Closing Bell: All 11 sectors sell off, but Mesoblast jumps 52pc on FDA nod

The ASX hit a six-week low on a red Thursday, after the US Federal Reserve struck a more hawkish interest rates-related tone than expected.

ASX hits six-week low as Fed signals slower rate cuts

Mesoblast jumps 52pc on FDA approval

Aussie dollar tumbles on Fed comments

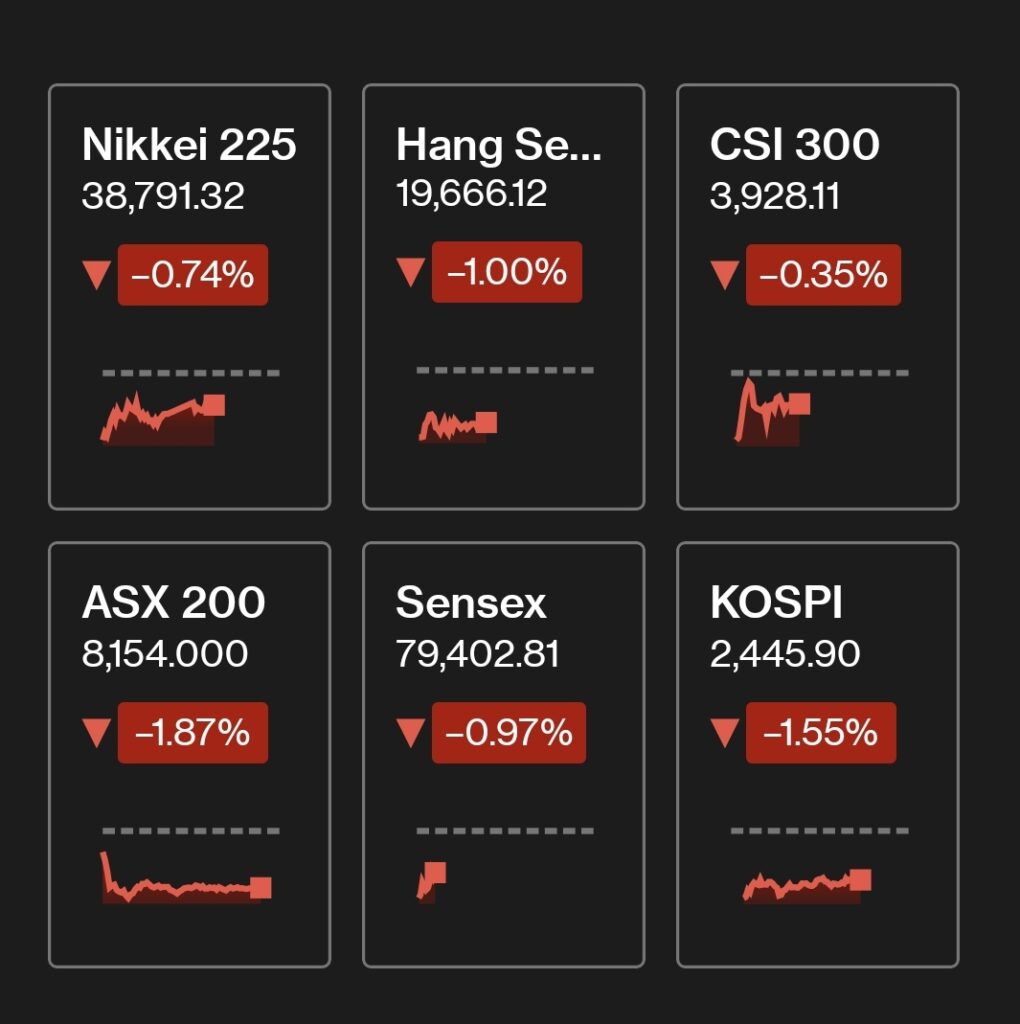

The ASX took a heavy hit on Thursday, down by 1.7% after the US Federal Reserve’s cautious outlook on future rate cuts triggered a broad sell-off across Asian markets.

