ASX Lunch Wrap: ASX rallies as Bitcoin soars past US$100k

ASX opens higher as Rio Tinto shifts focus to copper, and Bitcoin surges past US$100K.

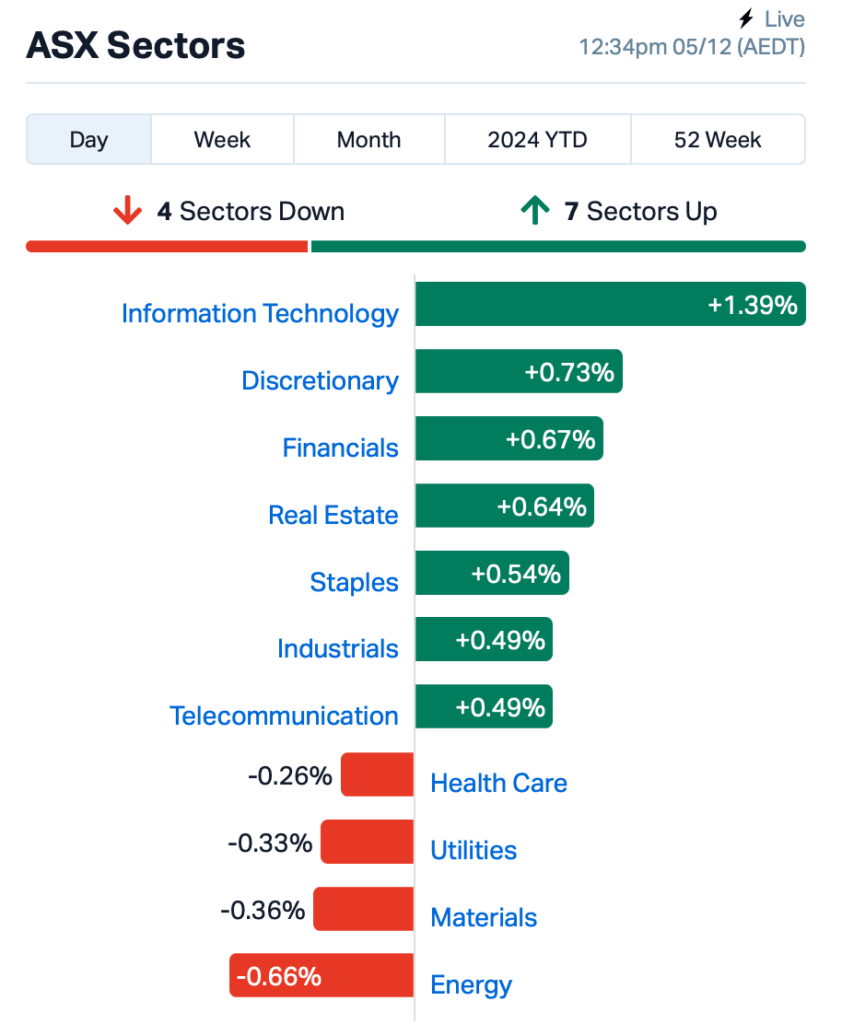

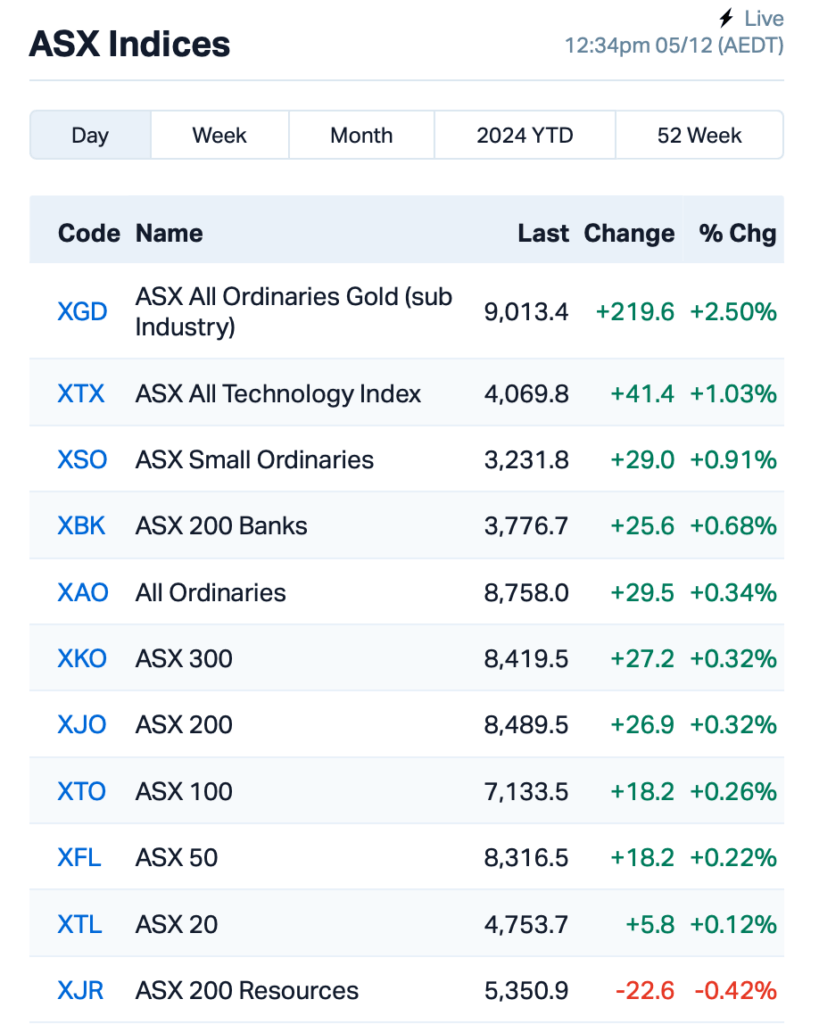

ASX opens higher, Tech leads, Energy lags

Rio Tinto shifts focus to copper

Bitcoin surges past US$100k on US SEC crypto-friendly pick

The ASX kicked off Thursday on a bullish note, echoing the Wall Street rally overnight where US tech giants, led by Atlassian's strategic Amazon tie-up, were the market's darlings.

Bitcoin, buoyed by Trump's crypto-friendly US SEC pick, Paul Atkins, also surged past the $US100,000 mark for the first time.

Atkins, a former SEC commissioner and experienced Washington insider, is expected to have a softer approach to crypto, including a more favourable stance on digital assets.

Also giving the price of BTC a boost, Federal Reserve chair Jerome Powell likened the leading digital asset to gold while speaking at the New York Times DealBook Summit midweek, describing it as a competitor to the precious metal.

"People use Bitcoin as a speculative asset. It's like gold, it's just like gold – only it's digital," said Powell, adding:

"People are not using it as a form of payment or a store of value. It's highly volatile. It's not a competitor for the dollar; it's really a competitor for gold. That's really how I think about it."

On the ASX today, the benchmark S&P/ASX 200 index was up by 0.3% at around 12.50pm AEDT.

Tech led, Energy lagged, and the Mining sector was a mixed bag.

Iron ore behemoth Rio Tinto (ASX:RIO) has signalled a strategic shift towards copper in an investor presentation, after saying that it eyes a 40% growth in copper production by 2030. Shares were down 1%.

In a separate development, HMC Capital (ASX:HMC) made a significant move in the renewable energy sector, acquiring Neoen's Victorian assets for $950 million. HMC’s shares jumped 2%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for December 5 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| GMN | Gold Mountain Ltd | 0.003 | 50% | 730,489 | $7,814,946 |

