Why Bunnings is keeping a close eye on Aldi

IF IT’S a cordless drill you’re after, you might head to Bunnings. Or you might head to a store that’s not traditionally thought of as a rival.

IF IT’S a cordless drill you’re after, you might head to Bunnings.

Or you may be busy jostling to get through the doors of the retailer that’s emerged as a surprise new competitor in the home improvement sector: Aldi.

The German supermarket sensation has already put the heat on Woolworths and Coles, prompting a frenzy of discounting. Now Bunnings, too, is sitting up and taking notice.

While Aldi’s bread and butter may be cheap groceries, it’s the retailer’s biweekly Special Buys that draw customers into stores.

Items stocked in the legendary centre aisle range from television sets and industrial meat slicers to lamps, heaters and cushions, along with home improvement items like drills, toolkits and ladders.

Fanatical Aldi shoppers line up outside stores on Wednesday and Saturday mornings for first pickings of the limited edition stock, which analysts have described as key to the discount chain’s success.

And it’s these products that Bunnings keeps an eagle eye on when updating its own offering, the retailer’s chief operating officer for Australia and New Zealand revealed on Wednesday.

Speaking at Wesfarmers’ annual investor strategy briefing, Michael Schneider said Bunnings had noticed its website traffic spiking around the same time that Aldi released its online Special Buys catalogue — and that his team was swift to respond.

“It’s good for us because competition drives you to go harder at what you want to do,” Mr Schneider said.

“We’re very quick to respond in terms of putting products in front of customers.”

Bunnings Group chief executive John Gillam chimed in that Mr Schneider was being too modest, saying the team was getting better at pre-empting competitors with its range and marketing.

The kinds of items that could pose a competitive threat include not only drills and saws. Bunnings and Aldi both sell a broad range of products, from garden hoses and outdoor furniture to mops, buckets, storage tubs, lighting, heaters and fans.

The difference is that while you can pop down to Bunnings on a whim, to get your hands on one of Aldi’s cheap versions of these items, you have to wait for it to appear in the Special Buys catalogue.

And the deals may not include accessories and parts (although this Saturday’s catalogue does include a $99.99, 300-piece drill and bit super set).

These factors mean that Aldi’s threat to Bunnings’ bottom line is likely to be limited. But that hasn’t stopped the retail giant from taking it seriously.

A glance at this Saturday’s specials reveals that the two retailers are competing head-to-head with an $89.99 cordless hammer drill — although a close inspection reveals they are not quite the same.

Aldi’s Work Zone version is 24 volts, has two gears, runs on a Lithium-ion battery, comes with a one-hour fast charger and has a three-year warranty.

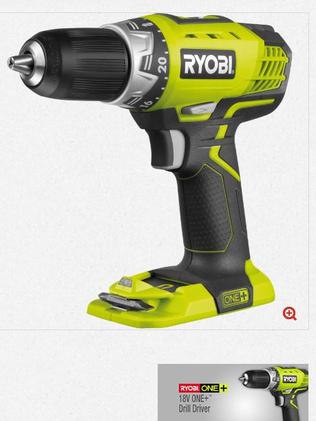

By comparison, Bunnings is selling an 18-volt Ryobi One+ for the same price with a two-year warranty.

It does not come with a battery, but has a variable speed control, an LED light for working in dark, confined spaces and a magnetic tray for storing screwdriver bits.

OPERATION BUNNINGS UK

Mr Schneider’s comments came amid a Q&A session at the end of Wesfarmers’ investor update on its home improvement business, which was dominated by the discussion of its controversial Homebase acquisition.

Bunnings bought the troubled United Kingdom home improvement chain for $670 million (£340 million) in January, prompting criticism from some analysts, who saw the move as too risky.

The plan is to continue operating Homebase while plotting a $1 billion rebrand as Bunnings Warehouse, using operational intelligence and price testing to better understand the British, Irish and Scottish markets.

“We want to launch a new business from a much stronger position than starting greenfields,” Mr Gillam said, adding that there would be “lots of learning over the next 12 months that will inform us when it comes to launching Bunnings Warehouse in the UK.”

He moved to reassure investors that the venture could pay off, saying Homebase had tasted success in the past but had suffered under “a decade of poor management”, which failed to steer it safely through the global financial crisis.

He said Bunnings UK was in the early part of phase one of a three-phase plan to rebrand Homebase, which the company was positioning “to run better until we close it”.

“If we thought for one second that ‘we’ll just charge over there and do what we do in Australia’, we’re going to be shredded,” Mr Gillam said.

Not only were the UK stores going to be a smaller size than the traditional Bunnings Warehouse — about 4000 sq m, against a 14,000 sq m full-sized warehouse — but customer needs were very different, he said.

Merrill Lynch analyst David Errington remained critical of the strategy, which he has compared with Woolworths’ disastrous home improvement company, Masters misadventure.

“You are spending $700 million on a business that is broken and fragmented and you have to commit another $1 billion,’’ he said during question time.

“The business doesn’t generate a lot of earnings but will have to go backwards before it goes forwards.’’

But Mr Gillam maintained that Homebase was “a good bet”, and said “if the pilots don’t work, we won’t invest’’.