Capital Economics says silver is set to outperform gold

Analysts forecast silver prices and demand set to soar as AI uptake expands across all sectors.

Silver prices could hit US$38/oz by the end of 2026

Capital Economics reckons demand will soar as AI use expands to all sectors

Production of the precious metal has stagnated post pandemic

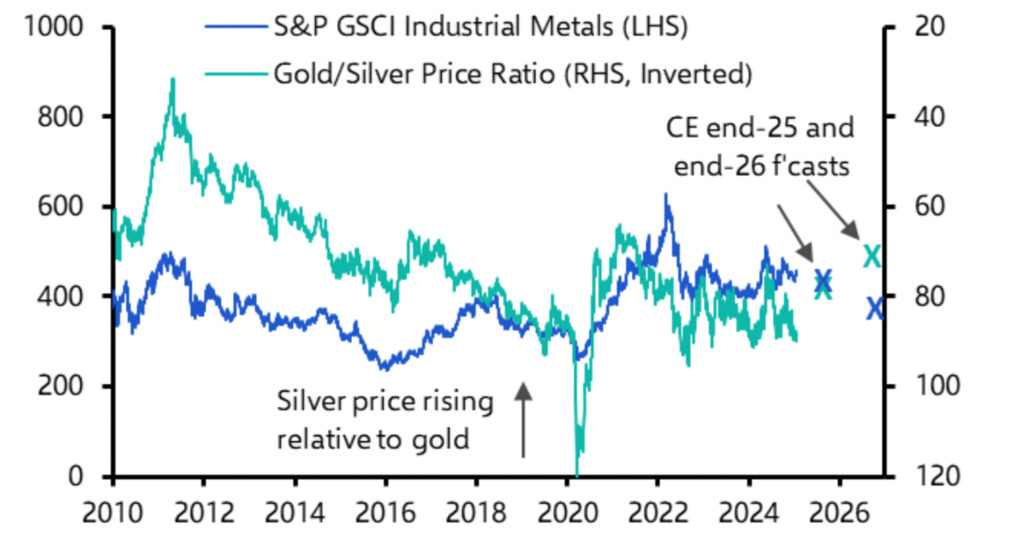

Capital Economics assistant economist Ankita Amajuri reckons silver is set to outperform gold over the coming years.

“Traditionally, our bearing view on industrial metals, informed by China’s struggling property sector, would lead us to expect weakness in silver demand and prices,” she said.

“But given the growing use of silver in fast-growing and non-cyclical sectors, as well as sluggish supply growth, we think silver prices will rise over the next two years, outperforming both gold and the consensus forecast in the process.”

The analyst puts this down to the metal's increasing use in fast-growing sectors like 5G tech, photovoltaics (PVs), batteries, EV and the semiconductors needed to power artificial intelligence – clearly strongly building narratives beyond the more traditional use-case areas for silver that include chemical catalysts, soldering and bearings.

US$38/oz by the end of 2026

Last week Barry FitzGerald noted the silver price hit $US32.25/ozmid-week, which is still well short of its all-time high of $US50/oz back in 1980 ($US180/oz inflation adjusted).

It’s not the record-breaking stuff of its more glamorous precious metals accomplice gold, but it's still gone some way to undoing some of the share price hit that silver stocks took late last year when the metal fell from 12-year highs in October of $US35/oz to below $US30/oz.

