Closing Bell: ASX ends week in decent nick; Trump-Putin talks lift spirits

The ASX ended Valentine’s Day in okay spirits after reaching a record high in morning trade. Staples and tech stocks, in particular, felt the love.

ASX closes in green after reaching new record high in morning trade

Staples and tech stocks felt the love on Valentine's Day

Energy stocks and healthcare, however, got cold feet. Or the cold shoulder. Maybe both

The ASX leapt out of bed in a good mood on Valentine's Day. And while that vim and vigour didn't quite last an entire trading day, the benchmark did at least close out Friday in the green, up 0.19%.

Earlier, the S&P/ASX 200 index hit a fresh record high at 8598.70 points at 10.15am AEDT, up 0.7% before some profit taking appeared to be coming through and dropping back.

The Aussie bourse followed the lead of Wall Street overnight, where the S&P 500 and Dow Jones indexes closed 1% and 0.8% higher, respectively, while the technology-focused Nasdaq gained 1.5%. The heavyweight tech stocks fuelled the US rally.

US futures are pointing to love being in the air for Valentine's Day trade. More key economic data is forecast to come through tonight for the world's largest economy for January including US retail sales, US import and export price indexes , US industrial production and US business inventories.

Meanwhile, across Asia today, stock markets were mostly mixed. At At 2.45pm (AEDT) Japan’s Nikkei was up down 0.44%, Hong Kong’s Hang Seng index rose 1.65%, while Korea’s Kospi gained 0.36%.

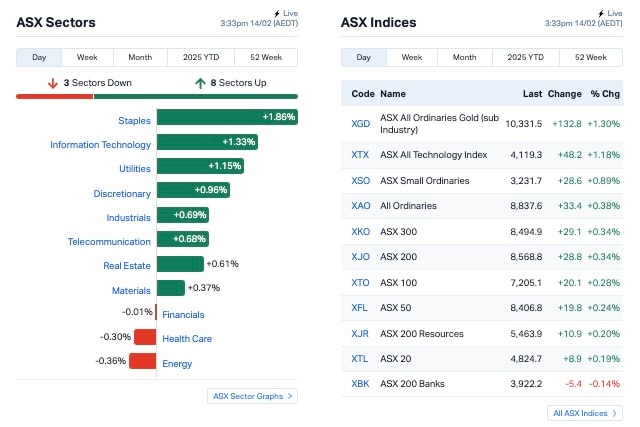

Meanwhile, just three of the 11 indices finished down today, with financials slipping into red in afternoon trade. Staples and tech led the winners, while energy and healthcare led the laggards with hearing-tech giant Cochlear (ASX:COH) pulling down the sector at large, falling more than 13% on its H1 FY25 results.

Cochlear reported its implant revenue had grown 13% but that services growth had declined 12%.

This is how the ASX looked nearing closing time.

Trump-Putin talks help sentiment

Per DeVere Group CEO and founder Nigel Green:

Global markets have roared higher following President Donald Trump’s declaration that Washington and Moscow will enter negotiations to end the war in Ukraine.

The US dollar, long the safe-haven of choice during geopolitical upheaval, has slipped, while Asian equities and European stock futures have climbed.

The message from investors? The potential for peace is too big to ignore.

Read more > here.

And… per David Rogers at The Australian:

Uncertainty over US trade policy remained high this week as US President Donald Trump announced steel and aluminium tariffs, as well as so-called reciprocal tariffs on its trading partners.

At the same time, the US President started talks with Russian President Vladimir Putin to end the Russia-Ukraine war, pushing European stocks to record highs as European gas prices dived.

As was the case last week, when 25 per cent tariffs on Canada and Mexico were delayed a month, investors were relieved the new tariffs didn’t start “immediately”, as Trump had said.

The White House has indicated the steel and aluminium tariffs will start on March 12 and reciprocal tariffs will start after a comprehensive review of US trade policy is completed on April 1.

Read more at The Australian > here

ASX small cap leaders

Today’s best performing small cap stocks:

| Code | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| SCN | Scorpion Minerals | 0.027 | 80% | 5,027,420 | $6,141,843 |

