ASX tech April winners: Sector pulls off market gymnastics to land on its feet

ASX tech found its rhythm in April as rate cut hopes and Wall Street gave it a lift; WhiteHawk and Elsight stole the defence show.

Tech gets its groove back with help from Wall Street and RBA

Defence tech darlings like WhiteHawk and Elsight grab the spotlight

Harvest Tech goes global, Droneshield fires again

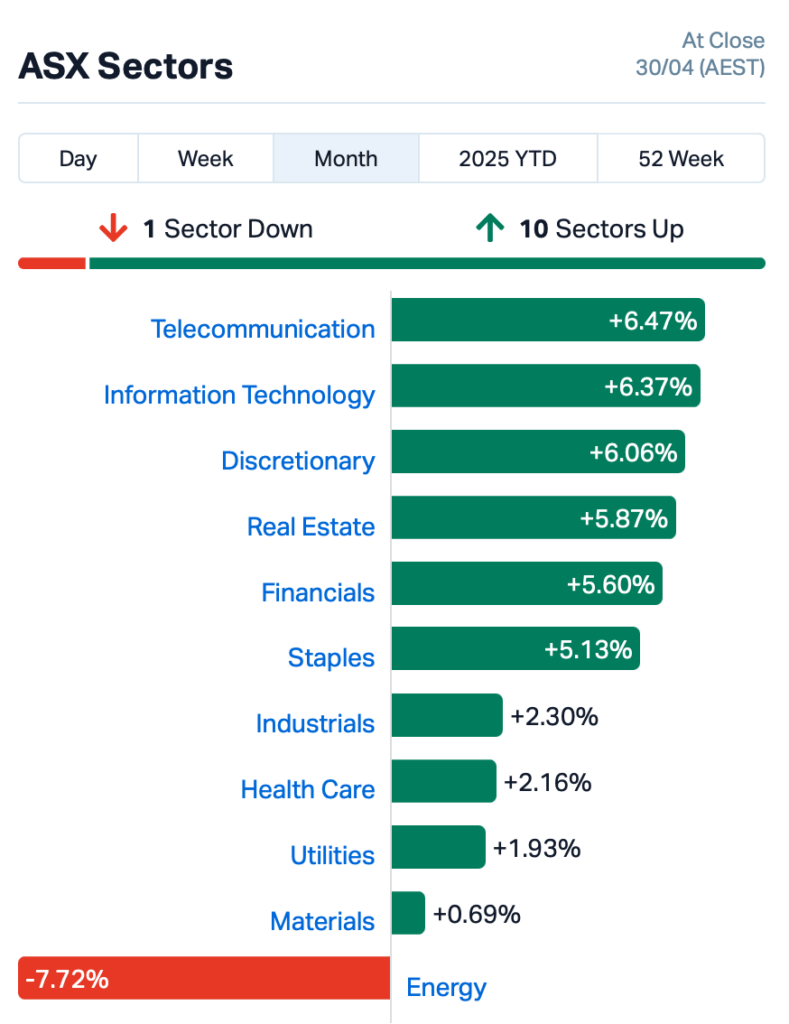

In April 2025, the ASX tech sector finally got its mojo back, punching out a near 6% gain and coming in just behind telcos for the month.

It marked a significant rebound for tech stocks, especially when the sector had been the worst performer in March.

Tech stocks managed to rally through the tariff chaos. Part of the lift also came from the RBA finally getting inflation back in the zone.

With trimmed mean inflation dipping to 2.9% – the first time it’s landed within the 2-3% target in almost four years – markets started whispering about rate cuts. ANZ thinks a 25bps this month is a near cert.

And in that kind of setup, tech stocks usually shine. Lower rates are like oxygen for growth stocks, and suddenly investors are leaning back in.

The US tech scene was lighting up too. Wall Street was rallying with the Nasdaq and S&P both ticking higher during the month, thanks to a fresh wave of optimism around the big global names after seeing off the worst of the post-Liberation Day sell off.

