Why your groceries are getting bigger at Coles and Woolworths

A US giant with supersized products is squeezing Woolies and Coles, forcing them to change the way they do business — and you’re the beneficiary.

IT’S NOT in your imagination.

Coles and Woolworths are supersizing their packaging, in a bid to ward off competition from discount supermarket chain Costco.

The membership-based retailer, imported to Australia from the United States in 2009, is tipped to double its share of the $90 billion grocery market within three years as bargain hunters sign up in increasing numbers.

So it’s not surprising that the major supermarkets — already under pressure from German discounter Aldi, whose market share is now about 10 per cent — are beefing up their bulk buy offerings.

Both Coles and Woolworths have increased the maximum package sizing on a range of everyday products to give shoppers better value and cut down on their own costs, a Morgan Stanley analysis reveals.

Back in February 2015 the best value washing powder stocked at Woolworths was a 1.8kg pack. These days, you can save by picking up a 4kg or 5kg pack.

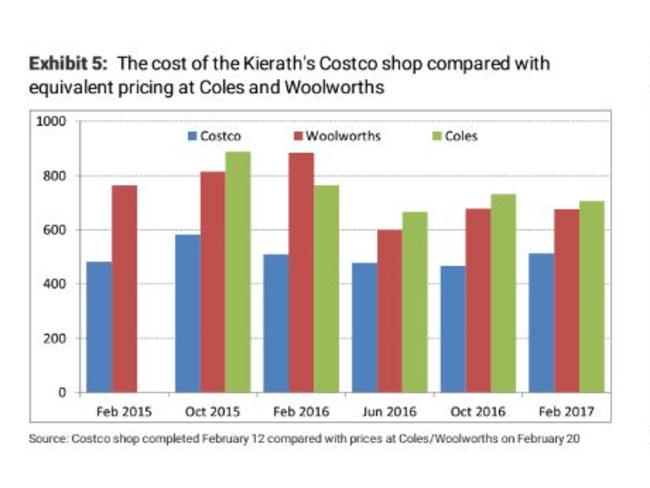

Costco is still much cheaper than the major supermarkets, with a typical family shop saving as much as 27 per cent.

But Woolworths is closing the gap, indicating that its $1 billion investment in lowering prices appears to be paying off.

According to retail analyst Thomas Kiernay, whose family recently visited Costco for a sixth comparison shop, the price difference between it and Woolworths has narrowed from 37 per cent in 2015 to 24 per cent today. The biggest savings were on household basics, the Kiernays found.

“The type of product that we buy influences the level of discount achieved at Costco — for instance the saving on dishwashing tablets is more than 50 per cent, whereas blueberries are 10 per cent more expensive at Costco,” Mr Kierath said in a client note on Thursday.

SHOPPING BASKET ANALYSIS

The Kierath family visited the Costco warehouse at Auburn in Sydney’s west, buying a range of everyday items.

They spent $513 on a range of products such as Radox shower gel, Palmolive handwash, Finish dishwashing tablets, Huggies nappies, Cottonell toilet paper, Omo laundry powders and Lurpak butter — all in supersized portions. The equivalent basket of goods, calculated by weight, would cost about $706 at Coles and $676 at Woolworths.

“This unscientific analysis is purely to give clients an idea of cost comparisons with Coles and Woolworths which may be useful for bringing some granularity to larger trends,” the analysis said.

Mr Kierath noted an improvement in the quality of private label ranges at Coles and Woolworths, concluding that “it is now debatable whether Costco’s private label range, Kirkland, is superior in quality (as it was a few years ago)”.

On the other hand, he said, so-called “specials” at the major supermarkets “don’t seem all that special as both often run exactly the same promoted price”.

Aside from the dollar savings on major bands, Mr Kierath’s family described their Costco shopping experience as “more convenient” than shopping locally — even though their nearest warehouse was a 40-minute drive away.

“This might seem odd (but) we buy far larger quantities, which means that we don’t need to keep going back over and over again to the local Coles or Woolworths,” they said, saying “we only buy washing powder about once a year.”

Coles’ chief customer officer Simon McDowell dismissed the relevance of the experiment, pointing out that the Costco basket did not contain any fresh produce — apart from the eggs and overpriced blueberries.

“There isn’t much for the family to eat,” Mr McDowell said.

He noted the Kieraths had bought items such as a 1kg bottle of Peri Peri sauce, quipping: “that’s a lot of chicken”.

Families shopping at Coles typically stuck to a budget of $150 a week and could not afford to splash out $513, he said.

COSTCO’S GROWTH PLANS

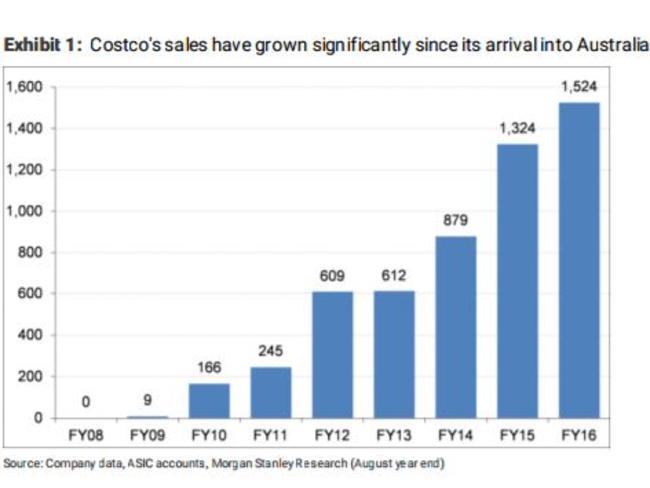

The Morgan Stanley analysis estimates Costco’s share of Australian grocery sales at 1 per cent, based on the company’s reported earnings of $1.5 billion in 2015-16, on the understanding that it generates about 60 per cent of its sales from food products.

Costco plans to double its local store footprint to 16 warehouses by fiscal 2020, when it is expected to increase its market share to 1.8 per cent.

It currently has two Sydney stores with a third under construction, three in Melbourne and one each in Brisbane, Adelaide and Canberra.

“Longer term we understand that Costco intends to operate between 20 to 25 warehouses in Australia,” Mr Kierath wrote.

“Given it operates a warehouse-style format, it has a very low cost base, evidenced by its

13 per cent operating cost.”

By contrast, he noted, Woolworths’ food business had operating costs of 27.9 per cent, and 17 per cent in its liquor business.

“This enables [Costco] to operate with very thin gross margins (14.3 per cent) compared to the major supermarkets.”

Woolworths had a gross margin of 23.6 in the first half of fiscal 2017.

A Woolworths spokesman said the retailer’s approach to packaging was about delivering on customer expectations.

“Woolworths will always provide the products our customers tell us they want to see and where there is a demand for bulk products we will look to deliver it,” the spokesman said.

“Customers should be assured that when they shop at Woolworths, they are getting the great quality products they want at fantastic value.”