018 13% 1,859,024 $10,227,237 NNL Nordicresourcesltd 0.083 12% 87,914 $10,906,405 RVT Richmond Vanadium 0.145 12% 44,853 $28,838,333 LGM Legacy Minerals 0.250 11% 1,566,593 $28,105,498 ATS Australis Oil & Gas 0.010 11% 2,230,546 $11,704,559

Broadcasting tech firm BirdDog Technology (ASX:BDT) is seeking to voluntarily delist from the ASX, after receiving in-principle approval from the exchange. The company believes this move is in the best interest of both the business and its shareholders, mainly due to poor share price performance, low trading liquidity, and the costs of staying listed. If shareholders approve the delisting at the upcoming meeting on 14 May, BirdDog will also conduct an off-market share buy-back, offering up to 100% of shares back to current investors.

Strategic Energy Resources (ASX:SER) has drilled down on its South Cobar Project, where a recent IP (induced polarisation) survey at the Miti Prospect uncovered a promising chargeable feature beneath a strong polymetallic anomaly, making it a high priority drill target. The team’s also refining targets with an infill soil survey while continuing regional exploration for more potential spots to drill. With IP proving effective in finding Cobar-style mineralisation, SER’s confident this will lead to some promising finds.

Atomo Diagnostics (ASX:AT1) is rolling out a national program to distribute free HIV self-tests through vending machines across Australia, funded by the Federal Government’s 2024 budget. Thorne Harbour Health has placed an order worth around $230,000 to help get this off the ground, with plans to expand testing in 2026. Atomo’s HIV self-test is also now available in New Zealand through Chemist Warehouse.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| RMI | Resource Mining Corp | 0.003 | -40% | 256,371 | $3,327,029 |

| AXP | AXP Energy Ltd | 0.001 | -33% | 85,078,217 | $9,862,021 |

| CZN | Corazon Ltd | 0.002 | -33% | 10,750,000 | $3,553,717 |

| DGR | DGR Global Ltd | 0.004 | -33% | 8,701,579 | $6,262,176 |

| FAU | First Au Ltd | 0.002 | -33% | 2,382,051 | $6,215,980 |

| MRD | Mount Ridley Mines | 0.002 | -33% | 1,998,144 | $2,335,467 |

| VFX | Visionflex Group Ltd | 0.002 | -33% | 16,895,982 | $10,103,581 |

| FCT | Firstwave Cloud Tech | 0.012 | -29% | 2,302,196 | $29,129,818 |

| CUF | Cufe Ltd | 0.005 | -29% | 4,822,208 | $9,426,024 |

| KPO | Kalina Power Limited | 0.005 | -29% | 2,054,741 | $20,221,206 |

| IRX | Inhalerx Limited | 0.018 | -28% | 405,000 | $5,336,206 |

| ASH | Ashley Services Grp | 0.135 | -27% | 502,624 | $26,635,542 |

| RMY | RMA Global | 0.025 | -26% | 445,480 | $22,587,276 |

| AOA | Ausmon Resorces | 0.002 | -25% | 50,000 | $2,622,427 |

| BCM | Brazilian Critical | 0.006 | -25% | 2,805,850 | $8,503,669 |

| BP8 | Bph Global Ltd | 0.003 | -25% | 10,833,534 | $2,433,233 |

| EDE | Eden Inv Ltd | 0.002 | -25% | 1,140,217 | $8,219,762 |

| EMT | Emetals Limited | 0.003 | -25% | 9,240,000 | $3,400,000 |

| M2R | Miramar | 0.003 | -25% | 1,428,900 | $1,825,387 |

| MOH | Moho Resources | 0.003 | -25% | 1,347,560 | $2,923,498 |

| PAB | Patrys Limited | 0.002 | -25% | 2,254,300 | $4,114,895 |

| PIL | Peppermint Inv Ltd | 0.003 | -25% | 6,370,062 | $8,845,917 |

| SVY | Stavely Minerals Ltd | 0.012 | -25% | 1,996,203 | $8,704,673 |

| HAL | Halo Technologies | 0.027 | -25% | 147,580 | $4,630,910 |

| NC6 | Nanollose Limited | 0.031 | -24% | 387,043 | $9,544,895 |

IN CASE YOU MISSED IT

In a major legal win, Indiana Resources (ASX:IDA) has secured the final US$30 million payment from the Tanzanian Government, part of a larger US$90 million settlement the state was ordered to pay over its unlawful expropriation of the Ntaka Hill nickel sulphide project. The company has subsequently applied to make a payment to shareholders as a capital return.

While formal results will have to wait a few more weeks, White Cliff Minerals (ASX:WCN) has unearthed visual sulphide copper hits of up to 96 metres in width at the Rae copper project, which has already produced rock chip samples of up to 54.12% copper. The company has a strong pipeline of exploration targets, with seven more historical copper workings to investigate at the Danvers prospect alone.

At Stockhead, we tell it like it is. While Indiana Resources and White Cliff Minerals are Stockhead advertisers, they did not sponsor this article. This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: ASX has worst drop since Covid; gold, iron ore, Bitcoin also hammered