ASX Lunch Wrap: ASX crumbles 2pc after Powell triggers brutal sell-off on Wall Street

The ASX plunged nearly 2pc earlier, as a brutal Wall Street sell-off followed the Fed’s cautious outlook, signalling just two rate cuts for 2025.

ASX drops almost 2pc after big Wall Street sell-off

Fed signals just two rate cuts in 2025

Megaport, Block Inc hit hard; Patriot Battery Metals rallies

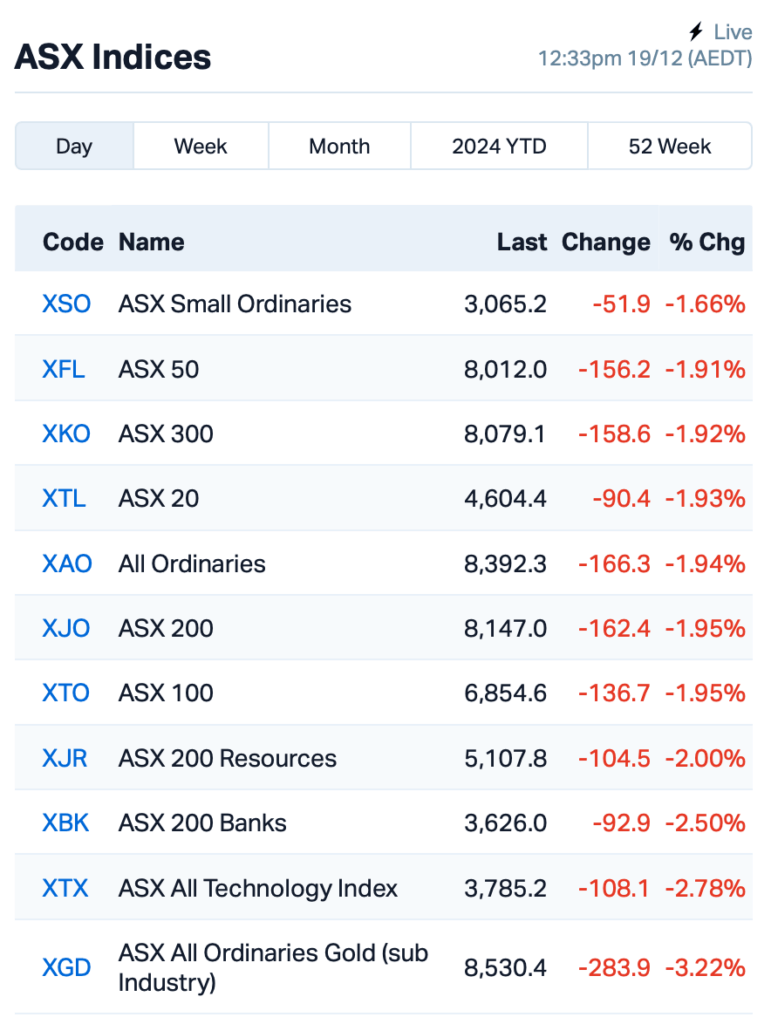

The ASX crashed on Thursday morning, with the S&P/ASX 200 benchmark dropping close to 2% within the first hour of trade.

This followed a particularly brutal session on Wall Street, where the major indices plummeted in response to the US Federal Reserve’s latest outlook on interest rates.

The Fed cut its rates by 25 basis points, as expected, but signalled only two rate reductions for 2025, dampening the market's mood.

And, at the tail end of last night’s press conference, a reporter threw Chair Jerome Powell a curveball: could the Fed rule out hiking rates next year?

You might have expected Powell to close the door on that idea. After all, US inflation is just a whisker above the Fed’s 2% target.

But his response was “You don’t rule things completely in or out in this world.”

The comments left investors scrambling for the exit – the S&P 500, the Nasdaq, and the Dow Jones all dropped by around 3% each.

“The next question is, how long will this sell-off go for?” said momoo’s Jessica Amir.

“We expect traders to be selective and perhaps buy the dip, which we're starting to see after hours. Some traders believe they can scoop up bargains at these levels.”

