ASX Lunch Wrap: ASX up 1pc as bargain hunters swoop in after last week’s sell-off

ASX dodges CHESS disaster, rises 1pc as bargain hunters swoop in across all sectors.

ASX dodges disaster after CHESS glitch

CBA, consumer stocks rebound; iron ore hit

Novo Nordisk tanks 20pc and Bitcoin slides

The ASX managed to avoid disaster on Monday, with the market opening as normal after a weekend scramble to resolve a major glitch in the CHESS settlement system.

The issue, which reared its ugly head late on Friday afternoon, left trades unprocessed, leaving brokers to scramble for billions to cover unsettled transactions.

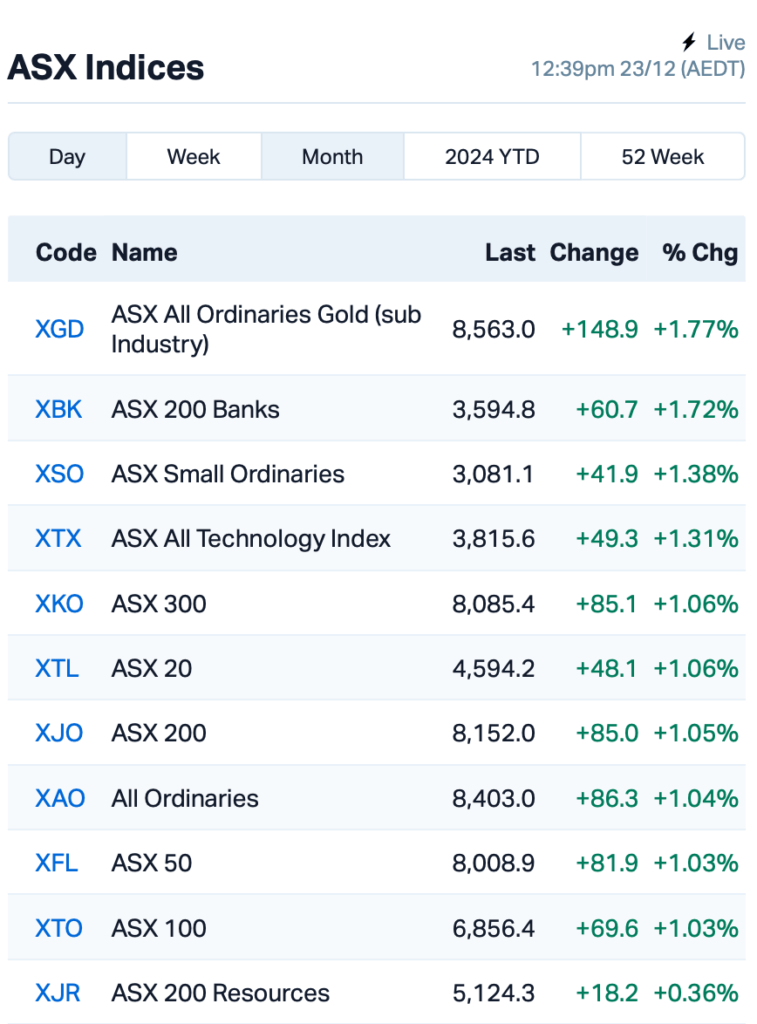

Investors took a breath of relief with the S&P/ASX 200 climbing 1% this morning, driven by bargain hunters swooping in after the heavy sell-off last week.

The big four banks were back on the up, with Commonwealth Bank (ASX:CBA) leading the charge, jumping 1.5% after a brutal 5% drop last week.

Consumer stocks also bounced back with Wesfarmers (ASX:WES) enjoying a decent gain of almost 1%.

On the commodities front, iron ore futures fell by 1.5%; while oil also posted a loss, trading below US$70 a barrel.

News Corp (ASX:NWS) rallied by 1.75% after agreeing to sell Foxtel to global sports streaming giant DAZN for $3.4 billion.

