ASX Lunch Wrap: ASX defies Wall Street slump once again as Paladin, Boss Energy surge

The ASX is edging up at lunch on Friday despite a Wall Street slump. Energy stocks have surged, the Aussie dollar has dipped and RBA rate cuts are at risk.

ASX rises despite Wall Street slump

Energy stocks soar as oil prices climb

Aussie dollar dips, RBA’s rate cuts in jeopardy

The ASX started the second day of 2025 with a surprise lift, defying Wall Street’s grim session and keeping the momentum going after a strong showing yesterday.

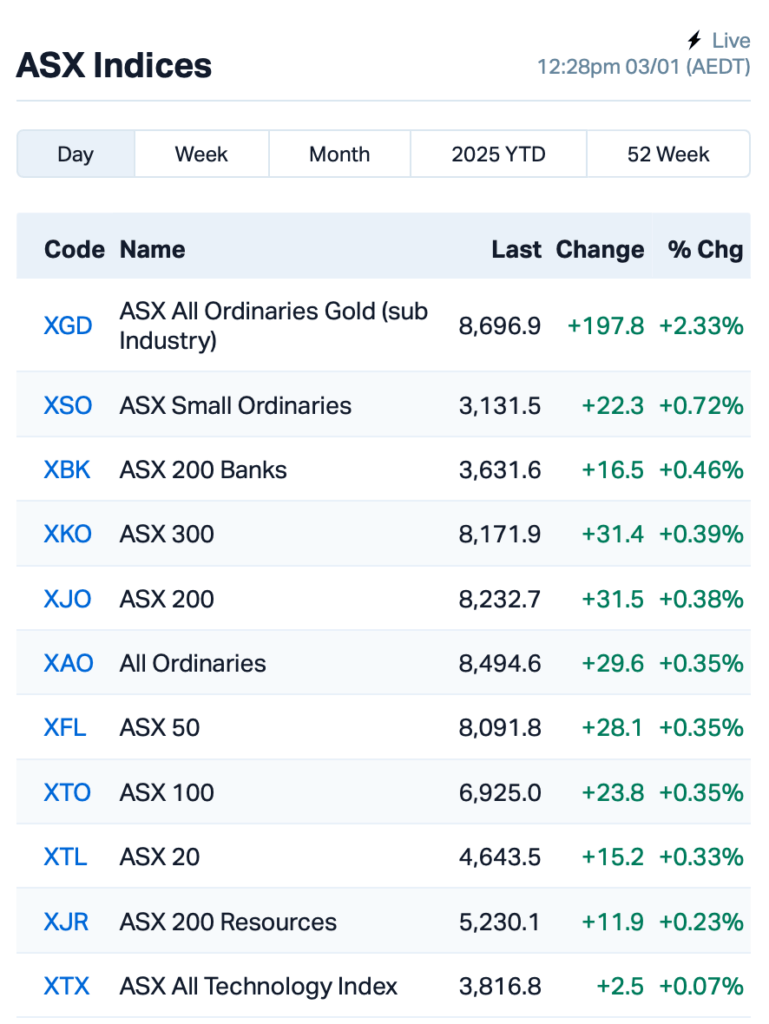

The S&P/ASX 200 index was up by 0.4% at 12:30pm AEDT, way ahead of what ASX futures had suggested before the opening bell.

Overnight, Wall Street had a rough ride again as it wiped out over a trillion bucks in the space of five days.

The S&P 500, Dow, and Nasdaq all finished in the red, dragged down by tech giants like Tesla which plunged by 6%.

Tesla tumbled after missing its Q4 delivery targets and seeing sales drop for the first time in a decade.

Traders were also spooked after US weekly jobless claims fell to an eight-month low.