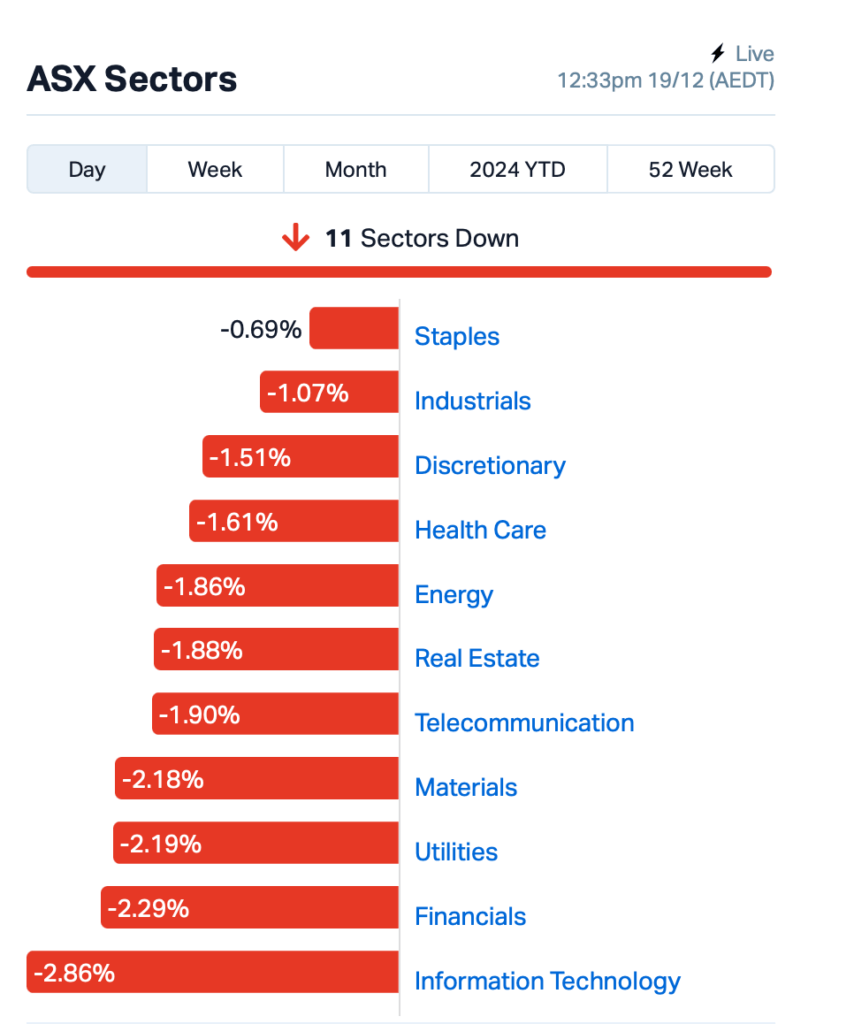

The ASX didn’t escape the fallout this morning, with all 11 sectors in the red by 12:30pm AEDT.

Tech and financials were hit particularly hard, while the Aussie dollar sank over 1% to hover just above US62 cents.

In the larger end of town, Mesoblast (ASX:MSB) stole the spotlight as its Ryoncil (remestemcel-L) became the first-ever FDA-approved mesenchymal stromal cell (MSC) therapy, now the go-to treatment for children aged 2 months and older with steroid-refractory acute graft versus host disease (SR-aGvHD).

The therapy showed a 70% response rate in its phase III trial. Mesoblast’s shares surged by 35%.

Shares in Patriot Battery Metals (ASX:PMT) also jumped 14% after Volkswagen invested C$69 million to secure a 9.9% stake in the lithium miner, locking in a long-term supply of critical materials for its electric vehicle batteries.

Now read: Carmakers power dreams of lithium revival as Patriot nabs C$69mn Volkswagen deal

Meanwhile, Megaport (ASX:MP1), the data centre giant, was hit hardest, falling 6.5%; while financial heavyweight Block Inc (ASX:SQ2) tumbled by 5%.

AGL Energy (ASX:AGL) also dropped 3% after being hit with a $25 million fine by the courts. The penalty stemmed from AGL’s failure to notify and refund around 500 customers on time.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for December 19 :

