Closing Bell: ASX flexes 1.38pc gain as Big 4 banks and jobs data deliver

The ASX ripped higher on Thursday on banks and jobs boost. Meanwhile Zip and Tabcorp rocketed and oil spiked on supply fears.

ASX jumps on strong banks and jobs report

Zip and Tabcorp surge as markets rally

Oil prices soar amid supply risks and cold weather

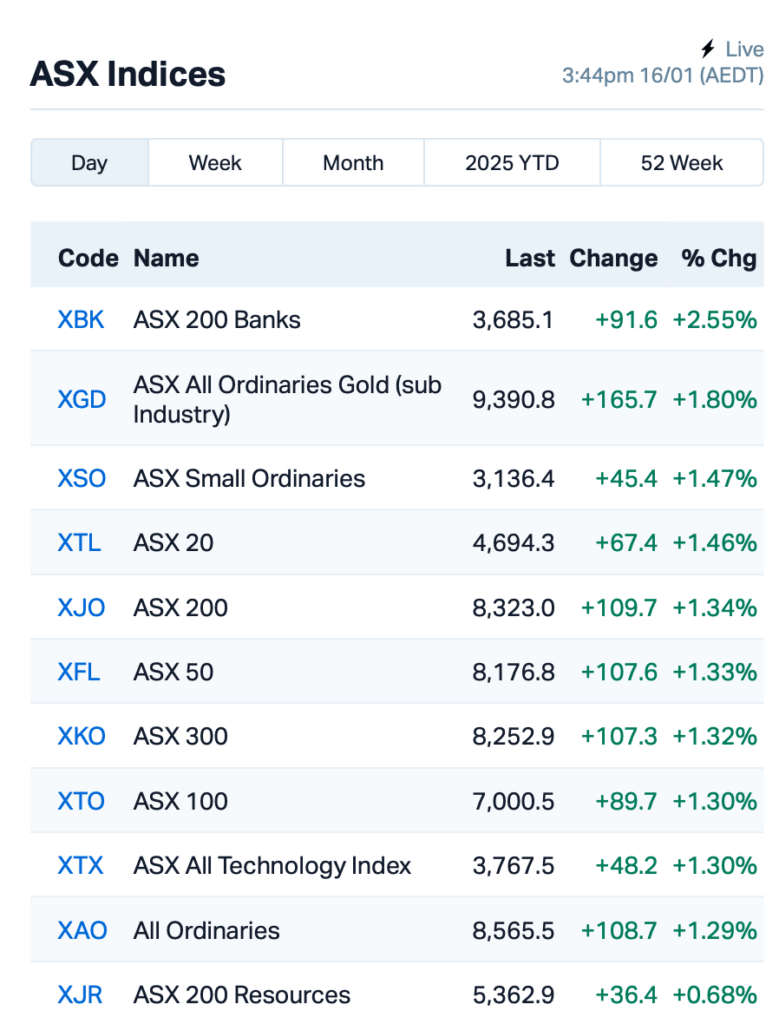

The ASX flexed its muscles today, up 1.38% on the back of strong bank gains and a bit of global risk-on action.

