What this $2 Kmart T-shirt proves about Australia

The cost of living crisis in hitting more and more Australians, but it’s not hurting Kmart. And there’s a reason we can’t stop buying there.

ANALYSIS

While Australians are suffering under record inflation, there has been one big winner. One retailer has turned this time of pain into a time of profit.

That retailer doubled their profits – actually more than doubled them – after selling an extra billion dollars worth of stuff compared to the year before. The retailer is Kmart, we found out this week, and its reputation as cheap and cheerful has made it the place Australians are shopping as prices rise.

Kmart raked in an astonishing $475 million in profits in the first six months of this financial year, helping its owner, the conglomerate called Wesfarmers, to post a whopping profit of nearly $1.4 billion.

“We did pretty well on turning the sales into profit dollars,” boasted Kmart boss Ian Bailey in a call with investors this week. Kmart more than reversed its Covid profit slump.

I have certainly contributed to their sales. When I hang out the washing, it seems like half my kids’ clothes are from Kmart. How can you turn up your nose at a kids T-shirt for $2?!

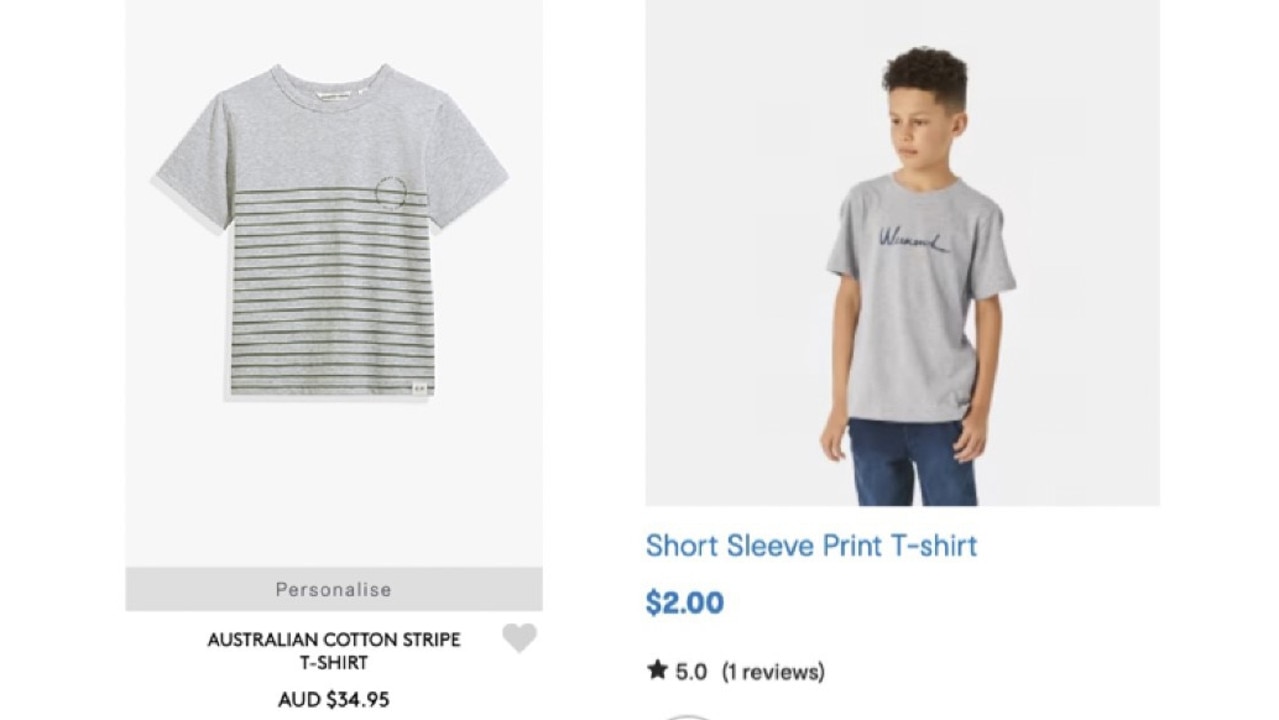

This is the good news about inflation. The government measures how much the average price of things has gone up. But it doesn’t always measure what we do in response. If we stop buying kids clothing at Country Road (kid’s T-shirt: $34.95) and start buying from Kmart, well, both places might have put up their prices 10 per cent but we are spending less.

It’s a good time to be a discount retailer. Or at least to have a reputation as a discount retailer.

“Customers continued to respond positively to Kmart’s lowest price positioning,” says Wesfarmers.

The same cannot be said of the Wesfarmers’ online store Catch. It doesn’t have a reputation of being low-cost, or much of a reputation at all. It managed to lose $108 million in the past six months, as sales dried up. I’ve seen a lot of ads on TV for Catch, but they don’t seem to be spruiking its low-cost advantages. Customers have decided they don’t need another website with no discernible advantages and nobody’s clicking on it.

The irony is Catch ended up discounting things to try to clear out the inventory they’re stuck with. At a time like this, if you run a store with a reputation for being cheap, customers beat down your door and you might get away with raising prices. But if you run a store with a reputation for being expensive you end up discounting.

It’s no surprise that Australia’s biggest and fastest-growing retailers, Aldi, Bunnings, Kmart and Chemist Warehouse, all trade on the idea they are very cheap. Meanwhile the department stores David Jones, which has an up-market reputation, has been struggling and recently got sold off to private equity for a big loss.

“Households are facing headwinds and becoming more value conscious,” said Wesfarmers CEO Rob Scott.

That is going to only increase in the second half of this financial year as wages growth gets further and further behind inflation, mortgage repayments rise, and people have to figure out how to get more from their limited funds.

Should you try to get your hands on that profit?

Wesfarmers is a public company. The profit it makes comes back to shareholders in the shape of a dividend.

Would you be better off putting your money in the bank and collecting interest, or investing in Wesfarmers shares and collecting the dividend?

Getting paid 88 cents for owning a share of Wesfarmers for six months works out as a return of 3.8 per cent at its current share price (the shares cost $49.35 at time of writing). That’s still less than inflation, but a fair bit better than the interest rate you’d get on a term deposit: NAB is offering 2.55 per cent annual interest rate for six months. But of course the term deposit is safe, while the share investment could go up or down.

But with the Australian economy looking to slow down as 2023 continues, even discount retailers might struggle to make profit in future. Buyer beware!

Jason Murphy is an economist | @jasemurphy. He is the author of the book Incentivology.