| FRS | Forrestaniaresources | 0.025 | 67% | 9,014,041 | $3,659,452 |

| M2R | Miramar | 0.005 | 67% | 6,001,197 | $1,190,470 |

| H2G | Greenhy2 Limited | 0.003 | 50% | 813,724 | $1,196,368 |

| MRD | Mount Ridley Mines | 0.003 | 50% | 200,835 | $1,556,978 |

| PAB | Patrys Limited | 0.003 | 50% | 100,000 | $4,114,895 |

| 88E | 88 Energy Ltd | 0.002 | 33% | 3,020,985 | $43,400,718 |

| AOA | Ausmon Resorces | 0.002 | 33% | 1,894,235 | $1,634,591 |

| BP8 | Bph Global Ltd | 0.004 | 33% | 10,281,614 | $1,449,924 |

| MEL | Metgasco Ltd | 0.004 | 33% | 2,788,663 | $4,372,760 |

| MMR | Mec Resources | 0.004 | 33% | 276,987 | $5,549,298 |

| OB1 | Orbminco Limited | 0.002 | 33% | 510,000 | $3,249,885 |

| TX3 | Trinex Minerals Ltd | 0.002 | 33% | 282,361 | $2,817,978 |

| MRZ | Mont Royal Resources | 0.041 | 28% | 37,032 | $2,720,953 |

| LSA | Lachlan Star Ltd | 0.075 | 25% | 6,760 | $15,154,392 |

| PRX | Prodigy Gold NL | 0.0025 | 25% | 852,961 | $6,350,111 |

| RLG | Roolife Group Ltd | 0.005 | 25% | 350,000 | $5,684,125 |

| XGL | Xamble Group Limited | 0.02 | 25% | 1,000 | $5,424,228 |

| TEE | Topendenergylimited | 0.115 | 22% | 2,799,620 | $25,547,438 |

| CLA | Celsius Resource Ltd | 0.011 | 22% | 3,611,101 | $24,023,146 |

| MKR | Manuka Resources. | 0.028 | 22% | 838,729 | $18,647,656 |

| AU1 | The Agency Group Aus | 0.023 | 21% | 208,746 | $8,351,955 |

| MM1 | Midasmineralsltd | 0.15 | 20% | 397,133 | $15,516,210 |

| AKN | Auking Mining Ltd | 0.006 | 20% | 6,388,983 | $2,873,894 |

| ALM | Alma Metals Ltd | 0.006 | 20% | 85,841 | $7,931,727 |

ASX small cap losers

Today’s worst performing small cap stocks:

| Name | Price | % Change | Volume | Market Cap | |

|---|---|---|---|---|---|

| AVWDB | Avira Resources Ltd | 0.009 | -55% | 150,000 | $2,938,790 |

| CR9 | Corellares | 0.002 | -33% | 60,455 | $1,403,230 |

| PFT | Pure Foods Tas Ltd | 0.015 | -29% | 1,123 | $2,843,938 |

| SKK | Stakk Limited | 0.005 | -29% | 2,332,169 | $14,525,558 |

| PKO | Peako Limited | 0.003 | -25% | 203,176 | $5,950,968 |

| BPM | BPM Minerals | 0.055 | -24% | 2,861,094 | $6,218,799 |

| RLL | Rapid Lithium Ltd | 0.004 | -20% | 2,166,584 | $5,162,223 |

| VEN | Vintage Energy | 0.004 | -20% | 51,111 | $8,347,656 |

| ZMM | Zimi Ltd | 0.008 | -20% | 109,160 | $3,869,441 |

| MML | Mclaren Minerals | 0.03 | -19% | 177,157 | $5,236,148 |

| ATS | Australis Oil & Gas | 0.009 | -18% | 160,000 | $14,305,573 |

| IPB | IPB Petroleum Ltd | 0.005 | -17% | 69,100 | $4,238,418 |

| LNR | Lanthanein Resources | 0.0025 | -17% | 2,252,476 | $7,330,908 |

| ROG | Red Sky Energy. | 0.005 | -17% | 3,485,227 | $32,533,363 |

| AMP | AMP Limited | 1.4825 | -15% | 33,085,147 | $4,430,544,718 |

| CWX | Carawine Resources | 0.09 | -14% | 79,970 | $24,793,172 |

| DTM | Dart Mining NL | 0.006 | -14% | 325,015 | $4,186,389 |

| IXR | Ionic Rare Earths | 0.006 | -14% | 3,783,046 | $36,668,998 |

| MGU | Magnum Mining & Exp | 0.006 | -14% | 3,463,845 | $5,665,530 |

| OSL | Oncosil Medical | 0.006 | -14% | 930,604 | $32,246,061 |

| PRO | Prophecy Internation | 0.455 | -13% | 142,978 | $38,697,190 |

| COH | Cochlear Limited | 264.57 | -13% | 519,913 | $19,926,030,882 |

| PHL | Propell Holdings Ltd | 0.02 | -13% | 20,000 | $6,401,777 |

| RON | Roninresourcesltd | 0.17 | -13% | 10,000 | $7,873,127 |

| CVL | Civmec Limited | 1.065 | -13% | 1,216,908 | $620,404,160 |

In case you missed it

Everest Metals Corporation (ASX:EMC) has produced 1.4t gold concentrate during the commissioning phase of the bulk sampling program at its Revere project in WA’s Murchison region. The concentrate contained visible gold grains, and its production is timely given the record-high gold price environment.

Suvo Strategic Minerals (ASX:SUV) has extended its hydrous kaolin offtake agreement with China’s Chaozhou Chengcheng Industrial for an additional five years. The extension includes a 24% increase in sales volumes, with a minimum order of 8750 tonnes over the period. Valued at approximately $6.56 million, the agreement follows SUV’s recent sales contract extension with Norske Skog in January.

Scorpion Minerals (ASX: SCN) has struck a deal to acquire a majority interest in the Jungar Flats gold project in WA’s Murchison region after finalising a binding agreement with E79 Gold Mines. The company can earn up to a 70% stake in the project by investing $3 million over five years. Scorpion also announced a $1.5 million capital raise at a 33% premium to the last traded price to drive exploration across its portfolio.

At Stockhead, we tell it like it is. While Everest Metals Corp, Suvo Strategic Minerals, Scorpion Minerals and Axel REE are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: ASX ends week in decent nick; Trump-Putin talks lift spirits