ASX Small Caps Lunch Wrap: ASX spikes as gold stocks rally; Equinox surges on antimony finds

The ASX rose on Friday morning, thanks to Wall Street’s gains and China stimulus hopes. The bourse was led by gold miners, while Block dropped despite profit growth.

The ASX is up following Wall Street's positive run and China stimulus hopes

Gold miners lead as commodity prices rebound

Afterpay-owner Block drops despite profit growth

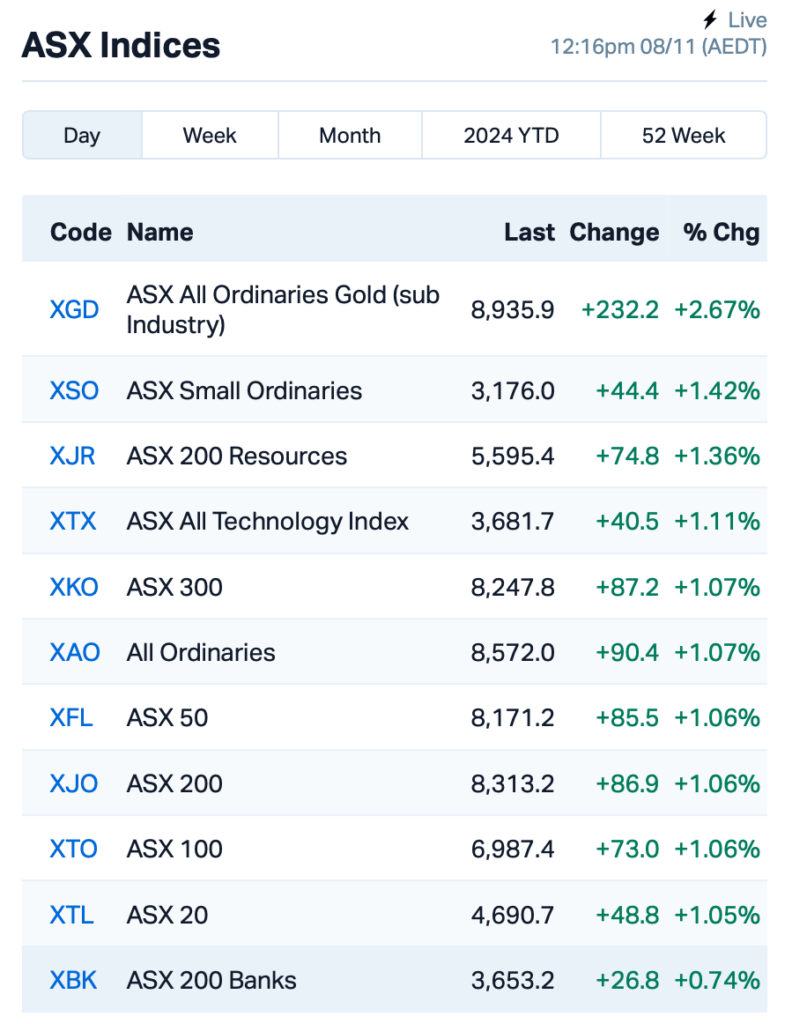

The ASX was up by about 0.98 per cent at the time of writing, following a positive run on Wall Street and growing expectations that China will announce fresh economic stimulus measures later today.

