ASX Lunch Wrap: Novonix signs with car giant Stellantis, Resolute dumps after CEO detained in Mali

Mining and China-sensitive stocks have dipped on Monday, with Resolute Mining plunging after its CEO’s detention in Mali.

ASX struggles as mining stocks drop, China-sensitive shares hit

Resolute Mining plunges after CEO's detention in Mali

Wall Street hits record highs, Tesla surges 30pc last week

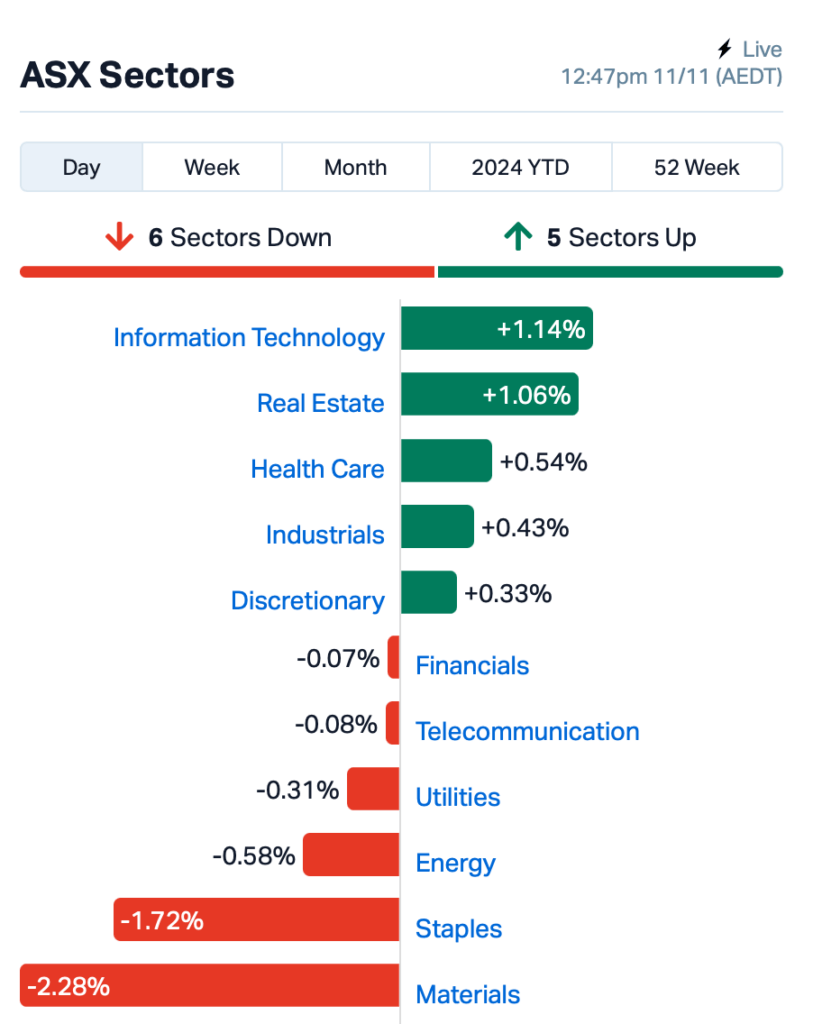

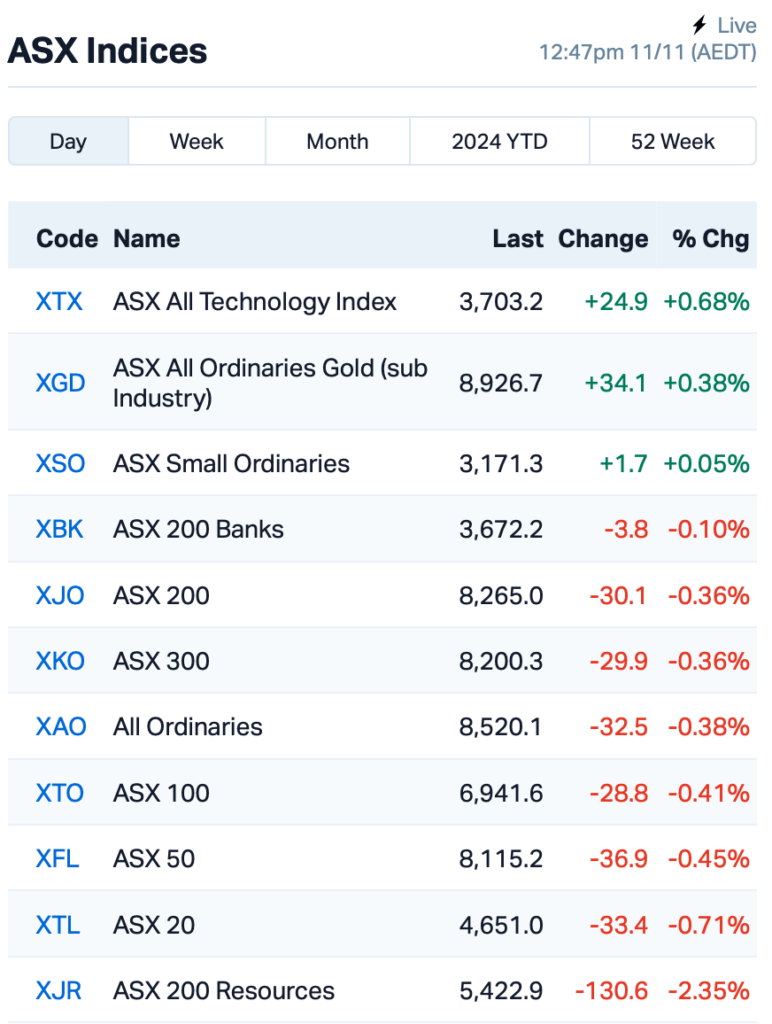

The ASX is off to a tough start this week, with mining stocks taking an early hit on Monday, weighing down the market.

At about 1.30pm AEDT, the benchmark S&P/ASX 200 Index was down 0.46 per cent.

China-sensitive stocks were hit after China unveiled its stimulus package on Friday afternoon, which fell short of investor expectations.

Despite the huge headline figure, the 10 trillion yuan ($2.1 trillion) plan to ease local government debt was seen as inadequate given the country's slowing economy and weak consumer spending.

With trade tensions heightened by Trump’s election, many believe the package needed to be more substantial to protect China’s growth – and, by extension, global markets.

On the ASX today, China sensitive heavyweights BHP (ASX:BHP) and Rio Tinto (ASX:RIO) both dropped by around 3 per cent, with Fortescue (ASX:FMG) sinking even further, down 4 per cent.

Tech and real estate stocks, however, managed to pull up some of the slack, with seven out of the 11 sectors showing a bit of green at noon (AEDT).

Dominating the headlines on Monday morning, Resolute Mining (ASX:RSG) plunged by 29 per cent after news broke that its CEO, Terry Holohan, along with two other employees, had been detained in Mali.

The three were detained by Mali’s military government over the weekend, and comes amid tensions involving the company’s 80 per cent stake in the Syama gold mine, which is partly controlled by the Malian government. The reason for the detention has not been officially confirmed.