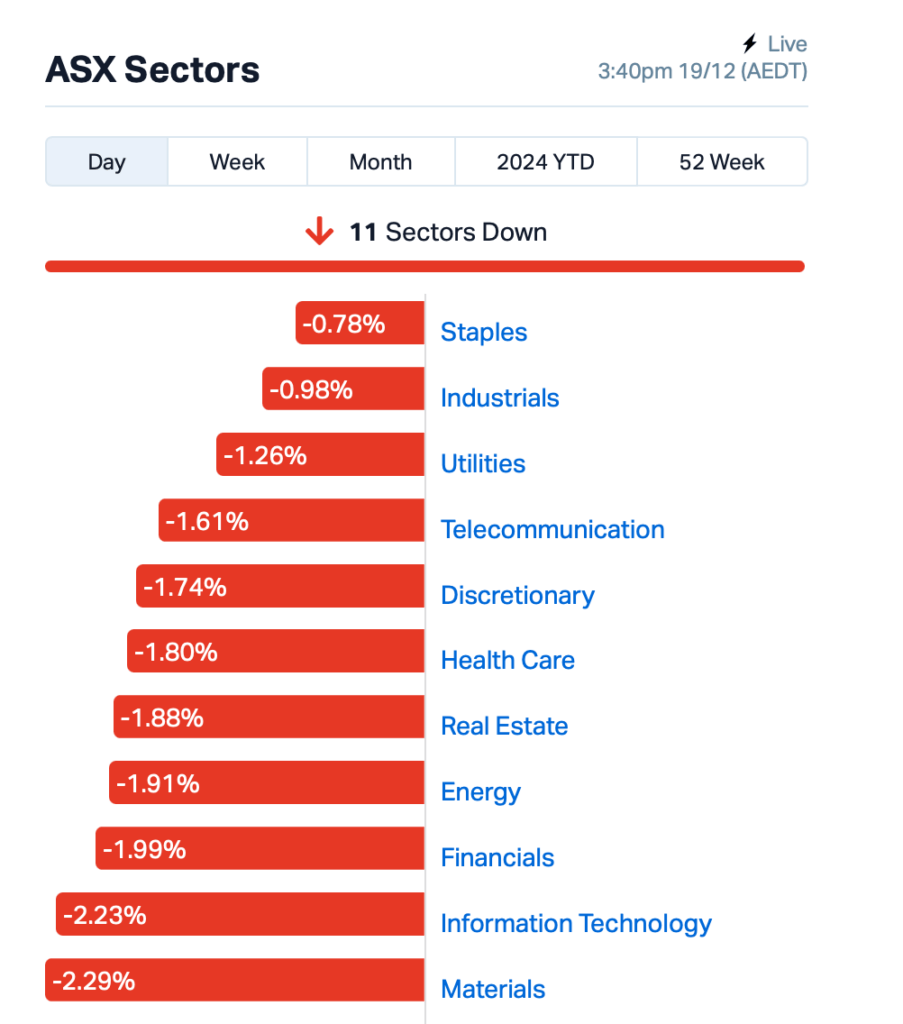

All 11 ASX sectors closed in the red. Mining and tech stocks, particularly US-exposed companies such as Megaport (ASX:MP1), were among the hardest hit. MP1 shares plunged by 10%, while BHP (ASX:BHP) was down 2%.

The Australian dollar also got hammered, dropping almost 2% to trade at US62.25 cents, while Bitcoin retreated to US$100,877 at the time of writing.

Overnight, the market was braced for a 25 basis point rate cut from the Fed, which it delivered.

But the real shock came from its warning that future cuts would be much slower, with the forecast dropping from three to just two cuts in 2025, spooking investors.

This sent Wall Street into a tailspin, with the S&P 500 down 3%, and Asian markets followed suit, all sliding today.

