Closing Bell: ASX dragged down by iron ore miners despite China’s market push

ASX drops with iron ore miners hit by weaker commodities, tech stocks soar, Myer merger gets the green light.

ASX falls as iron ore miners hit

Fortescue reports bumper shipments

Myer merger approved, while China gets a lift from officials

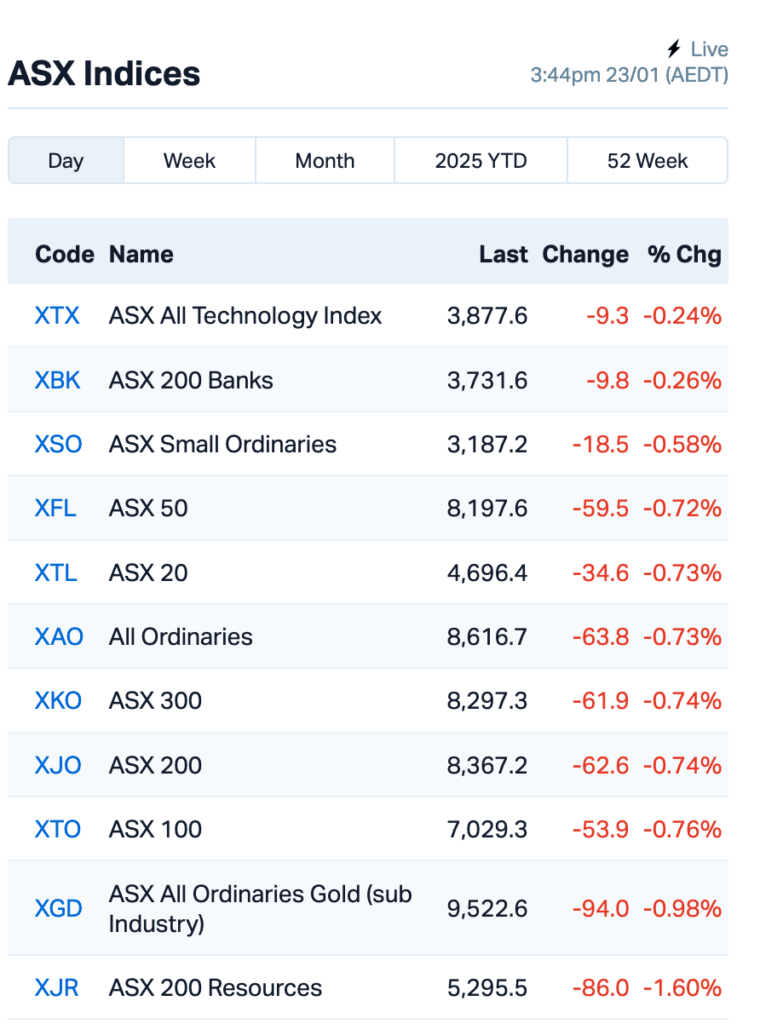

The ASX was down in the dumps on Thursday, with the benchmark S&P/ASX 200 falling by 0.7%.

The index was dragged lower by weaker commodity prices, which weighed on miners, particularly iron ore mining stocks.

Both BHP (ASX:BHP) and Rio Tinto (ASX:RIO) were down almost 2%.

Fortescue Metals Group (ASX:FMG) also fell by over 2% despite hitting record iron ore shipments for FY25’s first half, moving 97.1 million tonnes. Weaker cash flow was blamed on rising working capital, though analysts expect earnings upgrades in H2 with the Aussie dollar tailwind.

Trump’s tariff threats have been hitting iron ore miners hard, with a 10% tariff on China and more duties on the EU possibly coming.

Meanwhile, there was a bit of positive action in the retail space.

Myer (ASX:MYR)’s proposed merger with Solomon Lew’s Premier Investments (ASX:PMV)’s fashion brands got a green light from shareholders, sending Myer’s shares up 5%. Premier, however, dropped 0.7%.

Across the region, Asian markets were seeing a bit of a lift, with China’s CSI 300 Index jumping 2% after Chinese officials pushed local insurers to increase their stock market investments.

But some experts reckon this is just a sugar hit until China sorts its bigger economic mess.

“This is like stacking the firewood to build a campfire,” said Tai Hui at JPMorgan. “We are setting up for a more constructive environment, but you need a spark.”