Endeavour Group (ASX:EDV) , the company behind Dan Murphy’s and BWS, warned that weaker sales and rising costs are going to hit profits, sending their stock down by over 5 per cent.

Meanwhile, battery tech company Novonix (ASX:NVX) made a big move on Monday, announcing a supply deal with car giant Stellantis.

The two companies have inked an agreement for the supply of high-performance synthetic graphite, with Novonix set to expand its Riverside facility and build a new site in the US to meet the demand. Novix’s shares shot up 10 per cent in response.

NOT THE ASX

On Friday, Wall Street wrapped up its best week of the year, with major indices hitting new record highs.

The S&P 500 briefly touched the 6000 mark for the first time, while the Dow Jones Industrial Average crossed 44,000 for the first time ever.

The surge was fuelled by a mix of stock market optimism surrounding Donald Trump's presidential victory and the Federal Reserve's latest rate cut.

Tesla was one of the best performers, with its stock soaring by 8 per cent on Friday, bringing its market cap to more than $US1 trillion. Tesla’s stock has been on fire all week, jumping more than 30 per cent as part of the broader rally triggered by Trump's victory.

Trump Media & Technology Group, the parent company of Trump’s social media platform, Truth Social, also surged by 15 per cent after Trump announced he would not sell his stake in the company.

But Nvidia, which officially joined the blue chips-focused Dow Jones Index on Friday, dipped by 1 per cent. Analysts are still uncertain about how Trump’s policies – particularly on China – will impact the semiconductor sector.

Meanwhile, US-listed Chinese stocks were a drag on the broader market.

Stocks such as Alibaba and PDD Holdings fell by about 6 per cent as investors grew skeptical of China’s latest $2 trillion stimulus plan aimed at refinancing local government debt.

