ASX Lunch Wrap: Stocks rally on surprise CPI rise; ETM pops 30pc on Trump’s Greenland rhetoric

The ASX keeps charging on Wednesday. Meanwhile Wall Street slips on strong US data and Energy Transition Minerals pops on Trump’s Greenland chatter.

ASX continues rally after surprise inflation rise

Wall Street drops after strong US data

Energy Transition Minerals jumps on Trump talk

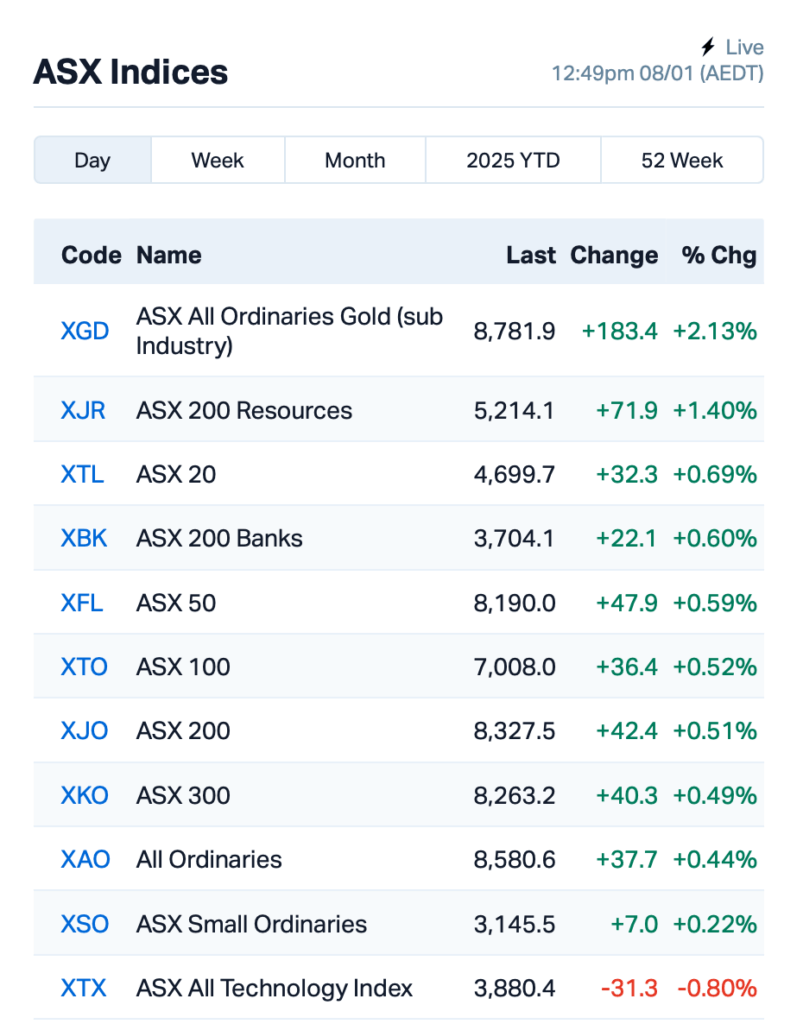

The ASX continued its five-day rally on Wednesday morning, up 0.5% as traders digested a surprise rise in Aussie inflation.

The November CPI came in at 2.3%, up from 2.1% in October and higher than expected.

This could make the RBA's decision easier, as inflation is still above the target range of 2%, giving the central bank more leeway to cut rates.

Local traders also reacted to a sell-off on Wall Street overnight, where the S&P 500 dropped 1% and the Nasdaq almost 2%.

So what happened? A solid report showed US job openings and business activity were higher than expected.

While that’s good for the economy, it’s bad for stocks. Strong growth could mean inflation sticks around longer, making the Fed less likely to cut rates any time soon.

