Closing Bell: ASX goes the distance as banks bet on interest rate cuts

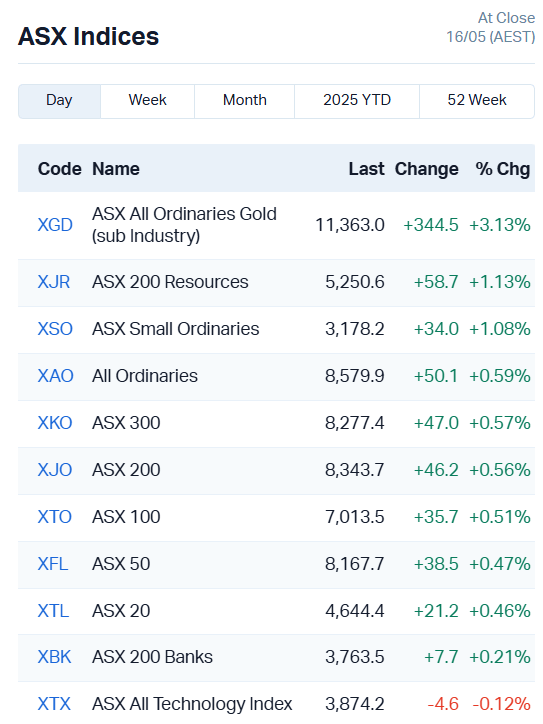

A surge in gold stocks has lifted the ASX 0.56pc, supported by strength in the Real Estate and Healthcare sectors for an eighth day in the green.

ASX posts eighth day of gains, lifting 0.56pc

All Ords Gold index surges 3pc

Real Estate, Resources Healthcare lead sector gains

The ASX has crossed the finish line firmly in the green, racking up an eighth straight day of gains and setting a new 50-day high.

This week, the bourse lifted 1.37% overall, making at least a little progress every day. That puts us 3.15% off our 52-week high, undoing the vast majority of tariff war damage.

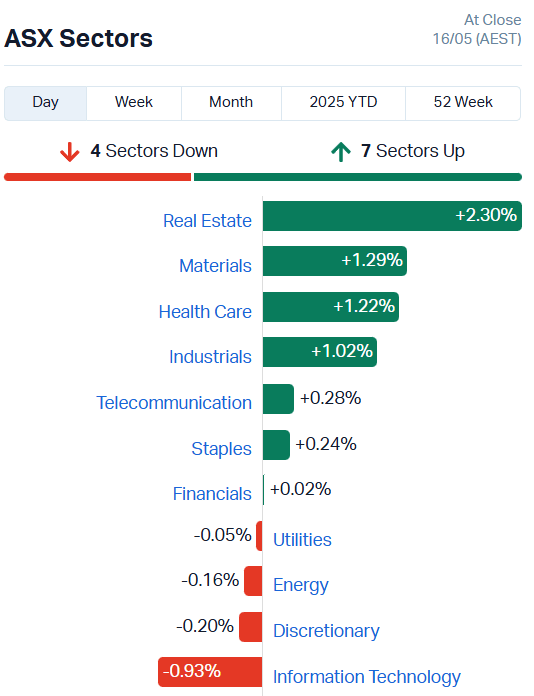

Looking at the sectors, Real Estate (+2.3%), Materials (+1.29%) and Health Care (+1.22%) stood out, while Info Tech (-0.93%) weighed heaviest.

That didn’t tell the full story, though. A surge in the ASX All Ords Gold index gave us a more of a look under the hood, highlighting the effect of a 1.2% hike in gold prices overnight.

Gold miners had a field day, with a handful jumping double digits.

Brightstar Resources (ASX:BTR) added 13.82%, Chalice Mining (ASX:CHN) 11.71%, Aurelia Metals (ASX:AMI) 8.62% and Pantoro Gold (ASX:PNR) 9.83%.

In fact, one of the best performing stocks on the ASX today was Bellevue Gold (ASX:BGL), up 4.22% alongside lithium miner Liontown Resources (ASX:LTR) which lifted 4.43%.

How much will the RBA cut rates?

Taking into account a weakening in producer prices and soft retail sales in the US, alongside a deteriorating global growth outlook, market analysts are convinced the RBA will be cutting interest rates at its next meeting on Monday – the question is now, by how much?

Strong labour force and wages data wasn’t enough to turn market opinion sour; Commonwealth Bank is betting on a 25-basis-point cut at the next meeting.

“Both the Q1 2025 trimmed mean CPI and the Q1 2025 wage price index printed right in line with the RBA’s forecasts from the February Statement on Monetary Policy,” A CBA note read.