ASX SMALL CAP WINNERS

Here are the best-performing ASX small cap stocks for November 11:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AVE | Avecho Biotech Ltd | 0.003 | 50% | 396,195 | $6,338,594 |

| RLC | Reedy Lagoon Corp. | 0.003 | 50% | 2,000,059 | $1,523,413 |

| DOU | Douugh Limited | 0.013 | 44% | 17,969,353 | $9,738,620 |

| SLH | Silk Logistics | 2.070 | 41% | 1,472,356 | $119,874,969 |

| AAU | Antilles Gold Ltd | 0.004 | 33% | 3,155,394 | $5,567,228 |

| ALR | Altairminerals | 0.004 | 33% | 71,352 | $12,889,733 |

| EVR | Ev Resources Ltd | 0.004 | 33% | 1,368,619 | $4,188,814 |

| RML | Resolution Minerals | 0.002 | 33% | 400,000 | $2,415,033 |

| FG1 | Flynngold | 0.040 | 33% | 1,708,490 | $7,839,494 |

| NAG | Nagambie Resources | 0.020 | 33% | 10,320,537 | $11,949,535 |

| ADG | Adelong Gold Limited | 0.005 | 25% | 4,811,321 | $4,471,956 |

| ERA | Energy Resources | 0.003 | 25% | 949,698 | $44,296,598 |

| IS3 | I Synergy Group Ltd | 0.005 | 25% | 20,000 | $1,424,871 |

| TTI | Traffic Technologies | 0.005 | 25% | 39,999 | $4,475,272 |

| NME | Nex Metals Explorat | 0.037 | 23% | 43,000 | $8,168,339 |

| PUR | Pursuit Minerals | 0.003 | 20% | 3,040,000 | $9,088,500 |

| MEG | Megado Minerals Ltd | 0.016 | 20% | 362,806 | $3,392,809 |

| ATC | Altech Batt Ltd | 0.076 | 17% | 8,332,351 | $125,831,535 |

| PPY | Papyrus Australia | 0.014 | 17% | 43,644 | $5,912,311 |

| RGL | Riversgold | 0.004 | 17% | 729,244 | $4,882,388 |

| PPG | Pro-Pac Packaging | 0.022 | 16% | 322,123 | $3,452,067 |

| NXM | Nexus Minerals Ltd | 0.062 | 15% | 2,163,739 | $26,261,559 |

| BLU | Blue Energy Limited | 0.008 | 14% | 9,250 | $12,956,815 |

Silk Logistics Holdings (ASX:SLK) has entered into an agreement with DP World Australia for the full acquisition of Silk by way of a scheme of arrangement. Under the scheme, Silk shareholders will receive $2.14 per share, minus any dividends paid before the deal goes through. This offer represents a significant premium, with a 45.6 per cent increase on Silk’s last share price and a 60.6 per cent premium on its one-month average.

Silk’s board fully supports the deal, recommending that shareholders vote in favour. Key shareholders, controlling 46 per cent of Silk’s shares, have already pledged their support, contingent on the same conditions. The scheme is still subject to regulatory approvals and shareholder voting.

Nagambie Resources (ASX:NAG) has updated its JORC Inferred Resource estimate for its Nagambie Mine gold-antimony deposit, showing a significant increase in both size and grade. The new figures reflect higher gold and antimony prices, which have allowed for a lower cut-off grade and a larger resource. The updated resource now stands at 322,000 gold equivalent ounces (AuEq) at an average grade of 18.6 g/t AuEq, a 110 per cent increase from the previous estimate, with gold contributing 18 per cent and antimony 82 per cent.

Fintech stock Douugh (ASX:DOU) announced it has received its FY24 R&D tax refund for the work carried out on its Embedded Finance platform, Stakk, in FY24. The total amount received was around $1 million.

According to DOU's ASX announcement, Stakk is a full-service embedded finance platform, which helps brands launch their own fintech products, managed through a single admin portal.

Fonterra (ASX:FSF), meanwhile, raised its farmgate milk price forecast for the 2024/25 season, giving its shares a nice 2 per cent bump. The company also announced its intention to sell off its consumer unit.

