Kids shoe company Bobux collapses into receivership, Australian staff, customers affected

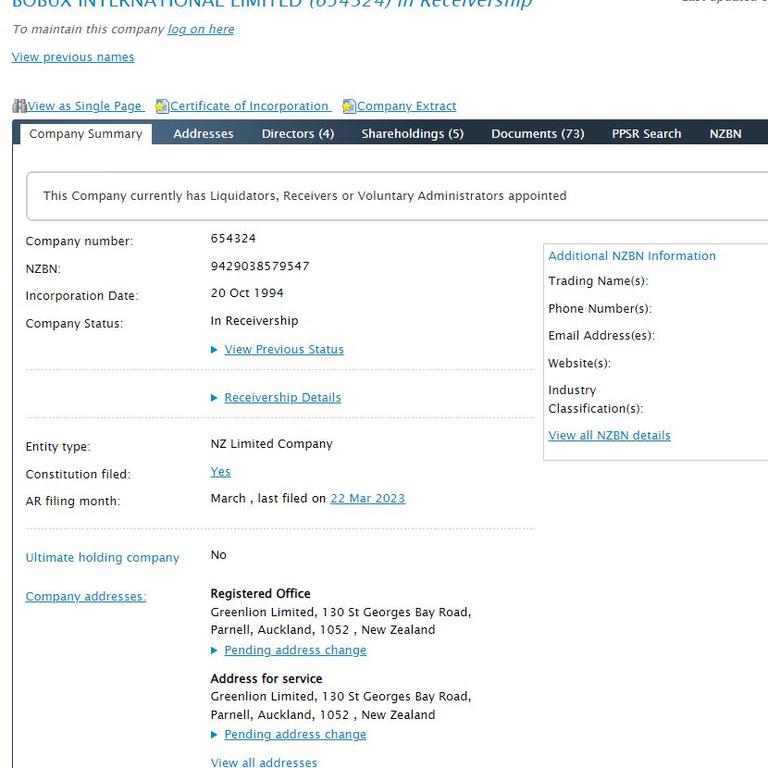

A major children’s retailer has gone bust after a bank appointed receivers to recoup their money, ending a 30-year company.

A major children’s retailer has gone bust after a bank appointed receivers to recoup their money.

Last Tuesday, New Zealand business Bobux, which sells shoes for young children, collapsed.

Conor McElhinney and Andrew Grenfell of insolvency firm McGrathNicol have been appointed as receivers and managers of Bobux and related its companies.

They are acting on behalf of the Bank of New Zealand.

