Closing Bell: ASX gains kept alive by health stocks and ETFs

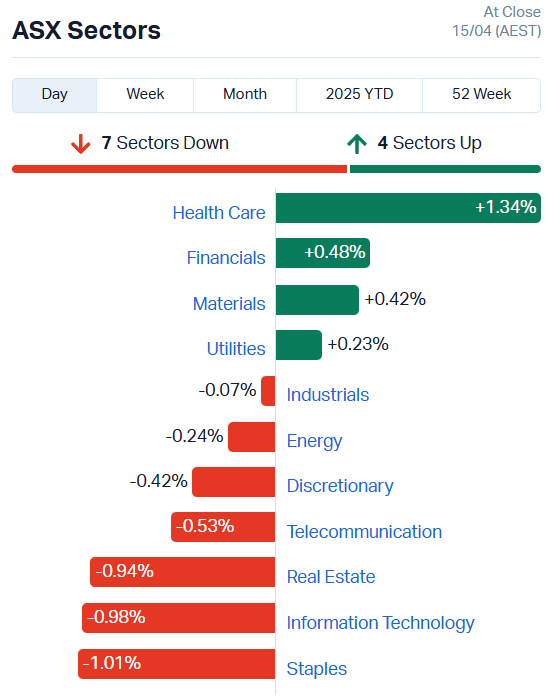

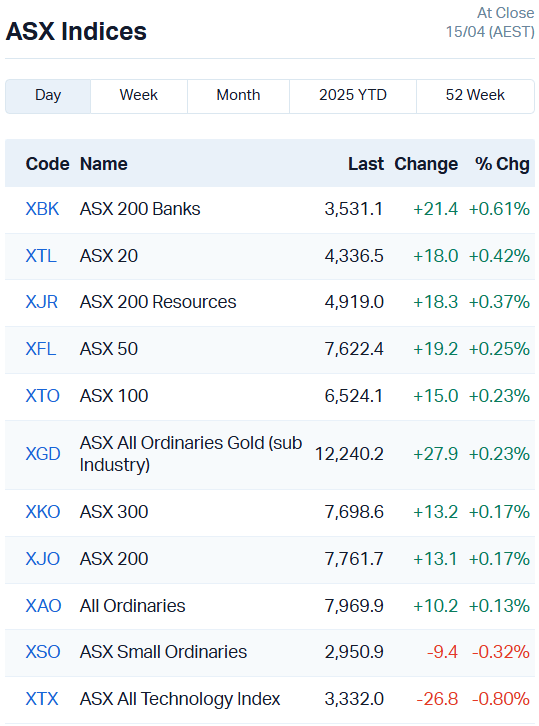

Despite climbing as much as 0.5pc by midday, the ASX has managed to hold onto only half of those gains, lifting just 0.27pc. Strength in the health care and financial sectors propped up the market.

Healthcare sector lifts 1.34pc, propping up ASX gains

ETFs and banks lift financials 0.48pc

Consumer staples, info tech and real estate sectors undercut early gains

It was a fair-to-middling day on the ASX, with the Aussie market paring back midday gains but ultimately finishing in the green. No gold star, but a satisfactory 'I believe in you' stamp from teacher.

The bourse couldn’t hold onto a 0.5% gain made at midday, but lifted 0.21% overall, mostly due to strength in the health sector with some help from financials.

CSL (ASX:CSL) once again stole the spotlight, gaining 2.56%. EBOS Group (ASX:EBO) also gained, up 1.14%, and mid-caps Mesoblast (ASX:MSB) and Nanosonics (ASX:NAN) ticked up 2.41% and 2.12% respectively.

As for financials, modest moves for major banks buoyed the sector – CBA, NAB, Westpac, Macquarie and ANZ all gained between 0.48% and 0.84% and QBE Insurance jumped 1.5%.

That wasn’t all, though; ETFs are on the rise yet again. JP Morgan’s JHGA soared 7% to $51.3 each, while the K2 Australian Small Cap Fund notched a 3.17% lift and Betashares’ GGFD and XMET ETFs gained 2.62% and 2.82% each.