“This means the prices and wages side of the economy in the March quarter have evolved exactly as the RBA anticipated in February.

“Household consumption, however, looks to be softer over Q1 25 than the RBA forecast in February.

“And the global growth outlook has deteriorated over the last six weeks because of US trade policy.”

NAB disagrees, arguing an outsized 50-bp cut is on the cards. NAB economic chief economist Sally Auld points to the slowdown in both domestic and global growth as a strong reason to leave a restrictive policy position behind.

“Our call for a 50bps easing in May reflects the fact that with the real cash rate of 1.3% and policy currently restrictive, the RBA needs to play catch up,” Auld says.

“Once the cash rate reaches a level more consistent with a neutral policy setting, we then expect the RBA to pause for a few months before taking the cash rate into modestly accommodative territory."

Auld reckons the RBA will need to take further action to reduce interest rates in the near future, whether they make the full 50-bp cut or not.

At present, the market seems fairly evenly divided on how far it thinks the RBA will jump. The ASX Rate Indicator trackers reveals that the market has priced-in a 51% chance of a 50-point cut, and pretty much everyone is expecting interest rates to be reduced by at least 25bp.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Security | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| RMI | Resource Mining Corp | 0.024 | 85% | 46428210 | $8,650,275 |

| NPM | Newpeak Metals | 0.015 | 67% | 5157460 | $2,898,646 |

| NES | Nelson Resources. | 0.003 | 50% | 75000 | $4,343,855 |

| VPR | Voltgroupltd | 0.0015 | 50% | 300282 | $10,716,208 |

| ERL | Empire Resources | 0.005 | 43% | 2329204 | $5,193,696 |

| MOH | Moho Resources | 0.007 | 40% | 2030022 | $3,654,373 |

| SER | Strategic Energy | 0.007 | 40% | 4231761 | $3,355,167 |

| W2V | Way2Vatltd | 0.007 | 40% | 266684 | $4,670,001 |

| ZMM | Zimi Ltd | 0.011 | 38% | 127741 | $3,420,351 |

| AMN | Agrimin Ltd | 0.075 | 36% | 251070 | $18,879,453 |

| GTR | Gti Energy Ltd | 0.004 | 33% | 15047576 | $8,996,849 |

| RML | Resolution Minerals | 0.012 | 33% | 4751489 | $4,732,082 |

| VTM | Victory Metals Ltd | 0.93 | 27% | 954027 | $79,936,981 |

| FLG | Flagship Min Ltd | 0.08 | 27% | 14722 | $12,826,436 |

| AER | Aeeris Ltd | 0.065 | 25% | 16004 | $3,819,341 |

| DTR | Dateline Resources | 0.04 | 25% | 92430238 | $88,498,196 |

| EAT | Entertainment | 0.005 | 25% | 1000 | $5,235,144 |

| WMG | Western Mines | 0.215 | 23% | 244096 | $15,811,835 |

| AM5 | Antares Metals | 0.011 | 22% | 13400839 | $4,633,676 |

| ECS | ECS Botanics Holding | 0.011 | 22% | 7520151 | $11,664,446 |

| FRS | Forrestaniaresources | 0.062 | 22% | 5981377 | $15,299,993 |

| AON | Apollo Minerals Ltd | 0.012 | 20% | 2261603 | $9,284,569 |

| SPX | Spenda Limited | 0.006 | 20% | 11216497 | $23,076,077 |

| TMK | TMK Energy Limited | 0.003 | 20% | 325705 | $25,555,958 |

| E79 | E79Goldmineslimited | 0.027 | 17% | 539768 | $3,643,491 |

Making news…

ECS Botanics (ASX:ECS) is set for a record cannabis harvest, with most of its 6-tonne outdoor crop now high-value A-grade flower. The company said it’s cutting costs, boosting margins, and launching four new premium strains in June.

With strong demand and upgrades underway, ECS says it’s still on track for positive cash flow this year.

Moho Resources (ASX:MOH) has uncovered a 4km-long gold anomaly at its Silver Swan North project near Kalgoorlie, the first real gold sniff at a site once chased for nickel.

The hotspot includes a higher-grade 1.4km core and sits just 2km from Horizon’s Black Swan plant, smack in the middle of WA’s gold-rich Eastern Goldfields. Moho reckons it’s a promising sign of what’s sitting beneath.

TMK Energy (ASX:TMK) has offloaded its 20% stake in the Talisman Deeps Project, clearing the decks to focus fully on its Mongolian coal seam gas play.