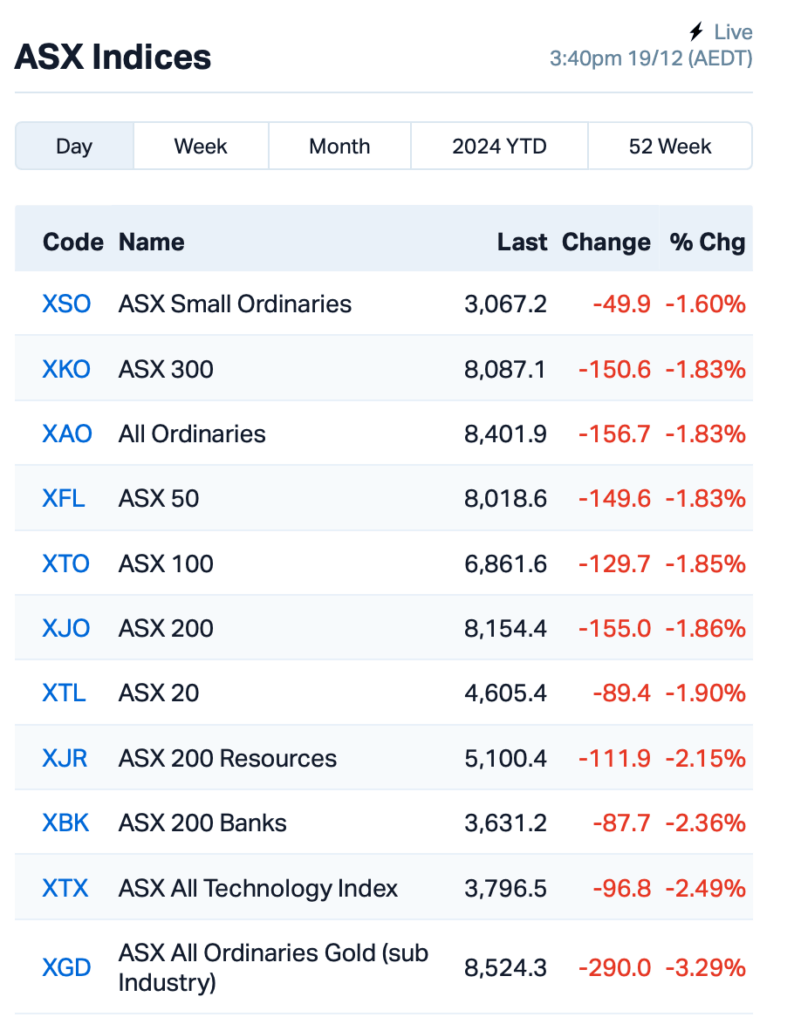

On the ASX, this is where the things stood at 15:40 AEDT:

In the large caps space, Mesoblast (ASX:MSB)surged 52% after the US FDA approved its groundbreaking cell therapy, Ryoncil, to treat children with a serious blood disorder.

Read more: Joy as Mesoblast wins its first FDA approval for a stem-cell therapy after decades of trying

Patriot Battery Metals (ASX:PMT) also saw a 16% jump after Volkswagen bought a 9.9% stake in the lithium miner for nearly $77 million.

In Energy, Woodside Energy Group (ASX:WDS) fell 2% after a deal with Chevron that saw it exit the $US34 billion Wheatstone LNG project in WA.

And, Australia and New Zealand Banking Group (ASX:ANZ) fell 2.5%, with its shareholder base in revolt over the bank’s executive pay report. This led to a vote that saw over a third of shareholders protest by rejecting the remuneration plan at today's AGM.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| 1TT | Thrive Tribe Tech | 0.002 | 100% | 4,594,000 | $703,362 |

| IS3 | I Synergy Group Ltd | 0.005 | 67% | 10,000 | $1,068,653 |

| 88E | 88 Energy Ltd | 0.002 | 50% | 946,540 | $28,933,812 |

| MSB | Mesoblast Limited | 2.755 | 39% | 24,006,321 | $2,260,732,546 |

| ERG | Eneco Refresh Ltd | 0.013 | 30% | 1,603,334 | $2,723,583 |

| C1X | Cosmosexploration | 0.044 | 26% | 981,225 | $2,921,331 |

| ERA | Energy Resources | 0.003 | 25% | 4,875,320 | $810,792,482 |

| MNC | Merino and Co | 0.335 | 24% | 32,915 | $14,330,674 |

| SCP | Scalare Partners | 0.200 | 21% | 5,000 | $5,755,662 |

| AXE | Archer Materials | 0.470 | 21% | 1,842,588 | $99,390,335 |

| ALM | Alma Metals Ltd | 0.006 | 20% | 600,000 | $7,832,611 |

| EPM | Eclipse Metals | 0.006 | 20% | 174,027 | $11,439,278 |

| NTD | Ntaw Holdings Ltd | 0.275 | 20% | 386,389 | $38,572,750 |

| EWC | Energy World Corpor. | 0.020 | 18% | 209,027 | $52,341,661 |

| TOU | Tlou Energy Ltd | 0.016 | 14% | 369,735 | $18,180,180 |

| VKA | Viking Mines Ltd | 0.008 | 14% | 2,617,467 | $9,297,031 |

| PMT | Patriotbatterymetals | 0.360 | 14% | 4,463,983 | $182,244,800 |

| BDG | Black Dragon Gold | 0.035 | 13% | 1,079,982 | $9,358,365 |

| PVL | Powerhouse Ven Ltd | 0.090 | 13% | 363,838 | $9,979,454 |

| SHN | Sunshine Metals Ltd | 0.009 | 13% | 1,436,667 | $12,701,158 |

| TEG | Triangle Energy Ltd | 0.005 | 13% | 2,498,470 | $8,356,936 |

Cosmos Exploration (ASX:C1X) has secured an exclusive option to acquire EAU Lithium, a company focused on Bolivia’s Lithium Triangle. EAU has partnered with Bolivia’s state-owned lithium group, Yacimientos de Litio Bolivianos, to test lithium brines from key salars using Vulcan Energy Resources (ASX:VUL)’s direct lithium extraction (DLE) technology. If successful, Cosmos said this could help unlock Bolivia’s vast lithium resources.

