ASX Lunch Wrap: ASX starts sluggishly as iron ore, energy and ANZ take a tumble

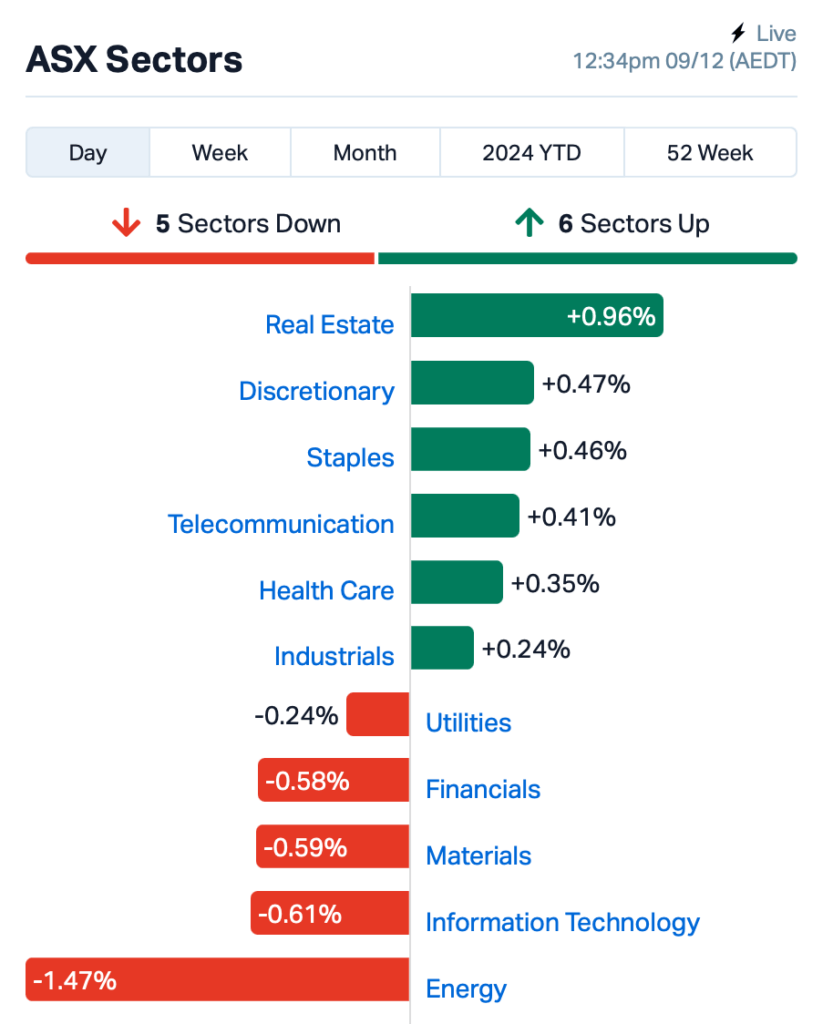

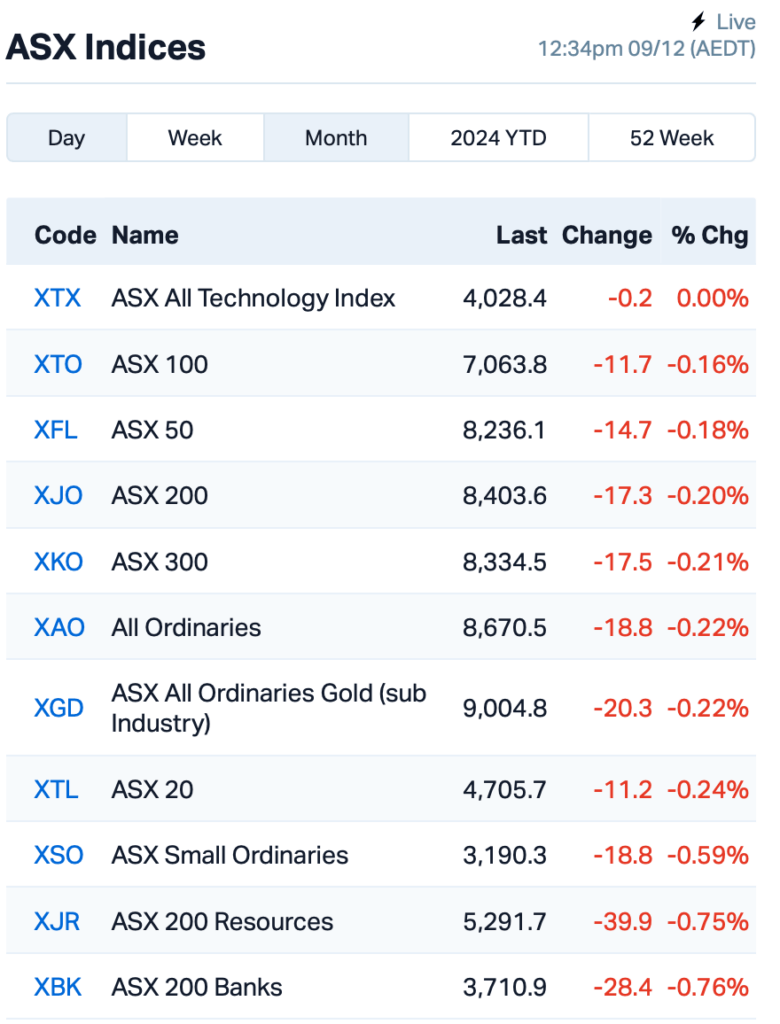

The ASX 200 has begun in sluggish fashion on Monday after Wall Street’s record high on Friday. ANZ has dipped on CEO news, while energy and iron ore sectors have fallen.

ASX drops after Wall Street record

ANZ shares fall with new CEO appointment

Energy sector, iron ore also took a hit

The ASX had a sluggish start to the week this morning, down about 0.2%, despite Wall Street hitting yet another record high.

On Friday, the S&P 500 reached its 57th record high of the year, though traders had a mixed reaction to the latest jobs report.

The report showed the US economy added 227,000 jobs in November, slightly surpassing expectations. The market is now pricing in a 90% chance of a 25 basis points rate cut by the Fed later this month.

On the ASX, however, investors appeared to shrug off that upbeat momentum, as iron ore prices fell and the Australian dollar dropped below US 64 cents this morning.

Iron ore futures dipped more than 1% in Singapore, dragging down the mining sector. Big names including BHP (ASX:BHP), Fortescue (ASX:FMG), and Rio Tinto (ASX:RIO) fell.

The energy sector also took a hit, following a larger-than-expected oil price cut by Saudi Arabia for Asia.

In the large caps space, Australia and New Zealand Banking Group (ASX:ANZ) tumbled 3% following the announcement of Nuno Matos as the bank's new CEO. Matos, who previously served as the CEO of HSBC Wealth and Personal Banking, is stepping into the role after Shayne Elliott’s retirement.

Platinum Asset Management (ASX:PTM) had a sharp drop of 16% after Regal Partners (ASX:RPL), a rival firm, ended buyout talks without a new deal in sight.