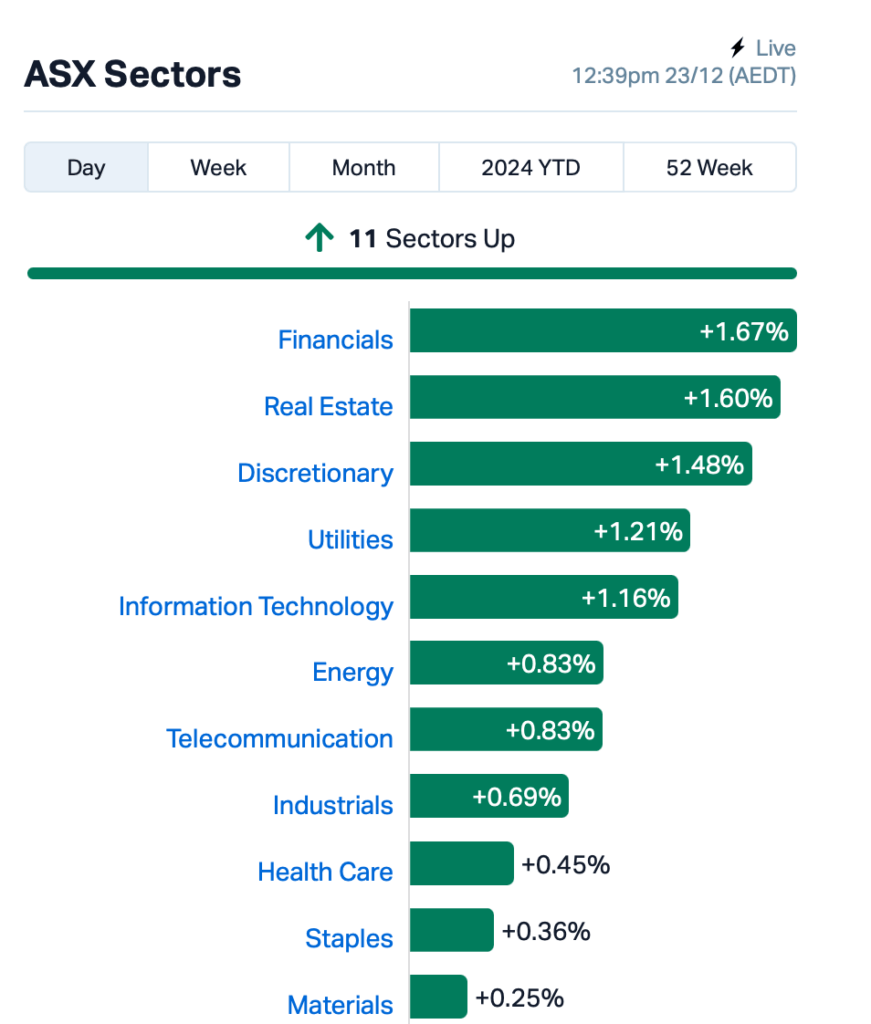

This is where things stood at around 12:40pm AEDT, where all 11 sectors were flashing green:

Over on Wall Street, all major indexes rose about 1% on Friday, but it wasn’t enough to make up for the losses earlier in the week.

The big news of the day was Novo Nordisk getting slammed, with its stock diving 20% after a disappointing trial for its obesity drug.

Study showed Novo's CagriSema helped patients lose 20.4% of their weight over 68 weeks, falling short of the 25% target it had promised.

Bitcoin, too, took a hit, with BTC now losing more than 10% over the past week. At the time of writing, it’s slipped below US$95,000, about $14,000 below its record high set earlier this month.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for December 23 :

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| AMD | Arrow Minerals | 0.002 | 100% | 3,598,726 | $13,223,628 |

| QEM | QEM Limited | 0.055 | 62% | 2,067,476 | $6,488,345 |

| BDG | Black Dragon Gold | 0.068 | 51% | 2,018,451 | $13,584,723 |

| CZN | Corazon Ltd | 0.003 | 50% | 349,907 | $2,335,811 |

| TX3 | Trinex Minerals Ltd | 0.002 | 33% | 17,500 | $2,742,978 |

| VEN | Vintage Energy | 0.004 | 33% | 686,816 | $5,008,594 |

| VFX | Visionflex Group Ltd | 0.004 | 33% | 500,000 | $10,065,974 |

| VPR | Voltgroupltd | 0.002 | 33% | 28,440,073 | $16,074,312 |

| PTX | Prescient Ltd | 0.054 | 32% | 9,872,775 | $33,018,112 |

| MTM | MTM Critical Metals | 0.190 | 31% | 9,982,951 | $58,958,273 |

| GIB | Gibb River Diamonds | 0.050 | 25% | 21,355 | $8,580,378 |

| LM1 | Leeuwin Metals Ltd | 0.125 | 25% | 410,974 | $4,685,167 |

| ERA | Energy Resources | 0.003 | 25% | 532,512 | $810,792,482 |

| DTZ | Dotz Nano Ltd | 0.110 | 21% | 84,393 | $49,808,029 |

| ASP | Aspermont Limited | 0.006 | 20% | 433,332 | $12,350,058 |

| AUK | Aumake Limited | 0.006 | 20% | 1,331,500 | $15,053,461 |

| MEM | Memphasys Ltd | 0.006 | 20% | 1,956,388 | $8,815,407 |

| AUQ | Alara Resources Ltd | 0.037 | 19% | 212,446 | $22,260,714 |

| JAT | Jatcorp Limited | 0.465 | 19% | 233,411 | $32,473,998 |

| BRN | Brainchip Ltd | 0.295 | 18% | 15,665,215 | $493,116,994 |

| GT1 | Greentechnology | 0.062 | 17% | 232,798 | $20,603,861 |

Arrow Minerals (ASX:AMD) said its Niagara’s bauxite discovery in Guinea just got bigger, now covering 12km². The latest drilling results have confirmed high-grade mineralisation, with grades up to 50% Al2O3. The company said the project is gaining interest from global bauxite giants, and with the world’s highest bauxite prices at US$120/t, the potential could be huge. Arrow’ is also progressing towards a maiden JORC resource estimate and scoping study in mid-2025.