Security Description Last % Volume MktCap AYM Australia United Min 0.004 100% 977,360 $3,685,155 AMD Arrow Minerals 0.002 50% 3,118,346 $13,223,628 IBG Ironbark Zinc Ltd 0.003 50% 2,047,671 $3,667,296 BDG Black Dragon Gold 0.036 44% 2,821,386 $7,547,068 OBL Omni Bridgeway Ltd 1.385 44% 1,296,533 $272,693,739 NRZ Neurizer Ltd 0.002 33% 4,105,000 $4,226,791 AKN Auking Mining Ltd 0.005 25% 100,083 $1,565,401 T3D 333D Limited 0.010 25% 2,008 $1,409,468 TMK TMK Energy Limited 0.003 25% 1,586,000 $18,651,130 DCC Digitalx Limited 0.067 24% 39,991,599 $46,785,818 YOJ Yojee Limited 0.150 20% 123,413 $34,450,482 LNR Lanthanein Resources 0.003 20% 1,000,000 $6,109,090 CDR Codrus Minerals Ltd 0.019 19% 20,000 $2,646,200 CU6 Clarity Pharma 5.410 17% 1,913,339 $1,478,162,446 ICL Iceni Gold 0.075 17% 3,915,853 $17,753,908 RVT Richmond Vanadium 0.245 17% 13,056 $18,103,639 BUY Bounty Oil & Gas NL 0.004 17% 166,666 $4,495,503 OSL Oncosil Medical 0.007 17% 6,600,000 $27,639,481 PAB Patrys Limited 0.004 17% 250,000 $6,172,342 RGL Riversgold 0.004 17% 732,398 $4,882,388 WBE Whitebark Energy 0.007 17% 424,872 $1,514,001

Cosmos Exploration (ASX:C1X) has secured an exclusive option to acquire EAU Lithium, a company focused on Bolivia’s Lithium Triangle. EAU has partnered with Bolivia’s state-owned lithium group, Yacimientos de Litio Bolivianos, to test lithium brines from key salars using Vulcan Energy Resources (ASX:VUL)’s Direct Lithium Extraction (DLE) technology. If successful, Cosmos said this could help unlock Bolivia’s vast lithium resources.

Revaia has agreed to merge with RegenCo in an all-scrip deal, valuing Revaia at $24 million. Following the merger, Revaia's shareholders will own 32% of RegenCo, which will become one of Australia's leading independent carbon project developers, with a combined annual production of 450,000 Australian Carbon Credit Units (ACCUs). Powerhouse Ventures (ASX:PVL), which holds an investment in Revaia, will increase its stake with an additional $250,000.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for December 19 :

Code Name Price % Change Volume Market Cap PER Percheron 0.008 -86% 238,879,649 $64,158,820 NTD Ntaw Holdings Ltd 0.225 -42% 1,371,570 $64,567,430 MTL Mantle Minerals Ltd 0.001 -33% 167,650 $9,296,169 PKO Peako Limited 0.002 -33% 500,000 $3,285,425 TD1 Tali Digital Limited 0.001 -33% 1,380,000 $4,942,733 TKL Traka Resources 0.001 -33% 12,450 $2,963,488 PGY Pilot Energy Ltd 0.007 -30% 28,873,580 $16,420,716 CRR Critical Resources 0.005 -29% 11,462,290 $17,023,742 1TT Thrive Tribe Tech 0.002 -25% 256,064 $1,406,723 88E 88 Energy Ltd 0.002 -25% 1,510,910 $57,867,624 CR9 Corellares 0.003 -25% 1,023,116 $1,860,370 LNU Linius Tech Limited 0.002 -25% 300,000 $12,302,431 TX3 Trinex Minerals Ltd 0.002 -25% 21,989 $3,657,305 VRC Volt Resources Ltd 0.003 -25% 6,796,333 $16,634,713 ERG Eneco Refresh Ltd 0.010 -23% 80,000 $3,540,659 FHS Freehill Mining Ltd. 0.004 -20% 2,450,235 $15,392,639 AUK Aumake Limited 0.005 -17% 9,425 $18,064,153 AUR Auris Minerals Ltd 0.005 -17% 8,592 $2,859,756 BLZ Blaze Minerals Ltd 0.005 -17% 2,461,618 $9,401,687 ECT Env Clean Tech Ltd. 0.003 -17% 3,198,507 $9,515,431 RNX Renegade Exploration 0.005 -17% 400,000 $7,704,021 VML Vital Metals Limited 0.003 -17% 1,415,615 $17,685,201 BMR Ballymore Resources 0.130 -16% 217,709 $27,393,241

Deep Yellow (ASX:DYL) 's share price dropped after the company delayed its Final Investment Decision (FID) for the Tumas Uranium Project until March 2025, citing issues with delayed costings. While early works continue, the final plant construction depends on securing better pricing incentives for the greenfield project.

Originally published as ASX Lunch Wrap: ASX crumbles 2pc after Powell triggers brutal sell-off on Wall Street