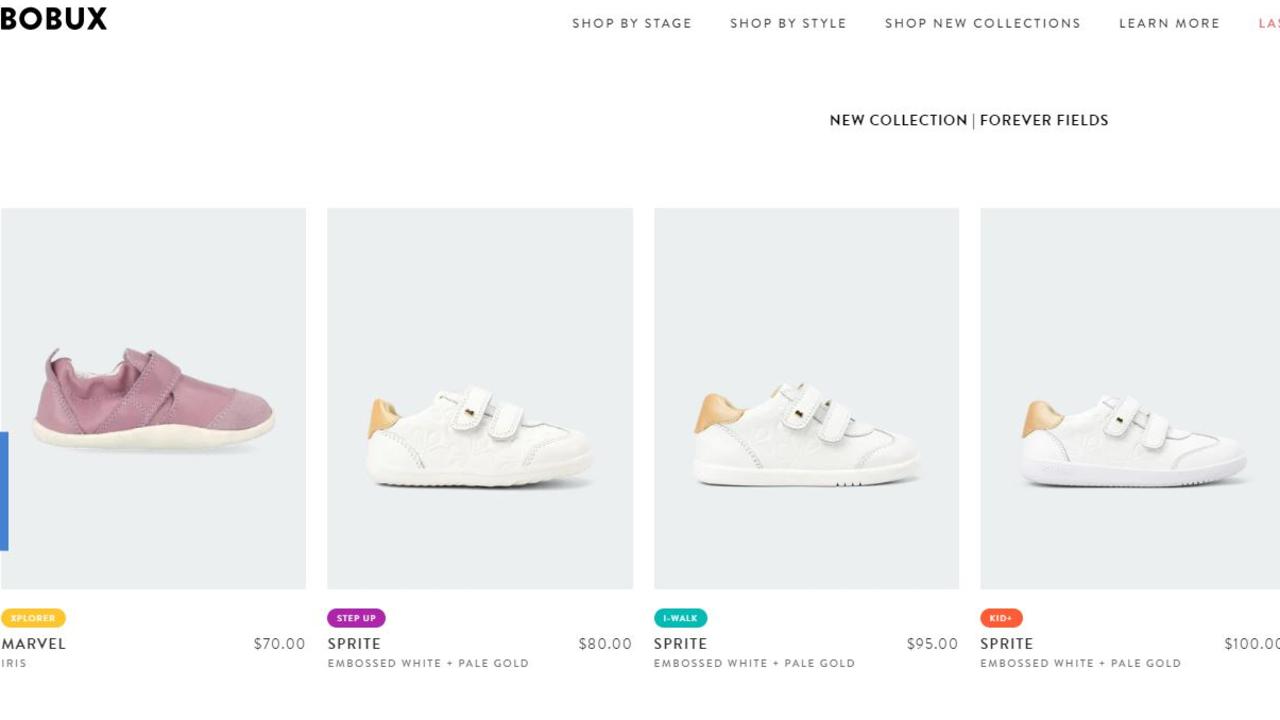

The brand, which was popular with young parents, had headquarters in New Zealand but staff in Australia.

Bobux widely sold to Australian customers, with a dedicated warehouse in the country and a large online presence, making Australia one of its primary markets.

In New Zealand, 25 employees will be impacted, as will eight staff members in Indonesia, and one in Australia and another in Denmark, which corresponds with where the company had warehouses.

At this stage, the receivers are unsure of how much money the company owes or the number of creditors.

Bobux was established more than 30 years ago but suffered an unsustainable drop in sales due to the Covid-19 pandemic.

“The business suffered significant supply chain disruptions from Covid-19 that resulted in overstocking to combat delays and challenges with an IT system overhaul,” McGrathNicol said in a statement to news.com.au.

Bobux made more than NZ$20 million (A$18.4 million) in annual sales.

The receivers are now looking to sell the business.

Its website is still functioning as its remaining stock is also still available for purchase.

Bobux sold to over 40 countries. The UK, Australia, Europe, New Zealand and the US were its main customer base.

Tough market conditions across all these areas ultimately sealed Bobux’s fate.

“As a result of these pressures, the business was unable to secure ongoing funding for losses and consequently requested that the group be placed into receivership,” a McGrathNicol spokesperson added.

The company’s founders, Colleen and Chris Bennett, said they were upset by the demise of their business and the impact it would have on everyone involved.

“This is a tragic outcome for our staff, suppliers, and customers after putting our hearts and souls into the business for 30 years”, Mr Bennett said.

“Our sincere hope is that a buyer can be found to take Bobux forward.”

It comes as earlier this month another e-commerce brand collapsed due to the lingering after-effects of Covid-19.

In early April, news.com.au reported that clothes seller EziBuy, which had an online presence across Australia and New Zealand, went into voluntary administration.

The retailer had suffered a 51 per cent decline in sales from June to December last year.

Retailers are dropping like flies in recent months amid the softening market.

Iconic music and entertainment retailer Sanity shut down all 50 of its stores across Australia at the end of March, as the pandemic took a toll on the business, although it continues operate in a digital space.

In February, Australian prestige clothes firm Alice McCall went into liquidation. News.com.au reported that the company owes $1 million to creditors.

Then in January, furniture seller Brosa fell into liquidation after its restructuring attempt failed, leaving behind debts of $24 million, including $10 million to customers from unfulfilled orders.

In July last year, trendy sunglasses business Soda Shades also went into administration owing $2.3 million, and just a week before, sneaker company Sneakerboy also folded with $17.2 million owed to more than 100 creditors.

Online fashion giant Missguided also had no choice but to call in administrators after failing to secure a rescue bid, with big name brands like The Iconic and Myer selling its wares prior to its collapse.