What are the odds of Amazon coming to Australia and succeeding?

WILL Amazon destroy all retail in Australia? It might have Woolworths and Coles worried, but the Australian market isn’t that easy to crack.

WILL Amazon destroy all retail in Australia? It’s a big question for shoppers, and for our economy. Some people seem certain the US online retailer is about to arrive, and promptly eat Coles and Woolworths lunch, and Myer and David Jones’ too.

Amazon is remaining very tight-lipped about whether it is coming. It has never responded to my questions on this topic. But we are hearing a lot of strategically placed rumours just as Amazon is ramping up its international business by investing across Asia.

They made their video service available here in November. And the latest big headline suggests they have registered a lot of trademarks and brands in Australia.

But in the world of business, rumours don’t always materialise. Until Amazon announces an Australian launch officially, they could just be using the rumours to see if we’re interested.

Trademarks are cheap to register so that doesn’t mean too much. Lidl (Germany’s other Aldi) registered a lot of trademarks in Australia years ago and never came.

And in fact, few Amazon trademarks were registered in 2016. Amazon Fresh, the food business some fear will kill Coles and Woolworths, had its trademark registered in 2007.

In my opinion there’s a 70 per cent chance Amazon arrives in the next year or two.

IF AMAZON DOES COME, WILL IT WIN?

In trying to make predictions, I like to use an approach called inside view/outside view. For the inside view, we will try to zoom in on Amazon itself, and see if its characteristics are suitable for coming to Australia and winning. For the outside view, we ask in general terms whether foreign retailers come to Australia and succeed.

Combining the two approaches should lead to better predictions than just using one.

The inside view has arguments for both yes and no.

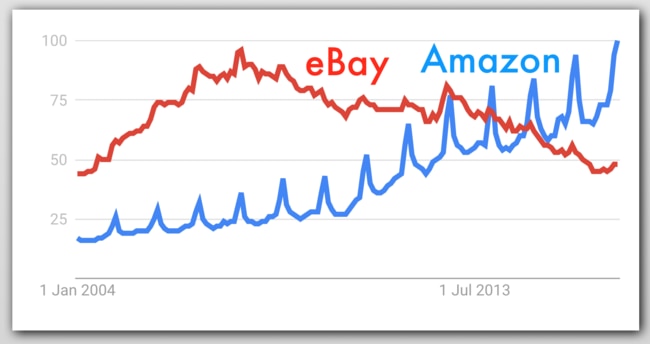

On the yes side, Amazon is an enormous retail juggernaut. It is smashing its major online rival, eBay.

Google Trends data shows Amazon now has a major lead on its biggest rival, eBay, globally.

It is in the top three retailers in the world, with revenue expected to be over $130 billion this year.

But unlike most big retailers, it is growing at the speed of a start-up. Amazon revenue in the most recent quarter was 29 per cent higher than last year. Its retail skills are pretty special.

Australia, an English-speaking country, is similar enough to the USA that the Amazon model is a good chance of working very smoothly. No large Australia competitor offers what Amazon Prime Now does, like two-hour delivery.

Amazon is also famous for adapting to meet local conditions. It doesn’t just roll out one business model across the world. In India, for example it lets the many people who don’t have credit cards pay cash on delivery. It will adapt to Australia in order to win.

Amazon doesn’t record any profits to speak of, but not because it is struggling. Instead of giving money back to its shareholders it invests in relentless expansion. (Did you know that if you type in relentless.com it leads to Amazon.com?) The leader of Amazon is a fanatic who doesn’t seem to rest. He’s apparently aiming to take over the world.

But Amazon is mortal. It closed a foray as an online travel agent, and its smartphone, Amazon Fire, turned into a megaflop.

It has seen a lot of headlines about its struggles in expansion countries. It is more or less bombing in China, where it even opened up a shop on a rival’s website to try to increase traffic. In the past few months growth offshore has matched growth in North America, but before that sales were growing far better in the US.

On balance, the inside view suggests Amazon would most likely do well.

The outside view mostly disagrees.

Most really big retailers operating in Australia are Australian. Aldi is the glaring exception, but it doesn’t have much company. (There were a lot of American entries into the fast food space in decades past, but not much since.) Even online we seem to like domestic retailers. Kogan, the Iconic and Gumtree are doing great.

And what’s more, online retail in Australia is not becoming the great destructive force everyone expected and feared. NAB data shows online retail has about 7 per cent of Australia’s retail market and its growth is slowing. People, it turns out, just like shops.

This view says the amount of opportunity for Amazon is pretty limited.

If I had to put some rough figures on the above arguments, I’d say there’s a 20 per cent chance Amazon will enter the Australian market and become a major destructive force.

So those predictions of Amazon “destroying retail in Australia” could be way off.

ADDING IT ALL UP, WHAT HAVE WE GOT?

• A 30 per cent chance it won’t come at all.

• A roughly 50 per cent chance it will show up and not really trouble the scorers, and:

• A roughly 20 per cent chance it will arrive and rock us to our foundations.

This is just a rough exercise, but it certainly suggests the risk of Amazon coming is big enough that Australia’s retailers should spend some time and money to prepare for it.

Jason Murphy is an economist. He publishes the blog Thomas The Thinkengine. Follow Jason on Twitter @Jasemurphy