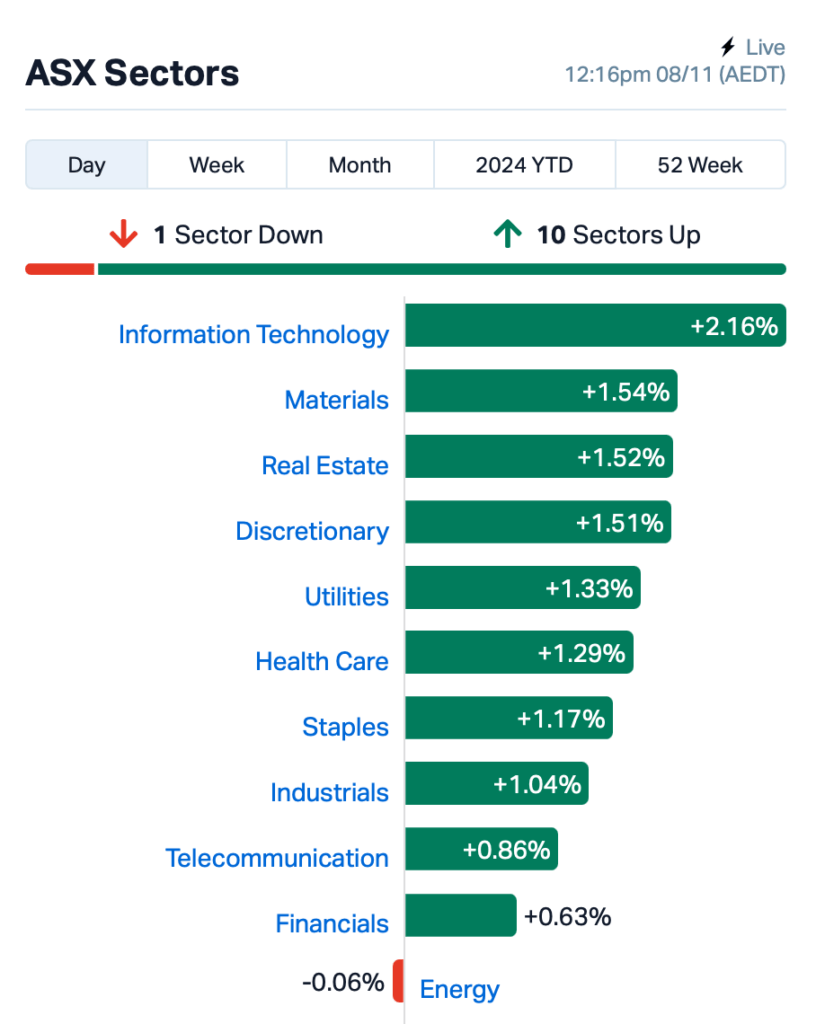

Ten out of 11 ASX sectors were in the green, with InfoTech and Materials leading the charge.

Tech stocks were led by heavyweights WiseTech Global (ASX:WTC) and Xero (ASX:XRO), which climbed 2 per cent each.

Meanwhile, an overnight rebound in commodity prices – particularly gold, oil, and iron ore – is helping to drive the mining sector higher.

Gold miners are particularly doing well today, with the price of gold now back above $US2700 an ounce.

The optimism today was also fuelled by the Fed Reserve’s recent rate cut, and upbeat comments from Chair Jerome Powell, who reassured markets that the US economy remained strong.

The Fed lowered rates by 0.25 per cent on Thurssday night, bringing them to between 4.5 per cent and 4.75 per cent. This is the second rate cut in a row, following a larger cut of 0.50 per cent in September.

In large caps news, Afterpay-owner Block Inc (ASX:SQ2) has dropped 6.5 per cent, despite reporting a 19 per cent increase in profits for the September quarter. The company missed market expectations, particularly in its payment volumes.

Shares in News Corp (ASX:NWS) were up over 2 per cent after the company posted a solid revenue and earnings growth. Meanwhile, there’s movement at the top as its long-time CFO, Susan Panuccio, will step down in January, to be replaced by Lavanya Chandrashekar from multinational beverage company Diageo.

Still in the large end of town, Arcadium Lithium (ASX:LTM), the company in the spotlight following Rio Tinto’s $6.7 billion buyout bid, is struggling with falling lithium prices. The company’s shares fell 2 per cent on Friday after reporting a major fall in net income and adjusted earnings for the September quarter.

And Kelsian Group (ASX:KLS) the ferries and tourism group, is also in the news today after announcing that its CEO Clint Feuerherdt will step down in April 2025. Kelsian’s shares were down 0.4 per cent.

NOT THE ASX

US stocks soared to new highs overnight, with the S&P 500 hitting a record as investors reacted to the Fed’s 25 bp cut and positive comments from the chairman.

Powell said the US economy was in good shape, although he didn’t give any clear signals about future interest rate cuts.

“We’re seeing a solid economy right now,” he said, which helped push stocks, bonds, and commodities all higher.

Powell also said he would not resign if re-elected President Donald Trump asked him to.

“No. Not permitted under the law,” Powell said firmly.

After his speech, US Treasury yields fell (bond prices rise), and the US dollar dropped. US tech stocks performed well again, with the NYSE Fang+ Index up 2.5 per cent.

Expedia and Airbnb had strong earnings reports and raised their forecasts, showing high demand as the holidays approach.

Under Armour and Ralph Lauren both also saw strong sales and raised their outlooks.