Aussie tech tends to follow Wall Street’s lead, and this time was no different. When the big dogs bark, the pack moves.

The big bonus came when Donald Trump stepped in with some tariff relief, cutting a break for consumer tech gear like smartphones and chips, before winding back some of his rhetoric on China and the US' other trade partners.

That took some pressure off and gave global tech a bit more breathing room, another tailwind that carried over to local players.

Put all that together, and April found a sweet spot for ASX tech — a mix of cooling inflation, global momentum, and a bit of policy luck, giving the sector the boost it was hanging out for.

ASX tech winners in April

| Code | Name | Price | Month % Change | Market Cap |

|---|---|---|---|---|

| WHK | Whitehawk Limited | 0.015 | 88% | $10,794,154 |

| HTG | Harvest Tech Grp Ltd | 0.020 | 54% | $17,918,935 |

| BDT | Birddog | 0.049 | 53% | $7,912,815 |

| UBN | Urbanise.Com Ltd | 0.805 | 45% | $51,929,748 |

| DRO | Droneshield Limited | 1.340 | 41% | $1,171,280,813 |

| 1TT | Thrive Tribe Tech | 0.002 | 33% | $4,063,446 |

| ELS | Elsight Ltd | 0.450 | 27% | $81,716,045 |

| ASB | Austal Limited | 5.310 | 26% | $2,236,466,034 |

| BRN | Brainchip Ltd | 0.270 | 26% | $546,950,268 |

| SNS | Sensen Networks Ltd | 0.028 | 22% | $22,205,049 |

| X2M | X2M Connect Limited | 0.020 | 18% | $7,566,825 |

| AVA | AVA Risk Group Ltd | 0.105 | 17% | $30,499,563 |

| KNO | Knosys Limited | 0.043 | 16% | $9,293,964 |

| CAT | Catapult Grp Int Ltd | 4.090 | 16% | $1,110,124,675 |

| EOL | Energy One Limited | 12.550 | 15% | $393,196,307 |

| DUB | Dubber Corp Ltd | 0.041 | 14% | $107,558,066 |

| EIQ | Echoiq Ltd | 0.330 | 14% | $194,211,944 |

| MP1 | Megaport Limited | 11.420 | 14% | $1,835,759,096 |

| AJX | Alexium Int Group | 0.009 | 13% | $14,277,858 |

| SPZ | Smart Parking Ltd | 0.865 | 12% | $354,782,268 |

| DTZ | Dotz Nano Ltd | 0.075 | 12% | $42,817,322 |

| FND | Findi Limited | 4.600 | 11% | $284,285,617 |

| WTC | Wisetech Global Ltd | 88.520 | 11% | $29,615,314,049 |

| HSN | Hansen Technologies | 5.410 | 10% | $1,102,731,753 |

| ESK | Etherstack PLC | 0.285 | 10% | $37,669,021 |

| DWG | Dataworks Group | 0.175 | 9% | $17,889,208 |

| KYP | Kinatico Ltd | 0.180 | 9% | $77,776,557 |

| BCC | Beam Communications | 0.099 | 8% | $8,555,770 |

| ATA | Atturralimited | 0.875 | 7% | $333,959,567 |

| FCL | Fineos Corp Hold PLC | 2.190 | 7% | $741,314,266 |

| AMO | Ambertech Limited | 0.160 | 7% | $15,264,765 |

| YOJ | Yojee Limited | 0.175 | 6% | $55,975,125 |

| FCT | Firstwave Cloud Tech | 0.018 | 6% | $30,843,336 |

| AT1 | Atomo Diagnostics | 0.018 | 6% | $11,505,642 |

| TNE | Technology One | 30.060 | 5% | $9,840,698,342 |

| XRO | Xero Ltd | 164.190 | 5% | $25,222,482,282 |

| 360 | Life360 Inc. | 21.940 | 5% | $3,862,333,002 |

| TYR | Tyro Payments | 0.805 | 5% | $425,319,795 |

| SKO | Serko | 3.490 | 4% | $429,711,021 |

| DCC | Digitalx Limited | 0.052 | 4% | $62,588,442 |

| CF1 | Complii Fintech Ltd | 0.027 | 4% | $15,427,628 |

| VIG | Victor Group Hldgs | 0.062 | 3% | $40,438,054 |

| AR9 | Archtis Limited | 0.064 | 3% | $18,429,898 |

| OCL | Objective Corp | 15.650 | 3% | $1,495,956,050 |

| BTH | Bigtincan Hldgs Ltd | 0.215 | 2% | $176,660,326 |

| GTK | Gentrack Group Ltd | 10.800 | 2% | $1,163,396,477 |