| NVO | Novo Resources Corp | 0.115 | 37% | 1,425,309 | $9,396,804 |

| CAV | Carnavale Resources | 0.004 | 33% | 21,250 | $12,270,655 |

| YAR | Yari Minerals Ltd | 0.004 | 33% | 26,865 | $1,447,073 |

| BLU | Blue Energy Limited | 0.009 | 29% | 3,065,643 | $12,956,815 |

| NPM | Newpeak Metals | 0.014 | 27% | 361,836 | $3,359,456 |

| CYM | Cyprium Metals Ltd | 0.024 | 26% | 5,789,080 | $28,993,284 |

| ATH | Alterity Therap Ltd | 0.005 | 25% | 39,353,443 | $21,281,344 |

| AYT | Austin Metals Ltd | 0.005 | 25% | 20,000 | $5,296,765 |

| ERA | Energy Resources | 0.003 | 25% | 288,400 | $810,792,482 |

| INP | Incentiapay Ltd | 0.005 | 25% | 323,753 | $5,169,360 |

| M2R | Miramar | 0.005 | 25% | 1,200,953 | $1,587,293 |

| CC5 | Clever Culture | 0.021 | 24% | 10,849,356 | $29,889,622 |

| LDX | Lumos Diagnostics | 0.038 | 23% | 18,111,421 | $23,118,561 |

| ADD | Adavale Resource Ltd | 0.003 | 20% | 250,510 | $3,087,330 |

| EGR | Ecograf Limited | 0.095 | 19% | 671,798 | $36,330,546 |

| YRL | Yandal Resources | 0.285 | 19% | 482,821 | $72,024,873 |

| WNX | Wellnex Life Ltd | 0.820 | 17% | 36,757 | $20,997,124 |

| ESR | Estrella Res Ltd | 0.021 | 17% | 12,248,260 | $34,218,694 |

| RGL | Riversgold | 0.004 | 17% | 813,390 | $4,882,388 |

| ARD | Argent Minerals | 0.023 | 15% | 9,696,777 | $28,912,810 |

| CCO | The Calmer Co Int | 0.008 | 14% | 60 | $15,465,705 |

| WSR | Westar Resources | 0.008 | 14% | 1,245,000 | $2,791,074 |

Novo Resources (ASX:NVO) has raised $11.5 million from the sale of 38% of its stake in privately owned San Cristobal Mining. The proceeds will support ongoing exploration projects in Western Australia and Victoria, and contribute to a $3 million payment due to IMC Holdings in December. After the sale, Novo holds $16.7 million in cash and values its remaining San Cristobal stake at $19 million. The company plans to use the funds to advance exploration and identify new opportunities.

