This Woolies docket is worth a motza to a grey market baby formula dealer

IT’S just a flimsy piece of paper, but this Woolies docket is the ridiculously valuable tip of a multi-million dollar iceberg.

THIS flimsy scrap of paper is worth $144 — but for a grey market exporter with a crack team of supermarket trawlers in tow, it represents untold millions.

We all know Chinese parents are willing to pay a premium for Australian baby formula, with milk powders flying off supermarket shelves and leaving locals scrambling to find stock.

But it’s the humble shopper docket that holds the key to the lucrative trade, with insiders revealing it serves as a “certificate of authenticity” for the sought-after goods.

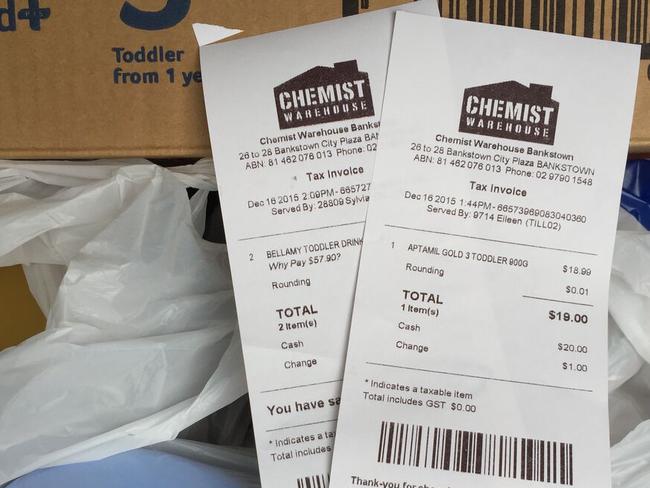

Sold along with the $56 receipt, these two cans of Bellamy’s organic infant formula bought at Woolworths Redfern on Wednesday could fetch about $200 in China.

And they’re being exported by the pallet load as part of a booming grey market worth hundreds of millions of dollars.

Think China Director Benjamin Sun, a marketing expert who specialises in Chinese commerce, told news.com.au that exporters routinely sold baby formula into China along with proof of purchase.

This reassures buyers they are getting the real authentic “clean and green” Australian products sold at retailers like Coles, Woolworths and Chemist’s Warehouse.

Mr Sun said exporters also wrapped cans of formula in Australian newspapers while packing them for export, as further proof of their provenance.

He said it was this evidence that allowed the cans to be sold at a massively inflated prices on Chinese supermarket shelves in a grey export market worth hundreds of millions of dollars.

“In China at the moment, I can see that shops are selling infant formula for $100 a can,” Mr Sun said.

The losers in this game are the Australian families who are struggling to get their hands on the precious formula when they need it — along with creeping price increases.

Popular brand Bellamy’s recently raised its prices by up to 30 per cent; it now retails for $28.

It’s not just Chinese Australians shipping gifts of formula to their families overseas; so-called buying agents send shipping containers of the stuff to retailers in China, just like any other commercial export industry.

In telling images captured in China on Wednesday afternoon, cans of Australian-made formula line the shelves of a Carrefour supermarket in the port city of Qingdao, where they sell for three to four times the Australian retail price.

Enfapro A+ infant formula is being sold for $77.31 (RMB 360) per can, Eleva for $100.72 (RMB 469) and Nestle Nan H.A for $66.57 (RMB 310).

Most baby formula brands retail in Australia for $18 to $28. Nestle Nan H.A can be bought as cheaply as $16.70 a can at Woolworths in Sydney.

Parental frustration has prompted Woolworths to instigate a four-can limit, and Coles a two-can limit.

But claims have surfaced that Woolworths has been merely “paying lip service” to its four-can limit on infant formula, which is supposed to protect supply for local customers, with an unnamed senior executive making the explosive allegation in an interview with Fairfax media.

A Woolworths employee told news.com.au there was a four-can limit in place, but exporters were getting around the rules.

The staff member said ethnic Chinese customers were known to line up outside one city store at 6am, then “come in and run straight upstairs to the baby formula and clear the shelves”.

“There’s a four can limit, but they would hide them all over the store, buy four, run out and get changed into different clothes and come back in to buy more,” the staffer said.

“I’ve had people ring up and say ‘if you let me buy a pallet I’ll give you $3500,’” the staff member said.

“I said ‘sorry I can’t do that’, I’m not going to risk my job for that.”

He said Woolworths’ check-out machines monitored how many cans were being purchased.

Mr Sun said the Australian government needed to take action to create legitimate supply channel into China, or the problem would continue.

And with China’s one child policy over, he said, demand was only going to keep growing.

A Woolworths spokesman said the supermarket “works hard to ensure there is sufficient infant formula available for all our customers”.

“We have been working with suppliers to try to increase supply, and at the same time have lowered out limit of tins per transaction to four,” the spokesman said.

“We enforce this by stopping larger transactions at the till.”