| OEC | Orbital Corp Limited | 0.090 | 2% | $14,830,175 |

| CCR | Credit Clear | 0.235 | 2% | $99,792,431 |

| PPS | Praemium Limited | 0.745 | 2% | $355,897,805 |

| XYZ | Block Inc | 92.300 | 2% | $5,191,834,942 |

| QHL | Quickstep Holdings | 0.575 | 2% | $41,242,573 |

| DTL | Data#3 Limited | 7.280 | 2% | $1,127,732,664 |

| CPU | Computershare Ltd | 40.720 | 1% | $23,804,505,004 |

| NXT | Nextdc Limited | 11.830 | 1% | $7,576,122,345 |

| DSE | Dropsuite Ltd | 5.810 | 1% | $412,442,372 |

Cybersecurity firm Whitehawk’s shares soared after landing a major cyber deal in the US, teaming up with Knexus Research and a few big-name players on a government-wide contract worth up to US$920 million over 10 years.

WHK is the only cyber partner on the team, which beat out 22 other groups to win the deal.

The contract doesn’t bring in cash straight away, it's task-based, so the dollars flow as the work gets handed out. But thanks to a White House order pushing more federal spending into deals like this, WhiteHawk reckons there’s big recurring revenue potential ahead.

WHK’s role will be to roll out cyber risk tools to help US agencies fight fraud and foreign threats.

Harvest Technology Group (ASX:HTG)

During the month of April, Harvest listed on the Frankfurt Stock Exchange, giving it a foot in the door to Europe’s massive capital markets without issuing new shares.

The move is aimed at building visibility and drawing in more European investors across key sectors like defence, telco, aerospace, and maritime, where demand for its low-bandwidth, secure video tech is on the rise.

The listing lines up with HTG’s growing customer base in Europe, where its Nodestream platform is already making rapid traction.

HTG is now planning a roadshow across the continent in June, catching up with customers and pitching to high-level investors.

No dilution, low cost, and a shot at global growth, HTG reckons this move is right on target.

During the month, Urbanise reported its performance year for FY24.

The company tightened its focus and set itself up for longer-term growth.

It brought in a new Chairman, Darc Rasmussen, who saw straight away that Urbanise could lead the way in strata and facilities management software.

The company is now running hard on a three-part game plan: grow its customer base, deliver more value through smart features, and connect clients with service providers directly through its platform.

Over the year, it locked in $1.04 million in new recurring revenue, added clever new tools like predictive analytics, and slashed operating costs by 14% thanks to better cash flow and fewer bespoke projects.

The plan is to hit cash flow sustainability by FY25, and the company said it’s laser-focused on making it happen.

Droneshield rose after locking in five fresh defence contracts worth $32.2 million from a military customer in the Asia Pacific during April, via a big-name global reseller.

The company will deliver counterdrone gear through Q2 and Q3 next year, with payments expected during that time.

The new deals follow $12.3 million in previous orders from the same buyer, showing demand is ramping up as militaries move from trial runs to full rollouts.

With gear that tackles next-gen drone threats, DroneShield reckons it’s in the box seat as interest picks up across the region.