Onto our market movers for the day…

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| ENV | Enova Mining Limited | 0.007 | 40% | 25705570 | $7,067,504 |

| SNS | Sensen Networks Ltd | 0.033 | 38% | 739452 | $19,032,899 |

| SRL | Sunrise | 0.665 | 34% | 1004557 | $44,662,612 |

| AOK | Australian Oil. | 0.002 | 33% | 1401546 | $1,502,674 |

| MEL | Metgasco Ltd | 0.004 | 33% | 125000 | $4,372,760 |

| MSG | Mcs Services Limited | 0.004 | 33% | 1521756 | $594,299 |

| DAL | Dalaroometalsltd | 0.02 | 33% | 1647107 | $3,734,279 |

| SUH | Southern Hem Min | 0.028 | 33% | 21367443 | $15,461,041 |

| PSC | Prospect Res Ltd | 0.145 | 32% | 3403481 | $62,992,928 |

| MEI | Meteoric Resources | 0.089 | 29% | 42932597 | $161,243,532 |

| SGQ | St George Min Ltd | 0.0245 | 29% | 77181299 | $50,688,626 |

| BCM | Brazilian Critical | 0.009 | 29% | 3962811 | $7,440,710 |

| MPR | Mpower Group Limited | 0.009 | 29% | 30002 | $2,405,923 |

| GML | Gateway Mining | 0.03 | 25% | 3589068 | $9,811,687 |

| BYH | Bryah Resources Ltd | 0.005 | 25% | 2691128 | $3,479,814 |

| CHM | Chimeric Therapeutic | 0.005 | 25% | 1716055 | $6,480,599 |

| IPB | IPB Petroleum Ltd | 0.005 | 25% | 3486089 | $2,825,612 |

| RLG | Roolife Group Ltd | 0.005 | 25% | 12675283 | $5,984,125 |

| RMI | Resource Mining Corp | 0.005 | 25% | 101002 | $2,661,623 |

| ASO | Aston Minerals Ltd | 0.0195 | 22% | 1924299 | $20,721,028 |

| ATH | Alterity Therap Ltd | 0.0085 | 21% | 8513277 | $63,891,595 |

| IXR | Ionic Rare Earths | 0.0085 | 21% | 54648602 | $36,668,998 |

| EUR | European Lithium Ltd | 0.052 | 21% | 1555275 | $62,142,803 |

| MAY | Melbana Energy Ltd | 0.029 | 21% | 29778448 | $80,884,898 |

Sensen Networks (ASX:SNS) posted record Q3 cash collections of $3.7m in its latest quarterly report, a 61% increase on the same period last year. It also marked the fourth consecutive quarter of positive cashflow for the company, leading to a net cash position of $700,000 after reducing costs by $800,000 compared to the previous corresponding period.

A new resource at the Barra do Pacu licence of Meteoric Resources’ (ASX:MEI) Caldeira rare earth ionic clay project in Brazil has boosted the total resource by almost 400Mt to 1.5Bt at 2,359 ppm rare earths. China’s recent imposition of new export controls on rare earths have thrown a spotlight on ex-China sources of the critical minerals.

Dalaroo Metals (ASX:DAL) is preparing for a busy field season at its Blue Lagoon project in Greenland, where the company intends to explore for zirconium, niobium and rare earths.

Melbana Energy (ASX:MAY) has transitioned to full-time production at the Block 9 PSC onshore Cuba oil asset. The company increased production at Unit 1B from 293 barrels of oil per day to 488 BOPD, a 66% increase.

Boosting its share price 33%, Southern Hemisphere Mining (ASX:SUH) has established a “clear correlation” between the 1km by 2km Curiosity copper target and a large magneto-tulleric resistivity anomaly that implies potential for a large porphyry copper-gold deposit.

Finally, Bryah Resources (ASX:BYH) has kicked off a strategic review of its gold assets in WA, citing high gold prices as the core incentive for beginning gold-focused exploration and drilling. Investors rewarded the move with a 25% uptick to BYH’s share price.