And, Woolworths (ASX:WOW) has reopened four of its distribution centres after an extended strike by workers came to an end. Woolworths reported a $140 million loss in Australian food sales during this period.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for December 9 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AMD | Arrow Minerals | 0.002 | 100% | 5,600,328 | $13,223,628 |

| NVQ | Noviqtech Limited | 0.130 | 40% | 9,748,498 | $20,872,673 |

| IGN | Ignite Ltd | 0.560 | 38% | 1,137 | $6,609,012 |

| M24 | Mamba Exploration | 0.015 | 36% | 1,301,747 | $2,068,905 |

| TGH | Terragen | 0.048 | 34% | 200,205 | $13,199,227 |

| IXU | Ixup Limited | 0.012 | 33% | 3,050,975 | $15,038,873 |

| KGL | KGL Resources Ltd | 0.115 | 29% | 602,900 | $57,682,061 |

| TON | Triton Min Ltd | 0.009 | 29% | 3,713,418 | $10,978,721 |

| DUB | Dubber Corp Ltd | 0.030 | 25% | 7,520,219 | $62,282,237 |

| ADD | Adavale Resource Ltd | 0.003 | 25% | 3,905,907 | $2,469,864 |

| NRZ | Neurizer Ltd | 0.003 | 25% | 495,169 | $5,635,721 |

| RRR | Revolverresources | 0.040 | 25% | 73,666 | $8,739,976 |

| VML | Vital Metals Limited | 0.003 | 25% | 8,949,264 | $11,790,134 |

| ARN | Aldoro Resources | 0.285 | 24% | 2,462,427 | $30,963,461 |

| KTA | Krakatoa Resources | 0.014 | 23% | 10,926,640 | $5,193,179 |

| ANX | Anax Metals Ltd | 0.011 | 22% | 1,559,616 | $7,842,914 |

| EMH | European Metals Hldg | 0.170 | 21% | 33,000 | $29,042,259 |

| CTN | Catalina Resources | 0.003 | 20% | 695,000 | $3,109,405 |

| SBW | Shekel Brainweigh | 0.024 | 20% | 1,500 | $4,561,225 |

| RAD | Radiopharm | 0.037 | 19% | 29,244,800 | $67,361,783 |

| TVN | Tivan Limited | 0.091 | 18% | 5,151,329 | $146,128,225 |

Arrow Minerals (ASX:AMD) share price doubled after the company reported exciting results from its Niagara Bauxite Project in Guinea. New high-grade bauxite assays extended the mineralisation to 5 km², confirming significant scale and quality in the deposit.