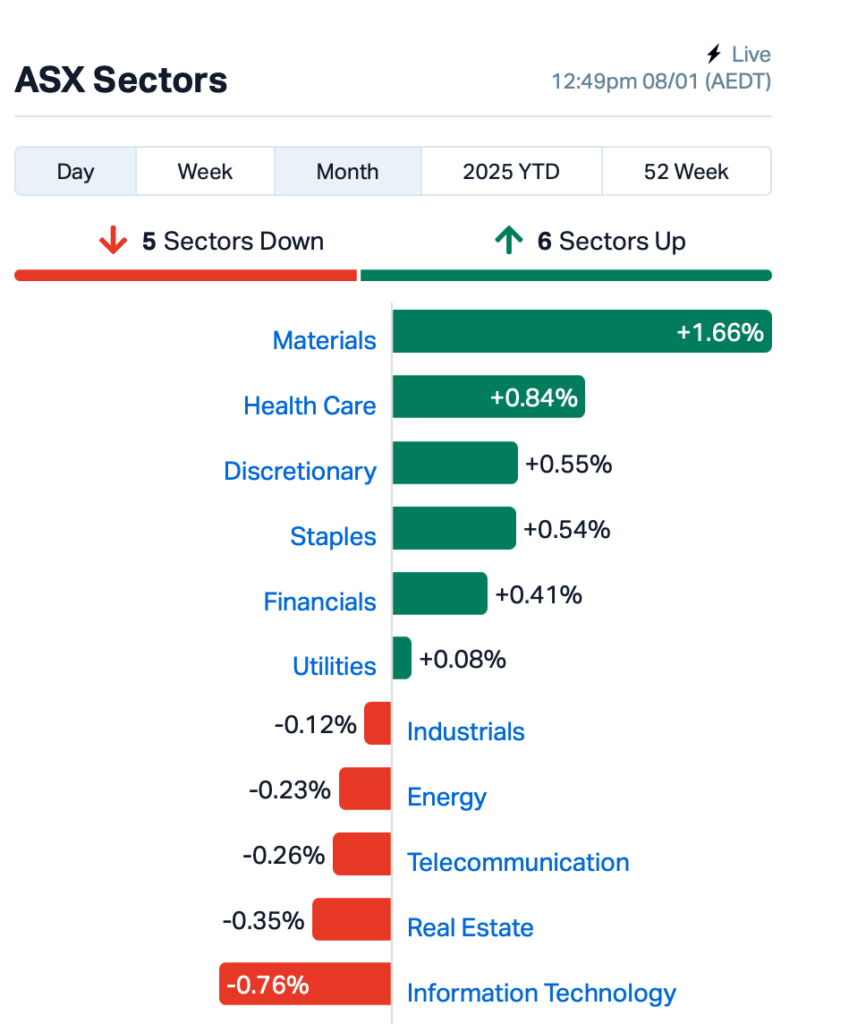

But back to the ASX – six out of 11 sectors were in the green this morning; with iron ore miners and goldies rebounding:

In the large caps space, fund manager Magellan Financial Group (ASX:MFG) saw a $400 million outflow in December, with both retail and institutional investors pulling back. Shares were down 1%.

Regal Partners (ASX:RPL), on the other hand, had a strong quarter, surpassing $18 billion in funds under management and pocketing $85 million in fees. Shares were still down 2%.

And just when you thought it couldn’t get stranger, there’s a twist from Greenland-focused miner, Energy Transition Minerals (ASX:ETM).

The company saw its shares soar 30% this morning after Donald Trump hinted at the possibility of a US takeover of the resource-rich island, which is currently an autonomous, sovereign territory of Denmark.

Trump has again expressed interest in purchasing Greenland, citing its strategic importance for US security and access to valuable natural resources like rare earth metals.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for January 8 :

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| ICU | Investor Centre Ltd | 0.003 | 50% | 982 | $609,023 |

