Soloman Lew buys up David Jones shares ahead of takeover by Woolworths South Africa

A NEW threat has emerged to put a dent in the David Jones/Woolworths takeover. One investor has been buying up millions of shares and looks set to block the deal.

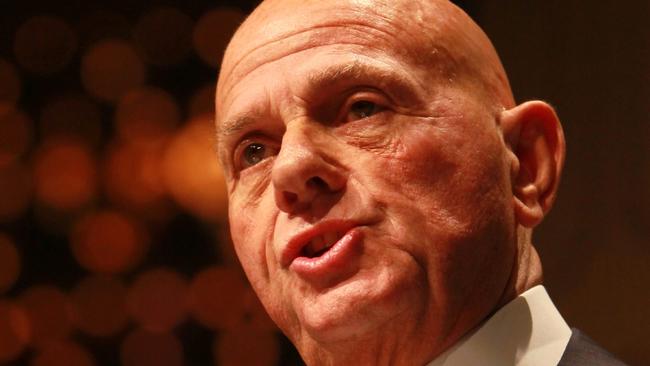

RETAIL mogul Solomon Lew has snared a near 10 per cent stake in David Jones amid speculation he wants to block South African retailer Woolworths' takeover bid.

David Jones on Wednesday revealed the businessman now held a 9.89 per cent stake, making him a substantial shareholder.

Speculation had been mounting about Mr Lew buying up millions of David Jones shares in recent days in an attempt to block Woolworths' $2.2 billion takeover of the department store chain. He is believed to be keen for Woolworths to buy his 12 per cent stake in fashion retailer Country Road, The Australian Financial Review reported.

News of Mr Lew's share-buying spree came after Woolworths shareholders approved the retailer's takeover bid for David Jones. A majority of Woolworths shareholders approved the deal and plans for a $1 billion capital raising to fund the takeover at a meeting in South Africa on Tuesday.

David Jones shareholders are due to vote on the proposal at a meeting in Sydney on June 30.

David Jones said its board continued to unanimously recommend its shareholders accept the takeover offer.

“The David Jones directors intend to vote all the David Jones shares held or controlled by them in favour of the scheme,” it said in a statement.