The project, located near a multi-user railway, has already caught the attention of potential bauxite customers, with strong demand driven by record high bauxite prices. The latest drilling results highlight impressive alumina grades, including several intercepts of over 50% Al2O3. With ongoing drilling and further results expected, Arrow has plans for a scoping study in 2025.

Triton Minerals (ASX:TON) has agreed to sell 70% of its Mozambique Graphite Assets to Shandong Yulong Gold for $17 million, to be paid in three stages by February 2025. Triton will retain a 30% stake in the assets.

The proceeds will fund Triton’s joint venture, exploration at its Aucu Gold and Copper Project, and new acquisitions. The company said it’s also confident the partnership with Yulong will advance its graphite projects and help drive future growth.

Krakatoa Resources (ASX:KTA) has secured an exclusive option to acquire up to 80% of the Zopkhito project in Georgia, a major antimony and gold deposit. The project covers 1,779 hectares and has a foreign estimate of 225,000 tonnes of antimony and 7.1 million tonnes of gold at significant grades.

KTA said only a fraction of the known mineral veins have been explored, leaving substantial upside potential. The company has raised $1.28 million to fund its next steps, with director participation pending shareholder approval.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for December 9 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ERA | Energy Resources | 0.002 | -33% | 511,198 | $1,216,188,722 |

| MOM | Moab Minerals Ltd | 0.002 | -33% | 197,340 | $4,700,998 |

| 88E | 88 Energy Ltd | 0.002 | -25% | 237,328 | $57,867,624 |

| T3D | 333D Limited | 0.010 | -23% | 799,865 | $2,290,385 |

| AYT | Austin Metals Ltd | 0.004 | -20% | 8,188 | $6,620,957 |

| BMO | Bastion Minerals | 0.004 | -20% | 309,108 | $4,223,623 |

| MMR | Mec Resources | 0.004 | -20% | 3,379,331 | $9,159,035 |

| SRN | Surefire Rescs NL | 0.004 | -20% | 7,631,286 | $9,931,539 |

| TMK | TMK Energy Limited | 0.002 | -20% | 1,488,442 | $23,313,913 |

| EUR | European Lithium Ltd | 0.050 | -19% | 3,909,762 | $86,683,604 |

| PAR | Paradigm Bio. | 0.470 | -19% | 4,192,969 | $202,596,090 |

| VAR | Variscan Mines Ltd | 0.009 | -18% | 4,632,012 | $8,121,673 |

| BTR | Brightstar Resources | 0.024 | -17% | 44,878,937 | $206,849,027 |

| PTM | Platinum Asset | 0.870 | -17% | 7,955,433 | $608,364,636 |

| RNX | Renegade Exploration | 0.005 | -17% | 2,008,357 | $7,704,021 |

| MNC | Merino and Co | 0.210 | -16% | 26,543 | $13,269,143 |

| 1CG | One Click Group Ltd | 0.011 | -15% | 100,000 | $12,335,278 |

| AZI | Altamin Limited | 0.023 | -15% | 300,739 | $15,511,578 |

| EFE | Eastern Resources | 0.036 | -14% | 484,152 | $5,295,778 |

| AL8 | Alderan Resource Ltd | 0.024 | -14% | 514,622 | $5,346,025 |

| BLZ | Blaze Minerals Ltd | 0.006 | -14% | 2,677,877 | $8,774,908 |

| KSN | Kingston Resources | 0.078 | -13% | 1,763,964 | $63,647,221 |

| BMG | BMG Resources Ltd | 0.013 | -13% | 5,315,093 | $11,366,957 |

IN CASE YOU MISSED IT

Recharge Metals (ASX:REC)has finalised the acquisition of the advanced Carter uranium project and a $2.5 million placement to drive exploration, with drilling set to start next year.

Located in the prolific Powder River Basin in the USA, the project sits within 250kms of six permitted ISR uranium production sites and lies in a region with a history of uranium exploration.

First announced in late October, the acquisition is a timely move, aligning with the renewed focus on nuclear power in the US.

At Stockhead, we tell it like it is. While Recharge Metals is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as ASX Lunch Wrap: ASX starts sluggishly as iron ore, energy and ANZ take a tumble