Revaia has agreed to merge with RegenCo in an all-scrip deal, valuing Revaia at $24 million. Following the merger, Revaia’s shareholders will own 32% of RegenCo, which will become one of Australia’s leading independent carbon project developers, with a combined annual production of 450,000 Australian Carbon Credit Units (ACCUs). Powerhouse Ventures (ASX:PVL), which holds an investment in Revaia, will increase its stake with an additional $250,000.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| MOM | Moab Minerals Ltd | 0.002 | -33% | 25,366,444 | $4,700,998 |

| EGY | Energy Tech Ltd | 0.021 | -32% | 177,017 | $13,833,665 |

| CRB | Carbine Resources | 0.003 | -25% | 15,300 | $2,206,951 |

| NTM | Nt Minerals Limited | 0.003 | -25% | 400,948 | $4,843,612 |

| 4DS | 4Ds Memory Limited | 0.063 | -21% | 10,650,333 | $141,074,793 |

| ALV | Alvomin | 0.040 | -20% | 106,710 | $5,857,944 |

| BMO | Bastion Minerals | 0.004 | -20% | 266,350 | $4,223,623 |

| GGE | Grand Gulf Energy | 0.002 | -20% | 974,000 | $6,125,968 |

| C7A | Clara Resources | 0.005 | -20% | 1,363,661 | $1,759,291 |

| AZY | Antipa Minerals Ltd | 0.025 | -19% | 42,401,211 | $150,471,287 |

| VMT | Vmoto Limited | 0.049 | -17% | 613,035 | $24,705,201 |

| NAG | Nagambie Resources | 0.015 | -17% | 567,808 | $14,459,442 |

| MEM | Memphasys Ltd | 0.005 | -17% | 184,000 | $10,578,489 |

| KCC | Kincora Copper | 0.026 | -16% | 200,000 | $6,725,503 |

| AS2 | Askarimetalslimited | 0.011 | -15% | 235,660 | $2,773,608 |

| AUA | Audeara | 0.034 | -15% | 50,000 | $7,005,709 |

| FAL | Falconmetalsltd | 0.115 | -15% | 55,809 | $23,895,000 |

| ATH | Alterity Therap Ltd | 0.006 | -14% | 4,239,479 | $37,242,353 |

| CHM | Chimeric Therapeutic | 0.006 | -14% | 2,227,814 | $11,026,049 |

| CPM | Coopermetalslimited | 0.038 | -14% | 394,191 | $3,447,649 |

| SBW | Shekel Brainweigh | 0.019 | -14% | 217,177 | $5,017,347 |

| NVQ | Noviqtech Limited | 0.130 | -13% | 4,912,560 | $33,665,601 |

| PR2 | Piche Resources | 0.085 | -13% | 65,044 | $7,868,473 |

IN CASE YOU MISSED IT

Trigg Minerals (ASX:TMG)has boosted the antimony resource estimate at the Wild Cattle Creek deposit within its Achilles project in NSW, by 92%, now totalling 1.52Mt at 1.97% Sb, containing 29,902t of antimony. The company is planning further drilling to expand the resource, believing there's plenty of upside and room to include gold and tungsten.

Non-bank lender MoneyMe (ASX:MME)has secured a $125 million funding facility from iPartners to drive funding efficiencies and support the expansion of its loan book.The funding will also help grow MME’s tech-driven offerings, and ultimately meet the rising demand for fast, flexible personal lending solutions.

Flotation testwork on the fines component of samples from TG Metals' (ASX:TG6) Burmeister deposit have returned excellent lithium recoveries, increasing total recovery to between 75.5% and 80.2%. The results also further support the potential for establishing Lake Johnston as a large, low-cost, open-cut lithium mining operation.

BlinkLab (ASX:BB1) has reached an important milestone with a positive outcome from a pre-submission meeting with the US Food and Drug Administration (FDA) on the regulatory pathway for its BlinkLab Dx 1 platform, aimed at aiding in autism diagnosis.The FDA has confirmed the design for the registrational study, with several top clinical sites across the US selected, and ethics submissions and site activations underway.

At Stockhead, we tell it like it is. While Trigg Minerals, MoneyMe, TG Metals and BlinkLab are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: All 11 sectors sell off, but Mesoblast jumps 52pc on FDA nod