The company will pocket a deferred $1 million if production ever kicks off at Talisman, but for now, the sale means no more risk or spend on the offshore WA project. TMK says it’s all about Mongolia from here.

Resource Mining Corp (ASX:RMI) could offer only a shrug after the ASX sent them a Please Explain over the stock’s share price movement today, pointing to an earlier announcement detailing a laboratory analysis workstream for copper-gold soil and auger samples collected from the Mpanda copper-gold project in Tanzania.

ASX SMALL CAP LAGGARDS

Today’s worse performing small cap stocks:

| Security | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| BP8 | Bph Global Ltd | 0.002 | -33% | 2104 | $3,152,954 |

| EDE | Eden Inv Ltd | 0.001 | -33% | 1110000 | $6,164,822 |

| MEL | Metgasco Ltd | 0.002 | -33% | 48000 | $4,372,760 |

| PIL | Peppermint Inv Ltd | 0.002 | -33% | 6417 | $6,712,918 |

| TMX | Terrain Minerals | 0.002 | -33% | 350263 | $6,745,670 |

| BPP | Babylon Pump & Power | 0.004 | -27% | 4137568 | $13,701,528 |

| AJL | AJ Lucas Group | 0.006 | -25% | 1575134 | $11,005,837 |

| AOA | Ausmon Resorces | 0.0015 | -25% | 192534 | $2,622,427 |

| SFG | Seafarms Group Ltd | 0.0015 | -25% | 125472 | $9,673,198 |

| DSK | Dusk Group | 0.8775 | -25% | 1886389 | $72,853,402 |

| CP8 | Canphosphateltd | 0.02 | -20% | 21771 | $7,669,013 |

| ASR | Asra Minerals Ltd | 0.002 | -20% | 976495 | $6,765,117 |

| C7A | Clara Resources | 0.004 | -20% | 3116 | $2,558,021 |

| CTN | Catalina Resources | 0.002 | -20% | 4000278 | $6,065,048 |

| LML | Lincoln Minerals | 0.004 | -20% | 376215 | $10,512,849 |

| TFL | Tasfoods Ltd | 0.004 | -20% | 1957448 | $2,185,478 |

| OD6 | Od6Metalsltd | 0.025 | -17% | 244628 | $4,814,039 |

| MBK | Metal Bank Ltd | 0.01 | -17% | 63022 | $5,969,508 |

| MSG | Mcs Services Limited | 0.005 | -17% | 114295 | $1,188,598 |

| SKK | Stakk Limited | 0.005 | -17% | 110000 | $12,450,478 |

| TEG | Triangle Energy Ltd | 0.0025 | -17% | 508122 | $6,267,702 |

| WBE | Whitebark Energy | 0.005 | -17% | 839710 | $3,454,733 |

| PUA | Peak Minerals Ltd | 0.016 | -16% | 12365119 | $53,339,105 |

| DY6 | Dy6Metalsltd | 0.11 | -15% | 808242 | $7,694,158 |

| AMO | Ambertech Limited | 0.14 | -15% | 326164 | $15,741,789 |

IN CASE YOU MISSED IT

Hillgrove Resources (ASX:HGO) has selected industrial minerals and logistics expert Luke Anderson as its new chief financial officer, effective June 2.

Anderson has more than 30 years’ executive leadership experience, having held senior positions with One Rail Australia, OZ Minerals, Unimin Corporation and most recently as CEO of Andromeda Metals (ASX:ADN).

He will lead finance, governance, reporting and planning functions and play a key role in supporting Hillgrove’s long-term growth strategy.

Altech Batteries (ASX:ATC) recently evaluated a 28-year-old Zebra battery to prove an impressive shelf life of solid-state sodium-nickel-chloride batteries. The first-generation Zebra battery shares the same chemical makeup as Altech's CERENERGY batteries. A performance as if it were new after decades of dormancy serves as a compelling demonstration of the technology's capabilities.

New Age Exploration (ASX:NAE) has completed phase one drilling at its Lammerlaw gold and antimony project, targeting high priority anomalies around historical workings and its own high-grade discoveries in an ascendant New Zealand mining jurisdiction.

Trading Halts

Bryah Resources (ASX:BYH) - announcement regarding an acquisition

Chimeric Therapeutics (ASX:CHM) - cap raise

Dotz Nano (ASX:DTZ) - cap raise

Midas Minerals (ASX:MM1) - cap raise

At Stockhead, we tell it like it is. While Hillgrove Resources, Andromeda Metals, Altech Batteries and New Age Exploration are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: ASX goes the distance as banks bet on interest rate cuts