Elsight is entering a big new phase, locking in a $4.25 million deal with a European defence giant to deliver its technology over four months.

CEO Yoav Amitai reckons it will not only give revenue a nice lift but also put Elsight firmly on the radar in the booming defence space.

With war tensions driving up defence budgets across Europe and the US, Yoav says Elsight’s drone comms gear is landing in the right place at the right time, giving unmanned systems stronger, smarter control.

And even with global tariff noise around, the company said it’s staying steady thanks to a spread-out manufacturing setup.

Yoav said this recent deal in Europe just the beginning.

ASX tech losers in April

| Code | Name | Price | Month % Change | Market Cap |

|---|---|---|---|---|

| FBR | FBR Ltd | 0.006 | -40% | $33,813,791 |

| ATV | Activeportgroupltd | 0.009 | -36% | $6,164,794 |

| NVQ | Noviqtech Limited | 0.031 | -34% | $7,797,633 |

| EPX | Ept Global Limited | 0.026 | -33% | $17,127,137 |

| LNU | Linius Tech Limited | 0.001 | -33% | $6,151,216 |

| VR1 | Vection Technologies | 0.018 | -33% | $27,549,994 |

| IFG | Infocusgroup Hldltd | 0.007 | -30% | $1,754,886 |

| 3DP | Pointerra Limited | 0.060 | -29% | $48,304,608 |

| SPX | Spenda Limited | 0.005 | -29% | $23,076,077 |

| CT1 | Constellation Tech | 0.002 | -25% | $2,212,101 |

| PIL | Peppermint Inv Ltd | 0.003 | -25% | $6,712,918 |

| NXL | Nuix Limited | 2.430 | -24% | $803,681,994 |

| GTI | Gratifii | 0.075 | -22% | $25,409,205 |

| EXT | Excite Technology | 0.011 | -21% | $20,049,061 |

| SP3 | Specturltd | 0.011 | -21% | $3,389,651 |

| CGO | CPT Global Limited | 0.050 | -21% | $2,094,868 |

| SEN | Senetas Corporation | 0.019 | -20% | $30,636,353 |

| IOD | Iodm Limited | 0.145 | -19% | $89,401,807 |

| ROC | Rocketboots | 0.081 | -19% | $11,795,694 |

| FL1 | First Lithium Ltd | 0.065 | -19% | $5,177,484 |

| OPL | Opyl Limited | 0.026 | -19% | $5,017,176 |

| RDY | Readytech Holdings | 2.100 | -19% | $256,494,158 |

| PRO | Prophecy Internation | 0.425 | -18% | $31,343,297 |

| SLX | Silex Systems | 3.090 | -18% | $735,737,417 |

| HCL | Highcom Ltd | 0.180 | -16% | $18,482,881 |

| CYB | Aucyber Limited | 0.078 | -16% | $16,332,942 |

| ASV | Assetvisonco | 0.032 | -16% | $23,659,570 |

| XF1 | Xref Limited | 0.115 | -15% | $25,310,323 |

| 8CO | 8Common Limited | 0.018 | -14% | $4,033,708 |

| EVS | Envirosuite Ltd | 0.072 | -14% | $104,306,666 |

| W2V | Way2Vatltd | 0.006 | -14% | $5,604,001 |

| WBT | Weebit Nano Ltd | 1.765 | -14% | $366,935,969 |

| DTI | DTI Group Ltd | 0.007 | -13% | $3,139,860 |

| EOS | Electro Optic Sys. | 1.225 | -13% | $236,366,321 |

| XPN | Xpon Technologies | 0.007 | -13% | $2,537,090 |

| LIS | Lisenergylimited | 0.110 | -12% | $70,422,025 |

| OLL | Openlearning | 0.015 | -12% | $7,240,120 |

