Broking Bad: JP Morgan’s iron curtain falls on BHP and RIO; UBS initiates Codan coverage

With life tough for China-leaning Aussie miners, JP Morgan has done investors a solid, with a head-to-head comparison of iron ore heavyweights Rio and BHP.

Tough times for China-leaning Aussie miners.

The client-side problem is evident – Thursday’s session for example captured the dichotomy nicely, thusly:

Chinese inflation data this week shows an economy unable to break the shackles of a deflationary vortex, the mixed messages on the stutter-rap nature of the world’s second-largest economy translates into a mixed day for the big miners.

For the latest ASX news, sign up here for free Stockhead daily newsletters

Hanging on for bad enough news to force Beijing onto a clearer stimulatory path appears to be an unsatisfactory strategy.

In some handy timing, JP Morgan this week completed and released a comparative appraisal of BHP’s (ASX:BHP) and Rio Tinto’s (ASX:RIO) respective iron ore divisions, which comprise about 60 per cent of the valuation for each company.

The conclusion is BHP until 2034, then jump ship to Rio.

So put that in your calendar.

JPM reckons that from an investment standpoint, there’s not much separating the companies, but BHP has underperformed over a six/12-month view and has the edge going forward.

BHP remains JPM’s preference based on:

- Its slightly cheaper valuation

- The fact BHP presents marginally cheaper than RIO with a price/NPV of 0.84x (RIO at 0.85x), with both stocks on about 11x PE and offering around 6 per cent yield

- BHP’s greater copper exposure (about 35 per cent versus RIO at about 18 per cent in FY25) is the winning angle for JPM and should provide a slightly stronger tailwind from a share price perspective

Here’s the espresso version of JPM’s comparative drill down:

- Over the next 10 years, BHP produces higher EBITDA per ton based on about $4-5/t lower operating expenditure and $1-3/t higher revenue

- Both are operating the businesses reliably, but RIO’s depletion replacement spend is materially higher over the next decade

- Unit costs also favour BHP near term, which are about $4-5/t lower – again RIO catches up longer term

- BHP generates about $18 billion more cumulative free cash flow to 2034, before it equalises long term, post RIO bringing on its depletion replacement mines, along with Rhodes Ridge

- BHP is set to report higher WAIO (West Australian Iron Ore) NPAT than RIO, with their net present value (NPV) for BHP’s WAIO operations about 13 per cent higher

- Long term, JPM models RIO and BHP production at 360Mtpa and 330Mtpa respectively, and FCF per ton narrowing to $4 (in favour of BHP)

On the operational front, RIO’s performance has notably improved over the last few years, JPM notes, but it says the company will need to continue to shell out heavily through the current investment phase to replace mine depletion, which JPM calculates is happening at circa 5 per cent per annum.

Morgan Stanley still Overweight on Rio

That all said, on Tuesday the other Morgans (Stanley) maintained an Overweight recommendation on Rio after it went big from Japan in Gladstone and snapped up Mitsubishi Corp’s 11.65 per cent interest in the Boyne aluminium smelter in that part of Qld.

The announcement follows Rio’s recent acquisition of Sumitomo Chemical Company’s 2.46 per cent stake.

Morgan Stanley’s investment thesis holds, as does Rio’s commitment to aluminium as a long-term player which could benefit from forward looking demand for the metal, especially through its low-cost/low-carbon Canadian interests.

It set a price target of $137.50 (versus $119.77 on Friday at 3.30pm), with a consensus view: of Attractive

Also under broker’s microscope

CODAN (ASX:CDA)

UBS has set a buy price target is $13.10 (versus the Friday price of $11.50)

Codan is an Australian manufacturer and supplier of communications, metal detection and mining technology.

Founded in 1959, the company listed on the ASX in 2003.

Its core clientele are gold prospectors in Africa, communications solutions for government, NGOs, and consumers globally.

UBS forecasts a 28 per cent three-year cash EPS compound annual growth rate, supported by an annual 150bps EBIT margin expansion in the Communication division and 10-15 per cent organic revenue growth.

Over the past three years, management has invested big time into its Communications fixed cost base via sales and marketing, and increasing the headcount within Product Development, explains the analyst.

MORE FROM STOCKHEAD: Oil looks a stubborn beast | FDA roadblock for MDMA | Apple’s AI takes bit out of Nvidia

The Communication division represents around 60 per cent of group earnings (was 10 per cent) and can be broken into 3 main areas:

- Domo Tactical Communications (DTC): Provides wireless communication systems to military, special services, and law enforcement. DTC’s products are purpose-built transmitters, radios, videos that enable uninterrupted and heavily encrypted communications. The division is exposed to developed economies’ defence budgets and general global conflict. There are tailwinds to this business given current global geopolitical conditions.

- Domo Broadband: Broadcasting solutions such as transmitters, receivers, encoders, decoders that enable low-latency video/audio streaming through wireless cameras. These products are used for sports, cinema, and general events broadcasting. Domo has a solid legacy presence in Europe.

- Zetron: IP protected portfolio of software & hardware products for command & control centres. The software element enables control room personnel to receive and log emergency/incident calls and then co-ordinate an appropriate response with emergency teams such as ambulances, fire stations, police etc.