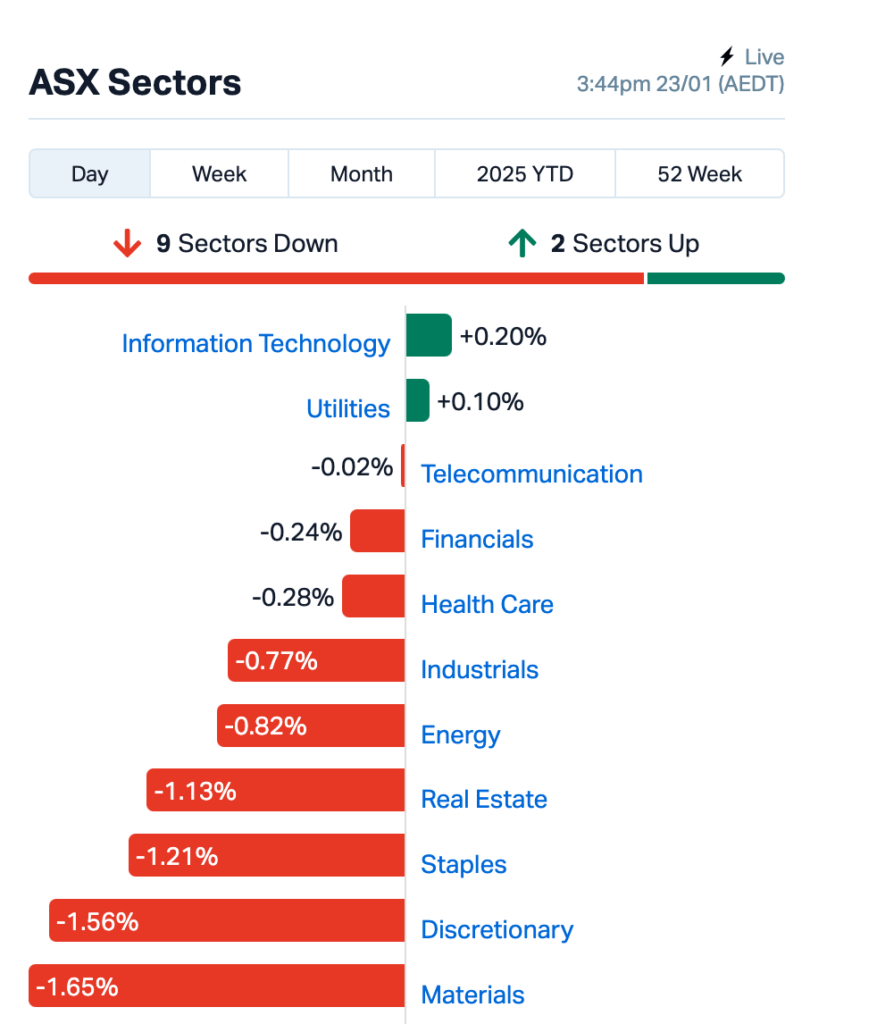

Nine out of 11 ASX sectors were in the red leading up to the close of day:

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Security Description Last % Volume MktCap AQD Ausquest Limited 0.023 188% 131,273,494 $9,039,478 HYD Hydrix Limited 0.027 170% 51,853,639 $2,727,688 BP8 Bph Global Ltd 0.003 50% 355,428 $946,616 IFG Infocusgroup Hldltd 0.023 44% 29,114,949 $2,627,389 NIM Nimy Resources 0.150 36% 3,611,567 $20,484,064 NTM Nt Minerals Limited 0.004 33% 3,394,371 $3,632,709 PKO Peako Limited 0.004 33% 8,439,461 $3,285,425 AX8 Accelerate Resources 0.012 33% 6,184,089 $5,595,785 LML Lincoln Minerals 0.006 33% 6,865,414 $9,253,168 CDX Cardiex Limited 0.130 31% 415,246 $40,117,823 AIV Activex Limited 0.009 29% 27,787 $1,508,518 G88 Golden Mile Res Ltd 0.009 29% 7,950,915 $3,309,760 ICE Icetana Limited 0.019 27% 6,246,011 $3,969,427 1TT Thrive Tribe Tech 0.003 25% 718,934 $4,063,446 ERA Energy Resources 0.003 25% 1,432,741 $810,792,482 FGH Foresta Group 0.011 22% 7,619,150 $23,662,069 ADG Adelong Gold Limited 0.006 20% 4,150,033 $5,589,945 FRX Flexiroam Limited 0.006 20% 102,006 $3,928,219 A1G African Gold Ltd. 0.069 19% 1,006,870 $22,138,427 RDG Res Dev Group Ltd 0.019 19% 239,462 $47,213,730

AusQuest (ASX:AQD) shares surged close to 200% after announcing a major copper-gold discovery at its Cangallo project in Peru. The first drill results show broad zones of copper and gold, with thick porphyry intercepts including 348 metres at 0.26% copper and 0.06ppm gold. The mineralisation starts near surface and is open in all directions, suggesting the potential for a shallow copper oxide resource.