Gold rebounded to over US$2,700 an ounce, Brent crude went back above $US75 a barrel, and Bitcoin surged above $US76,000.

Meanwhile, traders are expecting China to announce new stimulus measures today, as fears grow about Trump’s tariffs.

The exact size of the package is still up in the air, but experts say that what really matters is whether China actually delivers on it.

ASX SMALL CAP WINNERS

Here are the best-performing ASX small cap stocks for November 8 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| MHC | Manhattan Corp Ltd | 0.002 | 100% | 354,911 | $4,497,970 |

| PAB | Patrys Ltd | 0.005 | 50% | 16,862,568 | $6,172,342 |

| TKL | Traka Resources | 0.002 | 50% | 1,203,505 | $1,945,659 |

| VPR | Volt Group Ltd | 0.002 | 50% | 2,921,688 | $10,716,208 |

| EQN | Equinox Resources | 0.175 | 40% | 4,590,651 | $15,481,250 |

| MNC | Merino and Co | 0.930 | 37% | 399,465 | $36,092,068 |

| EEL | Enrg Elements Ltd | 0.002 | 33% | 340,921 | $1,744,524 |

| OAR | OAR Resources Ltd | 0.002 | 33% | 516,524 | $4,951,252 |

| RNE | Renu Energy Ltd | 0.002 | 33% | 500,000 | $2,590,993 |

| PVT | Pivotal Metals Ltd | 0.012 | 33% | 14,478,157 | $7,870,283 |

| XPN | Xpon Technologies | 0.019 | 27% | 1,930,366 | $5,436,622 |

| CXU | Cauldron Energy Ltd | 0.016 | 23% | 9,036,431 | $18,987,788 |

| PFE | Panteraminerals | 0.027 | 23% | 5,041,500 | $10,004,075 |

| CLEDA | Cyclone Metals | 0.023 | 21% | 591,658 | $12,102,016 |

| AUK | Aumake Limited | 0.006 | 20% | 1,326 | $13,566,205 |

| PRM | Prominence Energy | 0.006 | 20% | 200,000 | $1,945,882 |

| EMP | Emperor Energy Ltd | 0.025 | 19% | 2,500,000 | $9,507,761 |

| BSN | Basin Energy Ltd | 0.038 | 19% | 25,571 | $3,339,188 |

| BIS | Bisalloy Steel | 3.610 | 18% | 374,243 | $147,064,055 |

| FG1 | Flynn Gold | 0.035 | 17% | 808,709 | $7,839,494 |

| OVT | Ovanti Ltd | 0.028 | 17% | 34,811,778 | $48,723,494 |

| RNX | Renegade Exploration | 0.007 | 17% | 284,578 | $7,704,021 |

| TEG | Triangle Energy Ltd | 0.007 | 17% | 2,866,005 | $12,480,804 |

Mayne Pharma (ASX:MYX) jumped 10 per cent on Friday morning after responding to morning media speculation regarding its appointment of Jefferies Australia, confirming that Jefferies is its financial adviser.

An article suggested that Mayne, which has seen significant losses, was exploring potential interest from buyers, with Jefferies quietly marketing the company to secure an exit for shareholders. Mayne said on Friday that it continued to work with Jefferies to assess strategies for maximising shareholder value, and will provide updates as required by its disclosure obligations.

Equinox Resources' (ASX:EQN) shares jumped in the morning after the company reported rock chip samples from its Alturas Antimony project in British Columbia, Canada, with assays up to 69.98 per cent antimony (Sb). Equinox said this is one of the highest grades of natural stibnite ever found.

The company has also increased its land holdings by 3.3sq km, and the price of antimony has risen sharply to $US36,000 per metric tonne, driven by new export controls from China. Also, rock chip samples indicate potential copper mineralisation, and drilling is under way at the company's Brazilian projects. CEO Zac Komur said the project has immense potential, and there is a rare opportunity to explore this high-grade asset in a mining-friendly area.

Native Mineral Resources (ASX:NMR) has signed an agreement to acquire advanced gold projects in Queensland, including the Far Fanning and Black Jack deposits. These projects are in a promising mining region, and NMR believes they have significant exploration potential.

The total acquisition is valued at $18.9 million, payable over 33 months, with no new shares issued. NMR has also secured 100 per cent ownership of 17 mining leases and the Black Jack processing plant. Recent sampling from the Far Fanning project showed promising gold grades, and NMR plans further drilling and studies. To fund this acquisition, NMR is planning a capital raise through a placement and entitlement offer, aiming to raise up to $14 million.

