Premier Investments says earnings for the first half of FY21 have surged due to online sales

The owner of Just Jeans, Jay Jays and Peter Alexander has updated its earnings outlook for the first half of the financial year.

Retail conglomerate Premier Investments has flagged an online sales surge has prompted a jump in expected earnings for the first half of the 2021 financial year.

In an update provided to the Australian Stock Exchange on Wednesday morning, the owner of Peter Alexander, Just Jeans and Jay Jays said group earnings before tax and interest (EBIT) over the first half of the current financial period were expected to be between 75 per cent and 85 per cent higher than the previous corresponding period.

In dollar terms, EBIT is poised to be in the range of $221m and $233m.

Physical retail trading in 2020 was hit hard from the ongoing coronavirus pandemic, as government imposed lockdowns halted non-essential shopping in order to limit the threat of transmission.

Premier’s Asian and European operations are still impacted by lockdown measures.

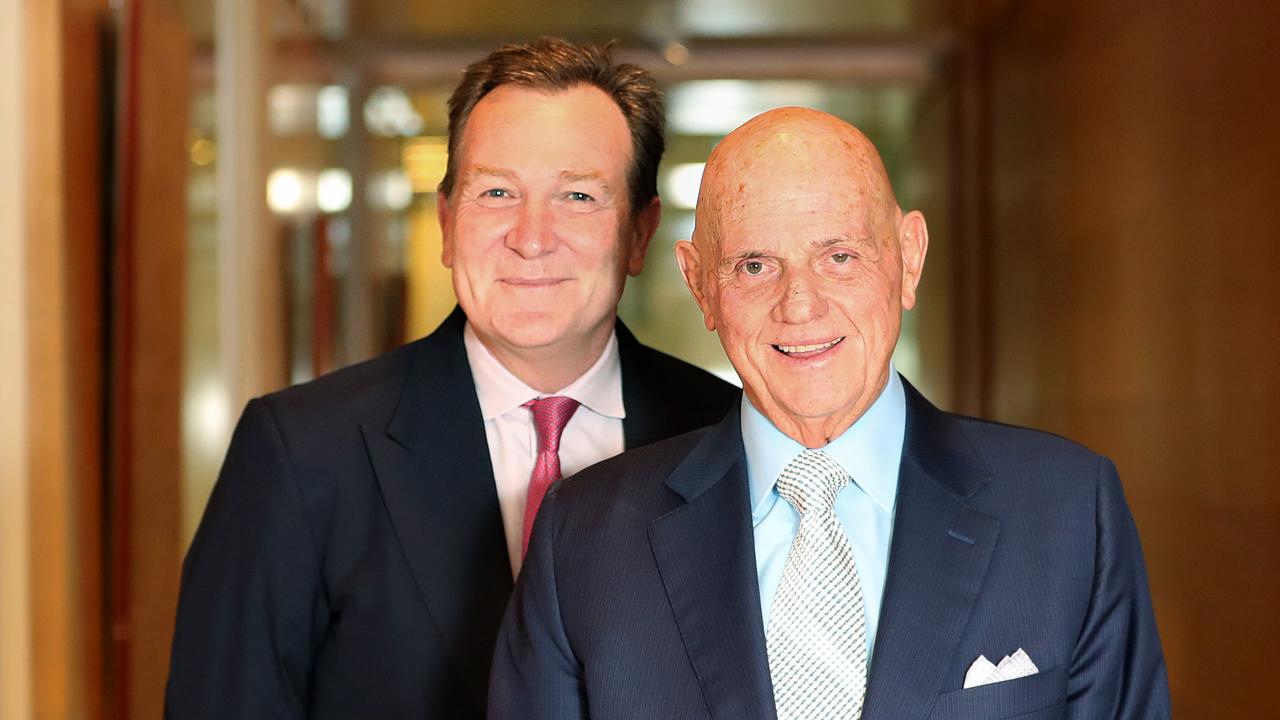

The outlook comes before the group backed by Victorian billionaire Solomon Lew is expected to hand down its mid-year report in March, which will reveal how the company’s slew of retail brands have performed in the 27 weeks up to January 30.

Premier noted an acceleration in online sales has led to the higher than expected EBIT margin, with the group recording for the first 24 weeks of the current financial year that digital trading was $146.2m, a 60 per cent jump on the previous reporting period.

Australian sales have led the group’s surge with regional like-for-like sales up 26.2 per cent compared with the first half of the previous year. Total global like-for-like sales are 18 per cent higher over the period.

Premier said access to JobKeeper payments during 2020 enabled the group to cover losses incurred from the extended Melbourne shutdown that prevented any retail trading from August to October.

“In Australia Premier was eligible to receive ‘JobKeeper 1’ during the wage subsidy scheme’s final months of August and September 2020. The loss of gross profit in Victoria during government-enforced store closures for most of Q1 more than offset the wage subsidy support. Premier Retail was not eligible to receive ‘JobKeeper 2’,” the company said in its update.

The company said it had also incurred additional costs by retaining employees over the latter part of 2020, where government wage schemes were not available but stores were forced to close because of restrictions.

Stores in the UK, Ireland and Malaysia have been forced to close due to government-imposed lockdowns. Premier also noted Australian stores in Adelaide, Brisbane and Sydney had been impacted by lockdowns following the introduction of new restrictions to curb local cluster outbreaks.