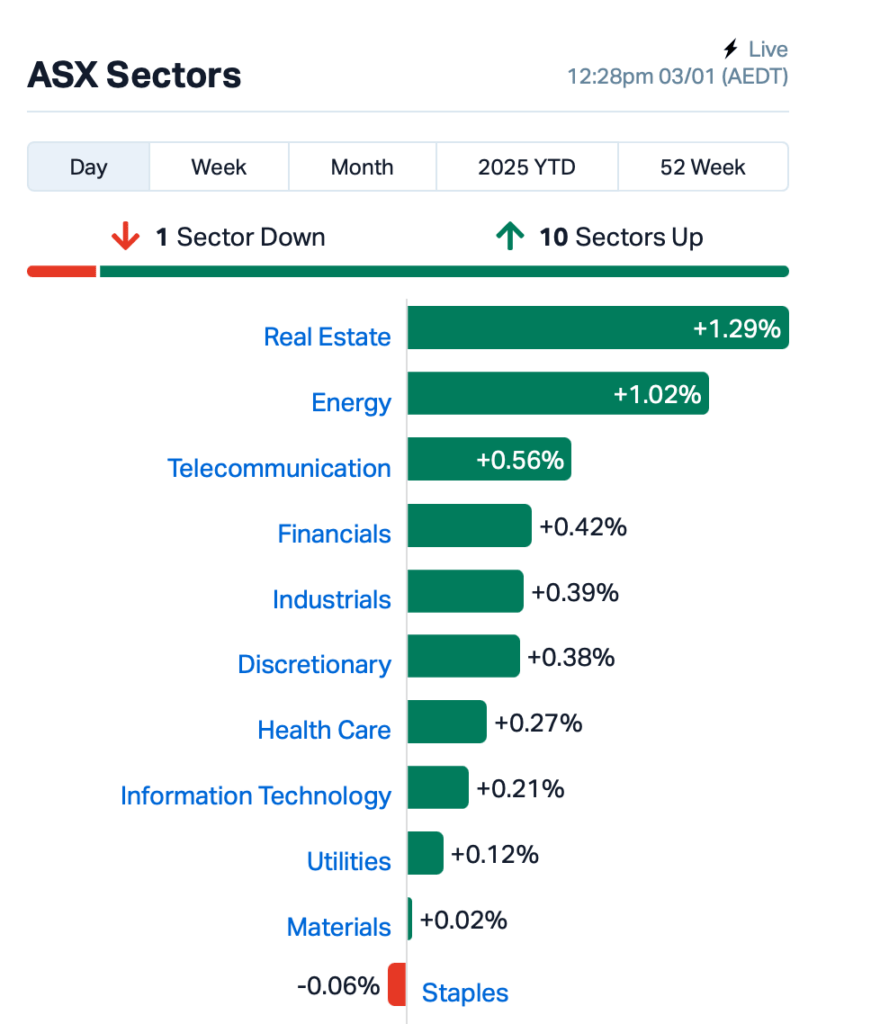

On the ASX this morning, ten out of 11 sectors opened higher, led by gains in real estate and energy stocks. This came as oil prices surged with US crude stockpiles falling.

Both Paladin Energy (ASX:PDN) and Boss Energy (ASX:BOE) saw huge jumps, up 8%.

Gold stocks are also having a good run this morning on the back of a 1% rise in spot bullion price.

But here’s one big worry: Aussie dollar weakness.

The AUD edged up overnight to just above US62 cents, although it’s still sitting at a two-year low.

Strategists warn it’s a sign the RBA’s rate-cut plans could be in jeopardy.

“If it keeps falling from here, say 20 per cent since the start of 2024, it could have an impact on the RBA’s decision,” said AMP chief economist, Shane Oliver.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for January 3 :

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| 88E | 88 Energy Ltd | 0.002 | 50% | 2,916,889 | $28,933,812 |