Bisalloy (ASX:BIS) shares rose following the chairman's address this morning, where he highlighted a 20 per cent increase in profit for the year, driven by strong domestic performance, improved margins, and reduced costs.

He also pointed to key developments, including Bisalloy’s successful qualification for supplying steel for the AUKUS submarines, the positive outcome of the anti-dumping review, and the company’s joint ventures, particularly in China.

Also, the company’s focus on expanding its armour and protection steel business, new product innovations, and increased export demand contributed to an optimistic outlook for the year ahead.

Flynn Gold (ASX:FG1) shares rose after the company announced its maiden JORC-compliant Exploration Target for its Golden Ridge Project in Tasmania.

The target estimates between 449,000oz and 520,000oz of gold across three prospects, with significant potential for further expansion as the mineralisation is open in all directions. This marks a key step towards defining a maiden Mineral Resource and has raised investor confidence in the project's growth potential.

ASX SMALL CAP LOSERS

Here are the worst-performing ASX small cap stocks for November 8:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| T3D | 333D Limited | 0.006 | -33% | 40,006 | $1,075,004 |

| TMK | TMK Energy Limited | 0.002 | -33% | 19,131,887 | $25,177,217 |

| VML | Vital Metals Limited | 0.002 | -33% | 5,695 | $17,685,201 |

| SAN | Sagalio Energy Ltd | 0.005 | -29% | 80,000 | $1,432,621 |

| PLC | Premier1 Lithium Ltd | 0.008 | -27% | 4,955,200 | $1,920,315 |

| BYH | Bryah Resources Ltd | 0.003 | -25% | 100,000 | $2,013,147 |

| PKO | Peako Limited | 0.003 | -25% | 947,970 | $3,513,899 |

| RGL | Riversgold | 0.003 | -25% | 45,000 | $6,509,850 |

| RML | Resolution Minerals | 0.002 | -25% | 900,000 | $3,220,044 |

| TAS | Tasman Resources Ltd | 0.003 | -25% | 1,000,000 | $3,220,998 |

| AVE | Avecho Biotech Ltd | 0.002 | -20% | 1,023 | $7,923,243 |

| AYT | Austin Metals Ltd | 0.004 | -20% | 30,000 | $6,620,957 |

| CAV | Carnavale Resources | 0.004 | -20% | 3,738,200 | $20,451,092 |

| IS3 | I Synergy Group Ltd | 0.004 | -20% | 99 | $1,781,089 |

| CBY | Canterbury Resources | 0.025 | -17% | 199,426 | $5,923,227 |

| ERA | Energy Resources | 0.003 | -17% | 1,084,862 | $66,444,898 |

| EAX | Energy Action Ltd | 0.285 | -16% | 186 | $13,253,690 |

| EXT | Excite Technology | 0.011 | -15% | 4,060,448 | $21,771,318 |

| ASR | Asra Minerals Ltd | 0.003 | -14% | 50,000 | $7,810,453 |

| PPY | Papyrus Australia | 0.012 | -14% | 14,880 | $6,897,696 |

| TYX | Tyranna Res Ltd | 0.003 | -14% | 150,000 | $11,507,739 |

| ASH | Ashley Services Grp | 0.190 | -14% | 12,500 | $31,674,699 |

| AAU | Antilles Gold Ltd | 0.004 | -13% | 1,401,243 | $7,422,971 |

| CRR | Critical Resources | 0.007 | -13% | 6,304,420 | $15,709,469 |

| CTN | Catalina Resources | 0.004 | -13% | 5,715 | $4,953,948 |

Premier1 Lithium (ASX:PLC) dropped on Friday morning after announcing $1.5 million cap raise through a combination of a placement and a fully underwritten entitlement offer. The Placement, at $0.008 per share, raised around $209,000, while the Entitlement Offer aims to raise $1.3 million by issuing up to 167.3 million shares. The funds will be used to advance exploration at the Yalgoo and Abbotts North projects, including geophysics, drilling and heritage work. Canaccord Genuity is managing and underwriting the offer.

This article does not constitute financial product advice. You should really consider obtaining independent advice before making any financial decisions.

Originally published as ASX Small Caps Lunch Wrap: ASX spikes as gold stocks rally; Equinox surges on antimony finds