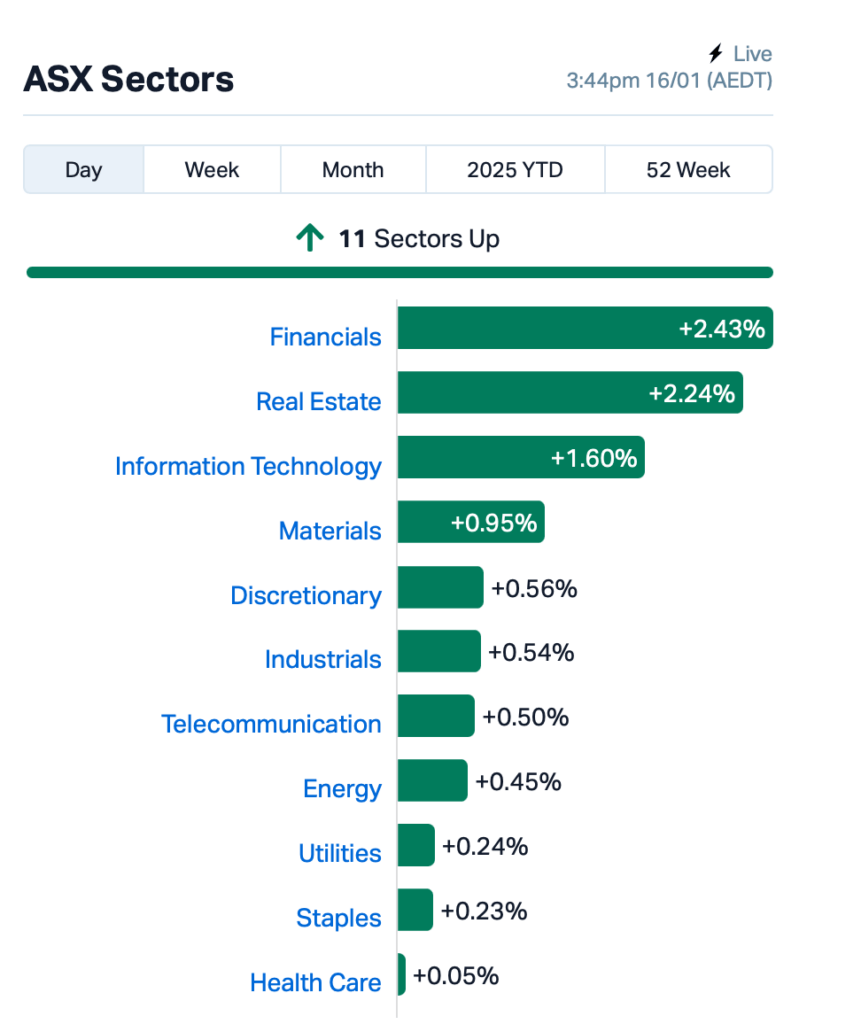

The S&P/ASX 200 shot up out of the gates from the opening bell, with all 11 sectors rallying.

Banking stocks led the charge, with the 'Big 4' jumping 2% or more each, following their US counterparts’ gains overnight. Commonwealth Bank (ASX:CBA) led the way with a 2.5% spike.

The lift in confidence also came from a mostly positive Australian jobs report today, which revealed a surprising 56,300 new jobs in December.

According to the ABS, Australia’s job market is strong, with more people employed than ever before, though the unemployment rate has edged up to 4%.

“While the data points to ongoing labour market resilience, it does not appear sufficient to significantly alter the RBA’s broader trajectory to cut interest rates next month,” said Global X’s Billy Leung.

Back to the ASX, this is where things stood approaching today's close:

In the large caps space, Zip Co (ASX:ZIP)was one of the day’s standouts, surging 7% after its US competitor Sezzle upgraded its revenue forecast.

Tabcorp Holdings (ASX:TAH) was also on the move, rising 6% after announcing the appointment of Michael Fitzsimons as its first chief wagering officer.

Meanwhile, the oil market's been on fire, with Brent crude climbing by around 7% over the past week and 10% since the start of the year.

The surge has been driven by worries over global supply risks, especially after new US sanctions on Russia's energy sector and colder winter in the States.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Security Description Last % Volume MktCap NRZ Neurizer Ltd 0.002 100% 2,829,297 $2,964,871 TMX Terrain Minerals 0.005 67% 38,811,799 $5,432,086 CND Condor Energy Ltd 0.028 47% 49,944,117 $11,140,340 HLX Helix Resources 0.004 33% 194,287 $10,092,581 MSG Mcs Services Limited 0.004 33% 1,612,824 $594,299 SCP Scalare Partners 0.200 29% 5,000 $5,406,834 SPN Sparc Tech Ltd 0.265 26% 590,216 $20,133,319 AHN Athena Resources 0.005 25% 100,000 $8,012,806 GES Genesis Resources 0.005 25% 100,000 $3,131,365 IS3 I Synergy Group Ltd 0.005 25% 38,179 $1,424,871 LNR Lanthanein Resources 0.003 25% 1,032,160 $4,887,272 MEL Metgasco Ltd 0.005 25% 101,538 $5,830,347 VEN Vintage Energy 0.005 25% 440,000 $6,678,125 KLI Killiresources 0.074 23% 1,171,139 $8,413,425 GRL Godolphin Resources 0.016 23% 1,708,606 $4,668,282 VMC Venus Metals Cor Ltd 0.075 23% 230,158 $11,963,850 AS1 Asara Resources Ltd 0.022 22% 2,309,792 $17,939,886 AU1 The Agency Group Aus 0.022 22% 450,018 $7,912,379 PSL Paterson Resources 0.011 22% 1,286,486 $4,104,341 SMX Strata Minerals 0.033 22% 377,456 $5,152,010

