Woolworths CEO Brad Banducci appears before South Australian inquiry into grocery prices

The man leading Australia’s largest supermarket has defended his company’s profits, but also made a big call on helping struggling Aussies.

Supermarket behemoth Woolworths will accept lower profits if its delivers “material value” to its customers, its CEO has said during a state-based grilling into grocery prices.

Chief executive Brad Banducci, appearing before the South Australian legislative council, defended his company’s $1.62bn profit haul in 2023, but said the retail giant would forego potential profits if it was “the right thing” for customers, referencing a decision to lower meat prices in the run up to Christmas last year.

“We will of course make those decisions,” he said.

“We are very sensitive on things like the price of milk, what we would call lunch box items.”

In October, the company lowered the price of its half-leg hams to $8 per kg, its lowest price since 2014, and in November, it dropped the price on 26 lamb products by 20 per cent, with the price drop running from November 8 to December 27.

Allegations of price gouging, or the sudden and seemingly unjustified increase in prices, have hit Australia’s dominant retailers Woolworths and Coles as the companies book handsome profits while most Australians struggle through rolling inflationary pressures.

The two rivals, in their submissions to the SA inquiry, claimed the state’s supermarket landscape was “competitive” and price rises in supply chains were a key driver for supermarket price increases.

While Mr Banducci suggested the company would not chase profits before all other considerations, he defended the retailer’s results and said the business tried to get “the balance right” between its suppliers, employees, customers and Woolworths shareholders.

“It’s always a balance, we’re not saying we always get it right,” he said.

Woolworths has about 26,000 shareholders and 10,000 employees in South Australia alone.

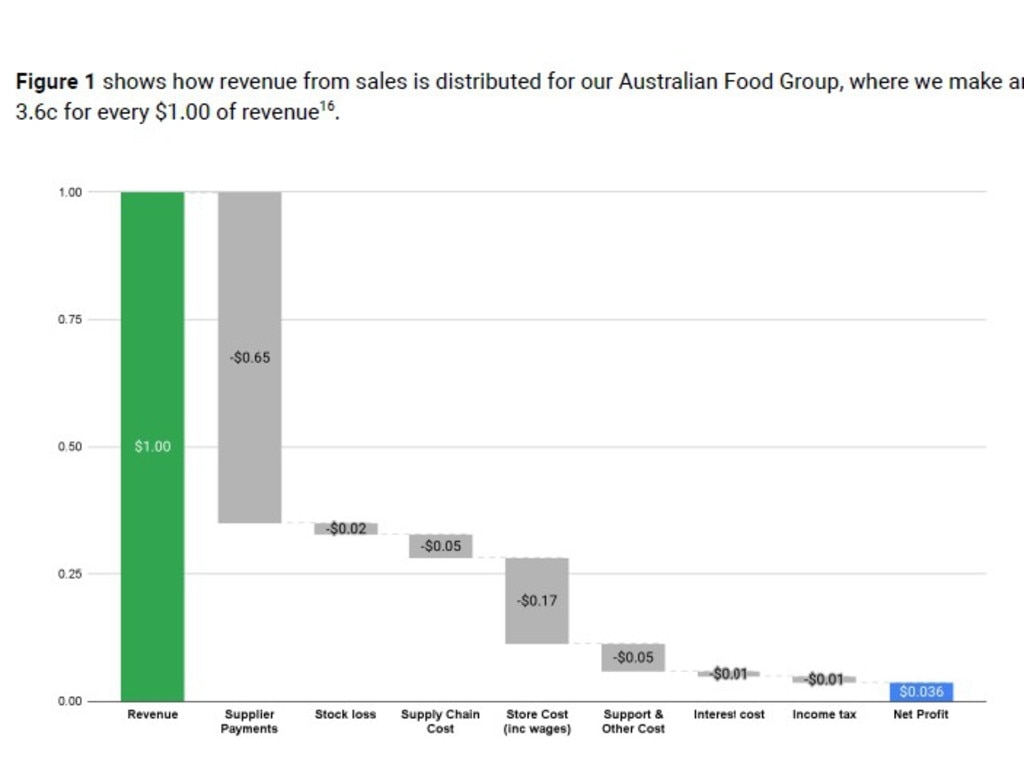

Mr Banducci said grocery retailing was “a very low margin business,” and out of every $1 in revenue, the company booked about 3.6c in profit after supplier payments, stock loss, supply chain costs, wages and payroll and income taxes.

Coles’ submission put its net profit per dollar in revenue at about 2.5c.

For the half-year ending December 31, 2023, Woolworths Group posted a 4.4 per cent increase in revenues to $34.6bn compared to the same period in 2022, with its Australian Food division contributing $25.9bn to the figure, a 5.4 per cent increase.

But profits at the company swung to a heavy loss following a writedown in the value of its New Zealand business and a fall in the value of its stake in ASX-listed Endeavour Group.

With those one-off costs, Woolworths posted a $781m loss for the half-year compared to a $845m profit in the prior period.

Without the impairments, the company would have booked a $929m profit, or a 2.5 per cent increase from the corresponding period.

Mr Banducci told the committee prices were also coming down across its stores, with inflation now running at less than 2 per cent across its stores.

The price of an average basket fell by 1 per cent from January through to Easter, he said.

South Australia’s inquiry is chaired by Greens member Robert Simms.

A federal Senate inquiry into supermarket prices concluded price gouging practices likely exist in the sector.

“The answer seems to be resounding yes, with it occurring in many and varied ways,” the committee’s report, delivered on May 7, states.

“While many of those ways appear minor on the surface - a dollar here, a fraction of a percentage there - they add up incrementally.

“Taken as a whole, those individual activities create a picture of an industry driven by profits at the expense of consumers, who have a right to affordable and nutritious food.”

The committee recommends the federal government amend section 46 of the Competition and Consumer Act to prohibit the charging of excess prices.

It also recommends the government amend the Act to create divestiture powers specific to the supermarket sector.