| AXE | Archer Materials | 0.265 | -12% | $67,534,458 |

| CXZ | Connexion Mobility | 0.027 | -11% | $22,174,299 |

| NVX | Novonix Limited | 0.425 | -11% | $270,323,663 |

| 1CG | One Click Group Ltd | 0.008 | -11% | $9,423,039 |

| BLG | Bluglass Limited | 0.016 | -11% | $29,448,965 |

| HYD | Hydrix Limited | 0.016 | -11% | $4,364,302 |

| SPA | Spacetalk Ltd | 0.205 | -11% | $14,926,476 |

| VNL | Vinyl Group Ltd | 0.094 | -10% | $118,350,130 |

| BEO | Beonic Ltd | 0.180 | -10% | $12,754,981 |

| AI1 | Adisyn Ltd | 0.050 | -9% | $36,116,280 |

| RKT | Rocketdna Ltd. | 0.010 | -9% | $9,155,232 |

| RWL | Rubicon Water | 0.255 | -9% | $61,377,250 |

| COS | Cosol Limited | 0.730 | -9% | $132,851,821 |

| XRG | Xreality Group Ltd | 0.032 | -9% | $18,271,433 |

| IFM | Infomedia Ltd | 1.240 | -8% | $469,240,416 |

| SOR | Strategic Elements | 0.034 | -8% | $15,939,487 |

| DUG | DUG Tech | 1.025 | -8% | $138,024,041 |

| NOR | Norwood Systems Ltd. | 0.024 | -8% | $11,750,684 |

| ODA | Orcoda Limited | 0.074 | -8% | $13,876,052 |

| JCS | Jcurve Solutions | 0.025 | -7% | $8,258,586 |

| 5GN | 5G Networks Limited | 0.130 | -7% | $38,744,410 |

| NVU | Nanoveu Limited | 0.039 | -7% | $28,954,779 |

| QOR | Qoria Limited | 0.395 | -7% | $514,126,184 |

| FLX | Felix Group | 0.200 | -7% | $40,899,943 |

| IRI | Integrated Research | 0.410 | -7% | $72,714,610 |

| MX1 | Micro-X Limited | 0.058 | -6% | $38,522,051 |

| SMN | Structural Monitor. | 0.390 | -6% | $60,178,969 |

| ACE | Acusensus Limited | 1.050 | -5% | $147,027,155 |

| PPK | PPK Group Limited | 0.305 | -5% | $27,697,812 |

| AD8 | Audinate Group Ltd | 6.140 | -5% | $511,815,627 |

| ERD | Eroad Limited | 0.840 | -4% | $157,424,931 |

| RUL | Rpmglobal Hldgs Ltd | 2.750 | -4% | $610,623,648 |

| SMP | Smartpay Holdings | 0.770 | -4% | $186,296,467 |

| NOV | Novatti Group Ltd | 0.027 | -4% | $14,657,783 |

| 4DS | 4Ds Memory Limited | 0.030 | -3% | $60,069,707 |

| TZL | TZ Limited | 0.062 | -3% | $17,398,074 |

| RKN | Reckon Limited | 0.480 | -3% | $54,381,519 |

| JAN | Janison Edu Group | 0.165 | -3% | $42,881,562 |

| DXN | DXN Limited | 0.034 | -3% | $10,155,924 |

| IKE | Ikegps Group Ltd | 0.715 | -3% | $115,159,825 |

| PHX | Pharmx Technologies | 0.077 | -3% | $46,085,023 |

| BVS | Bravura Solution Ltd | 2.190 | -2% | $981,895,264 |

| IRE | IRESS Limited | 7.950 | -2% | $1,484,976,318 |

| CDA | Codan Limited | 15.750 | -2% | $2,859,740,762 |

| EML | EML Payments Ltd | 0.975 | -2% | $372,343,316 |

| VGL | Vista Group Int Ltd | 3.280 | -1% | $783,376,770 |

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decision.

At Stockhead we tell it like it is. While Harvest Technology Group is a Stockhead advertiser, it did not sponsor this article.

Originally published as ASX tech April winners: Sector pulls off market gymnastics to land on its feet