Terrain Minerals (ASX:TMX) has kicked off a reverse circulation (RC) drilling campaign at its 100% owned Lort River Project in WA. The drilling targets high-priority sulphide conductors, which could signal valuable nickel-copper deposits similar to IGO’s Nova-Bollinger operations. This follows a successful EM survey that identified the sweet spots for drilling. The targets are in a prime location, on the western edge of the same mineral belt that houses Nova-Bollinger.

Sparc Technologies (ASX:SPN) has just bagged its first patent for its photocatalytic water splitting (PWS) reactor tech, giving it IP protection in Morocco. This tech could make green hydrogen production way more efficient and cost-effective by using the full solar spectrum, boosting reaction rates. The company said Morocco is the first of 18 jurisdictions to approve the patent, with more to follow in 2025.

Condor Energy (ASX:CND) has just dropped some exciting news – its Piedra Redonda gas field off the coast of Peru now holds a best estimate of 1 trillion cubic feet (Tcf) of gas, a massive jump from previous figures. This marks a 147% increase in resources, with even more potential in the pipeline as it plans future drilling. The field is now one of the biggest undeveloped offshore gas discoveries on South America’s west coast.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Code Name Price % Change Volume Market Cap ADD Adavale Resource Ltd 0.002 -33% 300,000 $4,622,496 CDT Castle Minerals 0.002 -33% 3,359,203 $5,690,442 EDE Eden Inv Ltd 0.001 -33% 1,963 $6,164,814 VML Vital Metals Limited 0.002 -33% 279,954 $17,685,201 BTC BTC Health Ltd 0.051 -31% 54,883 $23,985,125 CTO Citigold Corp Ltd 0.003 -25% 155,649 $12,000,000 LNU Linius Tech Limited 0.002 -25% 22,800 $12,302,431 RLL Rapid Lithium Ltd 0.004 -20% 110,799 $3,660,554 TM1 Terra Metals Limited 0.030 -19% 876,292 $14,697,174 SNX Sierra Nevada Gold 0.035 -19% 1,798,444 $7,022,623 ALR Altairminerals 0.003 -17% 97,222 $12,890,233 AVE Avecho Biotech Ltd 0.003 -17% 4,864,867 $9,507,891 CRR Critical Resources 0.005 -17% 1,654,800 $14,591,779 ERA Energy Resources 0.003 -17% 312,923 $1,216,188,722 PAB Patrys Limited 0.003 -17% 31,250 $6,172,342 SVY Stavely Minerals Ltd 0.021 -16% 2,233,207 $13,601,052 WGR Westerngoldresources 0.058 -16% 1,228,545 $11,754,499 YRL Yandal Resources 0.140 -15% 189,353 $51,023,772 BGT Bio-Gene Technology 0.035 -15% 557,625 $8,255,824 AJL AJ Lucas Group 0.006 -14% 3,781 $9,630,107 SKK Stakk Limited 0.006 -14% 223,404 $14,525,558 VFX Visionflex Group Ltd 0.003 -14% 1,930,368 $11,787,512

IN CASE YOU MISSED IT

Asra Minerals (ASX:ASR) has officially banked a $3 million deal today after selling its Tarmoola Pastoral Lease to Vault Minerals (ASX:VAU) – a transaction first signalled to the market in September of last year. ASR will retain access to the site’s exploration camp and access road while it will use the funds to accelerate regional consolidation and exploration programs across its Leonora gold projects.

“With the Leonora gold projects as our priority, we are well-positioned to accelerate exploration and growth initiatives that target high-grade, belt-scale discoveries,” ASR CEO Paul Stephen informed the market today.

