New study to look at the clever strategies to cut down on self-serve checkout theft

THEFT from self-serve checkouts at Woolworths and Coles is a massive problem. This is how the supermarkets could keep you honest.

WOULD you be more honest at the self-serve checkout if the register seemed more human and less robotic?

What if the automated voice greeted you by name? Or a sign popped up saying the vast majority of customers buying red onions actually swiped them as red ones, not the cheaper brown onions?

Researchers at Queensland University of Technology (QUT) are hoping to see if more subtle methods might guilt us into being less sneaky when we use self-serve.

They want to look into whether “moral triggers” and “extreme personalisation” will nudge us to being honest shoppers.

They also want to know if the behaviour of hotel guests when it comes to towels can provide an insight into the behaviour of shoppers when it comes to loose produce.

There’s no doubt theft from self-serve checkouts, from retail giants Coles and Woolworths all the way through to smaller stores, is a massive problem.

Retail theft costs Australian retailers $4.5bn a year. In early October, Police launched a high-profile campaign at a Coles supermarket to remind customers that self-serve checkout theft was still theft. Industry experts estimate several billion is lost through Australian self serve tills annually.

Coles spokeswoman Martine Alpins said at the time that there had been a “a normalisation of theft at self-service check-outs”.

The research is about strategies to push back our “deviance threshold,” Research Fellow and QUT’s PwC Chair in Digital Economy, Paula Dootson, told news.com.au.

“Everyone has a deviance threshold, everyone can be bad up to a point but all of our grey areas are a bit different.

“Some say they would never [scan inaccurately] while some say they swipe inaccurately all the time. But this is about changing the behaviour of people that steal just a little bit because that’s actually worse for the supermarkets than the few people that steal a lot.”

Dr Dootson said that self-serve technology — which has divorced us from actual staff — had dulled our conscience when it came to checkout theft.

“People struggle to understand who the victim is when committing deviance to a seemingly faceless organisation. But with smaller organisations, like mom and pop stores, they can see who they are harming.”

The QUT team did an experiment to see how untroubled the average customer was about stealing.

In a bank, customers were given too much money by an ATM, a human-like robot and an actual human teller.

People were far more likely to pocket the cash from the ATM than if handed to them by a human.

“The human component brings in this empathy which isn’t there with an inanimate object like an ATM and that’s why we’re seeing more theft out of self-serve checkout from people who would never normally steal”.

Could making the technology seem more human make us feel more guilty about doing a swiftie?

EXTREME PERSONALISATION

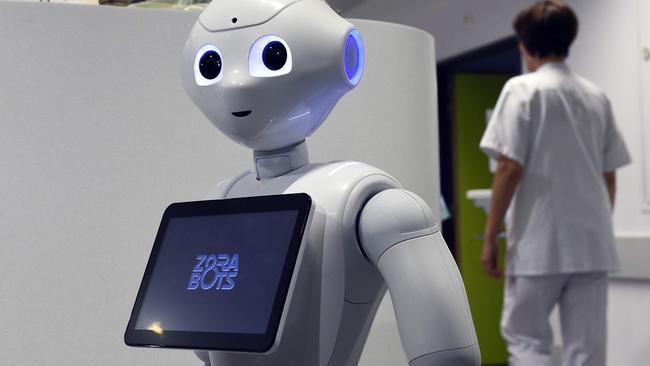

Some gambling machines have been designed to look more human-like, with a face that mimics eyes and a mouth. It might seem bizarre but anthropomorphising static objects can provoke an emotional response. In Japan, a friendly looking robot called Pepper has been helping customers in mobile phone stores.

If your register looked like Pepper would it be enough to dial down your desire to deliberately wrongly scan your red peppers for green peppers?

What if the checkout seemed to recognise you once you scanned your rewards card? “It might say, ‘Hi Paula, welcome to Coles, please scan all your items,’” said Dr Dootson. Would you then indeed scan everything and not leave out a few items?

In a further example of what’s known as “extreme personalisation” some stores overseas recognise their customers through their phones and ping them special offers while they are in store based on their past purchases.

“It’s just customer service but it reduces deviance because your know you’re no longer anonymous and you might feel more uncomfortable stealing.”

MORAL TRIGGERS

Another technique is the “moral trigger”. This would use existing self-serve technology but flash messages on screen encouraging you to do the right thing.

Research from 2012, showed people were less likely to lie on insurance forms if they had to sign a statement saying they were telling the truth at the beginning rather than the end. Highlighting honesty upfront seemed to spur people to do the same.

“Triggering notions of right and wrong means people are less likely to lie. So could you put a message on the terminal saying customers have submitted, say, $6000 through this checkout to Make a Wish Foundation, ‘we’re doing our part, thanks for you doing yours’ that kind of thing?

“It’s not asking them not to steal, it’s just triggering an idea of good behaviour,” says Dr Dootson.

SOCIAL PROOFING

Then there’s the lesson learned about towel cleanliness in hotel bathrooms.

For some years it’s been normal to see signs in hotels asking guests to consider not having towels washed to lessen the burden on the environment. About a third of guests do indeed choose this option.

In 2008, US researchers did an experiment where they changed the signs to read that ‘75 per cent of guests’ in that specific chose to limit their towel washing. The number of guests who chose not to have their towels washed jumped to almost half.

This technique, known as “social proofing” seems to proves that most of us want to be in the club.

“It could be an external or an in-store campaign that says the vast majority of people choose to scan the right way. It’s using the power of others to guide people to do the right thing”.

Dr Dootson and her team are hoping to get one of the major retailers on board to test their theories. If they prove correct, triggering customers’ good angels could be the most cost effective solution to customer theft, she says.

“It’s about encouraging an internal sanction rather than the store externally sanctioning customers. You end up policing yourself.”