The drama at Big W and Target could make Kmart the last man standing

WITH Big W and Target struggling to make money, Kmart reigns supreme. Could it do a Bunnings and be the last man standing?

HOW on earth did Australia’s discount retailers stuff things up so badly? Australia has never been so hungry to buy cheap stuff, but two of our three big discount retailers are circling the plughole.

Right now, Aussies do not feel rich. Underemployment is up, wages growth is at record lows, the Western Australian economy is in recession and everyone is scrimping to deal with property prices. (This explains, for example, why Aldi is going gangbusters in the cheap grocery segment.)

So you’d expect glory days for big discount retailers. Instead, Target and Big W are meandering round like lost little lambs. The CEO of Big W resigned this week after the chain of 186 stores continued to fail to impress.

The last three years have seen problems getting bigger, as the next graph shows.

The start of the 2017 financial year did not dawn any brighter, with sales continuing to fall sharply. When Woolworths announced the results from the first three months of this financial year, it stuck to its story that Big W was making “solid progress in driving our strategic plan” and mentioned a “multi-year” process.

Talk, as they say, is cheap. The sudden departure of the CEO speaks far more loudly. Big W is in strife. Nevertheless, the head of Woolworths Group says he has “a continued focus on BIG W’s long-term success.”

A good explanation for the troubles in discount retail would be if people were buying so much cheap Chinese stuff online they didn’t need to go to shops anymore.

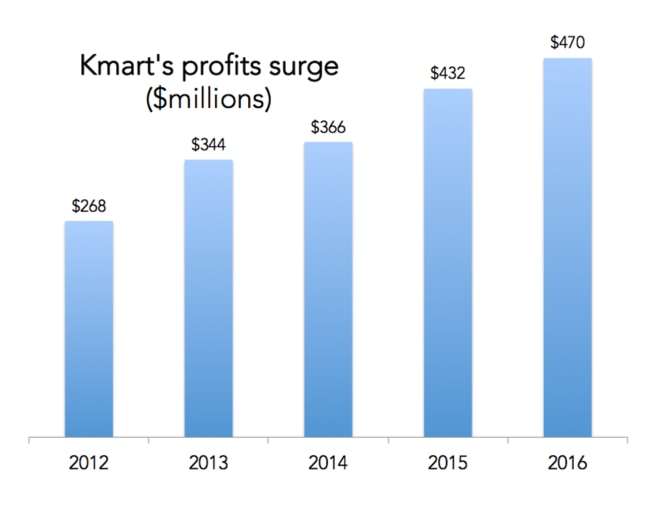

But the story of Kmart shows that can’t really explain the problem.

Merchandise for sale at Kmart is mostly the same type you can also buy online pretty safely, at places like AliExpress. Kmart, however, manages to be comparably priced to buying online. That’s the power of bulk buying.

Kmart is basically good for cheap things — home brand and no brand things. I went into a Kmart the other day looking for a new kettle. The options were limited and they all looked pretty crappy to me. Instead I came home with some $16 tracksuit pants for slouching round the house in. And a $3 baseball cap.

I’m not the only one spending money there. Kmart is doing very good business.

After years of growth, you might expect it to flatten off, but the first three months of the 2017 financial year showed Kmart continuing to boom, with 8 per cent comparable store sales growth.

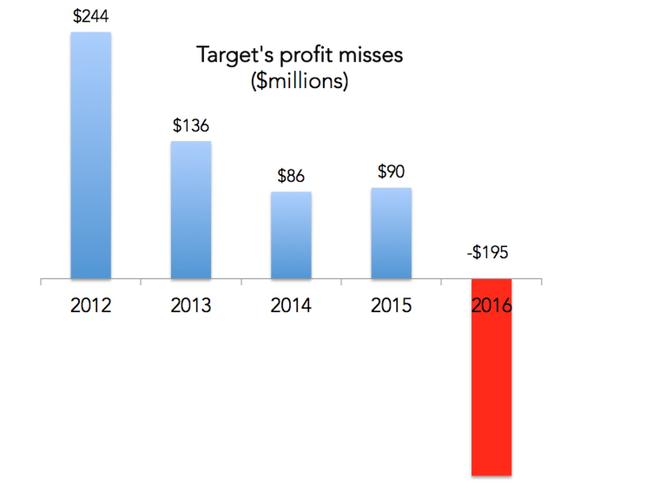

Target is a whole other story. It is changing its approach so it doesn’t compete directly with Kmart. (They are both owned by the same big company — Wesfarmers.) Target is now trying to specialise in mid-range fashion. Not as cheap as Kmart, not as fancy as Myer.

That might have been a good idea ten years ago, before Australia had H & M, TopShop, Uniqlo, Forever 21, etc. Nowadays mid-range is crowded with huge successful brands. It is not clear how Target can beat them.

Target is bleeding hard already. As this graph shows, profits were in free-fall last year.

Target’s problems got even worse in the first three months of the new financial year, with comparable store sales falling a mind-boggling 22 per cent. The chief executive of Target said at the time: “Target is making significant changes to its operating model which will take time to implement.”

But they may not have much time.

It seems quite possible Australia will end up with only one popular large discount retail chain — Kmart — just like we ended up with one dominant discount hardware chain — Bunnings.

If Target and Big W continue fade away, it will be bad for competition. Kmart will make hay, big time. But that won’t be the end of the story.

A NEW PLAYER ABOUT TO ENTER THE GAME?

Our discount retailers are home grown. (Kmart and Target use the same names as American chains but are not blood relations). We are long overdue a foreign invasion in this sector.

The most likely one is found in the American city of Seattle. A little retailer called Amazon.

Recently, rumours have begun to fly thick and fast about the online shopping giant’s imminent plans to come to Australia. Individually, each rumour might not be true. But the sheer number of them that have started to circulate so quickly suggests something is up.

Amazon, so far, has refused to comment. They did not reply to questions for this article. So all we have is rumours. But they are very interesting:

• They are looking for a warehouse site in Sydney’s Eastern Creek.

• They will sell fresh food.

• They are promising to “destroy the retail environment in Australia.”

In another intriguing sign, Amazon Prime Video (a video streaming service like Netflix) is now available in Australia. The company seems to have made access to their UK and US versions available, with no fanfare or announcement, in the middle of last week.

Maybe they will come, maybe they won’t. But if they do, it will dramatically change the way Australians shop for cheap goods. And it may mean we have to say our last goodbyes to Target and Big W.

Jason Murphy is an economist. He publishes the blog Thomas The Thinkengine. Follow Jason on Twitter @Jasemurphy