Myer’s darkest hour isn’t what it seems

MYER just posted a staggering $476 million loss. But the darkest hour for the retailer isn’t what it seems.

MYER has just notched up what looks like an enormous beating. On Wednesday it reported a loss of $476 million for the first half of the financial year, a negative 858 per cent change on the same period last year.

Not much is going right for the once great Australian retailer. Revenue is down. Sales are down. The cost of sales is up. Shoplifting has risen by 33 per cent. The CEO left and the company was forced to cancel the regular payment of profit to shareholders, because there is none.

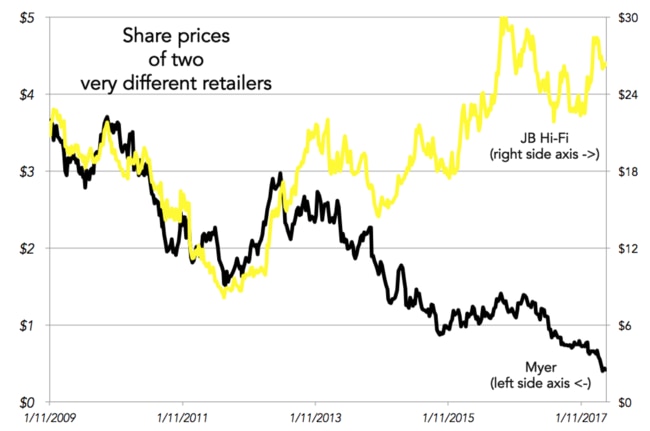

The stock price has fallen so much the company was recently kicked out of the ASX200 — the list of the 200 biggest public companies in Australia. Myer is now small-fry, in the shadow of chains like Harvey Norman and JB Hi-Fi.

Meanwhile shopping centres are already talking about what they will do with the extra space after Myer goes.

The Department store had a slow Christmas and that was been enough to tip it into a world of hurt as 2018 kicked off.

ARE THINGS AS BAD AS THEY LOOK?

Myer’s accounts show a $476 million loss. But that doesn’t mean they spent more than they earned. The loss is mostly due to an accounting manoeuvre called a writedown. A writedown is where a company says the assets it has are not worth as much as before, which happens when firms are struggling.

In Myer’s case, they admitted the brand is not the powerhouse it once was, and slashed the value of it. The total value of writedowns was a whopping $515 million.

If you dive into Myer’s accounts — and I did so eagerly — you discover Myer is still making money on the business of selling things. The surprise is that even though sales fell, and the cost of sales went up, they still made profit on operations. It’s a tiny profit for such a big business, sure, but it’s not a loss. Not yet.

To me, that’s a sign that not every customer has given up on the retailer. Things can yet turn around under the right guidance.

IF YOU’RE GOING TO TURN IT AROUND, NOW WOULD BE A GOOD TIME

As mentioned, Myer doesn’t have a permanent CEO at the moment, after the last one left with his tail between his legs. Chairman Garry Hounsell is filling in as boss. A former accountant, Mr Hounsell will be paid around $83,000 a month to run the show until they find a new CEO (if they can locate one brave enough).

Is Mr Hounsell up to the job? Myer shareholder Solomon Lew — a successful retailer — has called Mr Hounsell “discredited.” Mr Hounsell said yesterday that he has “renewed the entire team’s focus on product, price and customer service”. To my ears, that sounds like a football coach asking every player to play better. It’s not terribly specific.

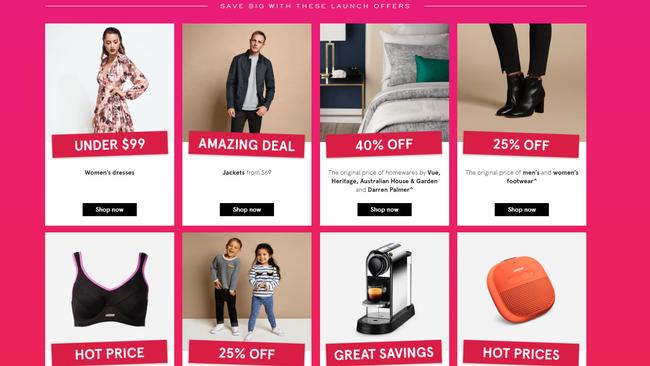

So a new CEO is a priority. When they get one, the person will discover a few glimmers of hope at Myer. Like their online business. Sales through the Myer website grew by 49 per cent in the last six-month period, to $105 million.

That’s actually pretty impressive.

I just tried the Myer website and I can confirm it’s no longer hostile to human users. It finally works like any other e-commerce website — maybe even smoother.

I visited the men’s clothing section. The selection was large and the prices seemed okay. The only thing standing between me and buying something there is the products for sale. To my eye a lot of the brands they stock seemed stale .(Maybe I underestimate the enthusiasm people have for Gazman, but my specialist adviser on women’s clothing also reckons the things Myer stocks are a bit “dowdy.”)

If Myer can change up its range so shopping there doesn’t feel like travelling back in time, it might yet have some hope.

Jason Murphy is an economist and author of the blog Thomas the Think Engine. You can follow him on Twitter: @jasemurphy