Zetron has a decent position in North America; the good news being ye olde Motorola Solutions is its key competitor in the States.

Codan’s other main business is metal detection selling into both recreational and military markets.

The business has had a very similar trajectory and strategy to that of Imdex (ASX:IMD) and ALS (ASX:ALQ) in terms of the track record of customer upsell to higher value products alongside greater levels of product investment versus competitors, which has driven long-term market share wins.

CDA also boasts a handy position selling into African miners. There’s significant volatility to this revenue stream, UBS notes, although it now only represents about 5 per cent of group revenue versus prior peak levels of around 40 per cent.

Visit Stockhead, where ASX small caps are big deals

This business mix segues from over two-thirds metal detection as recently FY21 to 60 per cent Communication, has created more predictable and resilient cash-backed earnings, the broker says.

A robust balance sheet and a fresh pocket of circa $150 million (debt facility) add ballast and flexibility for valuation accretive M&A, in the broker’s view.

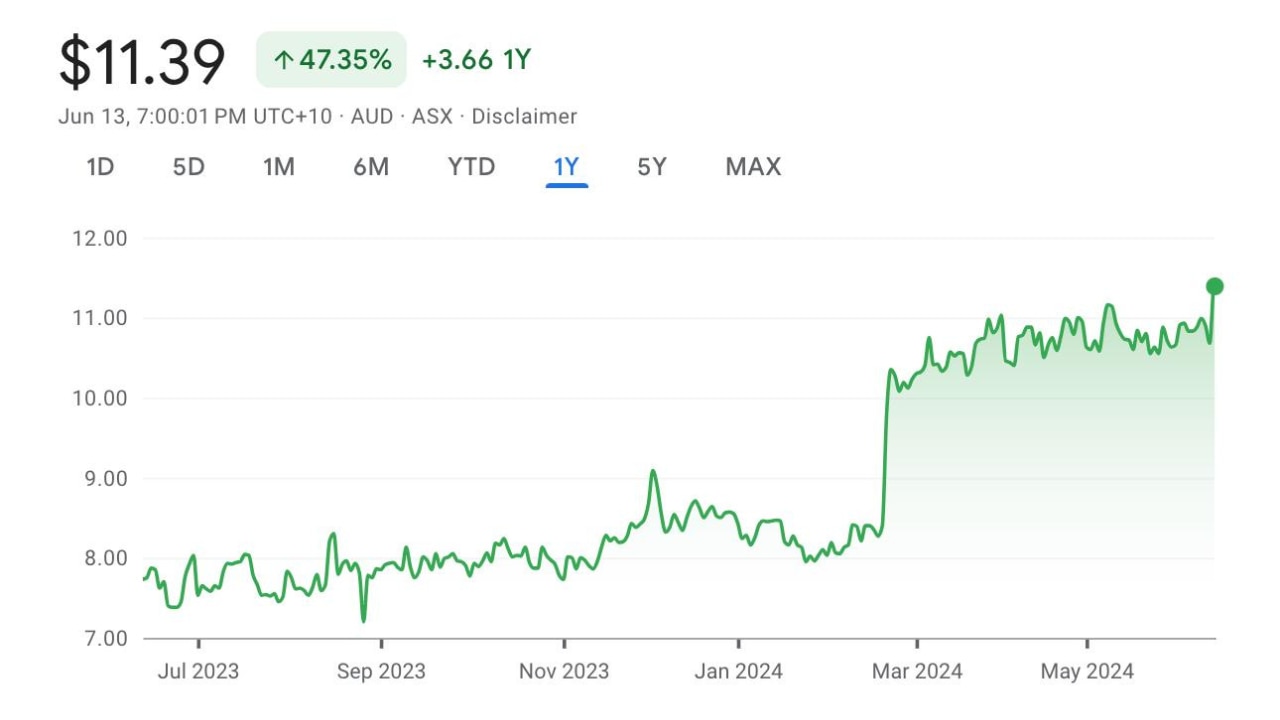

CDA’s share price has also rerated significantly over the past 12 months.

The stock is now trading at a one-year forward P/E of 20x versus the ~11-12x P/E Codan was trading at around 12 months ago.

UBS thinks this reflects the greater growth prospects of the Codan business, especially from the higher multiple Communications segment.

Nonetheless, UBS’ thesis is underpinned by the strong three-year EPS growth of 28 per cent p.a., which drives an attractive 0.7x PEG Ratio (price to earnings/EPS growth) versus the ASX Small Ords’ ~2x.

This earnings growth is largely underpinned by about 150bps p.a. EBIT margin expansion in the Communication division, towards company targets of more than 30 per cent (versus 25 per cent in FY23), alongside continued delivery of 10-15 per cent organic revenue growth.

Codan’s robust balance sheet (0.4x leverage) and new $150 million debt facility also provides support for accretive M&A (it’s worth noting that in deriving the $13.10 price target, UBS has added $1.20 for potential M&A).

This content first appeared on stockhead.com.au

SUBSCRIBE

Get the latest Stockhead news delivered free to your inbox. Click here

Originally published as Broking Bad: JP Morgan’s iron curtain falls on BHP and RIO; UBS initiates Codan coverage