NewPeak Metals (ASX:NPM) has entered into an agreement to acquire the Allaru Vanadium Project in Queensland, which holds an inferred resource of 710 million tonnes of vanadium. The acquisition will be paid with $5 million worth of NewPeak shares. NewPeak plans to raise an additional $2-3 million through a rights issue at the same share price. The project is a valuable addition to NewPeak’s portfolio of critical minerals, including vanadium, uranium and rare earth elements. In parallel, the company has sold assets in Finland, Sweden and New Zealand.

Cyprium Metals (ASX:CYM) has rejected a takeover offer from Appian Capital Advisory. The offer price of $0.035 per share was deemed too low and the conditions attached to the offer were seen as potentially detrimental to Cyprium's shareholders.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for December 5 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AFA | ASF Group Limited | 0.005 | -75% | 1,640 | $15,847,951 |

| AMD | Arrow Minerals | 0.001 | -50% | 22,857 | $26,447,256 |

| AXP | AXP Energy Ltd | 0.001 | -33% | 33,776 | $8,737,021 |

| NRZ | Neurizer Ltd | 0.002 | -33% | 727,384 | $8,453,582 |

| PRX | Prodigy Gold NL | 0.002 | -33% | 1,709,928 | $9,525,167 |

| LOM | Lucapa Diamond Ltd | 0.028 | -30% | 2,026,268 | $11,604,880 |

| BLZ | Blaze Minerals Ltd | 0.005 | -29% | 2,190,250 | $8,774,908 |

| ALR | Altairminerals | 0.003 | -25% | 6,799,226 | $17,186,310 |

| VPR | Voltgroupltd | 0.002 | -25% | 49,570 | $21,432,416 |

| BUS | Bubalusresources | 0.110 | -21% | 27,761 | $5,090,995 |

| WEC | White Energy | 0.038 | -21% | 10,000 | $9,551,245 |

| PPY | Papyrus Australia | 0.012 | -20% | 356,066 | $7,807,056 |

| AAU | Antilles Gold Ltd | 0.004 | -20% | 574,417 | $9,278,714 |

| BNL | Blue Star Helium Ltd | 0.004 | -20% | 218,502 | $13,474,426 |

| GGE | Grand Gulf Energy | 0.002 | -20% | 1,109,242 | $6,125,968 |

| MEL | Metgasco Ltd | 0.004 | -20% | 100,000 | $7,287,934 |

| RDN | Raiden Resources Ltd | 0.013 | -19% | 64,838,310 | $52,193,038 |

| CHM | Chimeric Therapeutic | 0.009 | -18% | 1,146,195 | $10,946,549 |

| 29M | 29Metalslimited | 0.270 | -18% | 6,158,651 | $230,881,255 |

| EV1 | Evolutionenergy | 0.023 | -18% | 10,000 | $10,095,880 |

| IMI | Infinitymining | 0.014 | -18% | 236,027 | $5,831,124 |

| ALM | Alma Metals Ltd | 0.005 | -17% | 5,011 | $9,399,133 |

| ASP | Aspermont Limited | 0.005 | -17% | 1,000,000 | $14,820,070 |

| CR9 | Corellares | 0.005 | -17% | 54,054 | $2,790,555 |

IN CASE YOU MISSED IT

Fresh off selling its Talga project to Global Lithium (ASX:GL1) to focus on antimony exploration, Octava Minerals (ASX: OCT) says it expects drilling results from the Discovery prospect early next year.

Drilling is progressing as planned, with the company gearing up for maiden drilling at the untested Central target, located 2km north of Discovery. Over at Octava’s Byro rare earths project, core drilling is complete, with metallurgical test work now underway at the CSIRO.

Legacy Minerals (ASX:LGM)has appointed Dr John Greenfield as its chief technical advisor.

Greenfield previously served as the director of the Geological Survey of New South Wales (GSNSW) and as Newmont Australia’s principal exploration geologist for NSW.

LGM managing director and CEO Christopher Bryne said Greenfield’s expertise and skills would be a welcomed addition to the company’s discovery-focused exploration efforts in NSW.

At Stockhead, we tell it like it is. While Octava Minerals and Legacy Minerals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as ASX Lunch Wrap: ASX rallies as Bitcoin soars past US$100k