US explorer Sierra Nevada Gold (ASX:SNX) has shared with the market today a major silver intercept from its Blackhawk project. Drilling at the historic Endowment mine uncovered an impressive standout intercept of 4.88m at 481g/t silver, 0.61g/t gold, 0.6% copper and 0.4% antimony from 87.78m.

Endowment previously produced 70,000oz of gold during the late 1800s before ceasing operations. After this now completed 11-hole drilling program at Endowment, Sierra Nevada will continue to assess the prospect’s geology while surveying Blackhawk’s larger high-grade epithermal vein system.

Graphite player Kingsland Minerals (ASX:KNG) has its sights firmly set on a scoping study at its Leliyn project in the Northern Territory. Infill drilling – in pursuit of an indicated mineral resource – brought to the market today successful intercepts such as 120m at 9.2% TGC from surface and 72m at 9.2% TGC from surface.

This drilling focused on a 600m strike from the existing 194.6Mt at 7.3% TGC inferred mineral resource. Once an indicated resource has been delineated, KNG is confident in switching gears to whip up a scoping study on the project’s amenability to produce flake graphite concentrate.

Indiana Resources (ASX:IDA) has confirmed a new high-grade gold zone following a reverse circulation drilling program at the Minos Gold zone, located at the company’s Gawler Craton project in South Australia. Standout hits from the newly developed Southwest Zone include 10m at 4.95g/t gold from 112m and 15m at 4.14 g/t from 82m. Indiana say the positive results means follow up drilling is now a high priority for its exploration program this year in pursuit of a maiden resource.

Resource confidence at Magnetic Resources’ (ASX:MAU) flagship Lady Julie gold project is on the up after a recent round of infill drilling at prospect North 4. MAU say the drilling has “significantly increased” resource confidence and continuity of mineralisation whilst also expanding gold inventory. The updated combined mineral resource estimate at the project now stands at 28.11Mt at 1.93g/t gold for 1.785Moz of gold at 0.5-1.5g/t cutoffs.

The project, situated near Laverton in Western Australia, is planned for three open pits, a CIL processing plant and additional associated infrastructure. An impressive 75% of its combined resource now sits in the indicated category.

Biopharmaceutical company Dimerix (ASX:DXB) has recruited its first paediatric patient for its ACTION3 phase III clinical trial in the United Kingdom. The UK site is part of a larger coordinated effort in a cohort of 19 specialist paediatric sites in Argentina, Mexico and the US with patients aged 12-17 years old taking part in the trial. The company’s lead drug candidate, DMX-200 is designed to treat focal segmental glomerulosclerosis.

Through a “minimal infill drilling program”, Victory Metals (ASX:VTM) has secured a major update for the resource estimate at its North Stanmore heavy rare earths project in Western Australia. More than 70% of the resource now sits in the indicated category, totalling 176.5Mt at 503ppm TREO with the whole indicated and inferred resource sitting at 247.5Mt at 520ppm TREO.

New magnetic data has Canadian explorer Riversgold (ASX:RGL) licking its lips at its Saint John copper, gold, silver and antimony project in New Brunswick. The company says high-resolution data from a recent drone survey has bolstered multiple targets now defined as a low magnetic response area. Riversgold is now assembling on-ground fieldworks in a jurisdiction it deems as excellent.

Bulk sampling for Mt Malcolm Mines (ASX:M2M) is continuing swimmingly at its Golden Crown prospect, to date yielding 122.4 ounces of gold. Managing director Trevor Dixon says this performance highlights the potential for an economic gold mining operation.

“ continuing to reinforce the company’s strategy for revenue generation and future full scale mining projects across the extended Malcolm project,” he said.

Chilean explorer Tesoro Gold (ASX:TSO) is confident more growth is on the cards at its El Zorro project after spotting up to 12.63g/t gold outside of the project’s current resource. EL Zorro’s Ternera deposit already flexes a 1.3Moz gold at US$1800/oz pit shell which is well below current spot price levels of close to US$2700/oz.

At Stockhead, we tell it like it is. While Asra Minerals, Sierra Nevada Gold, Kingsland Minerals, Indiana Resources, Magnetic Resources, Dimerix, Victory Metals, Riversgold, Mt Malcolm and Tesoro Gold are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: ASX flexes 1.38pc gain as Big 4 banks and jobs data deliver