| SMX | Strata Minerals | 0.027 | 42% | 1,363,500 | $3,625,488 |

| AUZ | Australian Mines Ltd | 0.011 | 38% | 21,698,620 | $11,188,097 |

| FML | Focus Minerals Ltd | 0.245 | 32% | 549,444 | $53,013,349 |

| RDN | Raiden Resources Ltd | 0.014 | 29% | 21,598,847 | $36,234,360 |

| ETM | Energy Transition | 0.063 | 21% | 13,333,821 | $73,252,851 |

| CMD | Cassius Mining Ltd | 0.012 | 20% | 10,291 | $5,420,045 |

| CRR | Critical Resources | 0.006 | 20% | 1,250,007 | $12,159,816 |

| MKL | Mighty Kingdom Ltd | 0.006 | 20% | 4,820,632 | $1,080,317 |

| SHE | Stonehorse Energy Lt | 0.007 | 17% | 170,525 | $4,106,610 |

| CDD | Cardno Limited | 0.180 | 16% | 154,410 | $6,054,403 |

| RR1 | Reach Resources Ltd | 0.008 | 14% | 1,976,579 | $6,121,019 |

| YOW | Yowie Group | 0.025 | 14% | 135,980 | $5,046,094 |

| BRX | Belararoxlimited | 0.170 | 13% | 200,000 | $21,581,660 |

| NIM | Nimyresourceslimited | 0.085 | 13% | 446,217 | $13,966,407 |

| MTM | MTM Critical Metals | 0.270 | 13% | 6,478,777 | $109,999,899 |

| ARV | Artemis Resources | 0.009 | 13% | 2,314,113 | $17,643,059 |

| FGH | Foresta Group | 0.009 | 13% | 497,266 | $21,032,950 |

| WCN | White Cliff Min Ltd | 0.019 | 12% | 3,965,794 | $32,138,003 |

| FXG | Felix Gold Limited | 0.110 | 11% | 1,200,472 | $32,536,926 |

Australian Mines (ASX:AUZ) just announced a major upgrade to its Flemington resource, with the 2025 scandium mineral resource jumping from 3.7 million tonnes to 6.3 million tonnes, maintaining strong grades of 446-458 ppm. The total mineralised inventory now stands at 28 million tonnes at 217 ppm scandium, a huge leap from 4.5 million tonnes in 2017. AUZ said most of the resource is near surface and classified as Measured and Indicated.

Reach Resources (ASX:RR1) has kicked off a drilling programme at its 100%-owned Murchison South gold project (formerly Primrose), targeting high-grade areas from previous drilling. The RC drill campaign will include around 12 holes, mostly between 60-80m deep. Updates are expected soon.

MTM Critical Metals' (ASX:MTM) Flash Joule Heating (FJH) tech has just achieved a major breakthrough, hitting 93% conversion efficiency for rare earth elements (REEs) to chlorides – a huge jump from previous results. The process also slashed impurities by 95%. FJH skips the old-school, energy-heavy methods like sulphuric acid roasting, offering a simpler, cleaner way to produce high-purity REE chlorides with over 90% purity.

And, Julian Hanna has been appointed managing director at Artemis Resources (ASX:ARV) to lead a big drilling push at the Karratha gold project in 2025. Hanna brings loads of experience from his time with Western Areas and MOD Resources. Meanwhile, executive director George Ventouras has stepped down to chase new opportunities.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for January 8 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AYM | Australia United Min | 0.002 | -50% | 113,636 | $7,370,310 |

| EM2R | Eagle Mountain - Rights 23-Jan-25 Def | 0.001 | -50% | 950,000 | $1,602,631 |

| FRX | Flexiroam Limited | 0.007 | -30% | 5,523,094 | $7,856,438 |

| LNU | Linius Tech Limited | 0.002 | -25% | 220,588 | $12,302,431 |

| QXR | Qx Resources Limited | 0.003 | -25% | 172,991 | $5,120,311 |

| VPR | Voltgroupltd | 0.002 | -25% | 342,072 | $21,432,416 |

| SBW | Shekel Brainweigh | 0.027 | -23% | 93,029 | $7,982,143 |

| AHN | Athena Resources | 0.004 | -20% | 503,737 | $7,971,402 |

| AVH | Avita Medical | 3.530 | -19% | 1,359,658 | $302,362,845 |

| ERA | Energy Resources | 0.003 | -17% | 109,186 | $1,216,188,722 |

| LNR | Lanthanein Resources | 0.003 | -17% | 55,710 | $7,330,908 |

| XGL | Xamble Group Limited | 0.022 | -15% | 13,675 | $8,814,370 |

| GR8 | Great Dirt Resources | 0.140 | -15% | 32,318 | $4,842,958 |

| KLI | Killiresources | 0.051 | -15% | 15,500 | $8,413,425 |

| FRS | Forrestaniaresources | 0.012 | -14% | 910,355 | $3,373,659 |

| GES | Genesis Resources | 0.006 | -14% | 200,000 | $5,479,889 |

| MTB | Mount Burgess Mining | 0.006 | -14% | 25,000 | $2,376,762 |

| PXX | Polarx Limited | 0.006 | -14% | 675,310 | $16,628,507 |

| RLT | Renergen Limited | 0.520 | -14% | 85,509 | $18,347,215 |

| DES | Desoto Resources | 0.065 | -13% | 8,000 | $6,943,950 |

| SUM | Summitminerals | 0.165 | -13% | 1,205,478 | $16,402,318 |

| NXS | Next Science Limited | 0.100 | -13% | 447,829 | $33,598,427 |

Avita Medical's (ASX:AVH) share price plunged 19% after the regenerative medicine company downgraded its annual revenue guidance due to slower-than-expected sales. AVH now expects full-year commercial revenue to hit $64.3 million, down from the previous forecast of $68-$70 million.

At Stockhead, we tell it like it is. While Australian Mines and MTM Critical Metals are Stockhead advertisers, they did not sponsor this article.

Originally published as ASX Lunch Wrap: Stocks rally on surprise CPI rise; ETM pops 30pc on Trump’s Greenland rhetoric