‘Trickery’: Supermarket multi-buy tactic criticised by shoppers

A clever tactic employed by supermarkets has been called out by shoppers amid a long-awaited government inquiry into our supermarkets.

A clever tactic employed by supermarkets across Australia has been criticised by shoppers amid a long-awaited government inquiry into the sector.

It comes after a customer pointed out an “excessive” number of multi-buy special options during their weekly Woolworths shop.

A photo of the chocolate aisle quickly amassed hundreds of comments on Reddit with fellow customers calling out the deal, which tempted shoppers to buy three chocolate bars for $15 – despite each item being individually priced between $5.50-6.

“Excessive multi-buys, this is as bad as it gets,” the poster captioned the photo.

“I know it’s been happening for a while but there really needs to be a massive boycott on engagement of these ‘specials’, this needs to stop.”

Other comments took aim at the small savings cost of about $1.50 and questioned whether the “trick” deal could be labelled a special offer in the first place. The ensuing debate gradually turned its attention towards the long-awaited Australian Competition and Consumer Commission’s supermarket sector inquiry that begun this year.

The 12-month ACCC inquiry will investigate the competitiveness of retail prices and allegations of price gouging for the first time since 2008, following widespread criticism of the sector from consumers, farmers, and government.

Supermarket tactics

University of New South Wales Business School Professor Nitika Garg said the inquiry will shine a light on how the supermarket giants operate. She also shared her insights into the consumer psychology behind their tactics.

“When people see a deal they get more tempted and they feel like they have been clever. There are lots of factors psychologically that play a role,” Prof Garg explained about the multi-buy strategy.

“It is a bit like securing a deal, every time we get a deal or we feel like we’ve sort of scored a good bargain we get a dopamine rush, so psychologically it is very satisfying.”

However, Prof Garg told news.com.au that if you look at the unit pricing, you might not actually saving very much.

“So consumers just need to be careful,” Prof Garg warned. “Compare the unit price. How much are you actually saving in dollar amount?

“A lot of times it might turn out that you’re not saving that much and that will sort of stop the consumer in their tracks and make them rethink whether or not they want to buy, because a lot of times you just see the red sticker or yellow sticker and think ‘yes’.

“Multi-buys are just a good strategy for supermarkets and sometimes retailers rely on them especially if they want to move stock.”

Chocolate price woes

However when it comes to chocolate in particular – supermarket tactics are not solely to blame for the hip-pocket crunch.

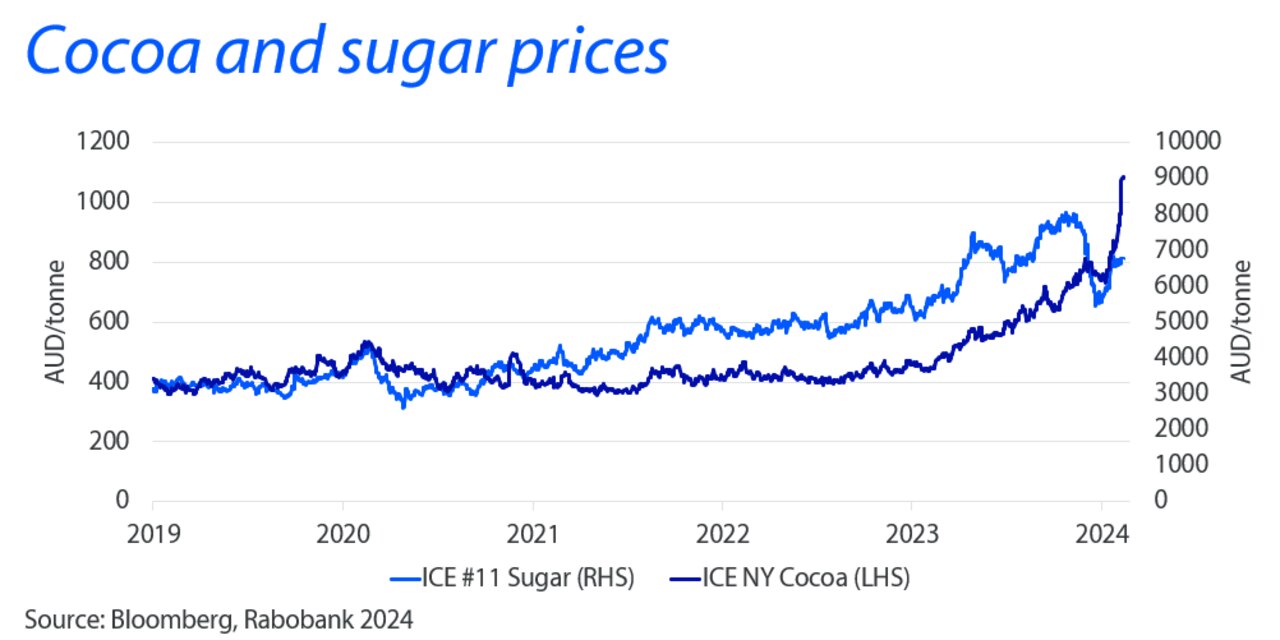

According to Rabobank’s podcast, titled Sweet Inflation and the Chocolate Factory, retail prices of chocolate have steadily climbed in the last two years due to surging input costs.

RaboResearch associate analyst Pia Piggott explained cocoa prices have been on the rise as “we head into a third year of cocoa deficit around the world”.

“Retail chocolate market details indicate chocolate prices have gone up about 10.3 per cent in the last year,” Ms Piggott said.

“Inflation in the confectionery and snacks category was up 6.8 per cent for the fourth quarter but chocolate prices are rising faster than other items.”

Ms Piggott said supply issues coming out of West Africa are largely responsible for higher prices as the region grapples with flooding, pest problems, and diseases in the cocoa trees.

“Raw material prices will be affecting chocolate providers. New York cocoa (market) prices are up 144 per cent from this time last year and they are continually reaching new heights,” she added.

“Hopefully by quarter two we should get more information regarding production forecasts in West Africa. If these are positive, prices should moderate.

“Otherwise the high prices will likely cause some demand destruction which should also moderate the prices, but they will still remain historically high as supplies cannot increase quickly.”