Retail giants promise utopian shopping future

ONE of the most frustrating things about shopping has been solved, as retail and banking giants promise the perfect, “seamless” experience.

IT’S the question that always comes when you’re least prepared: “Do you have a loyalty card?”

Often, the temptation is to pretend not to be a member and avoid the inevitable, fruitless handbag search — and an irritating wait while the shop assistant looks you up in their database.

The solution has finally arrived, with a new feature in CommBank’s mobile banking app that allows customers to store their reward club details in an easy digital format.

It’s just one step towards the utopian shopping experience that the big banks and retailers hope to usher in by 2021.

That’s the year CommBank analysts say we will be able to throw out our wallets, and enjoy a completely contactless shopping experience, from front door to carpark to check-out.

In the meantime, the bank’s customers can scan the barcodes of their physical loyalty cards — such as Priceline, Country Road and FlyBuys — and store virtual copies inside the CommBank smart phone app.

Next time they go to buy something, customers can use the app to display the card’s barcode to be scanned, before paying with tap and pay on their phone.

The “fully integrated” function is currently only available on Android, with an iOS version in development.

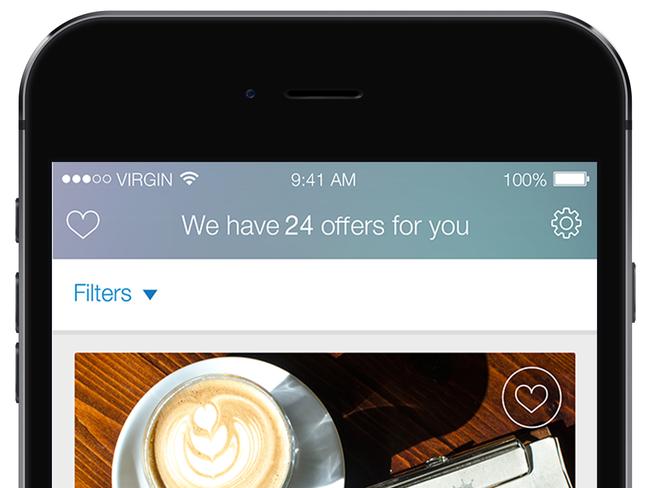

Customers taking part in a separate pilot will receive opt-in text message alerts of exclusive deals while shopping at Westfield, with plans to expand the number of participating retailers down the track.

A message might pop up inviting the shopper to enjoy a $4 coffee and cake in the food court, with offers tailored to their personal selections. The app allows the user to swipe right or left, Tinder-style, to signal their interest in product offerings.

Unveiling the updated app at the CommBank innovation lab, the bank’s general manager for retail products and strategy, Angus Sullivan, said the new function was “taking us one step closer to a day when you won’t need a physical wallet at all”.

“This is about value adding to our customers and it’s free to participate,” he said.

It’s all part of the retail and banking giants’ march towards digitally enhanced shopping, a strategy that aims to get people off their computers and back into shopping centres.

The more tailored and enjoyable the experience, the more revenue can be clawed back from that lost to online shopping.

CommBank has more than 3.7 million customers signed up to internet banking, and Scentre Group — the operator of Westfield Shopping Centres in Australia — wants to leverage this customer base to entice more shoppers into its malls.

“The shared interest we have with CommBank is we have a very large shopper base, they have a very large customer base,” Scentre Group’s brandspace general manager Bill Burton said.

“It’s about matching those as much as possible and making them as frictionless as possible ... The elbow grease for us in all of this is our centre teams out there engaging retailers, helping them understand what this is, and corralling all those offers by category, by different types of shoppers.”

The long-term aim, he said, was to give shoppers “one seamless journey” throughout the retail experience, “so we know who people are, if they want us to know who they are — we’re not just going to start pinging people left right and centre”.

Targeted marketing will become even more sophisticated when Westfield rolls out facial recognition through its network of SmartScreen digital advertising boards.

Westfield is trialling the screens in 37 of its shopping centres, with 1200 interconnected digital advertising boards, which broadcast centralised marketing content across Australia.

The technology will eventually enable Westfield to collect demographic information about shoppers, in order to tailor the timing and content of marketing.

Other innovations on the cards include ticketless parking, currently operational at Westfield Miranda in Sydney’s south.