| EEL | Enrg Elements Ltd | 0.002 | 50% | 10,000,000 | $3,253,779 |

| MTB | Mount Burgess Mining | 0.006 | 50% | 650,000 | $1,358,150 |

| H2G | Greenhy2 Limited | 0.004 | 33% | 200,737 | $1,794,553 |

| FFF | Forbidden Foods | 0.009 | 29% | 490,790 | $4,005,564 |

| FNR | Far Northern Res | 0.140 | 27% | 5,000 | $3,989,241 |

| ETM | Energy Transition | 0.047 | 27% | 7,161,193 | $52,122,221 |

| CDT | Castle Minerals | 0.003 | 25% | 400,000 | $3,793,628 |

| AER | Aeeris Ltd | 0.075 | 21% | 10,000 | $4,535,229 |

| NES | Nelson Resources. | 0.003 | 20% | 12,000,000 | $5,429,819 |

| VEN | Vintage Energy | 0.006 | 20% | 2,025,633 | $8,347,656 |

| ESK | Etherstack PLC | 0.310 | 19% | 72,065 | $34,285,910 |

| MGL | Magontec Limited | 0.220 | 19% | 20,000 | $14,734,097 |

| BDG | Black Dragon Gold | 0.072 | 16% | 1,131,993 | $18,716,729 |

| PGD | Peregrine Gold | 0.150 | 15% | 189,457 | $8,824,195 |

| AI1 | Adisyn Ltd | 0.103 | 15% | 3,820,371 | $27,348,582 |

| 1AE | Auroraenergymetals | 0.055 | 15% | 100,000 | $8,595,059 |

| SHN | Sunshine Metals Ltd | 0.008 | 14% | 2,695,000 | $11,113,514 |

| VAR | Variscan Mines Ltd | 0.008 | 14% | 63,125 | $5,480,004 |

| TAT | Tartana Minerals Ltd | 0.050 | 14% | 300,000 | $9,422,419 |

| EL8 | Elevate Uranium Ltd | 0.300 | 13% | 1,970,782 | $102,188,190 |

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for January 3 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| TMK | TMK Energy Limited | 0.002 | -33% | 843,000 | $27,976,695 |

| 8IH | 8I Holdings Ltd | 0.007 | -30% | 45,243 | $3,481,609 |

| EAT | Entertainment | 0.003 | -25% | 768,347 | $5,235,144 |

| ENT | Enterprise Metals | 0.003 | -25% | 67,520 | $4,713,269 |

| ERA | Energy Resources | 0.003 | -17% | 544,626 | $1,216,188,722 |

| LML | Lincoln Minerals | 0.005 | -17% | 8,000 | $12,337,557 |

| TIG | Tigers Realm Coal | 0.003 | -17% | 72,737 | $39,200,107 |

| VML | Vital Metals Limited | 0.003 | -17% | 2,414,458 | $17,685,201 |

| 1AI | Algorae Pharma | 0.006 | -14% | 100,000 | $11,811,763 |

| ADN | Andromeda Metals Ltd | 0.006 | -14% | 452,637 | $24,001,094 |

| SPQ | Superior Resources | 0.006 | -14% | 175,500 | $15,189,047 |

| VRC | Volt Resources Ltd | 0.003 | -14% | 20,000 | $14,746,338 |

| ROG | Red Sky Energy. | 0.010 | -14% | 66,216,419 | $59,644,499 |

| BCB | Bowen Coal Limited | 0.007 | -13% | 6,132,059 | $86,204,221 |

| FTC | Fintech Chain Ltd | 0.007 | -13% | 68,761 | $5,206,157 |

| EVG | Evion Group NL | 0.024 | -11% | 428,781 | $9,368,006 |

| AKN | Auking Mining Ltd | 0.004 | -11% | 206,666 | $1,872,933 |

| A11 | Atlantic Lithium | 0.305 | -10% | 80,509 | $235,670,086 |

| AXI | Axiom Properties | 0.035 | -10% | 529,262 | $16,875,833 |

| SPX | Spenda Limited | 0.009 | -10% | 798,505 | $46,152,155 |

| TMS | Tennant Minerals Ltd | 0.009 | -10% | 5,500 | $9,558,904 |

| WBE | Whitebark Energy | 0.009 | -10% | 64,416 | $2,523,335 |

Red Sky Energy (ASX:ROG) dropped despite securing a 35% stake in Block 6/24 offshore Angola, located in the Kwanza Basin. The block spans nearly 5,000km² and has been well explored with extensive 2D and 3D seismic data. After reviewing the data, Red Sky sees strong potential for oil, with previous drilling uncovering the Cegonha oil field and a potential commercial discovery. The company has signed a Risk Service Contract with ANPG, ACREP, and Sonangol E&P, marking its first move into Angola.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as ASX Lunch Wrap: ASX defies Wall Street slump once again as Paladin, Boss Energy surge