ASX SMALL CAP LOSERS

Here are the worst-performing ASX small cap stocks for November 11:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AMD | Arrow Minerals | 0.001 | -50% | 562,267 | $26,447,256 |

| GMN | Gold Mountain Ltd | 0.001 | -50% | 159,648 | $7,814,946 |

| HCD | Hydrocarbon Dynamic | 0.002 | -33% | 214,285 | $2,425,747 |

| VPR | Voltgroupltd | 0.001 | -33% | 115 | $16,074,312 |

| FCG | Freedomcaregrouphold | 0.040 | -31% | 727,154 | $1,385,267 |

| RSG | Resolute Mining | 0.475 | -29% | 31,821,473 | $1,426,463,509 |

| TMK | TMK Energy Limited | 0.002 | -20% | 51,687,027 | $20,981,014 |

| CSX | Cleanspace Holdings | 0.400 | -18% | 86,361 | $38,065,328 |

| CZN | Corazon Ltd | 0.005 | -17% | 4,322,377 | $4,007,434 |

| MNC | Merino and Co | 0.875 | -17% | 663,574 | $55,730,399 |

| PRX | Prodigy Gold NL | 0.003 | -17% | 309,334 | $9,525,167 |

| SW1 | Swift Networks Group | 0.010 | -17% | 1,086,165 | $7,848,258 |

| LGM | Legacy Minerals | 0.160 | -16% | 304,339 | $20,036,449 |

| S66 | Star Combo | 0.110 | -15% | 124,727 | $17,560,788 |

| A1G | African Gold Ltd. | 0.065 | -14% | 1,534,654 | $27,280,924 |

| JAV | Javelin Minerals Ltd | 0.003 | -14% | 33,000 | $18,162,887 |

| T3D | 333D Limited | 0.006 | -14% | 16,715 | $836,115 |

| TEG | Triangle Energy Ltd | 0.006 | -14% | 1,571,751 | $14,560,938 |

| ATG | Articore Group Ltd | 0.325 | -13% | 339,081 | $107,574,627 |

| TKM | Trek Metals Ltd | 0.026 | -13% | 862,444 | $15,416,186 |

| RHT | Resonance Health | 0.040 | -13% | 1,940,640 | $20,557,075 |

| DTR | Dateline Resources | 0.004 | -13% | 114,683 | $10,065,042 |

| GCM | Green Critical Min | 0.007 | -13% | 2,761,534 | $12,208,341 |

| TSO | Tesoro Gold Ltd | 0.021 | -13% | 10,600,270 | $37,281,937 |

| RGT | Argent Biopharma Ltd | 0.255 | -12% | 35 | $15,738,958 |

IN CASE YOU MISSED IT

RiversGold (ASX:RGL)has sent samples from drilling at the Northern Zone gold project in WA off to the laboratory,with assays expected in four weeks.

“Northern Zone progress continues and I look forward to the next round of assays, as well as completion of the mineralisation report and application for a mining lease, so we can advance the project more quickly as we continue to see significant mineralised intercepts over an increasing porphyry footprint,” chairman David Lenigas said.

The drilling is following up previous assays including 5m at 12.27 g/tgold from 32m (including 1m at 58.09g/t gold from 34m).

“The more recent set of significant high-grade gold assays at Northern Zone have continued to expand the gold mineralised footprint of the porphyry over a much larger area than originally thought and it has confirmed the presence of a significant gold mineralised system, that is located just 25km east of Kalgoorlie, Western Australia, with all of the benefits of being brilliantly located to excellent roads and infrastructure,” Lenigas said.

“The Australian dollar gold price has passed $4000/ounce recently, and hovers around this mark, which bodes well for the project, something the board was hopeful of when it embarked on this journey.”

Earths Energy (ASX:EE1)has appointed a new non-executive director in Glenn Whiddon, who has an extensive background in equity capital markets, banking and corporate advisory with a specific focus on natural resources.

He is also currently a director of a number of public listed companies in the resources sector.

"Glenn is a highly skilled director that brings extensive energy sector and listed company experience to the board,” executive chair Grant Davey said.

"This is a particularly exciting time for the company, with the technical and economic study on our Paralana Project demonstrating that Paralana has the characteristics of a world-class geothermal system.”

EE1 holds 84 per cent of the Paralana and Flinders West geothermal projects in South Australia, which stand as Australia’s most advanced geothermal projects – which the company says have “outstanding development potential”.

At Stockhead, we tell it like it is. While RiversGold and Earths Energy are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should really consider obtaining independent advice before making any financial decisions.

Originally published as ASX Lunch Wrap: Novonix signs with car giant Stellantis, Resolute dumps after CEO detained in Mali