Hydrix (ASX:HYD), a provider of engineering solutions for the medical and tech sectors, has announced a $2.8m contract extension with European medical device company Paul Hartmann AG. Total revenue from the project will now be around $6.5m, following on from previous stages. Shares almost tripled on the news.

BPH Global (ASX:BP8) has wrapped up its Indonesian seaweed joint venture. The company has acquired assets from local partners in Indonesia and is now focused on expanding into Asian markets with raw seaweed sales and developing bio-stimulant products for India.

InFocus Group Holdings (ASX:IFG) has received $500k in cash from its digital gaming project, VigoBet, as it nears the end of the first phase. The full phase is expected to bring in $1.2 million, with the remaining balance due once completed this quarter. Positive feedback from GBO Assets suggests the project will move into the second phase soon.

NT Minerals (ASX:NTM) has just dropped some exciting news from its Twin Peaks project in WA. During a recent field trip, the team found high-grade copper rock chips, with one sample showing a massive 25.6% copper from the Ringing Bell Lode. The company also spotted copper levels as high as 24.6% along a 330m stretch of the Main Shaft trend. On top of that, the samples showed elevated levels of other metals like silver, cobalt, and tungsten, all pointing to potential for a discovery.

And, Peregrine Gold (ASX:PGD) jumped after selling off its West Australian gold project to Capricorn Metals (ASX:CMM) in an equity-and-cash deal. Upfront consideration totalled $1.5 million in Capricorn’s shares.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Code Name Price % Change Volume Market Cap VML Vital Metals Limited 0.002 -33% 509,221 $17,685,201 CTO Citigold Corp Ltd 0.003 -25% 3,287,984 $12,000,000 HLX Helix Resources 0.003 -25% 3,150,000 $13,456,775 LNU Linius Tech Limited 0.002 -25% 645,024 $12,302,431 OB1 Orbminco Limited 0.002 -25% 1 $4,333,180 TX3 Trinex Minerals Ltd 0.002 -25% 2,315,189 $3,757,305 PRS Prospech Limited 0.021 -22% 148,549 $8,878,299 BNL Blue Star Helium Ltd 0.004 -20% 782,802 $13,474,426 EVR Ev Resources Ltd 0.002 -20% 48,000 $4,531,258 GMN Gold Mountain Ltd 0.002 -20% 184,026 $11,448,058 MOM Moab Minerals Ltd 0.002 -20% 5,750,499 $3,917,498 OCT Octava Minerals 0.105 -19% 1,409,952 $7,931,210 ADD Adavale Resource Ltd 0.003 -17% 242,689 $4,622,496 AOK Australian Oil. 0.003 -17% 532,000 $3,005,349 NHE Nobleheliumlimited 0.040 -17% 4,289,283 $27,689,692 CPO Culpeominerals 0.017 -15% 308,724 $4,399,244 E25 Element 25 Ltd 0.290 -15% 1,183,629 $74,770,216 BUY Bounty Oil & Gas NL 0.003 -14% 103,258 $5,244,753 SKK Stakk Limited 0.006 -14% 2,320,423 $14,525,558 PL3 Patagonia Lithium 0.085 -13% 816,927 $6,409,274 EQR Eq Resources Limited 0.033 -13% 13,558,990 $88,731,233 AUQ Alara Resources Ltd 0.034 -13% 875,193 $28,005,414

IN CASE YOU MISSED IT

Firetail Resources (ASX:FTL) has offloaded rights at one of its non-core assets to Spartan Resources (ASX:SPR) so it can inject more cash into exploring the Skyline copper project in Canada.

Firetail will receive $275,000 from Spartan for the lithium rights at its Yalgoo, Egerton and Dalgaranga projects in Western Australia. The Canadian-focused explorer is also open to leveraging its ownership at the Paterson copper-gold-uranium project and Mt Slopeway nickel-cobalt project to further bolster its position at Skyline.

At Stockhead, we tell it like it is. While Firetail Resources and Spartan Resources are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: ASX dragged down by iron ore miners despite China’s market push