Woolworths, Coles and big banks introduce new way to pay

It’s been a huge feature of the pandemic, and now retailers are planning on using it to make life even easier for consumers.

Aussies will be able to pay for their groceries at Woolworths and Coles by scanning a QR code, with the new option rolling out into stores before Christmas.

No longer the domain of the pandemic – where QR codes have become a feature of checking in to places – the supermarket giants and major banks including Commonwealth Bank and National Australia Bank have partnered with Eftpos to introduce a new payment platform, called eQR.

It will be rolled out nationally and is expected to help retailers glean more data from customers, by linking their loyalty programs to the QR code, allowing them to personalise offers.

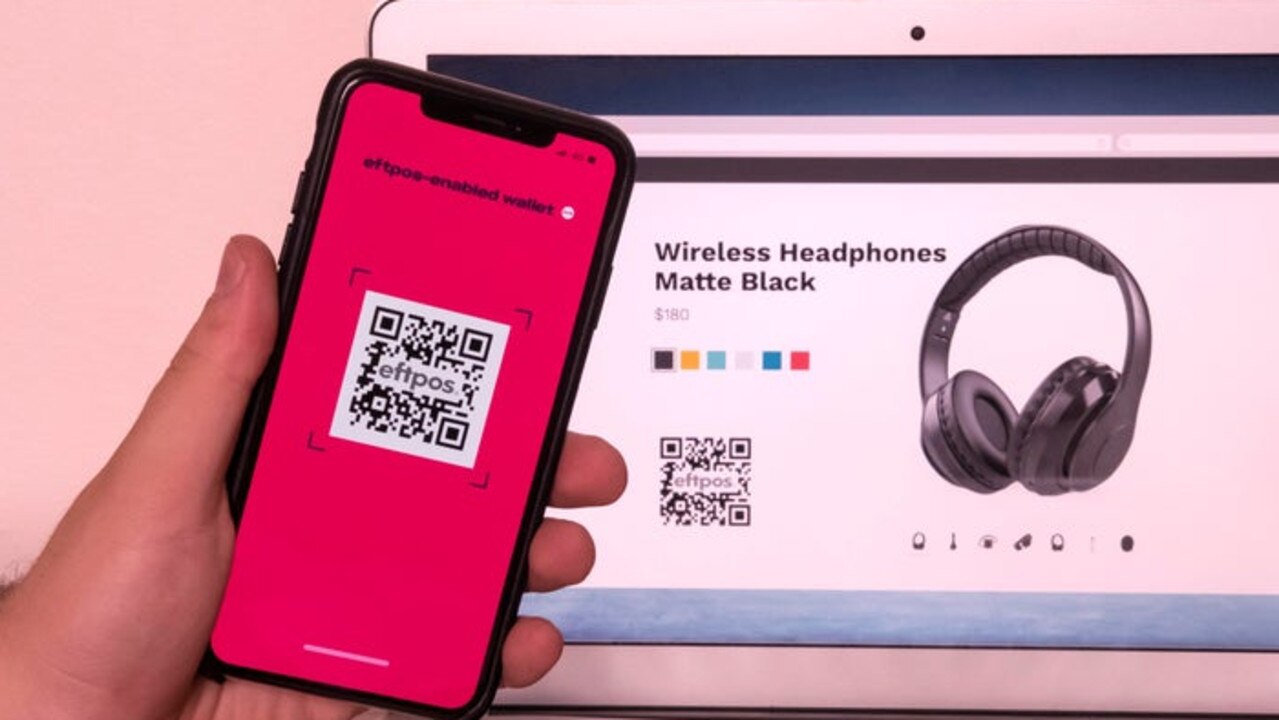

When in store, it will work by having a QR code at the checkout, which the customer can scan via their phone’s camera or through a shop’s app.

The payment feature will also be available for online shopping, where a QR code will appear next to the item a customer wants to buy.

Eftpos CEO Stephen Benton said the new payment platform was about re-imagining the Australian payment experience.

“We expect eQR will quickly become the QR equivalent of Eftpos tap and pay on debit cards. Covid has changed customer behaviour and Australians are now ready for the enhanced payment experience offered by eQR,” he said.

“The eQR platform aims to provide better experiences for consumers and merchants through added security, loyalty, offers and digital receipts, no matter where they choose to shop – online, on their mobile or at the checkout.”

Several Aussie retailers have been trialling the payment platform since it was launched in July, while fintech partners like Merchant Warrior, Azupay and Beem will help to bring on more Australian merchants in areas such as online entertainment, charities and fast food.

Woolworths Group’s Wpay managing director Paul Monnington, who heads up the supermarket giant’s own payment company, said the business was pleased to adopt QR to help offer its customers a simple way to combine payments and rewards in one transaction.

“We know speed and ease through the checkout are increasingly important to our customers amid their busy lives,” he said.

“Now is the perfect time to introduce QR and we look forward to building the next generation of seamless payment experiences with Eftpos in the months ahead.”

Coles general manager of financial services Paul Askew said the retailer would use the system to offer a better customer experience and link to its loyalty program.

Mark Rayment, NAB’s executive of merchant services said the innovative payment option would allow customers a faster digital way to buy, sell and make payments.

Commonwealth Bank, general manager of merchant solutions Karen Last added: “We’ve seen our business customers become increasingly familiar using QR codes and we’re working with Eftpos to support the roll out of eQR.”

In the future, the platform could also allow customers to check in and pay for their goods all at the same time.