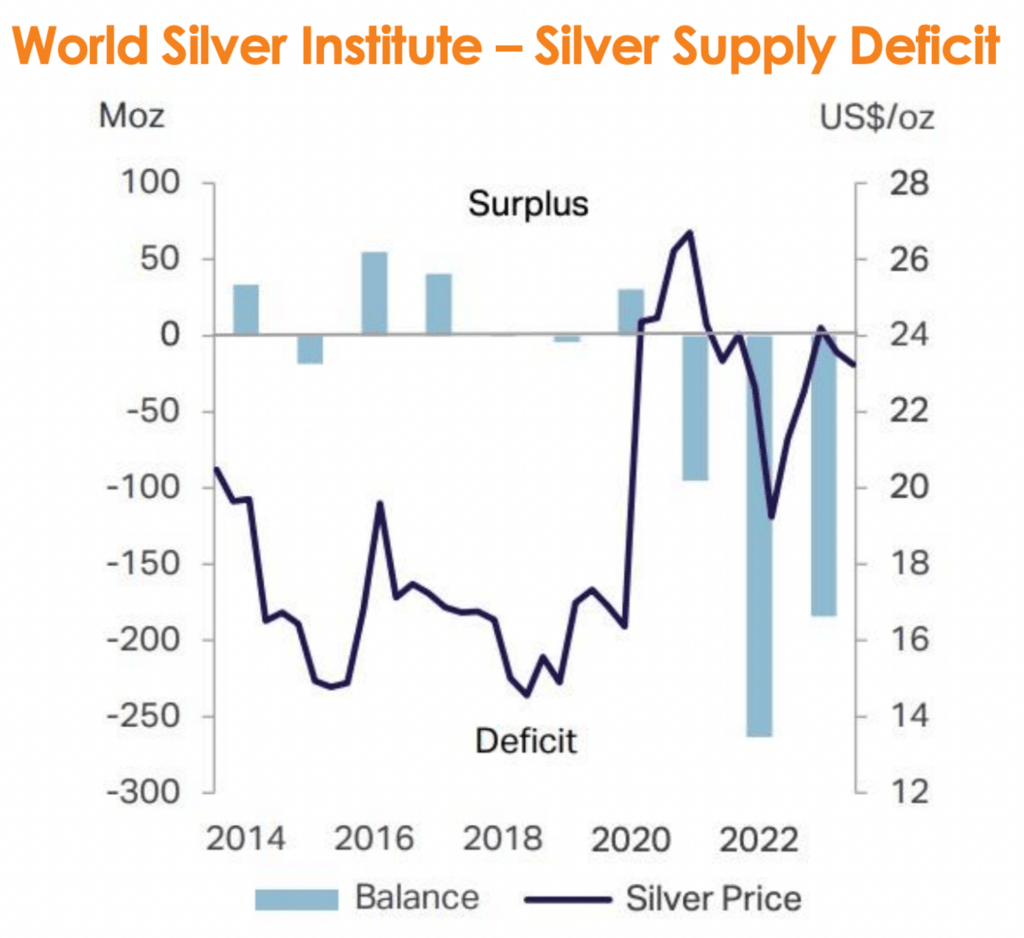

Amajuri said the demand and supply dynamics in the silver market have already started to push up prices.

“The silver market has already been in in a deficit since 2019, and prices have doubled over that period,” she said.

“However, the gold-to-silver price ratio remains much higher than historic levels, and we think silver remains undervalued.

“The upshot is that we have revised up our end-2025 silver price forecast to an above-consensus $35 per Oz.

“And in contrast to the consensus, we expect continued appreciation to $38 per oz by end-2026.”

Solar panels – the star of the demand show

Amajuri said that further growth in solar panel manufacturing will continue to support demand for silver over the coming years.

“Attempts to substitute silver with copper have not seen commercial success so far, and silver appears to be irreplaceable in large-scale manufacturing of PVs for now,” she said.

For context, the IEA estimates that global solar PV capacity additions in the six years between 2024 to 2030 will be triple what was installed in the six years prior.

Plus, the latest generations of more efficient PVs now use 20-120% more silver per KW of electrical capacity than previous incarnations.

“All told, having grown from 6% of total demand silver demand in 2015 to over 19% in 2024, we expect demand for silver from the photovoltaic industry to make up over 30% of total silver demand by 2030,” Amajuri said.

The increase in the use of silver in electronics is another reason to be bullish about demand, with the rise in AI expected to expand to basically every sector eventually.

“We remain confident that in time, the use of artificial intelligence will grow to all sectors, and the resulting demand for semiconductor chips will drive strong demand growth for silver,” Amajuri said.

But supply will likely struggle to keep up, with production remaining stagnant since the pandemic.

Not to mention, recycling only catered to around 15% of demand last year, and the majority of solar panels and semiconductors are not due to be decommissioned for another couple of decades.

Some notable ASX stocks in the silver space

Argent Minerals (ASX:ARD)