ASX SMALL CAP LAGGARDS

Today’s worse performing small cap stocks:

| Name | Price | % Change | Volume | Market Cap | |

|---|---|---|---|---|---|

| 88E | 88 Energy Ltd | 0.001 | -33% | 4772929 | $43,400,718 |

| KAL | Kalgoorliegoldmining | 0.057 | -27% | 33601494 | $29,628,170 |

| EEL | Enrg Elements Ltd | 0.0015 | -25% | 852499 | $6,507,557 |

| MRQ | Mrg Metals Limited | 0.003 | -25% | 5414798 | $10,906,075 |

| SFG | Seafarms Group Ltd | 0.0015 | -25% | 570000 | $9,673,198 |

| BGL | Bellevue Gold Ltd | 0.9 | -21% | 44958597 | $1,469,907,308 |

| ICL | Iceni Gold | 0.056 | -20% | 2022394 | $21,551,984 |

| CCO | The Calmer Co Int | 0.004 | -20% | 11723077 | $12,769,356 |

| ERL | Empire Resources | 0.004 | -20% | 953799 | $7,419,566 |

| RDG | Res Dev Group Ltd | 0.008 | -20% | 834754 | $29,508,581 |

| VRC | Volt Resources Ltd | 0.004 | -20% | 2968848 | $23,423,890 |

| DTZ | Dotz Nano Ltd | 0.061 | -20% | 941537 | $43,040,870 |

| CYB | Aucyber Limited | 0.076 | -19% | 843133 | $15,374,956 |

| BNL | Blue Star Helium Ltd | 0.0065 | -19% | 1302023 | $21,559,082 |

| LGM | Legacy Minerals | 0.25 | -18% | 1200965 | $38,098,564 |

| IMI | Infinitymining | 0.014 | -18% | 480756 | $7,191,268 |

| E79 | E79Goldmineslimited | 0.034 | -17% | 5261597 | $6,494,918 |

| ICG | Inca Minerals Ltd | 0.005 | -17% | 8453129 | $7,658,340 |

| LU7 | Lithium Universe Ltd | 0.005 | -17% | 676660 | $4,715,878 |

| MRD | Mount Ridley Mines | 0.0025 | -17% | 100000 | $2,335,467 |

| SER | Strategic Energy | 0.005 | -17% | 14997 | $4,026,200 |

| SCN | Scorpion Minerals | 0.017 | -15% | 1099102 | $10,234,124 |

| CP8 | Canphosphateltd | 0.029 | -15% | 103319 | $10,429,858 |

| CC9 | Chariot Corporation | 0.07 | -15% | 258235 | $9,787,009 |

IN CASE YOU MISSED IT

In a bid to focus on the Rae copper project in Canada, White Cliff Minerals (ASX:WCN) has offloaded its Reedy South gold project in Australia to Bain Global Resources Pty Ltd for $1.2 million in cash. The sale will allow WCN to devote all of its attention to the Rae project, where drilling is well underway.

A $15.2m strategic investment from First Quantum Minerals has lifted Prospect Resources’ (ASX:PSC) shares 30%. The new funds will support development of the Mumbezhi copper project, with phase 2 drilling set to begin Q2 2025.

PSC has also entered into a placement agreement with long-term shareholder Eagle Eye to raise an additional $2.8m for a total of $18.5m. You can read more about that here.

New export restrictions on a range of rare earths have thrown St George Mining’s (ASX:SGQ) Araxá project in Brazil into the spotlight, as a potential strategic source of critical minerals including permanent rare earth magnet metals. The project holds a resource of 40.6Mt at 4.13% total rare earth oxides.

“China’s increased restrictions on the export of rare earths and permanent magnets have significantly disrupted the global supply chains for these commodities which are critical to a wide range of sectors including defence, electric vehicles, energy, smartphones, robotics and medical equipment,” SGQ executive chair John Prineas said.

“The need for a sustainable rare earths industry outside China has never been stronger.”

While we’re on that topic, similar restrictions from Beijing on scandium have prompted Australian Mines (ASX:AUZ) to carry out further studies on the Flemington project in NSW, host to a resource of 28Mt at 2217 parts per million scandium.

“The high-grade, near-surface nature of the Flemington resource gives us a solid foundation to build from and the upcoming work to update the scoping study will further strengthen our understanding of the project’s potential,” AUZ CEO Andrew Nesbitt said.

Trading Halts

- Freehill Mining (ASX:FHS) – lease for new premises and cap raise

- Equity Story Group (ASX:EQS) - proposed material acquisition

- Tesoro Gold (ASX:TSO) – capital raise

- Asra Minerals (ASX:ASR) – cap raise

- Burley Minerals (ASX:BUR) – cap raise

- QMines (ASX:QML) – acquisition

- PRL Global Ltd (ASX: PRG) – significant acquisition

At Stockhead, we tell it like it is. While Meteoric Resources, White Cliff Minerals, St George Mining, Prospect Resources and Australian Mines are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: ASX gains kept alive by health stocks and ETFs