QEM's (ASX:QEM) Julia Creek Vanadium and Energy Project (JCVEP) has been declared a ‘Coordinated Project’ by Queensland’s Office of the Coordinator General. This milestone streamlines regulatory approvals and sets the stage for an Environmental Impact Statement (EIS) under Queensland’s State Development Act.

Prescient Therapeutics (ASX:PTX) has secured US FDA approval for the phase II trial of PTX-100, its first-in-class Ras pathway inhibitor, targeting relapsed and refractory cutaneous T-cell lymphomas (r/r CTCL). This follows promising phase 1b results, where PTX-100 showed a 42% overall response rate and significantly outperformed standard treatment with a median progression-free survival of 12.2 months.

Gibb River Diamonds (ASX:GIB) has signed a Mining Benefits and Heritage Agreement (MBA) with the Nyalpa Pirniku native title holders for its Edjudina gold project in WA. The deal paves the way for the grant of the M31/495 mining lease, expected in early 2025. GIB is also planning a heritage survey for early next year and preparing a Mining Proposal to proceed with operations at the Neta Gold Prospect.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for December 23 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| GCR | Golden Cross | 0.002 | -33% | 3,530,151 | $3,291,768 |

| LNR | Lanthanein Resources | 0.002 | -33% | 11,502,434 | $7,330,908 |

| LNU | Linius Tech Limited | 0.001 | -33% | 5,741 | $9,226,824 |

| MXO | Motio Ltd | 0.026 | -26% | 820,004 | $9,747,619 |

| EDE | Eden Inv Ltd | 0.002 | -25% | 1,937,410 | $8,219,752 |

| FAU | First Au Ltd | 0.002 | -25% | 500,000 | $4,143,987 |

| CNJ | Conico Ltd | 0.009 | -25% | 911,134 | $2,849,848 |

| EML | EML Payments Ltd | 0.710 | -21% | 10,637,932 | $342,124,515 |

| IRI | Integrated Research | 0.430 | -21% | 1,275,486 | $96,657,226 |

| AOK | Australian Oil. | 0.002 | -20% | 1,520,000 | $2,504,457 |

| LSR | Lodestar Minerals | 0.013 | -19% | 1,241,537 | $2,697,872 |

| ENV | Enova Mining Limited | 0.005 | -17% | 5,176,621 | $5,909,576 |

| HYD | Hydrix Limited | 0.010 | -17% | 3,334 | $3,273,226 |

| RMI | Resource Mining Corp | 0.005 | -17% | 404,669 | $3,914,087 |

| TMX | Terrain Minerals | 0.003 | -17% | 108,009 | $5,432,086 |

| NWM | Norwest Minerals | 0.017 | -15% | 1,582,201 | $9,702,390 |

| AJL | AJ Lucas Group | 0.006 | -14% | 905,602 | $9,630,107 |

| ODE | Odessa Minerals Ltd | 0.006 | -14% | 322,146 | $11,196,728 |

| OSL | Oncosil Medical | 0.006 | -14% | 6,150,000 | $32,246,061 |

| PXX | Polarx Limited | 0.006 | -14% | 4,100,000 | $16,628,507 |

| RR1 | Reach Resources Ltd | 0.006 | -14% | 240,000 | $6,121,019 |

| STM | Sunstone Metals Ltd | 0.006 | -14% | 471,706 | $36,049,325 |

| ASV | Assetvisonco | 0.020 | -13% | 910,538 | $17,005,316 |

IN CASE YOU MISSED IT

Singular Health Group (ASX: SHG) has appointed highly regarded radiologist Dr Ronny Low as a technical advisor. Dr Low has over 20 years’ clinical experience across both public hospitals and private radiology groups in NSW and WA.

Challenger Gold (ASX: CEL) has moved closer to achieving its toll milling ambitions with financing secured to refurbish and restart the Casposo plant in Argentina. The US$7 million loan will enable the plant's restart, advancing the binding MoU to process mineralised material from CEL’s Hualilan project.

Spartan Resources (ASX:SPR) has appointed highly regarded resources finance executive Anna Neuling as an independent non-executive director. Simon Lawson is also transitioning from interim executive chair to executive chair.

Trigg Minerals (ASX:TMG) has announced its intention to list on the US OTCQB, with the process expected to take three to five weeks. Trigg says the dual listing will enhance engagement with US capital markets, data providers, and media outlets, providing US investors with real-time access to the same high-quality information available to Australian investors.

Eagle Mountain Mining (ASX:EM2) has secured a strategic land package at the Wedgetail project in Arizona, USA. The US$200,000 purchase secures access and infrastructure between the Oracle Ridge mine and the tailings storage facility, along with valuable water rights.

Legacy Minerals (ASX:LGM) has raised ~$1 million through a securities purchase plan, supported strongly by existing and new shareholders. The funds will be used to drive exploration and drilling activities at LGM’s Thomson and Drake projects in NSW.

At Stockhead, we tell it like it is. While Singular Health Group, Challenger Gold, Spartan Resources, Trigg Minerals, Eagle Mountain Mining and Legacy Minerals Holdings are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions

Originally published as ASX Lunch Wrap: ASX up 1pc as bargain hunters swoop in after last week’s sell-off