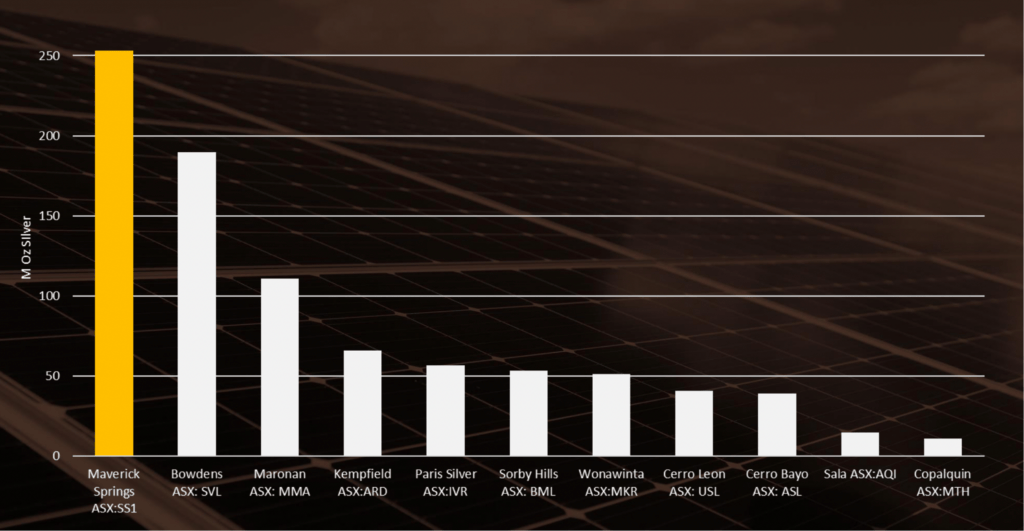

Argent’s Kempfield asset is the second-largest undeveloped silver deposit in Australia, containing 65.8Moz silver, 125,192oz gold, 207,402t lead and 420,373t zinc.

The company is on the hunt for Volcanogenic Massive Sulphide (VMS) deposits, which are mostly associated with base metals but hold the potential to produce economic levels of precious metals on top.

They tend to have strong grades and a large spread of commodities, which makes them a logical target for smaller-scale operators aiming to enter production.

So far, VMS mineralisation has been confirmed at the Sugarloaf Hill prospect, confirming a new VMS lode proximal to Lode 200 Mineralised Block, which contains almost half of the project’s silver metal.

Drilling has also confirmed further mineralisation over extensive intervals at the Golden Wattle prospect for the very first time.

And drilling last month extended volcanogenic massive sulphide mineralisation at the Kempfield NW Zone, and returned up to 27.02g/t silver – highlighting there’s even more upside on the horizon.

Sun Silver (ASX:SS1)

This stock listed last year and was one of the most successful of 2024, closing its IPO early in May after raising the maximum $13m in mere days before surging +170% in its first month on the bourse to hit $1.12 in October.

The company’s advanced Maverick Springs asset in Nevada has a resource of 423Moz at 67.25g/t silver equivalent or 253Moz at 40.25g/t silver, making it the largest pre-production primary silver project on the ASX.

The deposit itself remains open along strike and at depth, with multiple mineralised intercepts located outside of the current resource constrained model.

Inaugural drilling returned up to a whopping 887.2g/t silver equivalent, plus some bonus antimony on the side.

Maronan Metals (ASX:MMA)

Several pivotal moments await Maronan Metals during the first six months of 2025 with the company wrapping up its 2024 drilling program.

That program has comprised about 10,000m of drilling with the aim to increase the indicated component of its Starter Zone resource, which currently stands at 2.1Mt at 5.3% lead and 155g/t silver.

Assays so far have returned up to a massive 381g/t silver.

The new results will be included in a mineral resource update slated for release in April.

The updated resource is expected to pave the way for a scoping study due in the June 2025 quarter, focusing on the 500m-long by 600m-deep Starter Zone, which sits less than 90m from surface.

Polymetals Resources (ASX:POL)

Polymetals acquired the Endeavour mine in 2023 after resetting a prohibitive 100% silver streaming royalty to a 4% NSR over silver, lead and zinc.

Restructuring this royalty breathed new life to the mine, and the transfer of ownership has paved the way for production to resume in the Q2 FY25.

And if prices continue to track upwards, it could be perfect timing to restart silver production.

Not to mention, the company just wrapped up a $35m placement at $0.80, and has access to ~$26m in undrawn debt finance facilities so is looking in good financial shape to start surface and underground refurbishment works with first concentrate production to follow.

Mithril Silver and Gold (ASX:MTH)

Mithril is the only ASX-lister focused on silver in Mexico, an oft-forgotten jurisdiction, which continues to rank as the world’s gold standard of silver production.

The company has kicked off the second stage of drilling at its Copalquin project, which hosts a swathe of historic workings, as it works towards a resource upgrade in the new year.

Mithril’s mission is to double its current 529,000oz gold equivalent resource and managing director and CEO John Skeet said drilling was progressing well at the first of several targets at the high-grade, district scale project.

Preparations are on track for major exploration expansion, including the beginning of drilling two more resource targets areas and development and testing of a district model for this large epithermal system.

At Stockhead we tell it like it is. While Argent Minerals, Mithril Silver and Gold, Sun Silver and Maronan Metals are Stockhead advertisers, they did not sponsor this article.

Originally published as Capital Economics says silver is set to outperform gold